Tradelands Economic Update – November 3, 2025

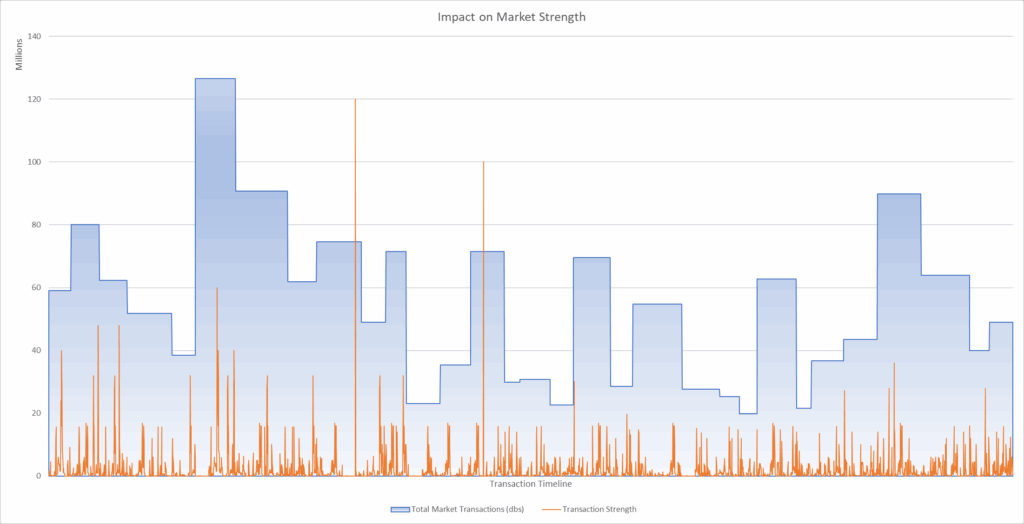

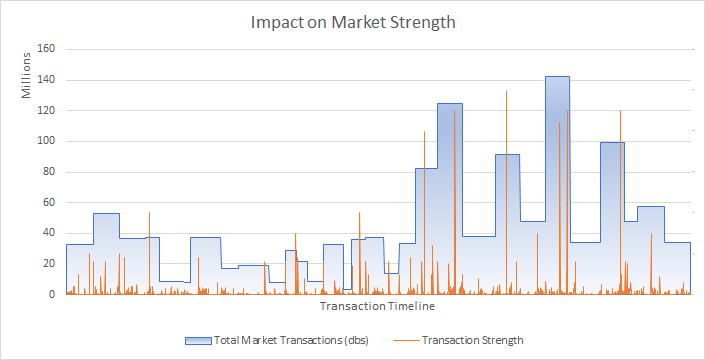

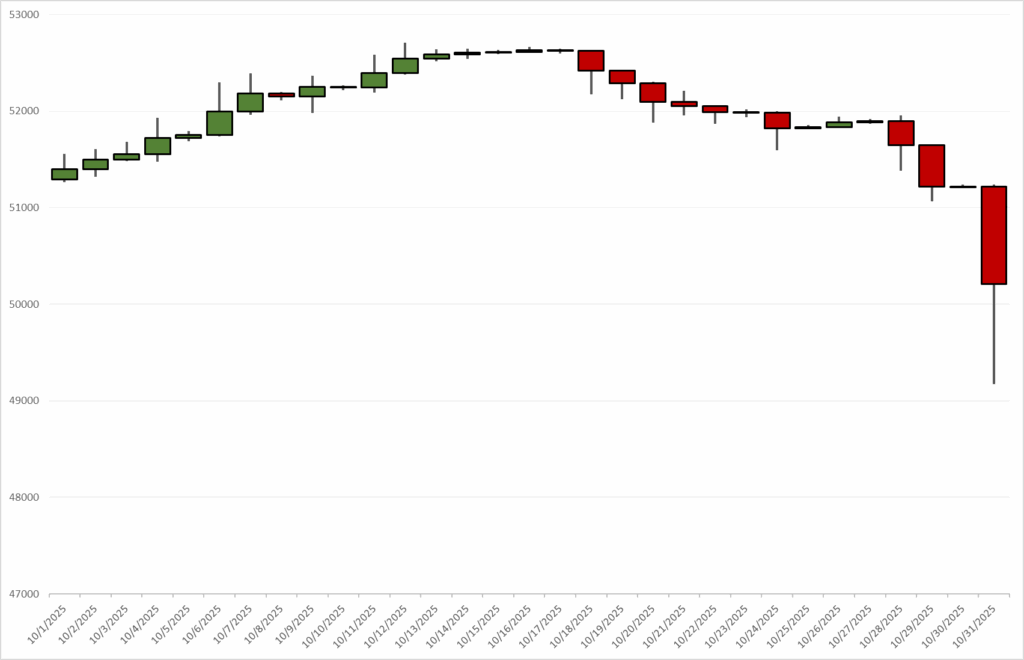

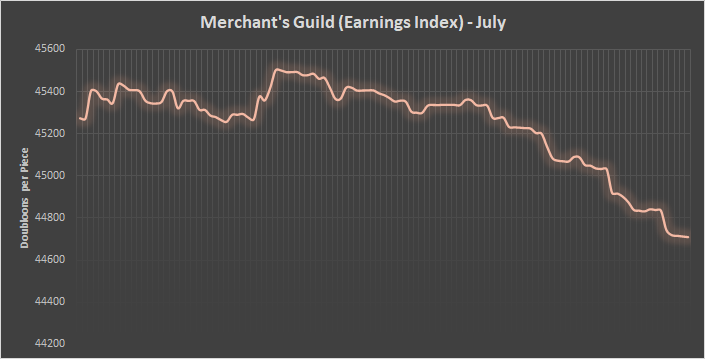

October saw lackluster market activity. The market added a total of $1.61 Billion Doubloons last month. This is only slightly higher than last year where the market added $1.21 Billion in activity. But the telling signs of trouble are the fact that the crate release at the end of the month seemed to have only a minor impact on the overall economy. This, couples with a lackluster Halloween event, and low levels of marketing around the event, meant players were not logging at an increased rate. In fact, during the peak hours of the Halloween Event, server totals showed less than 100 players logged in at the time.

Successful Warlock Variant

One of the reasons for the success at the first half of the month is the release of the Warlock. This is the first month where the market data clearly shows that a ship variant release has proven more successful than a crate release. Two variants of the Warlock was released in October along with several additional items. Moreover, the variant stayed active into the first part of November making it available for the entirety of the Halloween Event.

As a side note, we reported on stream that an added benefit for this variant is that it can be used as a Ghostship. This goes well with the figurehead and general vibe of the ship. Since it’s not yet clear if the variant will stay on for another week, it’s also possible that a new ship variant might also have this ability if it can be released before November 11, which is the date the developers gave for when the Ghostship vouchers will go off sale.

