Tradelands Economic Update – December 4, 2025

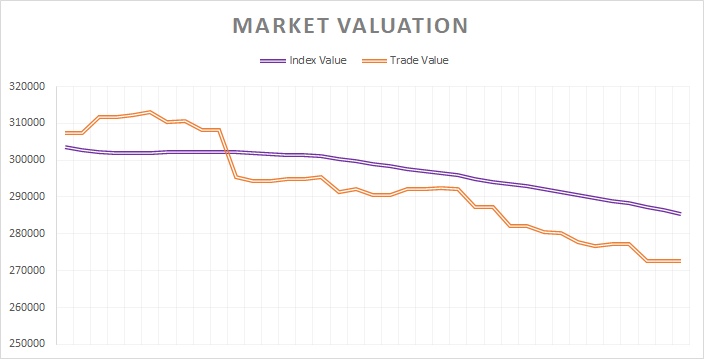

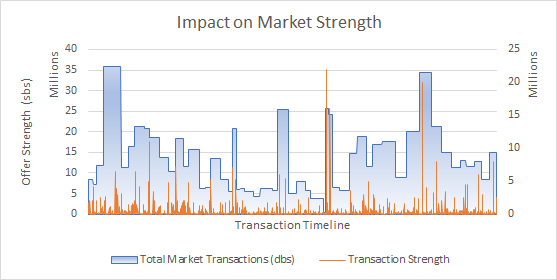

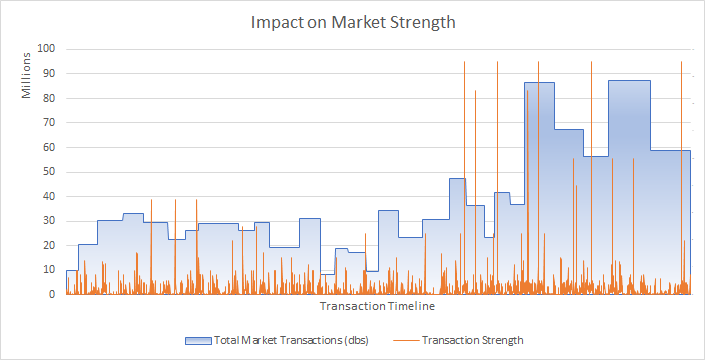

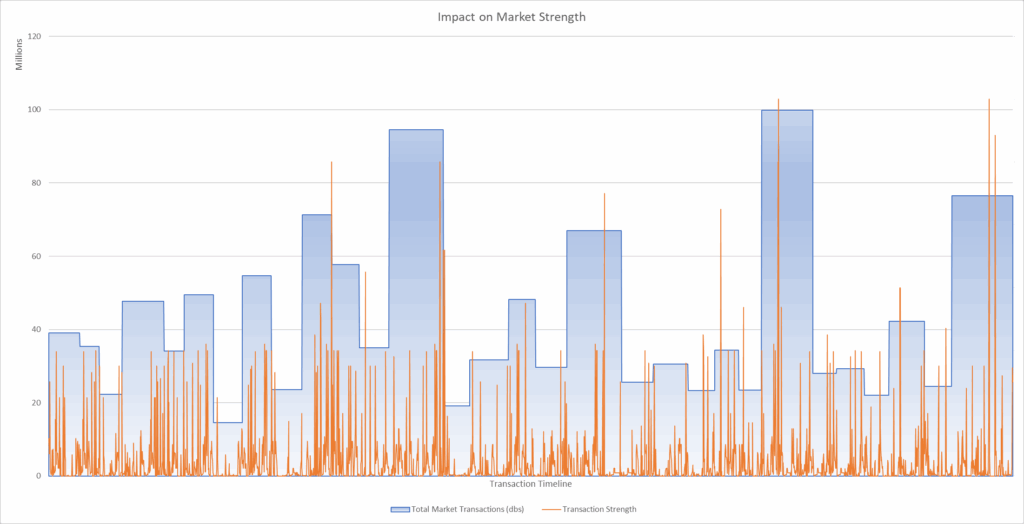

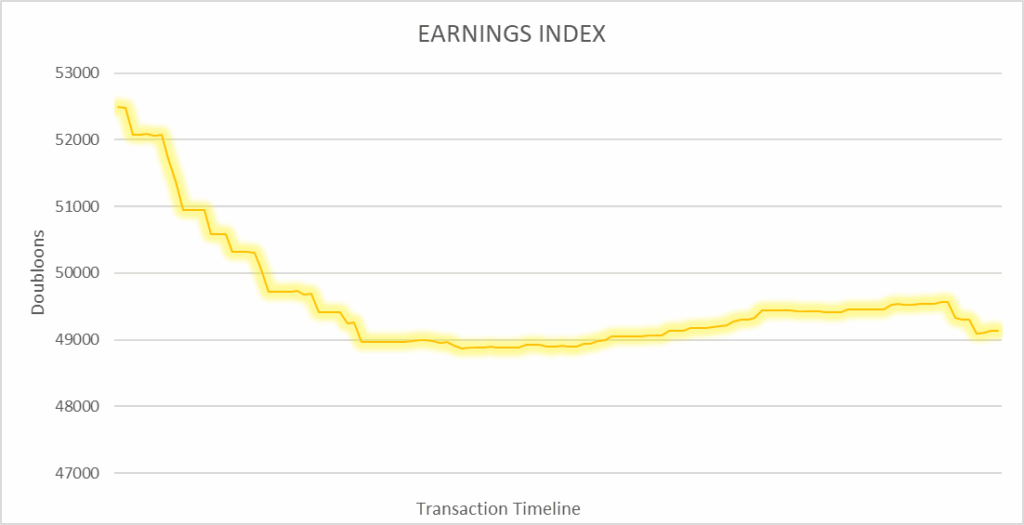

November was a strange month in Tradelands. The fairly reliable Halloween Crates were not a hit this year and had a muted impact on the economy. We saw $1,23 Billion in market activity, which was over $500 Million less than we saw last year. Needless to say, 2025 has