Tradelands Economic Update – September 1st, 2023

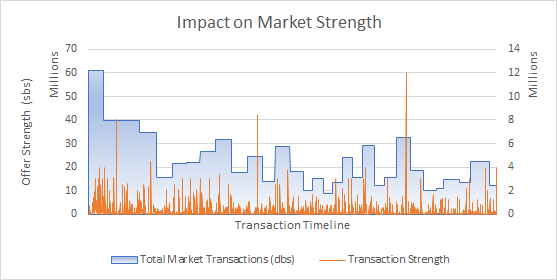

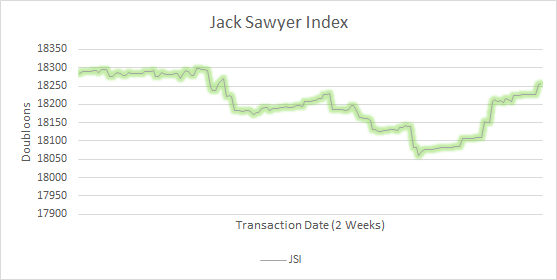

August traditionally sees a drop off in economic activity that lasts until the Halloween Release. This month saw stronger than expected activity, ending at around $1.2 Billion. However, all of the major indexes stalled out by the end of the month, driven primarily by the introduction of houses to the game which removed doubloons from the market. The market also saw a near collapses in August, but this is normal as the return to school (and thus less activity in-game) causes a shift in activity. It’s not the first time this phenomenon has happened and the game has survived it every time.

New Economic Reports

The F&BP Company added new metrics to the website in order to help players gauge economic activity in Tradelands. Previously, these were only available to members who were helping to provide data, and as a result had access to the Dashboards. However, in an effort to increase transparency and remove ambiguity, we have directly linked this data to the website.

