Tradelands Economic Update – August 1st, 2023

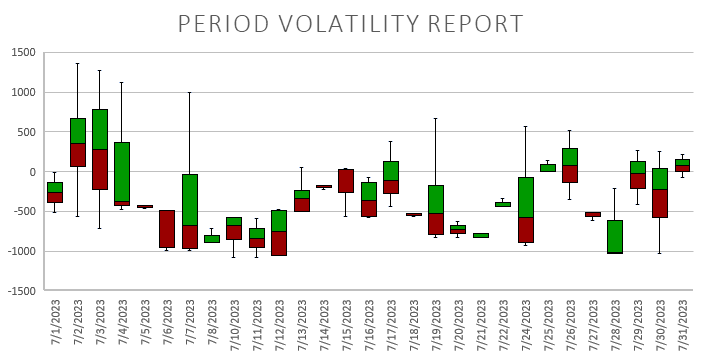

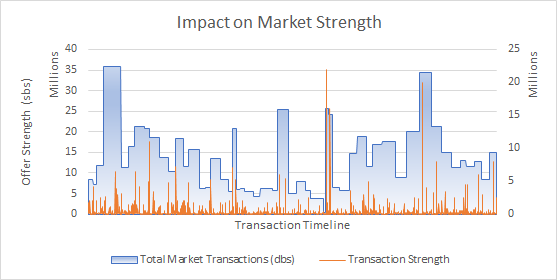

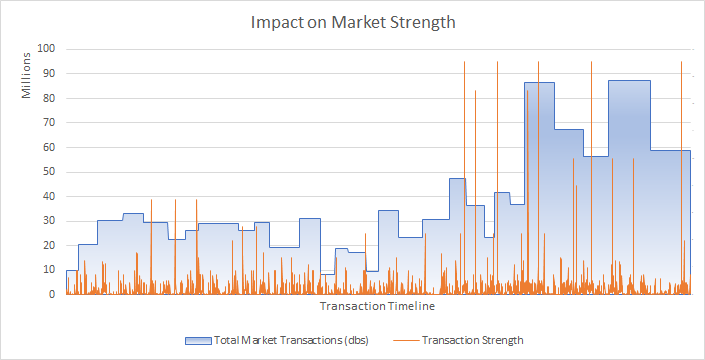

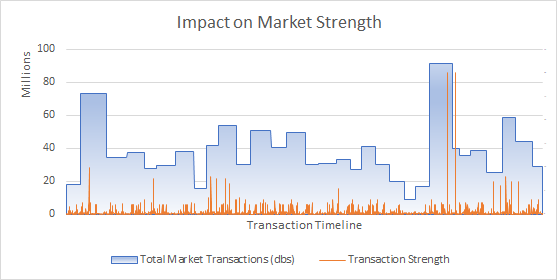

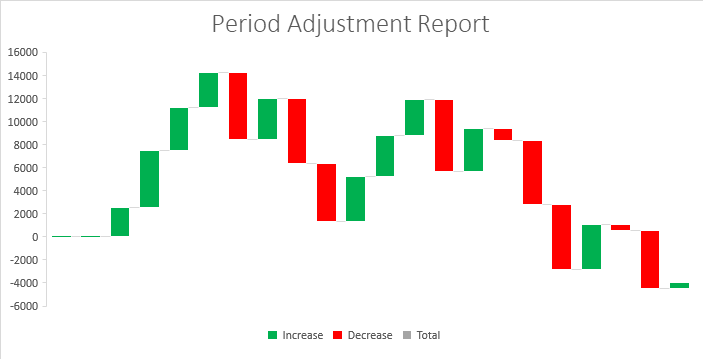

Note: The data cutoff for this article is August 1st, 2023 and published as of August 5, 2023. This differs from our usual reporting period.July saw total market activity at $1.13 Billion in July. This a drop of almost $100 Million from the previous month, a respectable outcome given there was no mid-summer release like last year’s Aukai Auction. The market is settling following a very long release which took nearly two months to complete from an economic perspective. Just saw half of all items reaching their culmination point (long-term average price) following the expected turbulence that follows the release of new items.