been a year of upending typical trends, and November’s poor performance is a continuation of that.

On the positive side, this is the second month in a row where the success of ship variants is evident. The two largest trading days were the beginning of Black Friday and the release of the Novem Ship Variant. This out shined the performance of Halloween crates by a significant margin, although it’s overall impact was minimal in long-term economic activity.

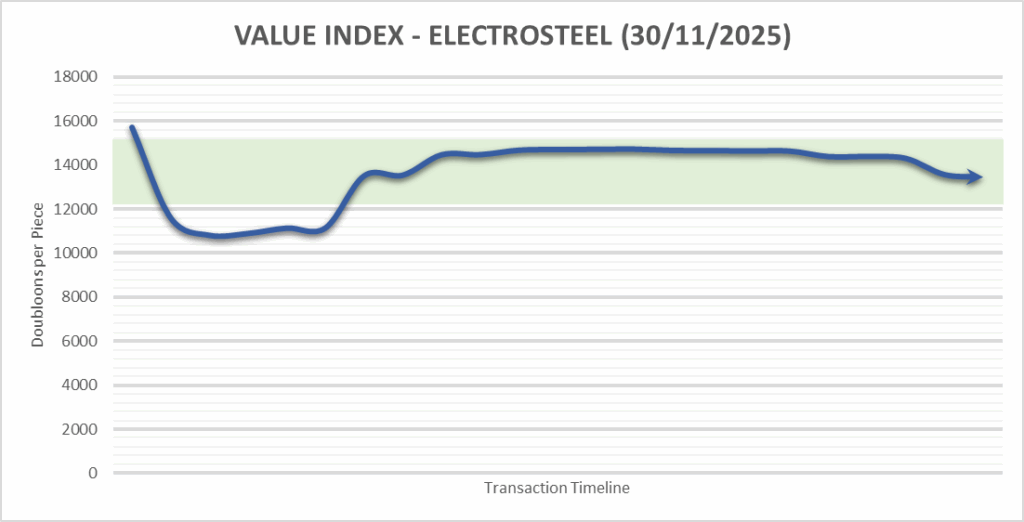

Electrosteel Returns?