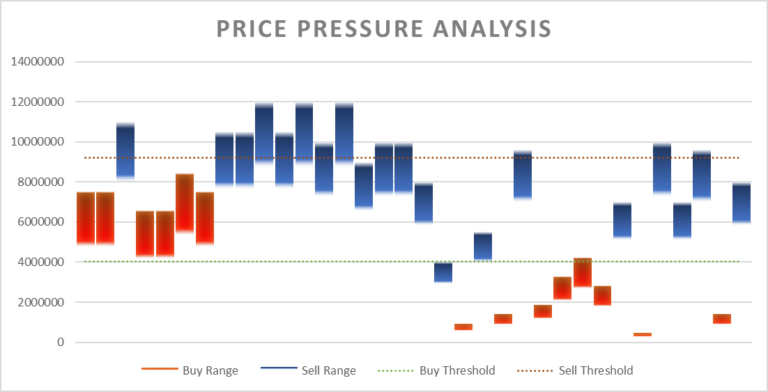

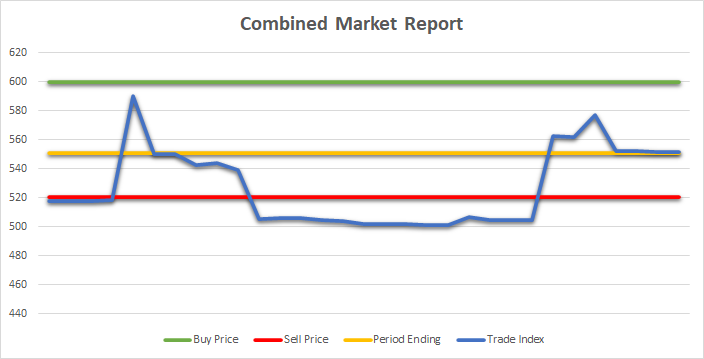

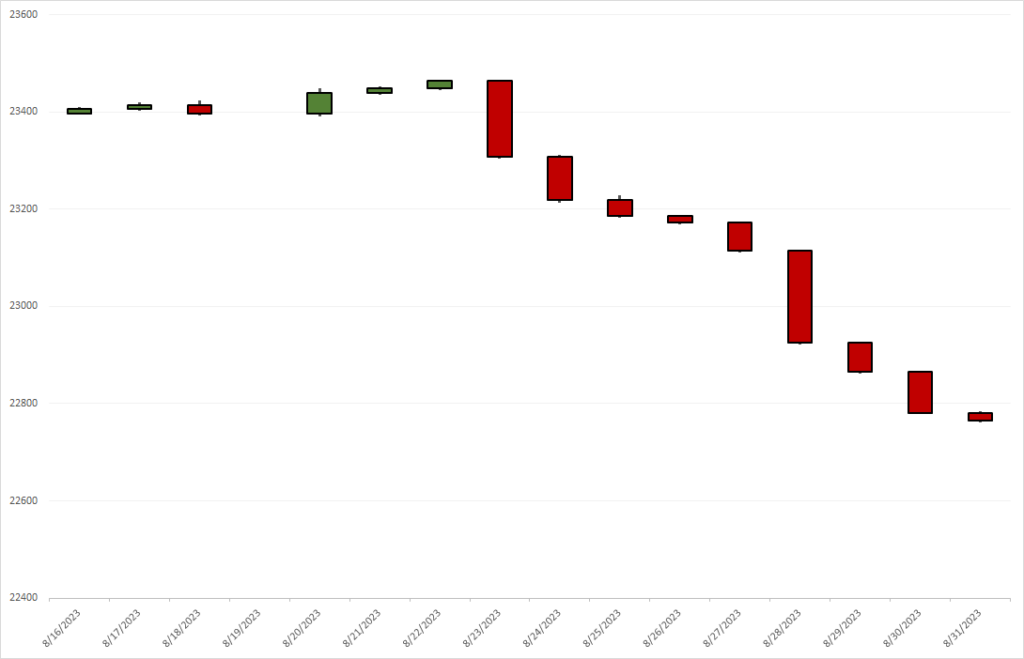

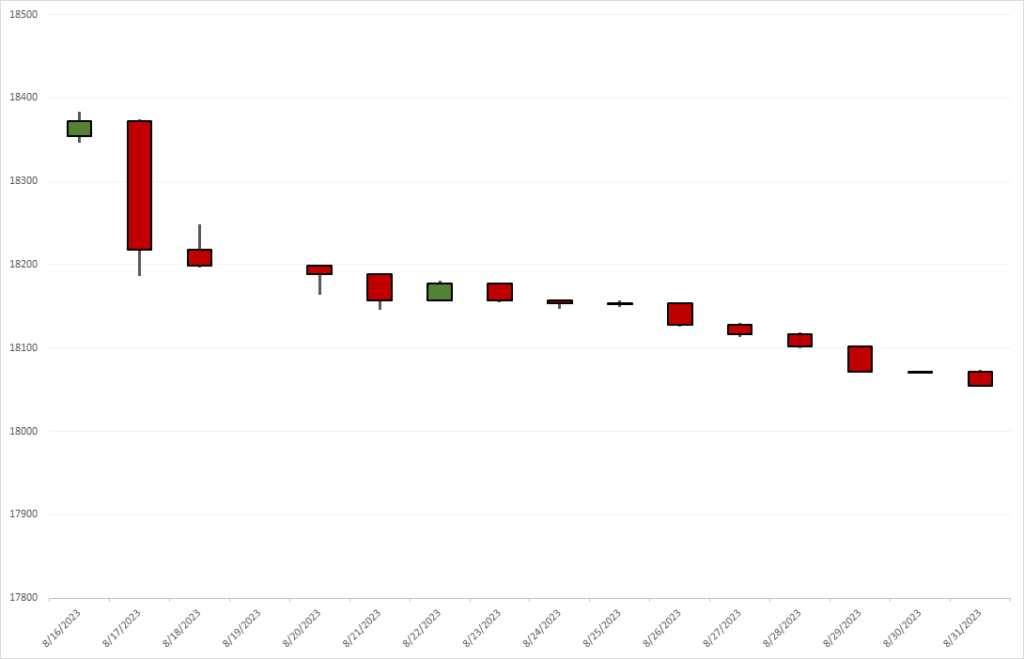

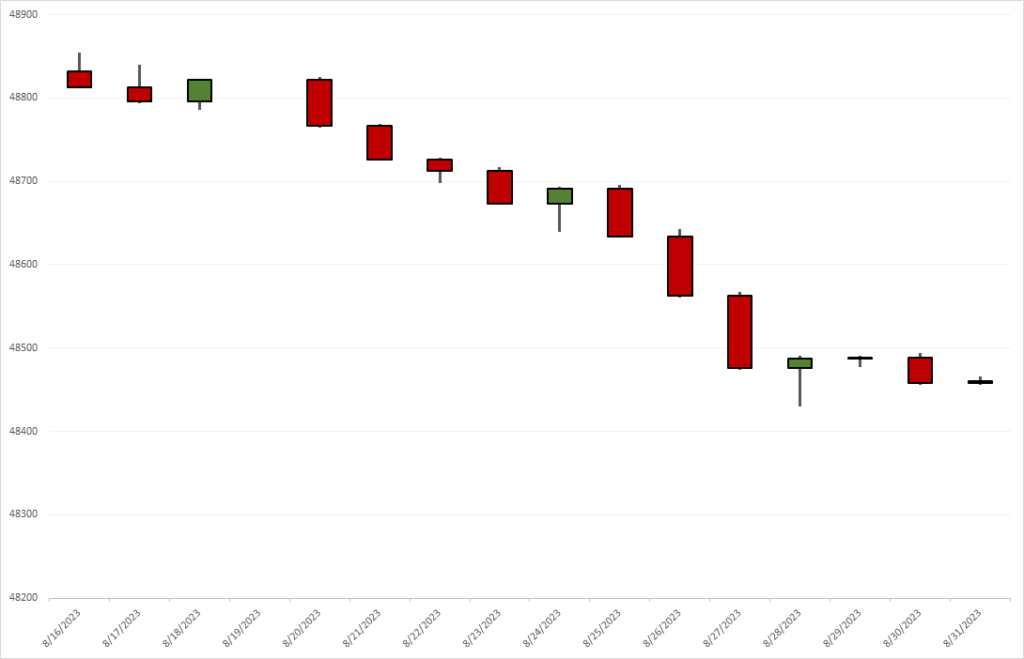

These charts are called Candlestick Reports. While probably not useful to most players, if you are familiar with stock trading mechanics, it should help in pricing items in game, or allow you to add your own stock trading company if that is of interest to you.

In addition to the charts above, we are also re-designing the way we handle the item prefix analysis. While the data has become more accurate over time, it is also becoming resource intensive. This component of the website is currently the third most visited page, but consumes 80% of all the processing bandwidth available on the server. We are going to move this to a dedicated machine and push the data into the website rather than perform the calculations directly on the server as it is doing today.