Gemstone Status

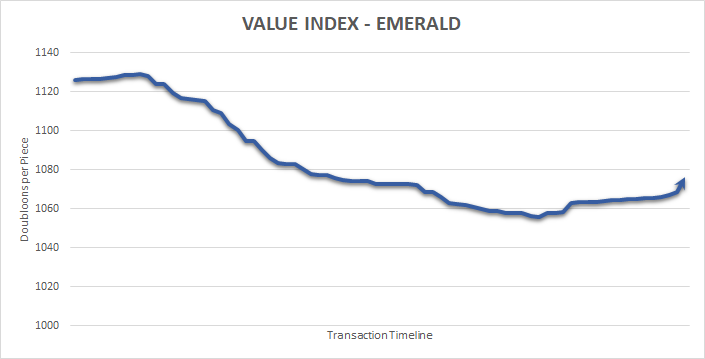

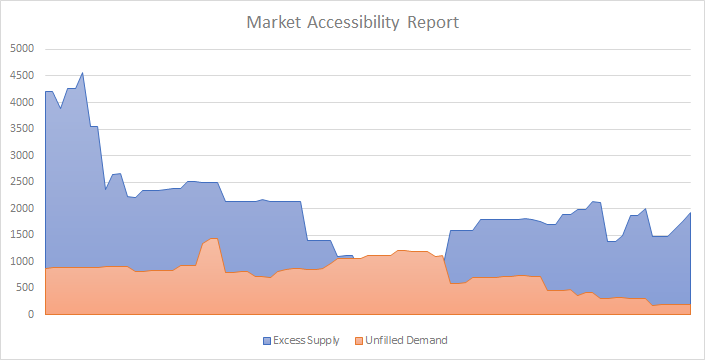

Emerald, Ruby, and Amethyst are the three primary gemstones that typically see prices about even. Emerald is often viewed as the price setter, the one that determines the price point for the category, since it is the most common one listed by players. It is used to construct gemstone axes which are in turn used to get other gemstones. Players are usually striving to obtain Sapphire and Onyx which are the two premium gemstones that can be collected.

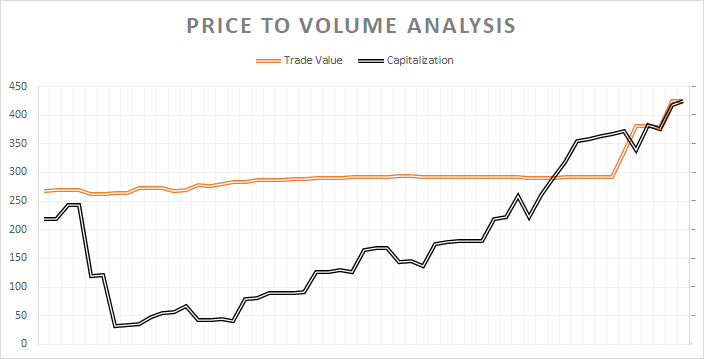

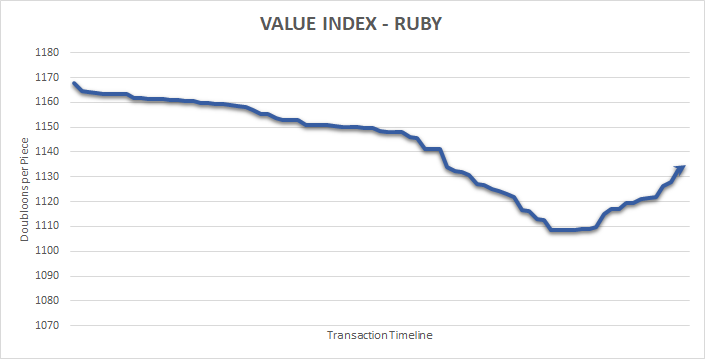

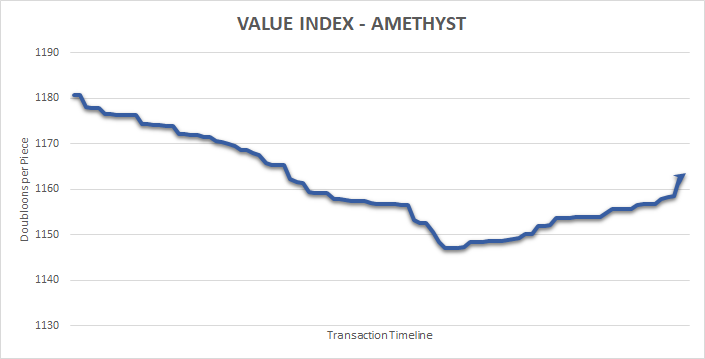

The price for all three indexes went down in July, with the low point occurring on July 20th before making a rebound. This low point is where a buyer attempted to bulk purchase the available gemstones off the market. The upward trend that followed is an indicator of the price resilience of the index. Emerald typically trades at the highest volume which is why the trend is not as pronounced. Amethyst and Ruby have less volume on the market, meaning once the low offers were accepted the remaining items on the market were able to demand higher price points faster due to scarcity.