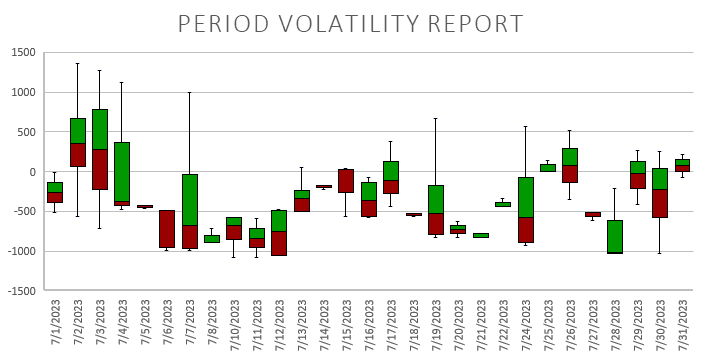

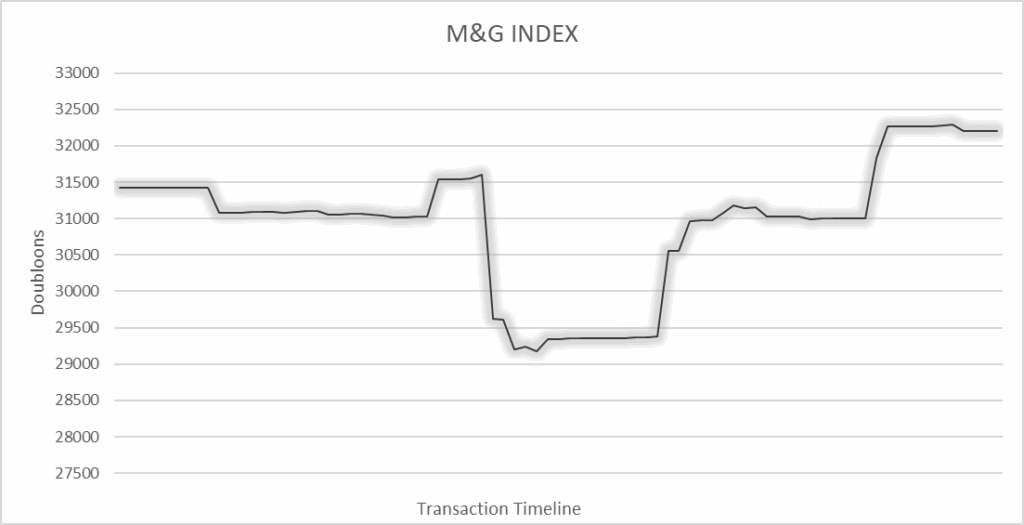

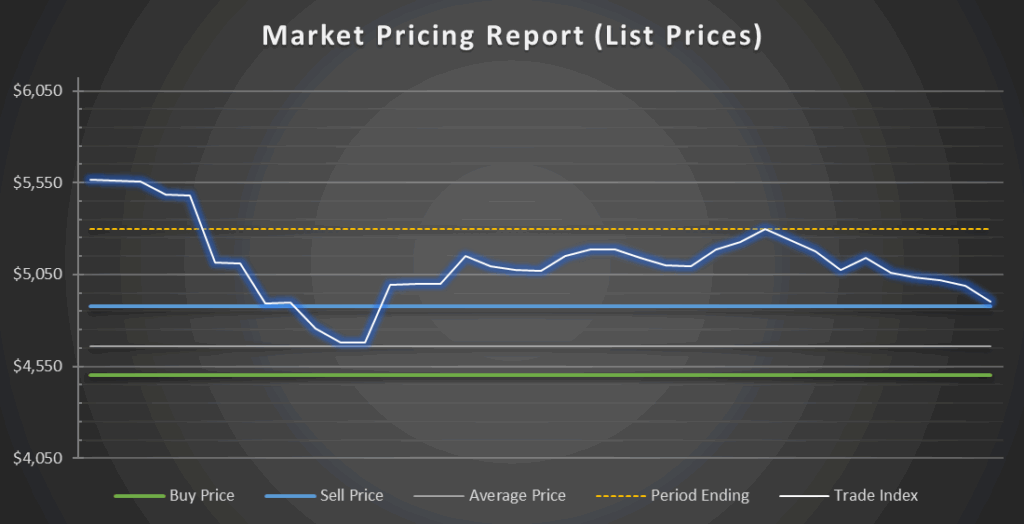

Several dev conversations, as well as information provided from community members, seems to indicate that a method of obtaining Electrosteel has returned to Tradelands. This had a sizeable impact on the M&G Index, Electrosteel prices fluctuated down to it’s pre-map update values, only to immediately increase once it became clear that the material would be gated and difficult to obtain.

One of the problems with Electrosteel is it will become a gated material. This means it requires the existence of another material in order to obtain. The best example of a gated material in Tradelands is Brekonium which requires a Breki Wealth Token to obtain. In turn, this Breki Wealth Token can only be given by someone who already has a token, meaning players determine who in game can get it and cannot.

The other benefactor of this is some of the gemstones with less demand. Amethyst is the big winner here, as it’s placement on the new material tier list has given it the same status as Sapphire. This means player who were holding on to Amethyst will now get a healthy increase in their net worth, while those holding on to stockpiles of Sapphire will see marginal increases, and more likely decreases in net worth.

