Tradelands Economic Update – September 2022

Earlier this week, the F&BP team announced that the Purshovian Recession appears to have finally entered the recovery phase. This announcement ushers in a new direction of the already tumultuous economic trends of the year. Today’s report will focus on this news as well as the premium materials update that occurred near the end of the month.

2022 Purshovian Recession

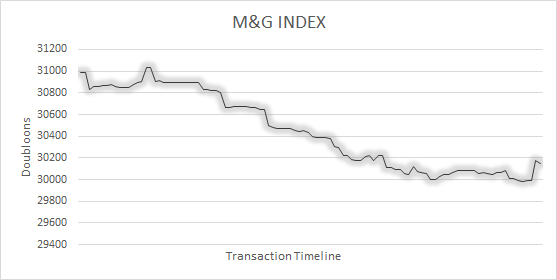

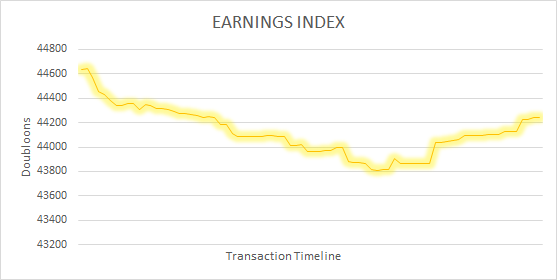

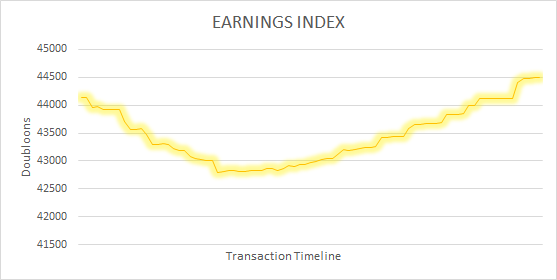

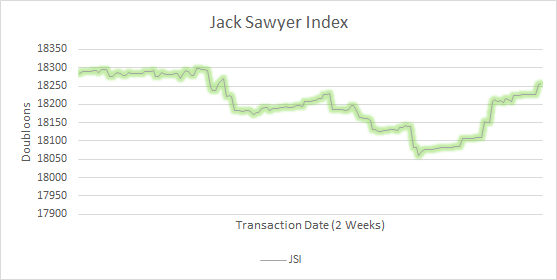

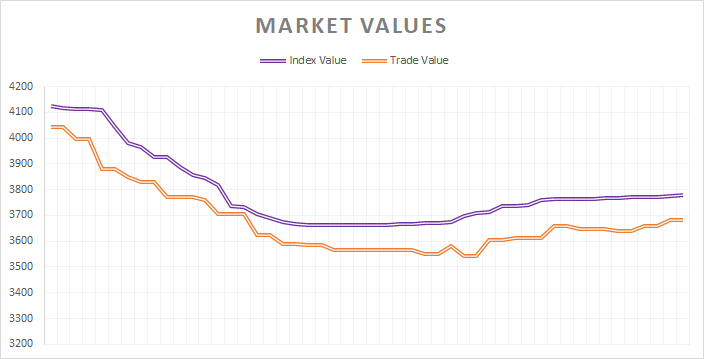

It’s official per the F&BP’s announcement on Discord earlier this week. The Purshovian Recession has entered recovery mode, effectively ending six months of losses for players. At the end, we analyzed that 21.5% of potential earnings within the Tradelands community has been lost in just six months of price reductions and sell offs.