The list prices for all three gemstones are higher than their sell point (the threshold where a seller will sell without bargaining) meaning the number of completed transactions slowed down at the end of the month. This is a sign that prices will likely go up in the near future and are currently projected to stabilize at $1.2k per piece.

Blood Oak Booming

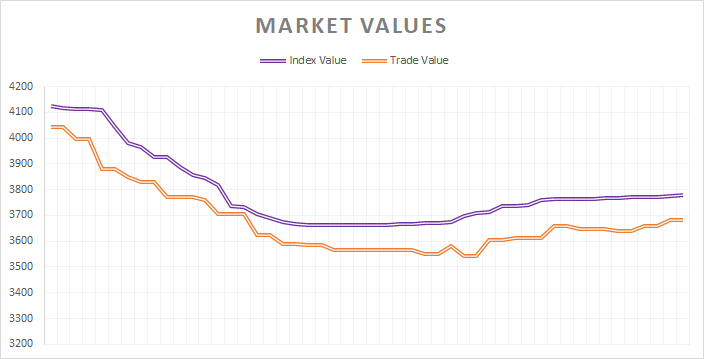

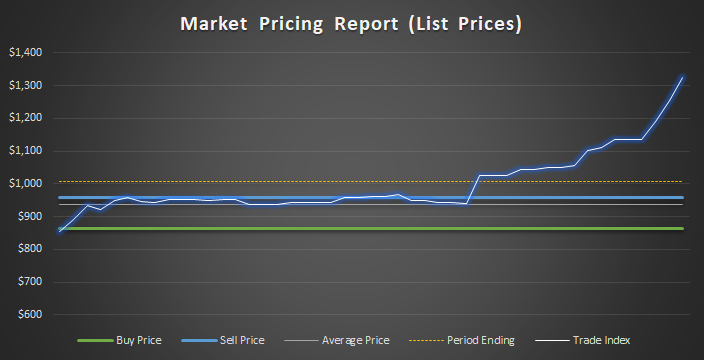

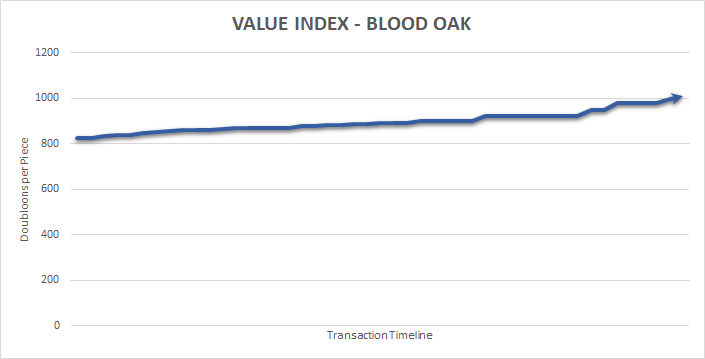

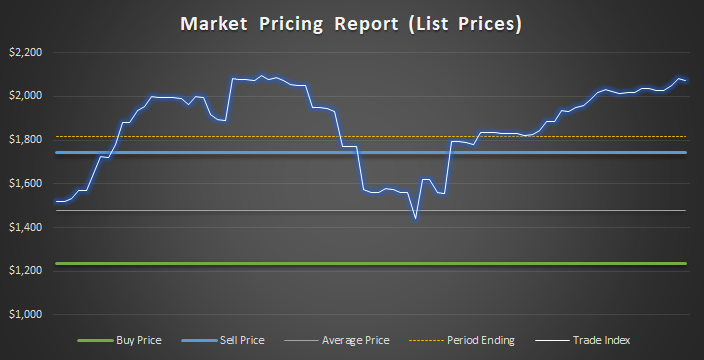

We previously reported that Blood Oak was heading for a price correction and it appears to have happened.

