Tradelands Economic Update – August 2nd, 2024

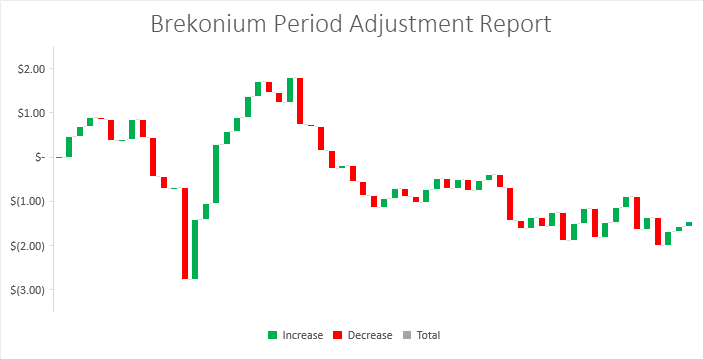

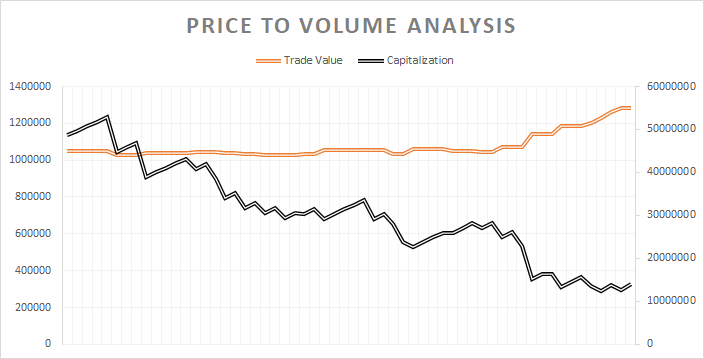

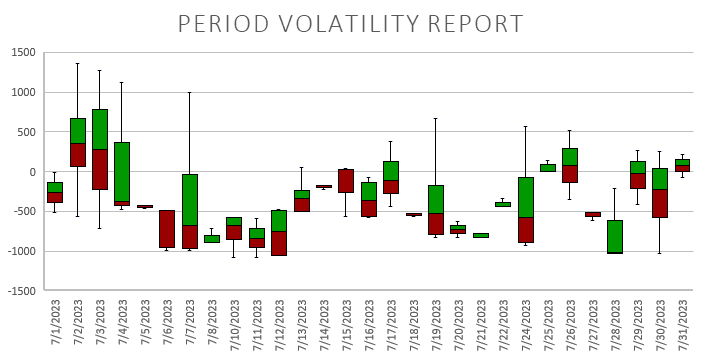

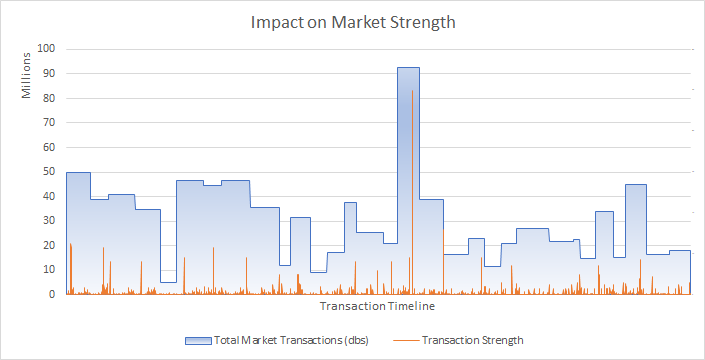

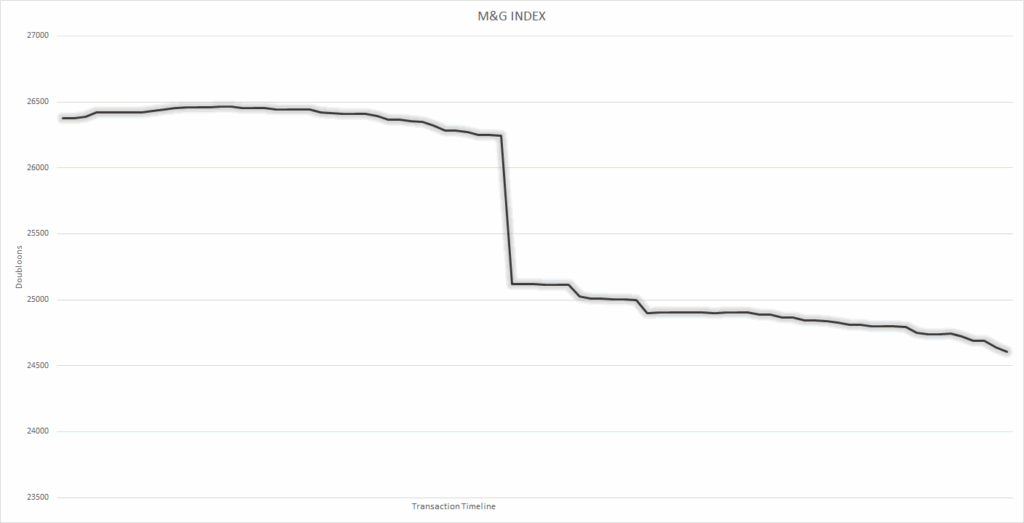

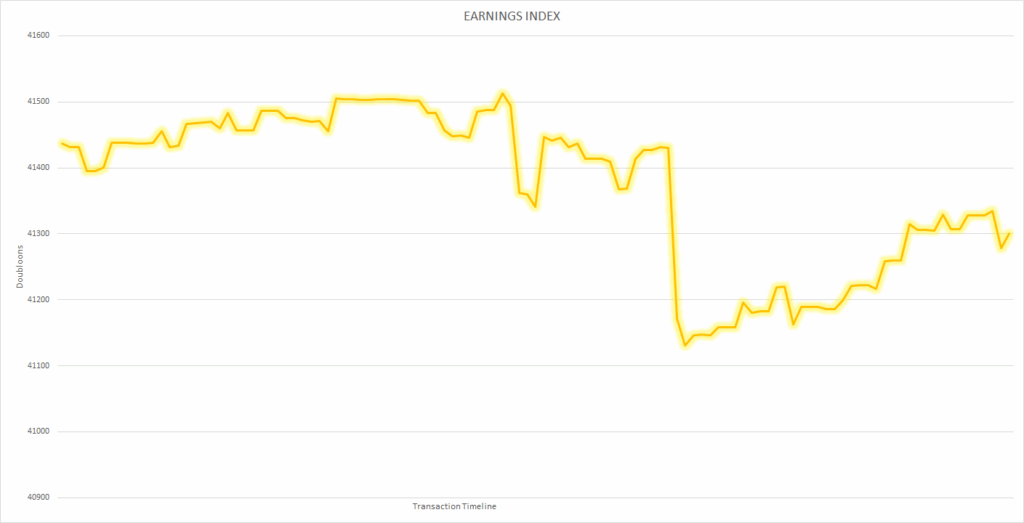

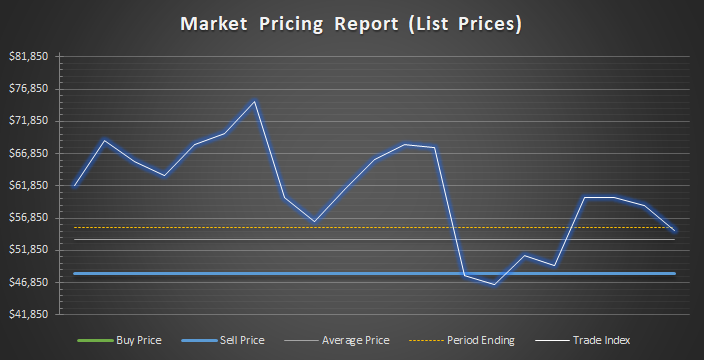

July had $912.4 Million in market activity. There were no major releases or updates during the month, and many of the weekly events were put on hold. The result was lower than expected market output, with total activity falling by around $900 million from the previous month. Seeing a drop off in market activity is normal for July, as we also saw the same trend in 2023 with a drop of $100 Million in July 2023. However, the loss of nearly half the market activity was far greater than expectations and caused all three of the market indexes to close lower for the month as a result.