Looming Recession

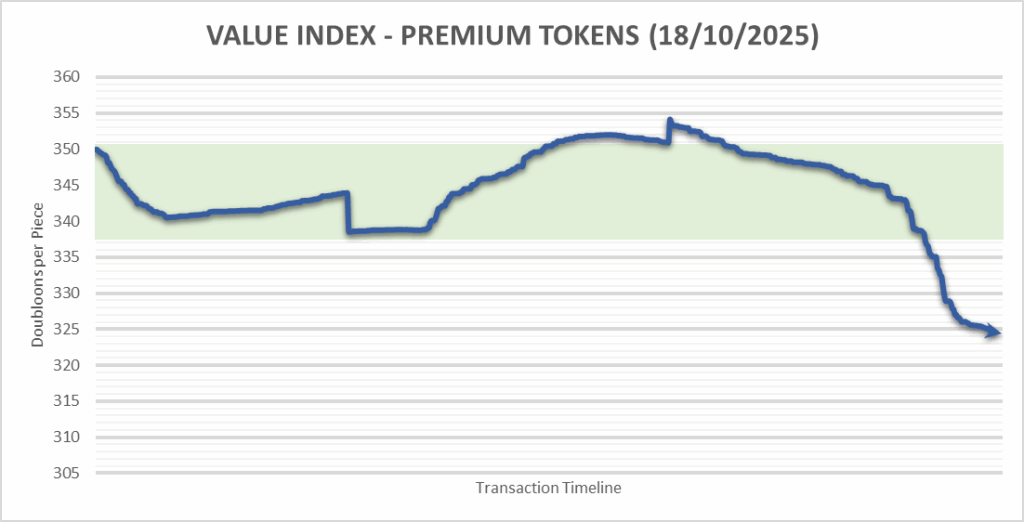

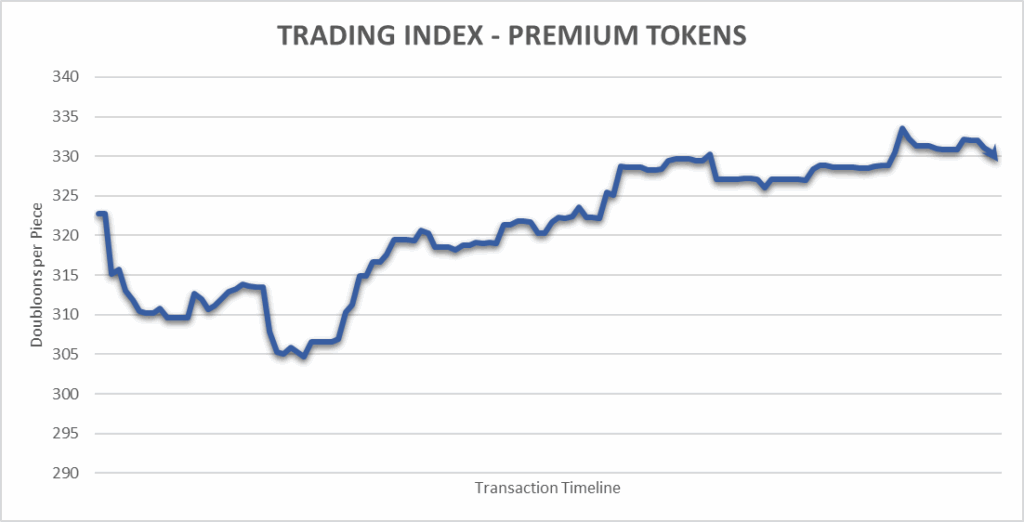

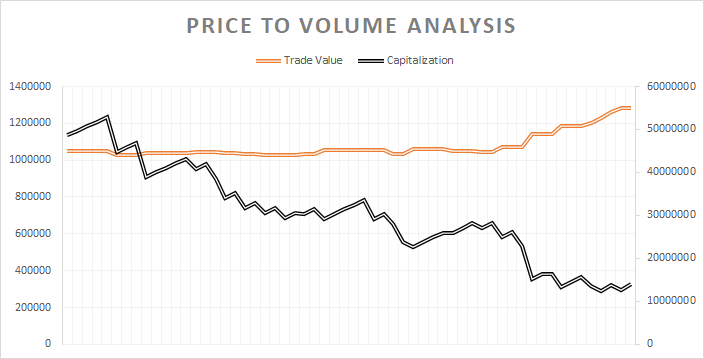

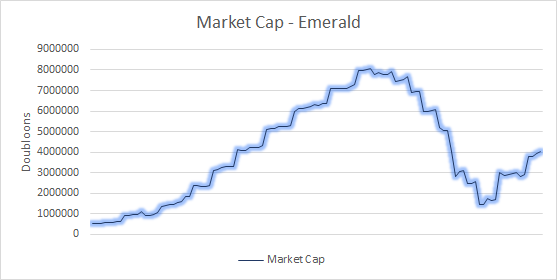

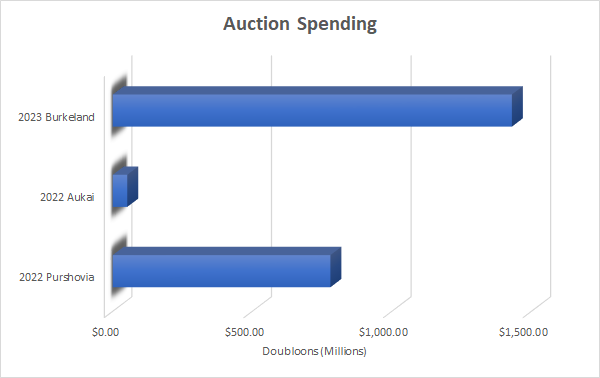

Last month, several queries went out asked for data on the long-term state of the Tradelands economy. Most players were asking for updates on the state of inflation in the game, and we reported that most of the data suggests that the inflationary period ended in July 2025. However, while pulling this data, we also found that there are warning signs that a recession in-game is on the horizon. This is the first time the indicators have gone off since the 2022 Recession.

