Tradelands Economic Update – May 2, 2025

The Tradelands economy ended the month of April at $1.85 Billion in activity. This is the result of two updates to the game. One was the April Fools release that occurs every year, and the other is the release of three new ship variants. These two updates resulted in continuing the upward momentum of Premium Tokens as well as a further closing of the gap between Timberfelling and Mining profitability.

Three New Ship Variants

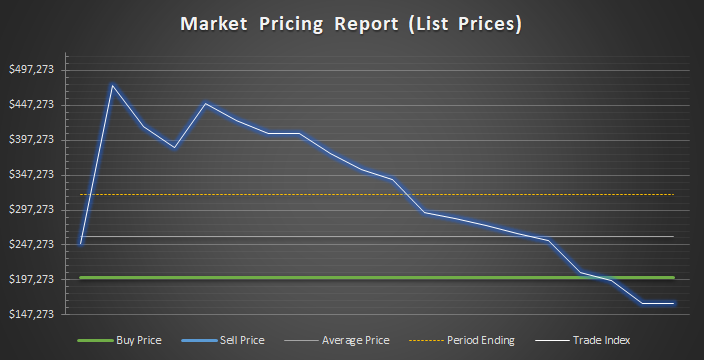

This month saw the release of the Aprilis variants. This is applied to the Hook, Osprey, and Falcon. However, of the three variants, only the Falcon returned any noticeable ROI for the buyer. The Hook and Osprey were a modest 12% ROI while the Falcon was able to provide the buyer over 40% ROI.

The release confirms the developers move away from the 5k Premium Token standard used in the first two months and opens the door to variable costs for future releases. As a side note, we noticed less market activity for Aprilis items than we saw with the Februa and the Mars. This is likely an indicator of two things:

- It is likely that fewer players purchased one of the Aprilis Variants

- The Aprilis Variant items, specifically the armament, figurehead, and blueprint, were not considered unique enough.

Looking back at the Februa, the decision to release an OG version of the blunderblaster made it a popular item. The Mars included a uniquely colored figurehead, turrets, and a high demand blueprint. The only Aprilis item that met the criteria for Initial Public Offering (IPO) on the stock exchange this month was the Aprilis Crossbow Blueprint, and it closed below buyer expectations on it’s first month.

On the plus side, due to it’s late release in April, the deadline to get one from the Premium Merchant has been extended into May so there is still some time to purchase one. However, based on activity so far, this one does not appear to be a high demand item from a market perspective. Still, as we noted in our own review of this ship, the decision to have the ship modify it’s armament, instead of requiring players to build a unique armament, makes the ship more valuable than the sum of its parts. This was not true for ships released earlier in the year.

Market Projections

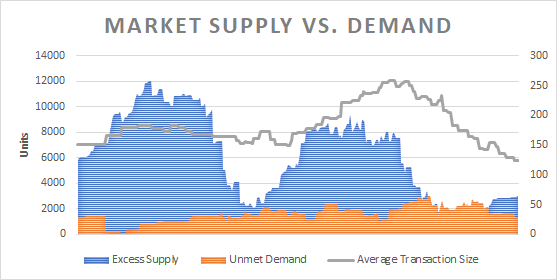

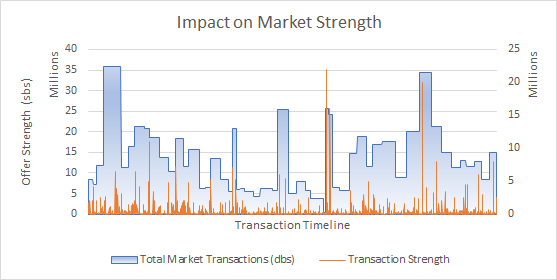

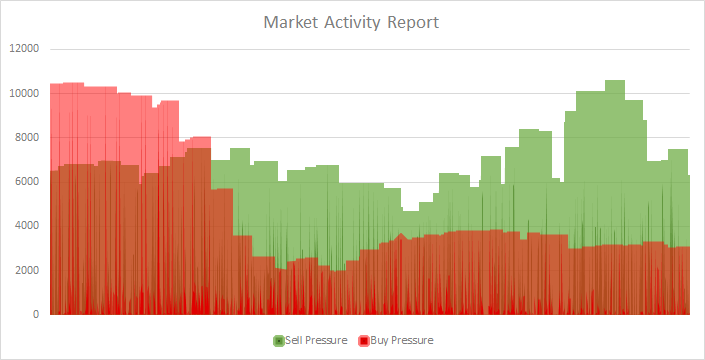

There were two interesting trends that were apparent in the market activity for the month. The first was the trend of excess demand at the end of March and early half of April. This was the impact of the April Fools release and the expectations that came along with it.