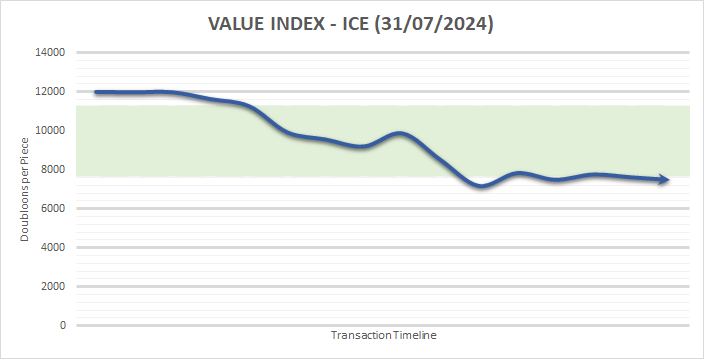

The Ice Crash

The biggest surprise of the month was the dramatic fall in Ice prices. In the past, this item has kept a price point similar to Electrosteel, the material needed to collect Ice. This was an important factor the “metal” because it meant that using Electrosteel to obtain Ice was able to return a profit, or at least break even. But it’s limited interest from buyers has always made this a risky buy, and today the expected collapse finally happened.

The price correction means that Ice will now become the capstone material for the gemstone tree, whereas Electrosteel will become the capstone of the metal tree. While the drop rate of Ice remains higher than the drop rate of Electrosteel, the price dip will mean that the value earned vs. effort spend to earn it will be higher from selling the Electrosteel outright to item crafters instead of trying to mine ice with it instead. Unless there are items added to the game that specifically require ice to make, it’s likely that the Ice mining profession is at a near dead end until there is demand for it.

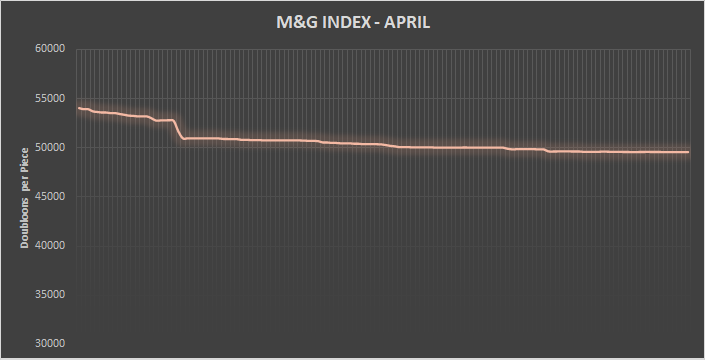

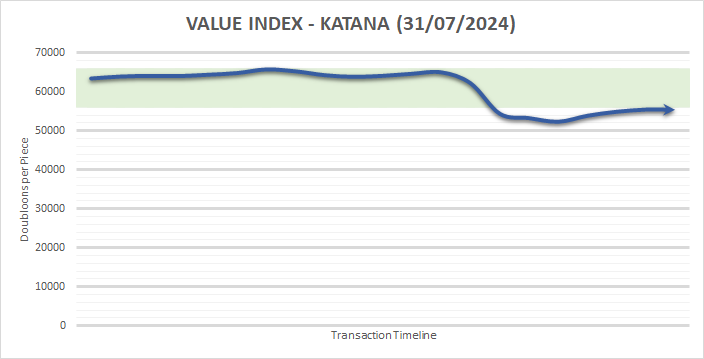

Katana Corrections

The other big change for the month was the price correction on Katana’s. Since the Inyolan Crate release included new versions of Katana’s, we’ve been reporting that a price correction was going to happen at some point. However, sellers who were used to the item being worth six figures worked hard to keep prices as high as possible and blur the line between the classic and 2024 variants. That came to an end this month, as the attempt at capping the price drop above $70k ended, and a bulk seller offered Katana’s at $40k per sword, effectively ending the price correction attempt.

