Tradelands Economic Update – July 2022

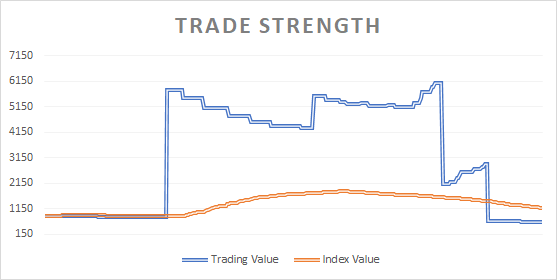

What a strange month for the Tradelands economy. After a missed promise to release a ship, followed by the announcement of another event, and ultimately the release of summer crates at the end of the month, we are finally seeing some momentum return to the market. After all that, it was the release of two new ships that finally caused the market activity to exceed the $50M daily threshold. With all that said, let’s see how it all turned out, and focus on expectations for August.

The Recession Continues

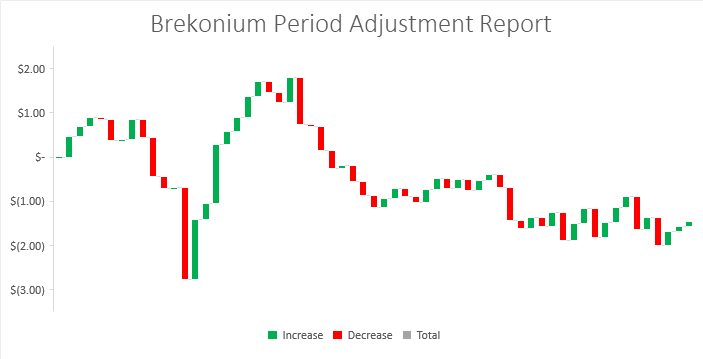

We keep holding out hope that the recession will finally come to an end. Unfortunately, another month has gone by and we once again report losses across the board. The Purshovian Update may go down in our books as the single greatest event ever to impact the Grand Isles since our group was first founded. To go from the largest trade activity in the history of the game, to the loss of 25% of the overall market value two months later is incredible. The best part of this is to remember that in real-life, an even like this would make headlines across every news outlet in the world. In Tradelands, however, the hottest topic of the month is the strange pirate fight over Fort Verner, while the recession barely gets mentioned.

Regardless of how it’s reported, traders are definitely feeling the pinch. Our fleet talked to people in game about the fact that Iron was 250 per piece 3 months ago, and now sells around 180 per piece. This isn’t lost on the ones who were making a living from mining. On the flip side, it’s causing people to perform merchant runs more often, which was part of the point of the release. Despite the recession’s continued impact on the economy, there is a bottom to all this. After all, prices can only drop to a certain point. If you look at the trends over the past three months, the declines have been -15.46%, -6.38%, and -1.27% respectively. That means the recession could end sometime in August unless the Aukai Event causes another freefall.

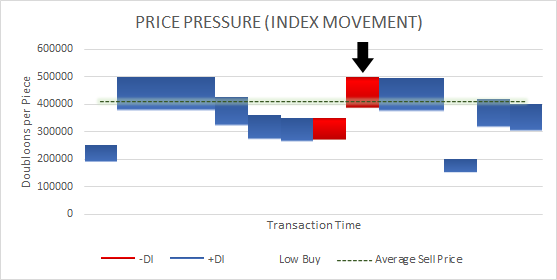

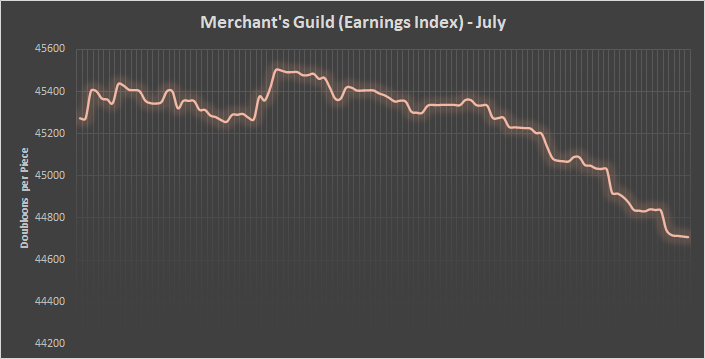

Cheap Coals

Coal closes under $300 per piece after a solid attempt by the market to keep prices above this point. The price index actually shows a price correction attempt known as a covered call. This is the long, straight line between July 4 and July 18. In Tradelands, a covered call takes two forms:

- A seller offers to sell a material, but maintains a share of the overall value in order to maintain a price point. In this way, they can cover any price manipulation attempts and keep a consistent market.