Iron Changes

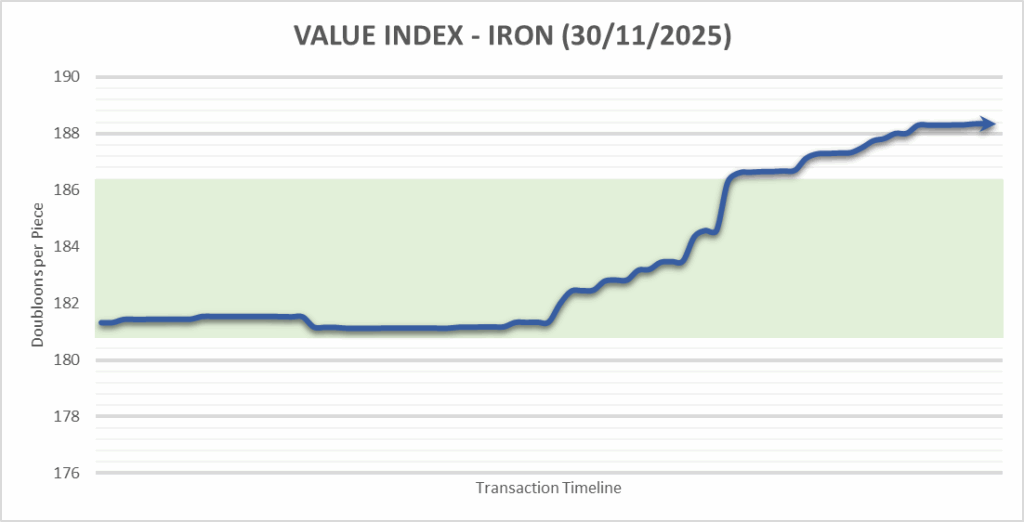

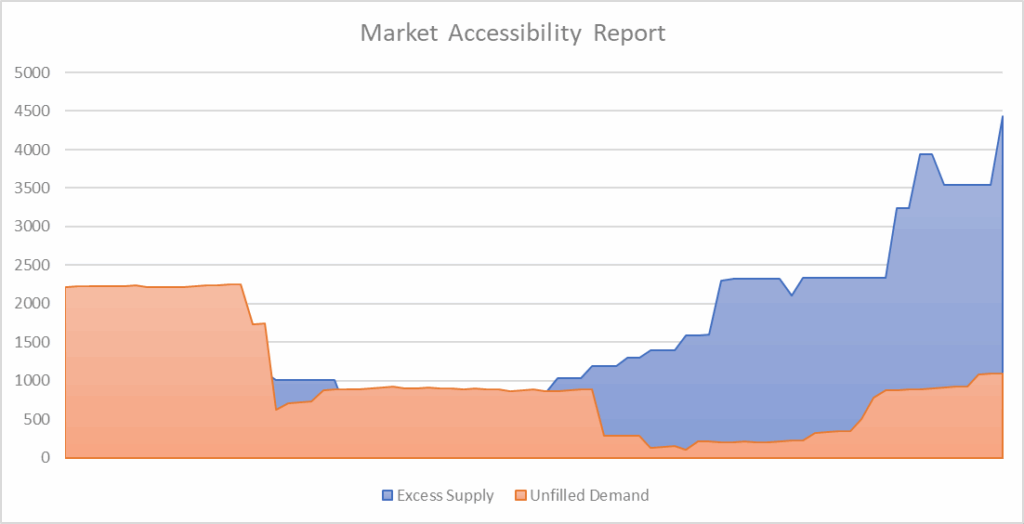

Along with the announcement of changes to Electrosteel, it’s widely reported that the drop tables have been re-aligned as well. The community speculates that this will lead to an Iron shortage. While we might see this happen in the future, it’s certainly not happening now, as demand is not increasing. That hasn’t stopped players from trying to raise prices though.

This phenomenon is known as speculative pricing. In short, it means players are pricing Iron at the price point they expect it to achieve based on the hype, not based on the current market price of the item. When looking at the market cap for Iron, we see that buyer interest has lessened over the course of the month, but seller excess supply as a result of increased prices has risen. This is usually an indication that the perceived lower availability of Iron, and thus higher price point, is not current true. In order for this to happen, sellers would have to buy out other players who are selling at lower price points, a trend we see in the last 10 days of the month, in order to change the prices to a new point.

While the current speculative pricing doesn’t look like it will hold, if enough players buy into the idea that Iron is $200 per piece now, it could stick, or at least maintain the elevated price longer than expected. However, this will require some coordinated effort, and we aren’t seeing it done broadly at the moment. This is an index to keep an eye on going into December to see how the market reacts.