However, this drop was not a shock to us. We noted that Katana prices were trading low for several months now so it was only a matter of time before this drop happened. Now that it has happened, it gives the market a chance to recover because one of the biggest points of saturation has been removed, and inflationary prices on Katana’s are now playing a direct part of keeping the prices in line with the market. This is the main reason for the upward trend following the collapse of the market.

Impact of Inflation

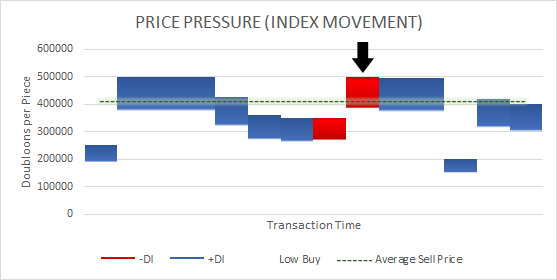

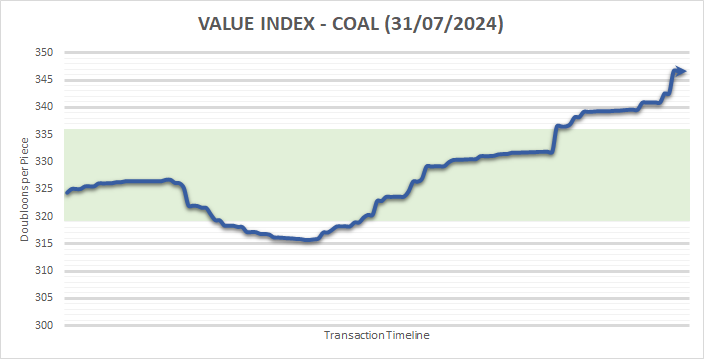

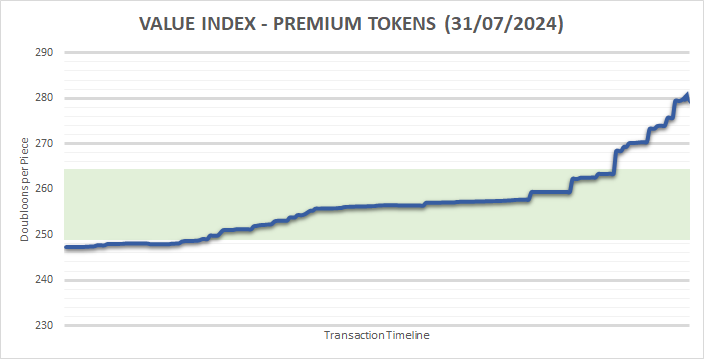

While the main indexes continue to trend downward, the market as a whole is reporting an overall increase in price inflation. We have seen this as well. The reason why the markets trend downward is because they are being impacted by a phenomenon known as market saturation, effectively there are so many items that it reduces their price because they are common and therefore have fewer interested buyers. On the other hand, items that are not experiencing saturation are seeing increases in prices overall, which is the true measure of inflation. Two examples that commonly see good demand are Coal and Premium Tokens.

When looking at these two, we see an inflationary rate of somewhere between 6% and 12%. The reason for the higher percentages in Premium Tokens is because they are valued at a lower price point, but both of these are seeing a price increase of around 30 doubloons in total, which is inflation at work. Also note that the increase has been a steady upward trend, meaning it is not reactionary due to some event in the game. That means if left unchecked, it could end up permanently changing the price of items going forward.