- A buyer also operates a re-sell option at or very close to the buy price, allowing for prices to remain consistent over the long-term while holding a dominant trading position. In this way, their position is always covered.

Unfortunately, the cover failed to keep its momentum once the Aukai release was announced. One of the main reasons is the release of two new ships, the Pillager and the Grouse. The Grouse is the specific reason, because it threatens the Demeter for the top spot among the trade ships. We will be posting a separate article to discuss the ship comparisons in more detail, but the impact on coal was a reduction in its overall importance to shipping. This is unfortunate for the coal index, because the fall below the $300 per piece threshold means it’s once again viable to purchase coal at a profit from the Premium Merchant rather than from other players.

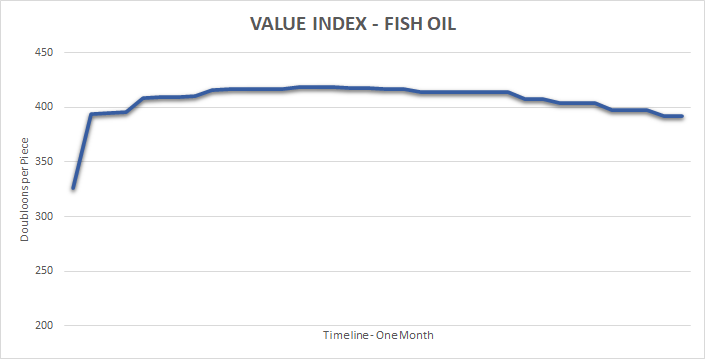

The Fish Oil Bounce

One of the key benefactors to the Blue Steel debacle has been the bounce in Fish Oil futures. It took two month’s for Blued Steel to even reach IPO status, so it’s safe to say the new material isn’t really a popular trade item. The components needed to product Blued Steel, on the other hand, have all raised in value. This is the second month a row where the material has seen a 15%+ bump in prices.

For the record, steel prices are up +20.84% on the month. This is at a time when both Coal and Iron are declining in prices. This means the one benefit that Blued Steel added to the game wasn’t in its own value, but the fact that is helped define Fish Oil and Steel as supply chain materials, making them unique in that their manufacturing value is actually being added as they make their way through the supply chain.