There are two factors impacting the current stabilization of inflation. First is that the anticipation for the 10th Anniversary event has passed, which is what drove a lot of the inflated value in the first half of the month. The second is the Housing auction which drew doubloons out of the market permanently. The reason why this is hitting harder this month is because the release of new Halloween Crates sparked a price correction on the items purchased during the Anniversary Event, so it’s more of a delayed correction to the market prices rather than something related directly to the valuation of the Halloween Crates.

I don’t want to be too doom and gloom around these numbers, however. This is not the time of year where recessions are likely to start. However, it does appear that there was less interest in this year’s Halloween Event, which is traditionally one of the strongest of the year. If this turns out to be accurate, then it could kick-off a downward spiral that may result in another recession. However, the Winter Event is just around the corner, and this is typically a jump start for the next year of Tradelands. So it would be premature to call for a recession in the game until the outcome of this event is determined.

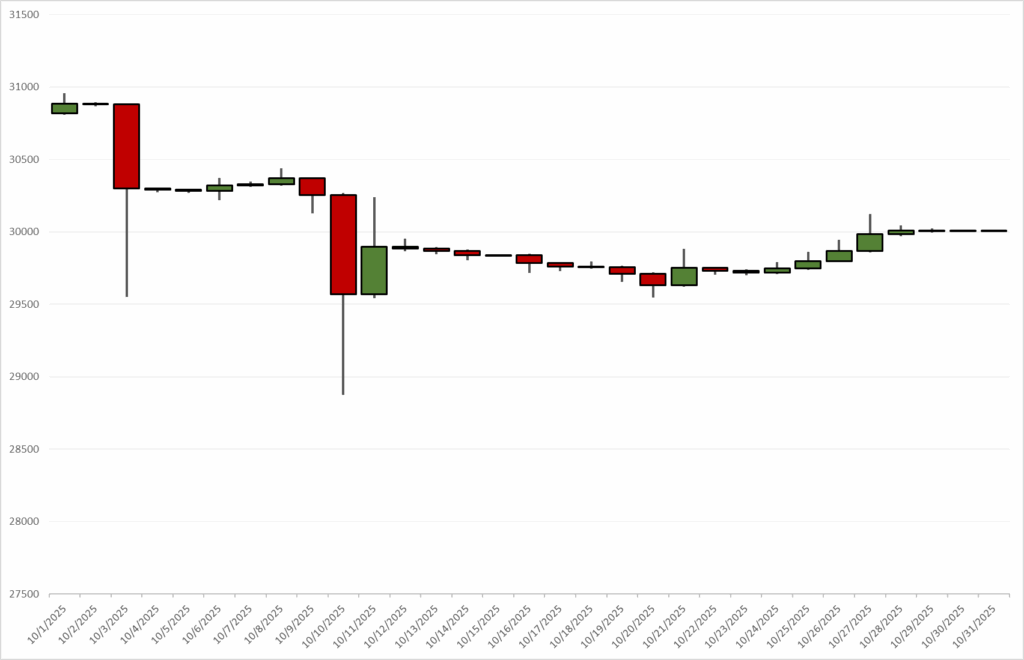

Wood Prices Are Up

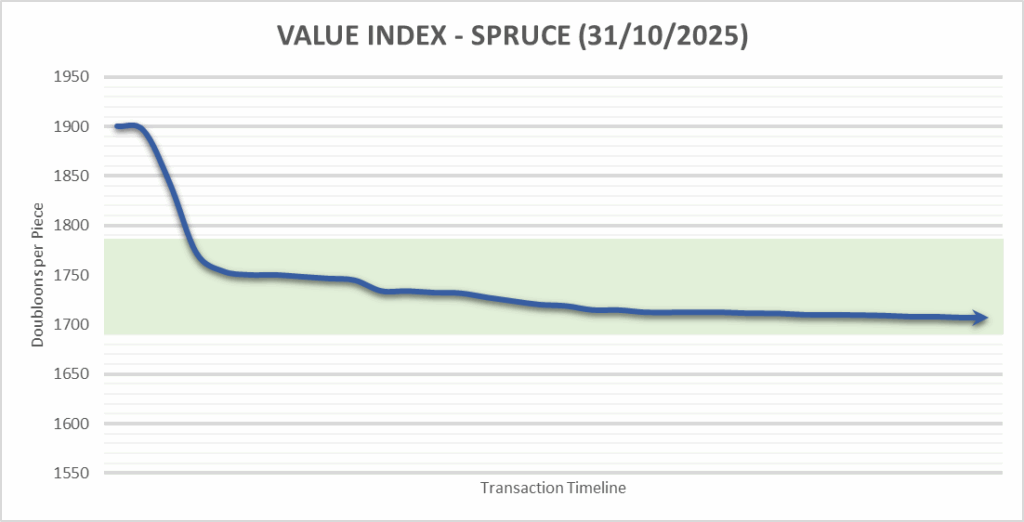