The Fall Crate Falls

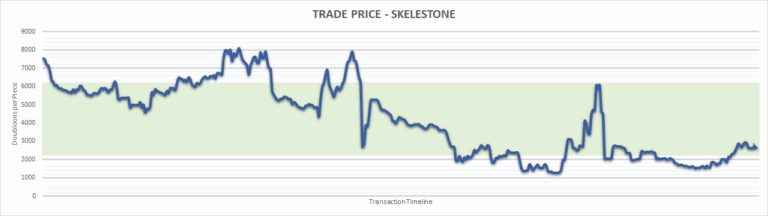

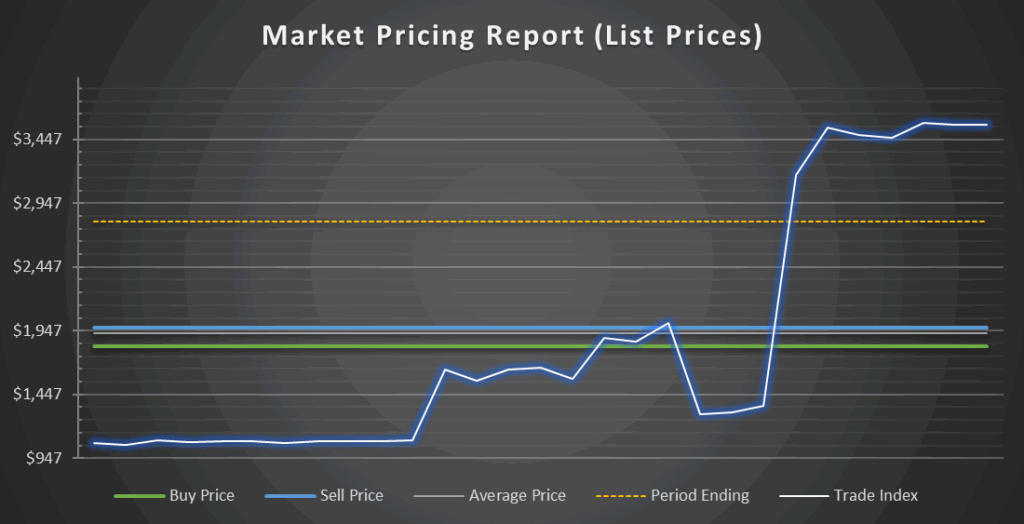

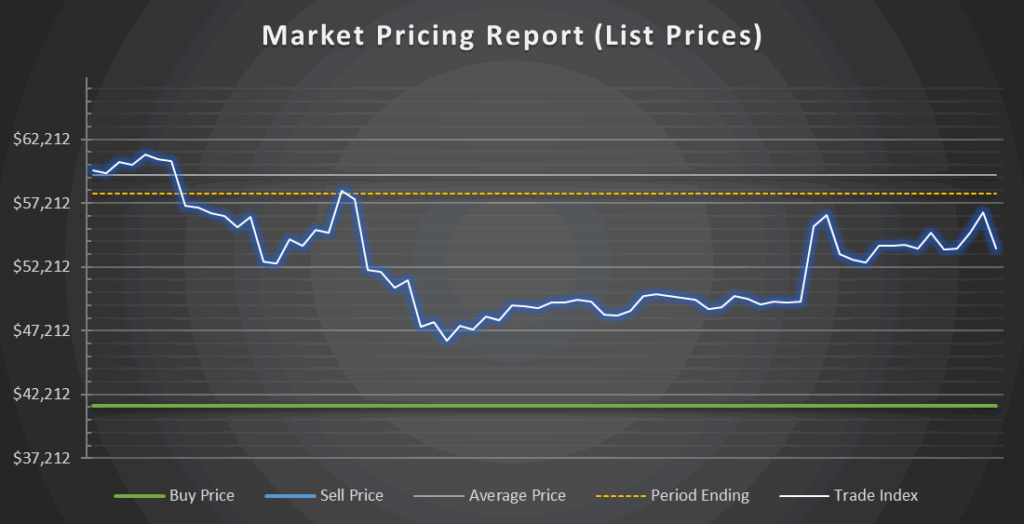

Finally, the Mystery Crates released in October had a definite impact on the market, and unfortunately not a good way. We are at a point where we can finally say that Mystery Crates in general have corrected their prices to be profitable. Previously, these were selling at $30k per piece which was too low to make a profit from selling them. Now they are at a consistent range of $50k to 75k on average. This mean they are a profitable purchase, especially if the items inside them are high value. On the flip side, the cost of this increase has been shifted onto the items themselves, as obtaining one through a crate, especially a high drop rate item, is more profitable than buying it from the market. To correct this, prices for items in general saw a high drop in pricing overall.

Prior to the Halloween Crates, some sellers were able to demand as much as $100k for high demand crates. However, the flood of low value crates in November has brought down the entire index by nearly a quarter. Moreover, the crate items saw a rapid decrease in value while Halloween crates were on sale, then stabilizing at their new price point with was under $50k. This was the end of a trend we saw start at the end of October, and is likely the combination of a Halloween Crate items as well as the end of the inflationary spending from earlier this year. Still, to completely reverse the impact of inflation, we would need to see another month like November. That will largely depend on how the Winder Event goes this year.