Coal Is Price Correcting

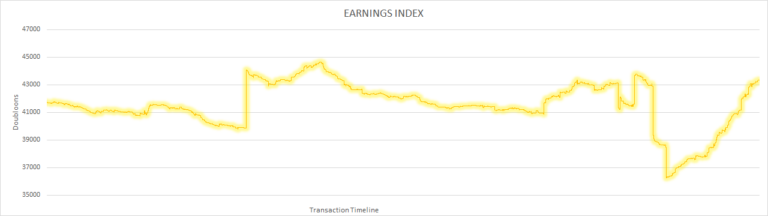

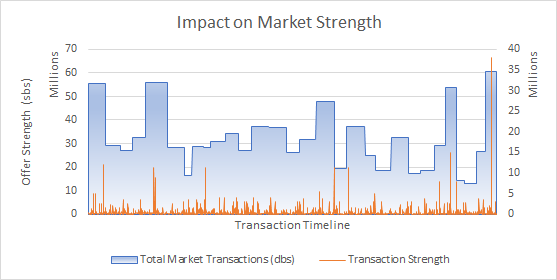

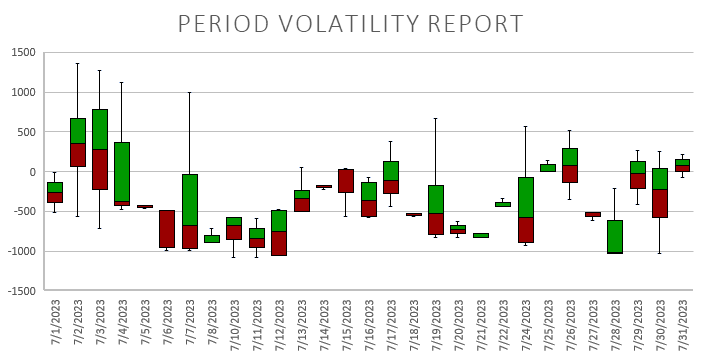

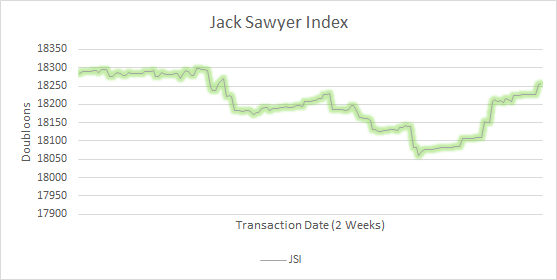

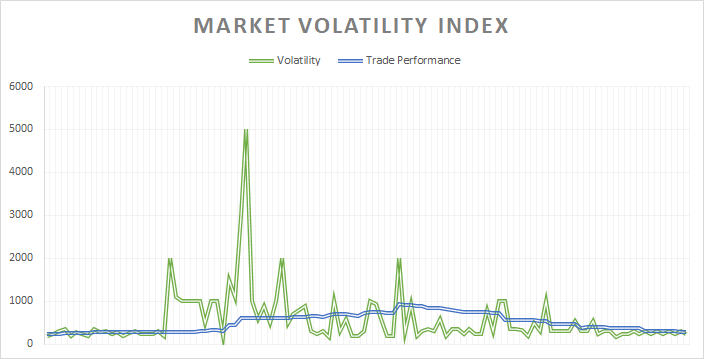

Last month, a release that removed Coal from the premium market caused some turmoil in the market. A quick glance at the market indicators today suggests that all the overpriced inventories have burned off, either through re-listing at lower prices or being sold/used. It will take some time for the Price Guide indexes to register the change, but all indicators suggest that Coal will return to a lower price point before the end of the month.

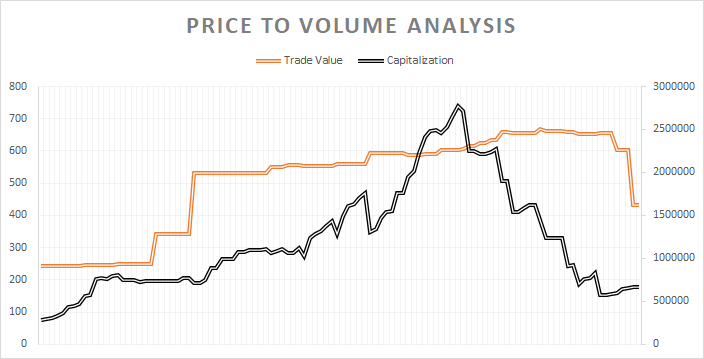

If we had to make a guess, based on the metrics to-date, coal will probably end around 300 – 350 per piece. This is still a jump of around +50 per piece due to to all the volatility. The material’s ability to stay at this level will depend on how receptive the market is at this new price point, as well as any potential releases during the Halloween event that might change demand for coal.

If you are a small-time miner and want to have a chance at manipulating a material price, now is the time to do it. If you wait too long, bulk traders will once again enter the market because Coal is once again available at the Premium Vendor.