Tradelands Economic Update – July 1st, 2023

Over the past two months, Tradelands has seen a steady release of new content. These are much smaller than the single big bang that we saw in last year’s Purshovian Release. Even if you consider all the changes from April to present, the cumulative impact on the game is less than last year. By July 2022, the game was introducing the Aukai Release, which means this summer is likely to see less of an overall impact than last year.

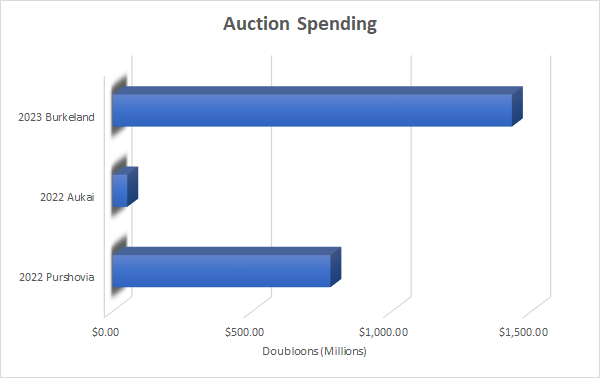

We Love Auctions (Apparently)

One of the biggest differences between this release and last year is that most of the new value is through the auctions instead of new items. This year, item spending on auctions exceeded $1.4 Billion, whereas last year’s highest auction spend was on the Purshovian Auction which netted nearly $800 Million total. Even when adding the Aukai Auction spending to this number, it is still far below the amount spent by players this year.

There are a couple of things we can learn from this data. First is that the developers are likely to view this method of auctioning off content as a success. It’s clear that a lot of players spent a lot of time and effort saving up for this event in the hopes of obtaining something. The decision to allow additional copies of some items once a certain price threshold was triggered, kept momentum going and players kept spending. Because this is viewed as the best way to remove wealth from the game, and that it successfully removed more doubloons from the market this year than was added all month, we can safely say that this was accurate.

The second thing we can see is that the all-in-one approach to auctions is far more effective than the piecemeal attempt from last year. The decision to have the Aukai release within 3 months of a previous auction saw a dramatic reduction in the amount spent. There were approximately 50 items this year (averaging approx. $30M per item) whereas the combination of Aukai and Purshovian releases in 2022 had around 40 (averaging approx. $13M per item). That means combining the potential items into one large event instead of multiple smaller events doubled the total value of all the items being sold.

As a result, we expect that the yearly auction will continue to be a part of the Tradelands legacy. On the bright side, we are pleased that some non-exclusive items were also added so casual players can still enjoy some small part of the update. However, the game is clearly going down a path where it is an expectation that you participate in these external events in order to fully participate in the game.