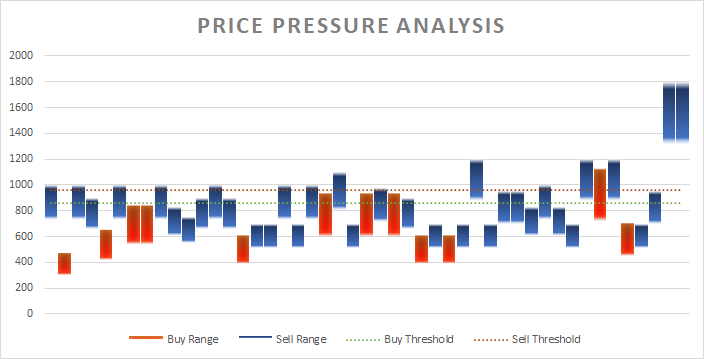

The surge in prices in the last two days of the month is not expected to be sustained. This upward momentum was the result of a single trader selling prices at $2k per piece. They currently control 6% of the total Blood Oak on the market, so we anticipate other sellers will eventually dilute their market share and drop prices to a reasonable level, or desperate players will buy out their inventory which will cause the price to enter a price correction. However, that price correction will only occur if the index price has exceeded $1k per piece. As of now, it is only $7 above this threshold which is not enough for a correction to make a noticeable difference in the overall price.

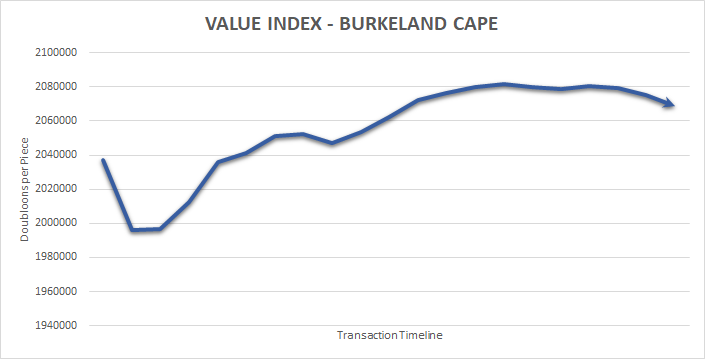

Burkeland Capes Are Selling

The release of the Burkeland Flag, which required a Prize Token, appears to be re-kindling interest in the Burkeland Cape. Because prize tokens were available through crates, and most of them went to the creation of clocks, some players are turning to the cape as a cheap alternative because they can also be hung on a wall.

Capes are notoriously resilient to price drops because they do not see frequent re-releases. As a result, they tend to hold their value if you are able to collect one in the time frame when they are available. In fact, the two highest selling capes are currently the Verner Cape at approx. $20 Million and the Inyolan Cape at approximately $10 Million. Despite being listed as accessories (i.e. wearable items) these are frequently displayed in houses or shops. It remains to be seen if the introduction of craftable flags as a true furniture item will impact the value of capes in a significant way.

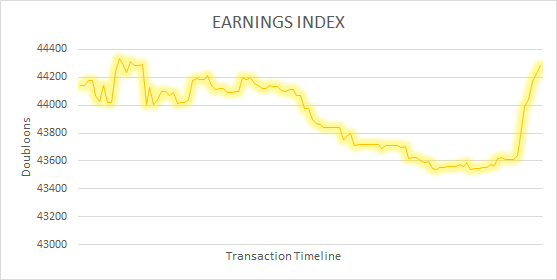

Ebony Price Correction

While reviewing the status of the premium woods, we noticed that Ebony has entered a price correction. This is driven by a sudden surge in Ebony purchases which drained inventories mid-way into the month. Sellers are now able to set prices higher and transactions are still occurring at these raised prices. This is an indicator that the prices are likely to stay higher in the long-run.

This kind of market correction is usually done as part of a coordinated scheme. However, the number of merchants involved, as well as the volume of items on the market, indicate that this is unlikely. There are currently 7.5k pieces of ebony being sold and two thirds of all players who are marketing their items are currently performing the action to raise the overall price. Additionally, most Discord price guides are still showing Ebony between 1k – 1.5k per piece, meaning this is not being driven by a price change from an “unofficial source”, but rather a natural market progression that was created by players.