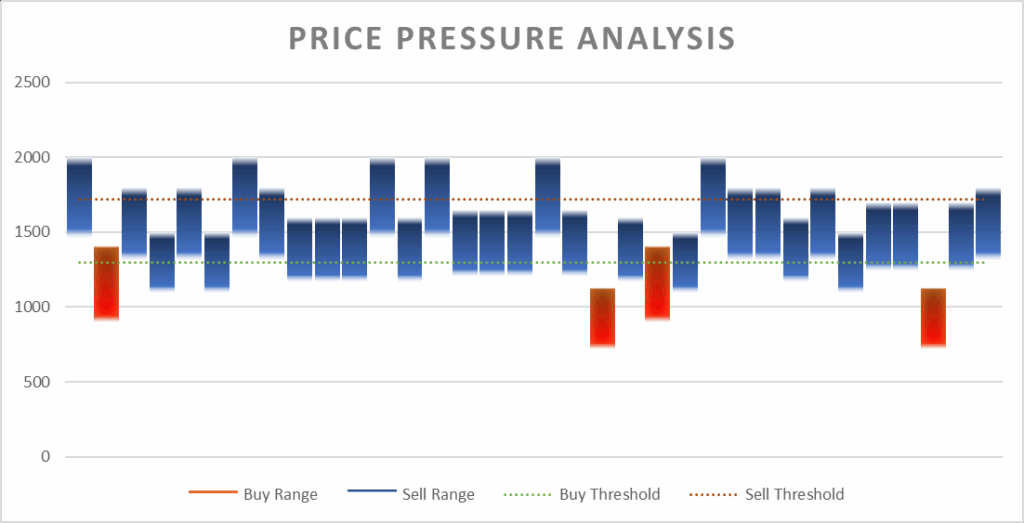

The one bright spot to all of this is that wood prices are up. And not just up, they are stabilizing at their higher price point. The JSI index was the winner this month, seeing a rise above $24k in total value. This isn’t enough to offset losses from other areas of the economy, but it’s a strong outlook for the profession. It’s also worth noting that this is the one profession which didn’t have changes in the July update, and the stability it is showing that the decision to leave it alone was a good one. Despite this overall upward momentum, the one item that is struggling is Spruce, which was a dip in October and a stabilization lower than expected. This wood seems to be following the trends of the rest of the market instead of what we are seeing across the rest of the JSI Index.

May I ask if the buy and sell price of Meridian BPs and Warlock related stuff is now different by a huge bit or?

The buy and sell prices were just updated to reflect where they are as of the end of 2025. I know this comes a bit late, but I can tell you the Warlock Blueprint is selling slightly above expectations because it is percieved as better than the Helios Staff. The Meridian is below expectations (which were $1M) and is likely to follow the same price as the Komodo and Megalodon in the long-term.