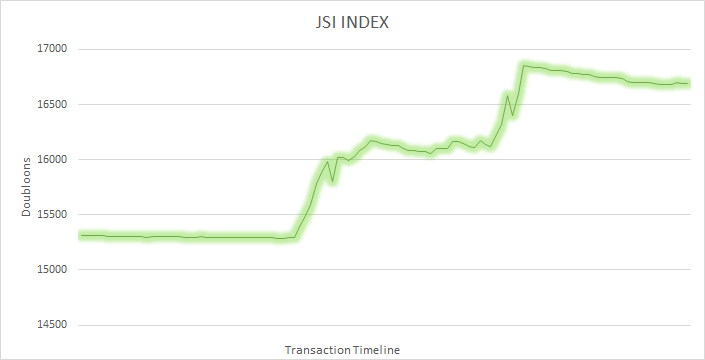

Wood Spikes

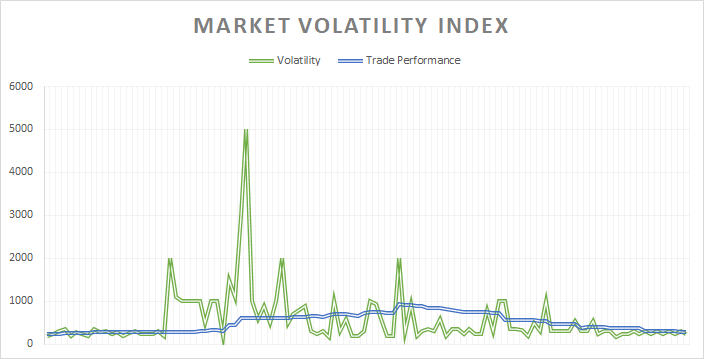

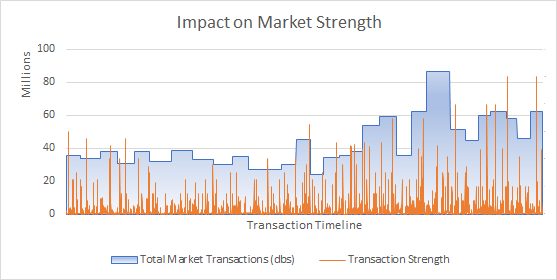

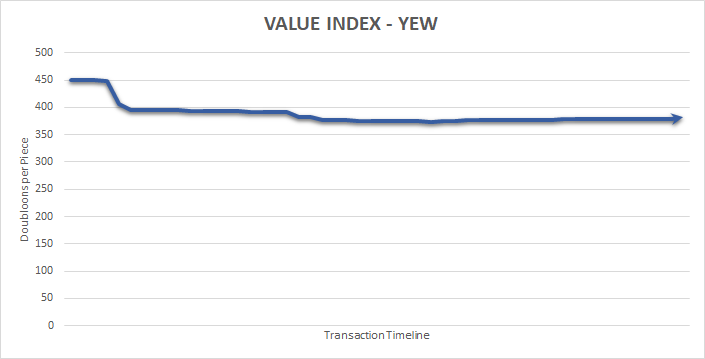

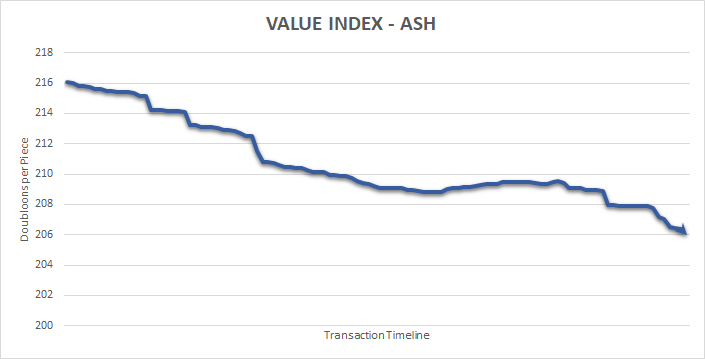

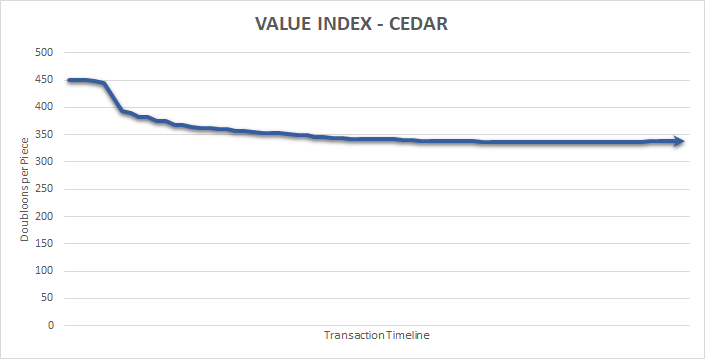

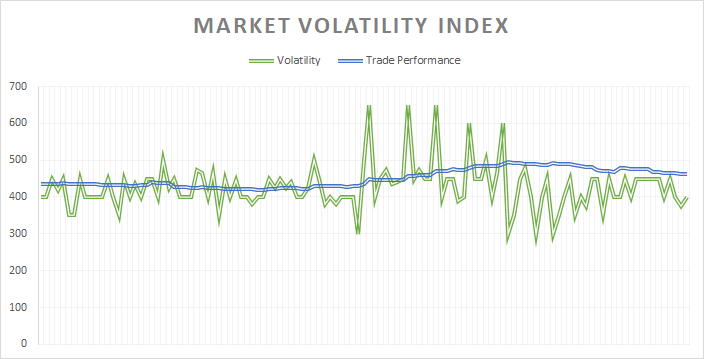

The wood market is experiencing turmoil and this is a good indicator of the market overall. The addition of Yew and Cedar to the timberfelling drop tables is already having an impact on the market and is the reason for the strong upward momentum of the JSI Index last month. In fact, the JSI Index, which tracks the value of timberfelling, is at the highest point since June 2022, right when the recession was starting to hit all materials simultaneously.