Excess demand usually means that sellers have an upper hand when placing items on the market. Normally, a healthy market will have buy pressure at around half the total available sell pressure. In this case, three events were creating this upside down activity.

- There was a momentary gap in the ship variant release schedule, causing a slight blip in Premium Token pricing trends, and players who were banking on Premium Token pricing to lose out on transaction activity.

- The new Mystery Crates were released at the beginning of the month, shifting players away from purchasing items and instead purchasing the new crates.

- There were fewer April Fools craftable items available than in years past.

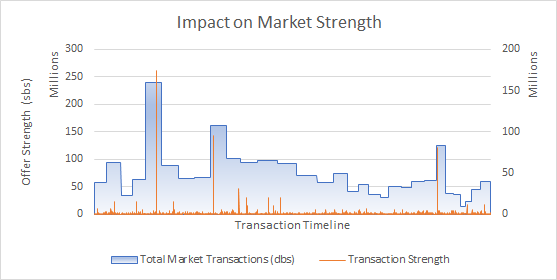

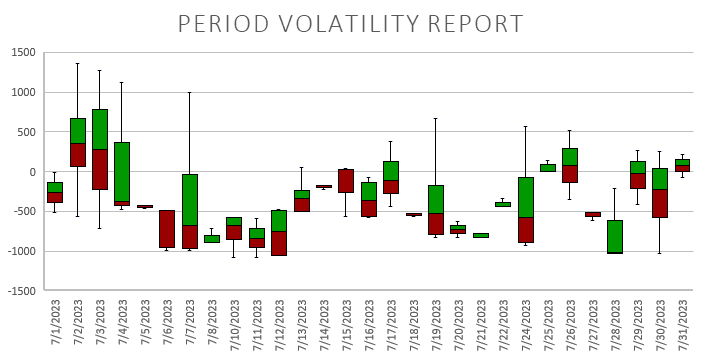

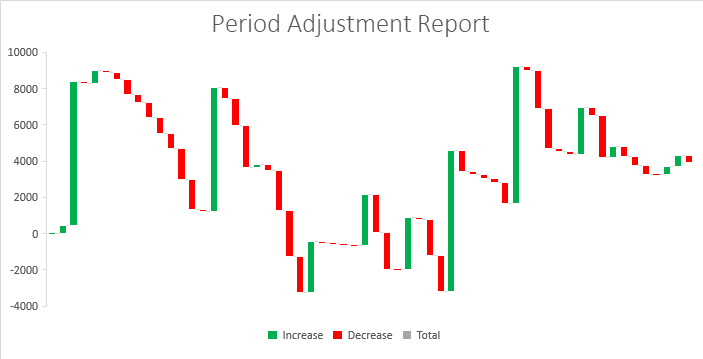

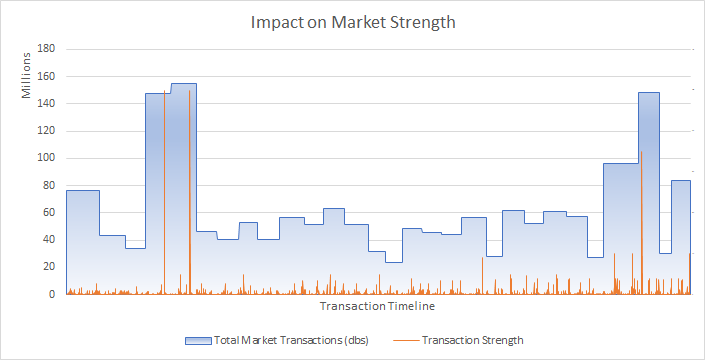

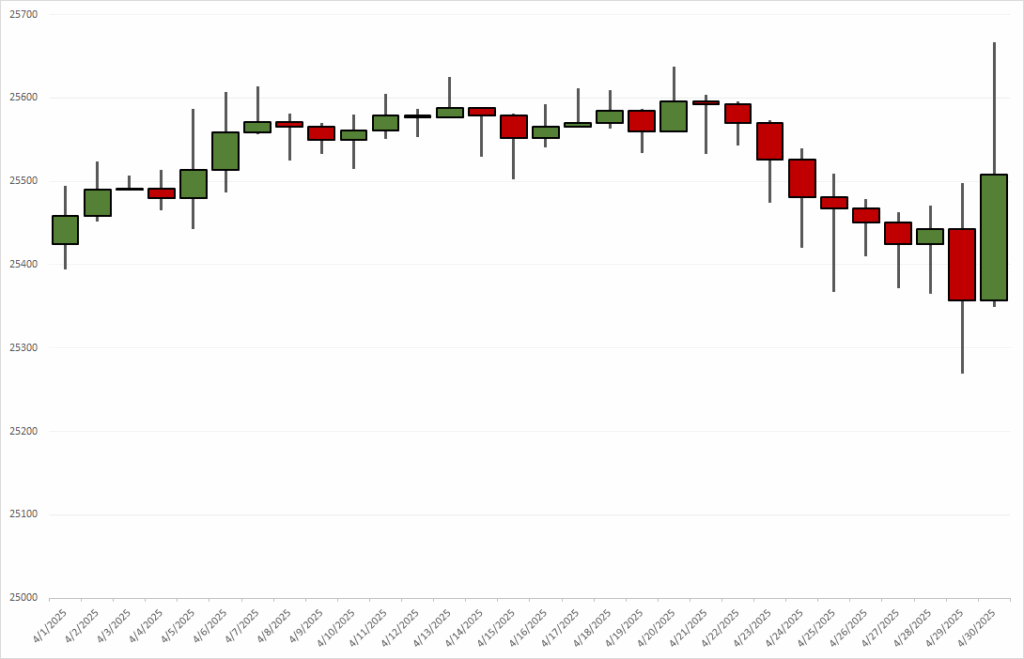

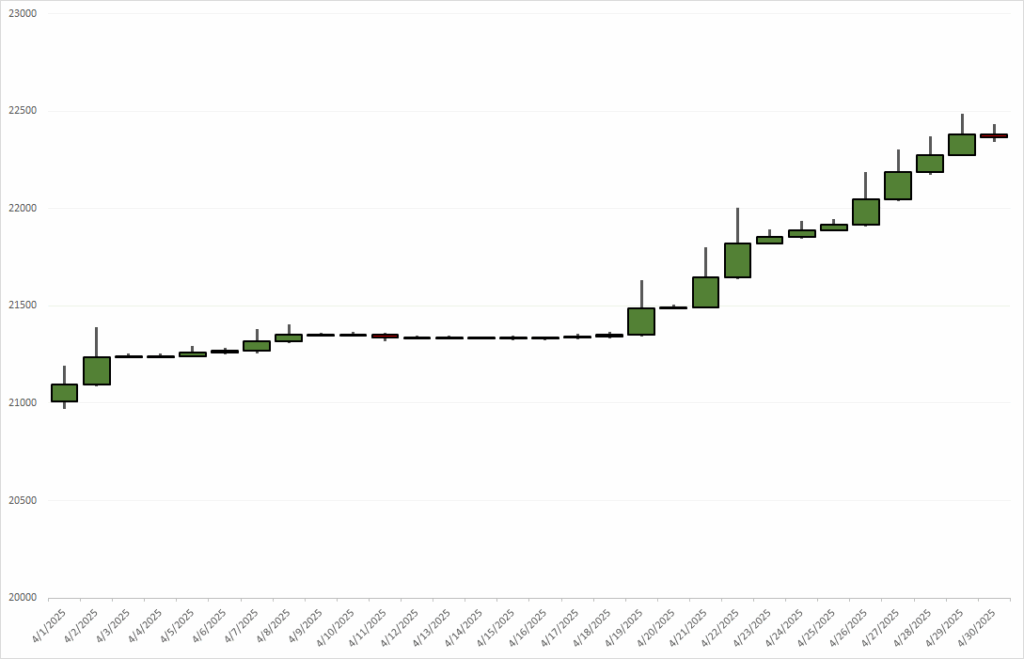

All of this corrected itself on Aprile 8th however, when the April Fools release effectively ended and the new ship variants were released. The graph clearly shows the immediate over-correction in pricing until it once again reached equilibrium. One of the positive outcomes to this was the gains the Timberfelling profession was able to make during the market shift, while at the same time the stagnant pricing of Mining.

The interesting note is the late month dip in Mining, and the solid futures projection, indicated by the large upward candlestick on the last day, meaning the mining profession may be ready to experience some strong upward momentum. This will depend on how the development team plans to handle releases in May, whether ships or items will have a heavy metal component to them. If it does, we could see a strong correction to the market.

On the other hand, the release of variants in April that were more valuable when built in the Shipwright as opposed to through Premium Tokens, means that the wood market is continuing to experience upward momentum in it’s value. We also noticed that several wood types have finally reached the coveted A rating, meaning the sellers are merging on price points and are creating a less volatile, and by extension more stable investment, market for wood materials.