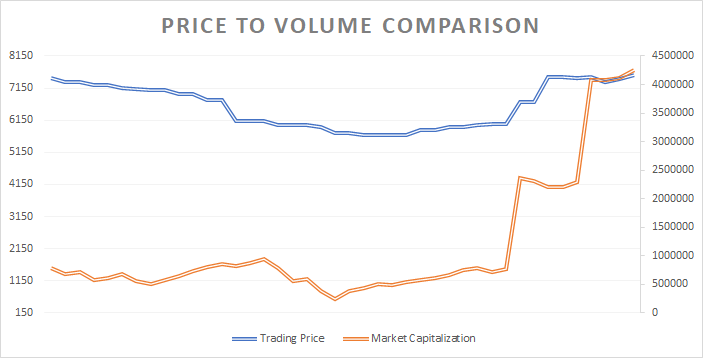

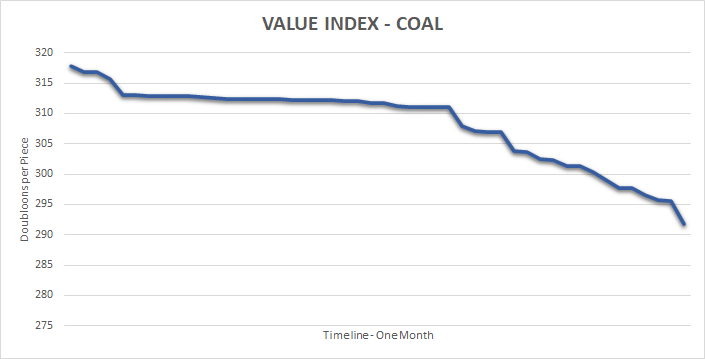

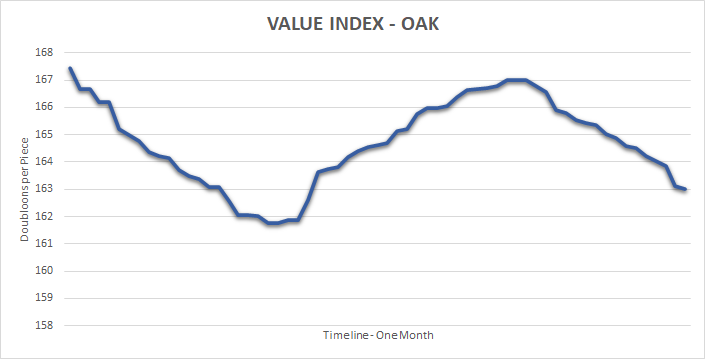

Impact of Ships

Oak prices saw a brief rebound this month before ultimately falling back to it’s closing price point. This change of direction was due to the announcement that two new ships would be released this month. The mid-month spike is from players who were stocking up in materials prior to the release. Once this happened, prices continued their fall.

Usually, when you see trends like this, it’s due to a price correction. However, we triple checked the data and found that this was not the case. There were no large-scale sellers attempting to change the market direction. Oak is usually one of the hardest markets to do a price correction due to the large number of materials you have to have on-hand to pull it off. That’s why we are confident in reporting that this isn’t a market correction, but a trend in the market as a whole.

In fact, this is also a sign that the recession is still in full swing. When announcements like this create temporary demand, it’s typical that prices fall back to their intended price once the event is over. If the market was stabilizing, the price point of Oak would have stayed consistent. The fact that it couldn’t hold its value is an indication that further reductions to the Oak price are possible next month.

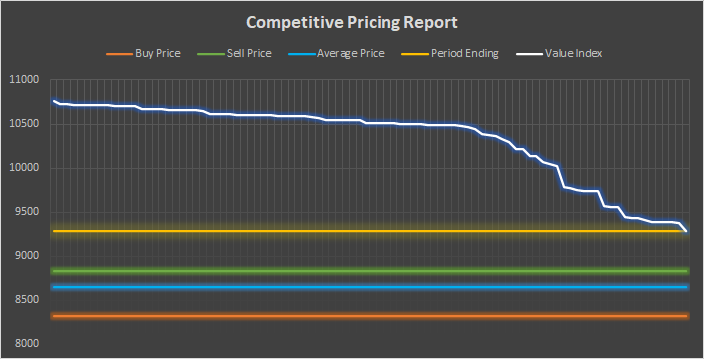

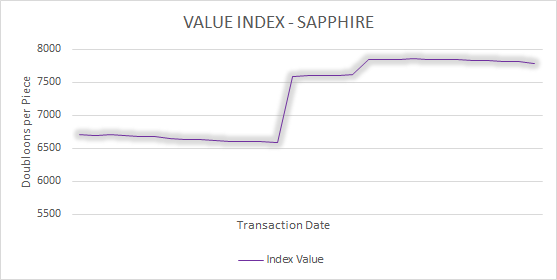

Sapphire Correction

We reported previously that we expected to see a price correction on Sapphire and the end of month close definitely shows this.

It’s still too early to tell if the correction will stick. As of now, it’s pretty stable. However, we’ve only seen the market capacity go down -2.12% which is not enough to accurately determine if the market is supporting the new price point. We will just have to keep an eye on this for a few more weeks to see what happens. The number of electrostorms that occur over the next few days will likely dictate how urgent the need for Sapphire becomes, and in return if miners are willing to pay more for them.