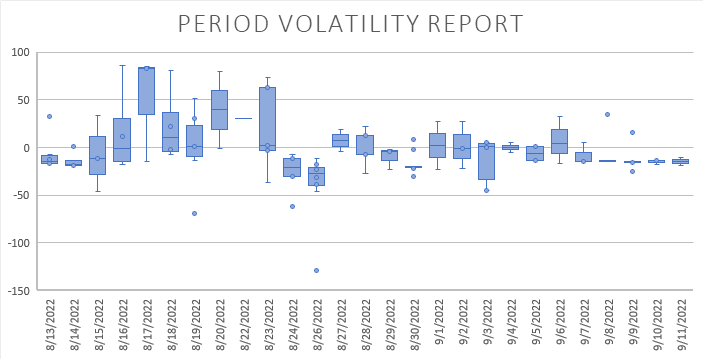

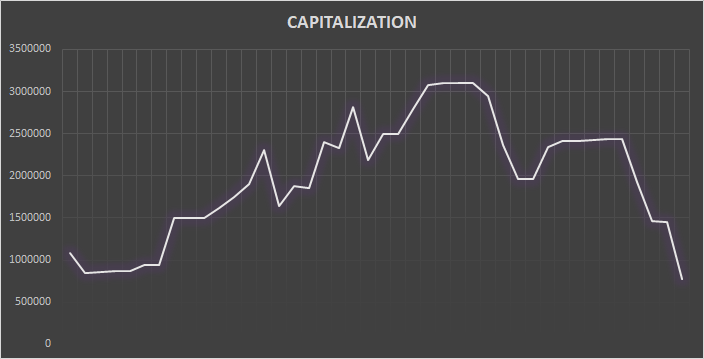

The difference between 2022 and today is the growth seen this month is all organic, meaning it was added to the game through players instead of through inflation of prices. In fact, when we break down the wood market into the individual types available, you start to see that the wood prices are generally trending down overall. This is why there is high fluctuation in the chart instead of a steady upward trend in prices. It means the market remains competitive and that value is occurring through increased capitalization and profitability.

The early dips in price are due to players still attempting to figure out the long-term value of these woods. Ash is a good indicator of an uncommon wood that doesn’t require a specialized axe type, whereas Yew and Cedar require special materials to acquire. In some cases, the axe may cost more to produce than the value of the items being sold on the market. That means we can expect to see more fluctuations in the future once the true cost to obtain these items is known. It’s also important to note that, because the wood can be obtained at the Premium Vendor, there is an anchor price that will create more stability that other woods may not experience.