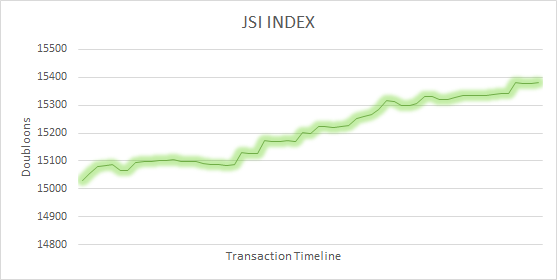

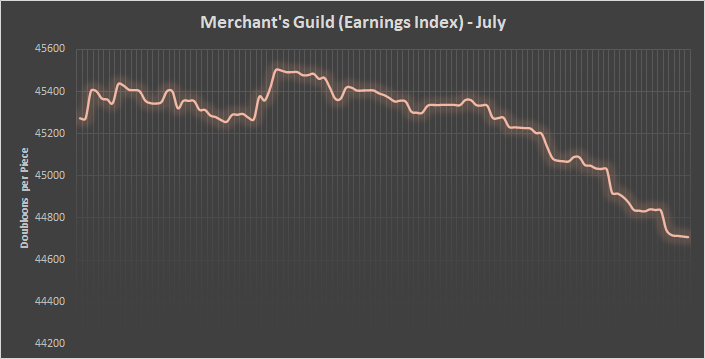

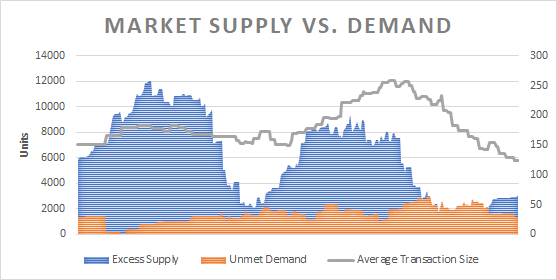

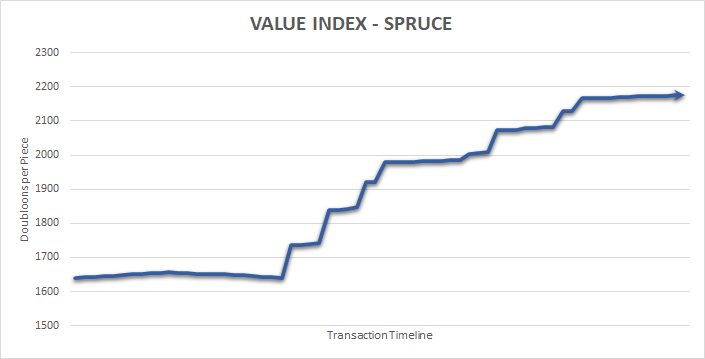

This update is welcome news for some players, specifically those who are invested in material trading. While the mining and gemstone market is still continuing to fall, it is showing strong signs of stabilizing. However, the market for wood is already recovering, due in large part to the release of new ships and demand for timberfelling.

For store owners, the recovery is still somewhat slow. September earned back the losses from August, but there is still a long way to go before we will reach the record highs he saw in April. The new items that have been released in the past few months have been underwhelming in terms of improving market conditions which is part of the struggle.

Premium Materials Update

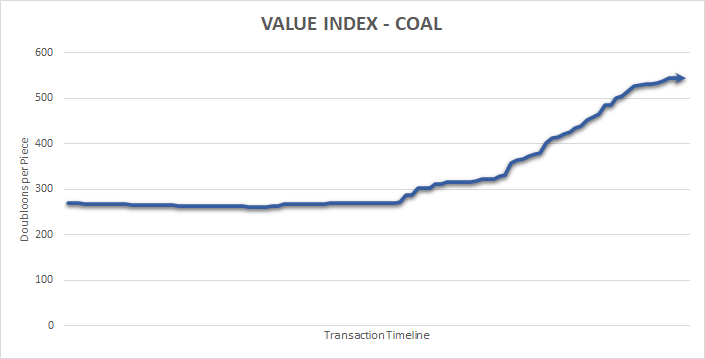

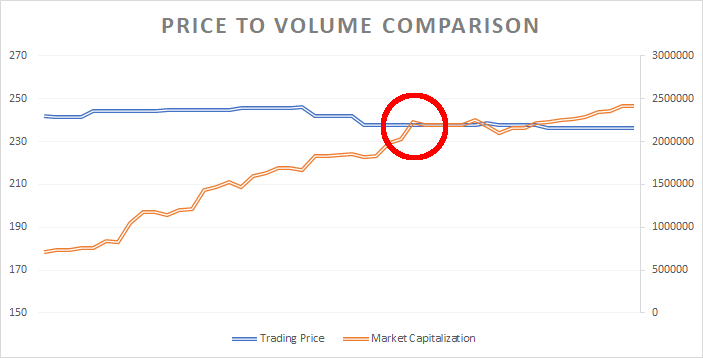

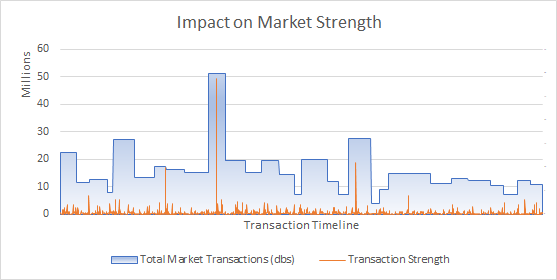

A late month surprise update to materials is going to re-shape some of the items on the market. The release effectively de-coupled the pricing for some materials from their premium vendor counterparts. The result will have a large impact on wood, which is the most common premium item put on the market, but the other surprising benefactor from this change is Coal.

In the case of Coal, it’s temporary removal from the premium vendor led to a skyrocket in prices. The immediacy of the price correction shows just how under-priced Coal has been. It’s used in far too many recipes and is a vital component to some ships. It also has a drop rate between 7 – 10% , meaning a dedicated coal miner could put around 150 non-premium pieces on the market before he/she starts losing money on the transactions (and therefore raising prices).

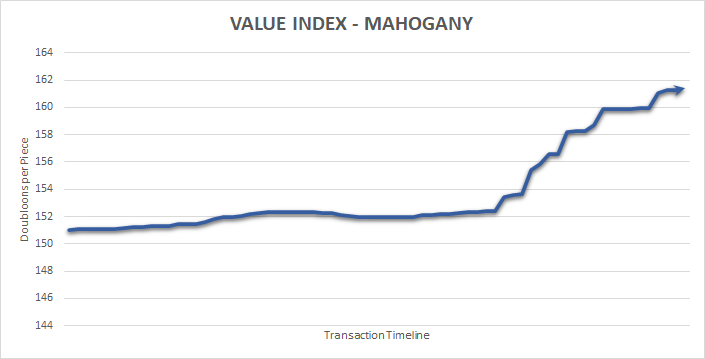

As for Wood, the premium vendor acted like a price anchor. Remember the past report where we predicted a price fall for Pine and Spruce because their non-premium status was worthless? Well, this change effectively reversed that, and we already see Spruce benefiting from all woods being placed on equal footing. In fact, Mahogany is an interesting case because the new price anchor is related to its value in the furniture Premium Cargo. It’s 10-point price increase in the past week is already visible on its index.