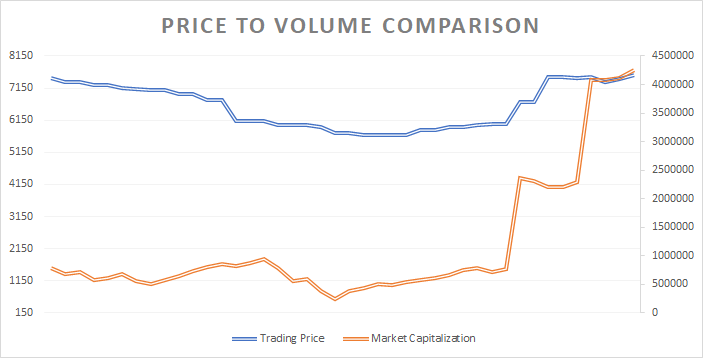

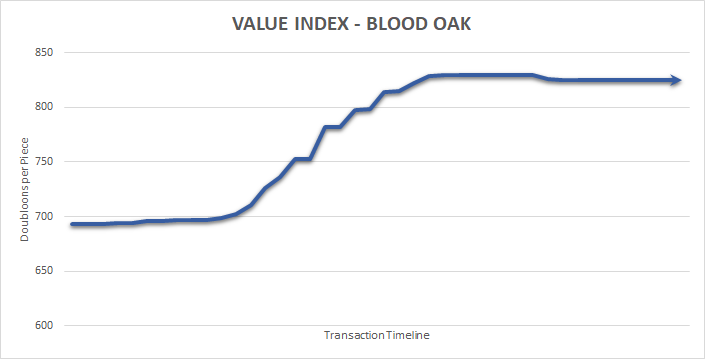

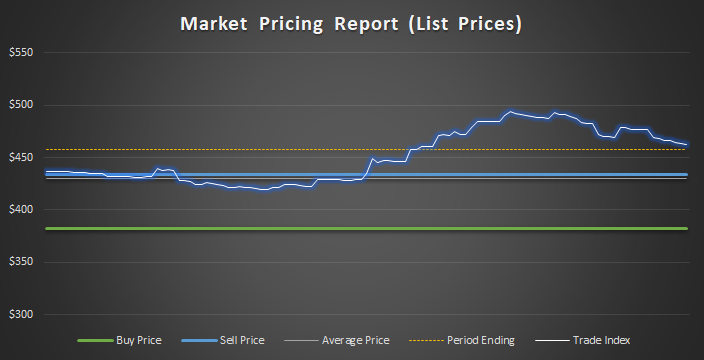

Blood Oak Correction

The status of Blood Oak changed significantly in the past month. This has bee changed from an premium wood to an exclusive one, meaning it is no longer available from the Premium Merchant. Because you can also collect this wood from timberfelling, albeit in extremely low percentages, the correction has been cautious so far. However, make no mistake about it, this wood is going to see a price spike in the coming months.

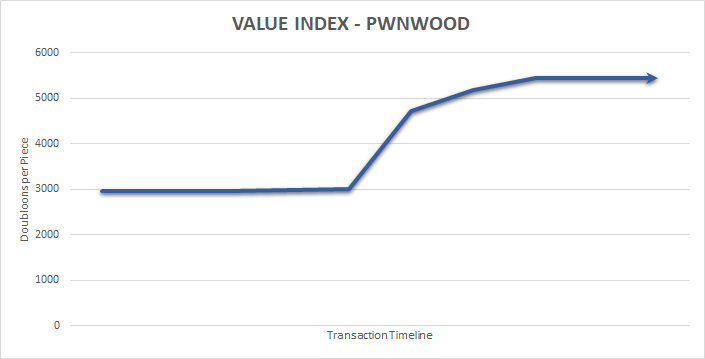

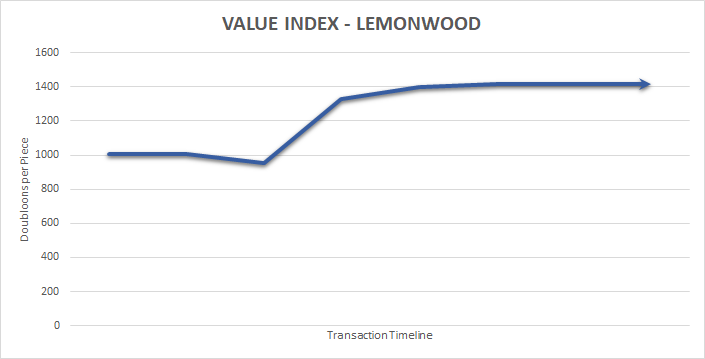

The main reason for the slow changes in price is the market capitalization remained high following its removal. However, now that the auction is over, and therefore removing the main reason to sell exclusive materials, the capitalization is starting to fall to its pre-hype amounts. As it does this, sellers who decide to leave their stocks on the market will be able to demand higher price points. Since there is no other way to obtain it in bulk, this means the price is expected to climb. As of now we expect the material to end up somewhere between the price of Pwnwood and Lemonwood.

The reason for the comparison against these two woods is because their Premium Token price tends to hover around the same amount we project Blood Oak to sell at once it returns to the market. Pwnwood was at $300 Rs and Lemonwood was at $250 Rs when the prices were established. Blood Oak was at $250 Rs before its removal and it may receive a price increase once it returns.

The Silver Onyx Dilemma

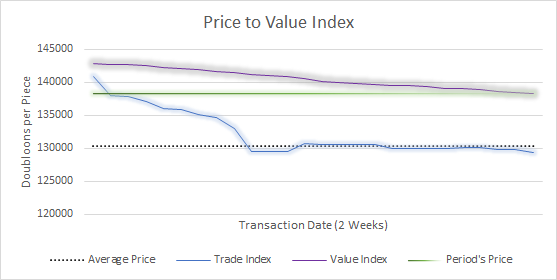

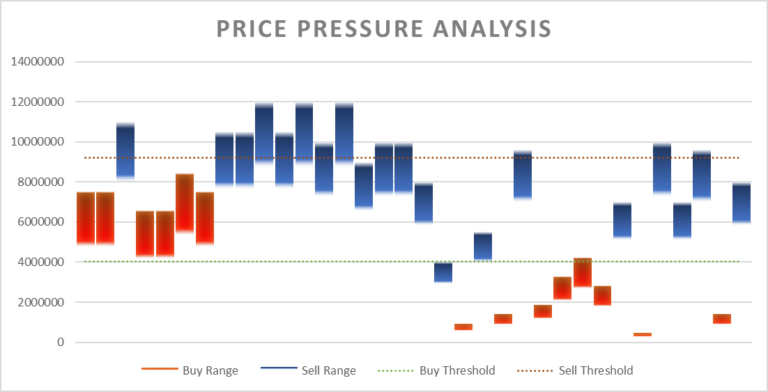

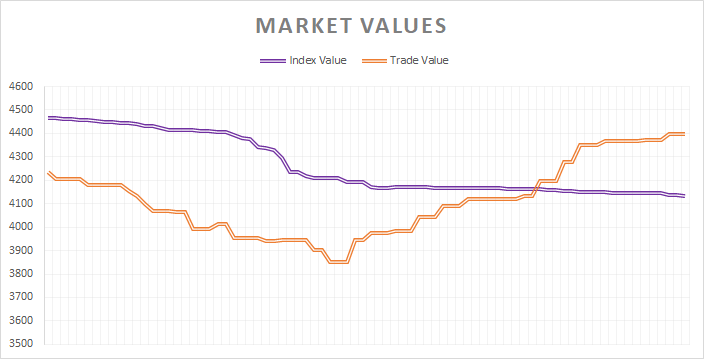

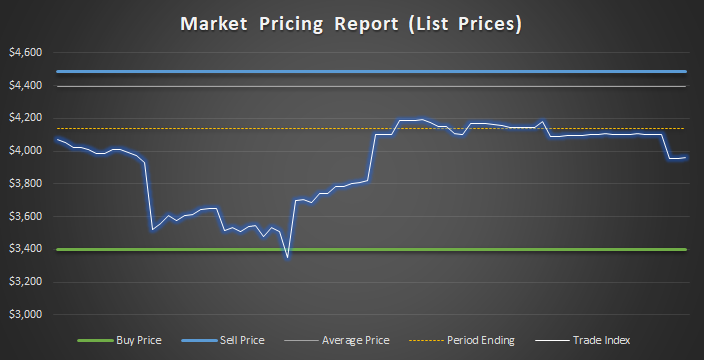

Players are trying to capitalize on the announcement that Onyx and Silver now have an important part to play in the timberfelling profession. Despite the push to raise rates in response to the change, the effort is largely failing.

In the case of Onyx, the attempt to raise prices caused alienation in the market. This allowed buyers to come in and demand lower price points. This caused sellers who were selling off inventory to capitalize on the new demand and undercut the sellers who are raising prices. The highest sell price recorded in-game last month was at $8k per piece. However, that has been offset by bulk sellers willing to match requests for as low as $3k per piece. As a result, we project that prices will likely slip below the benchmark $4k per piece in the future, as long as timberfelling is able to turn a profit with the new changes.

On the other hand, the Silver market was well handled by traders. This is an example of a market being controlled by experienced traders who manipulated an upward price correction without giving full control to buyers. While the gains were less, the sustained trend allowed for sellers to keep the overall price point above the Sell Price threshold, meaning they are exceeding profitability expectations for the month. As long as timberfelling is able to turn a profit, we expect to see Silver prices continue to increase as a result of this well-executed market shift.