The Cladifier Jump

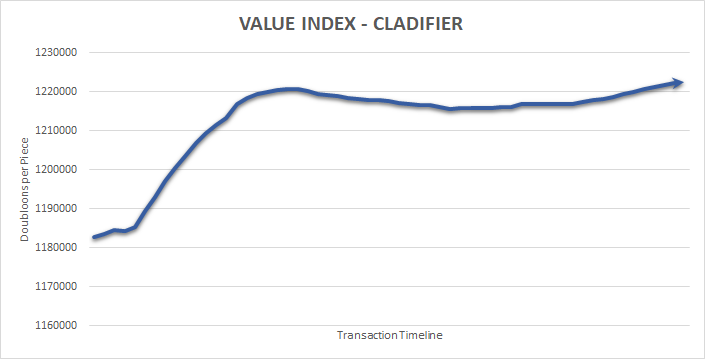

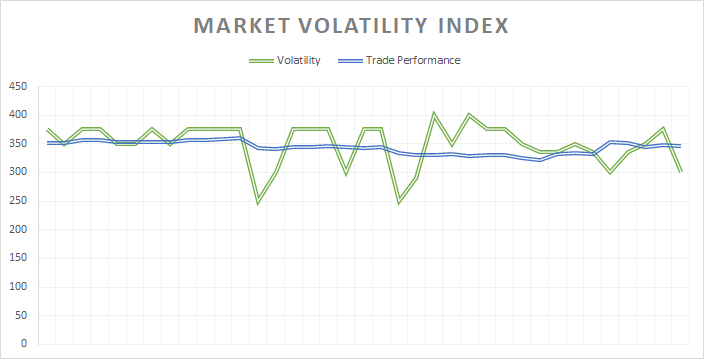

Cladifiers are notorious for having a consistent price point that hovers at around $1Million. This is due the item only being available for purchase from the Premium Merchant. However, in recent months, the volatility of the item has increased. The Bond Rating has been reduced and the interest rate is at almost 10%. As a result, this has gone from a consistent performer to a risky one.

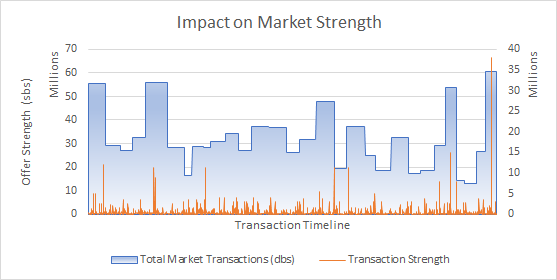

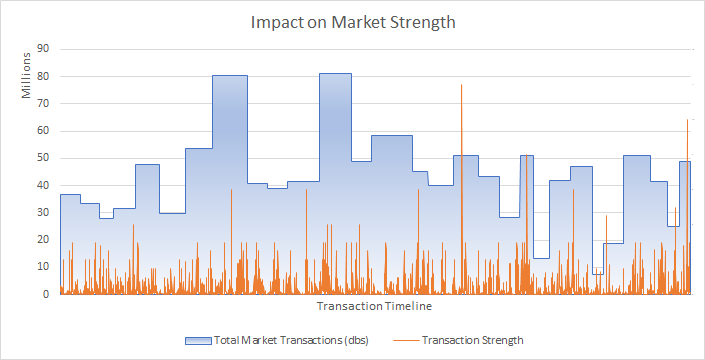

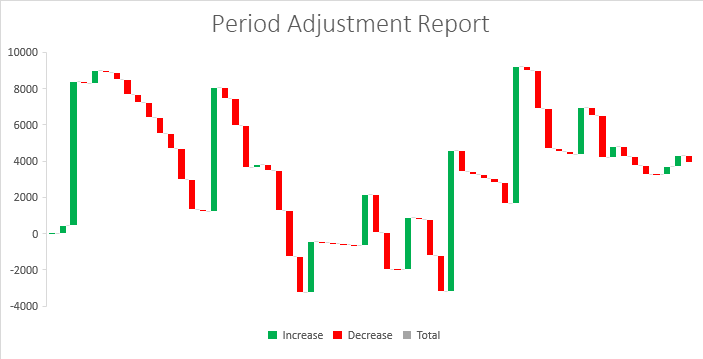

The trend this items is demonstrating is called a Sideways Market. This is when there are volatile fluctuations in asking prices but they aren’t actually moving the long-term price point. The two charts above demonstrate this phenomenon. The PAR report shows how much higher or lower a trade is compared to the expected price. During the period shown, prices varied by as much as $10k per transaction, but the overall price of the index itself didn’t change.

All of this nets an outcome of moving the Index Price higher to $1.22 Million but this doesn’t accurately reflect the true price of a Cladifier. Instead it reflects what items are still left on the market once the pushing and pulling from buyers and sellers removes the items that are reasonably priced. This phenomenon will likely continue until something is added to the game which requires players to fix this index, or if sellers ultimately decide to stop this phenomenon and allow prices to move towards their actual value.

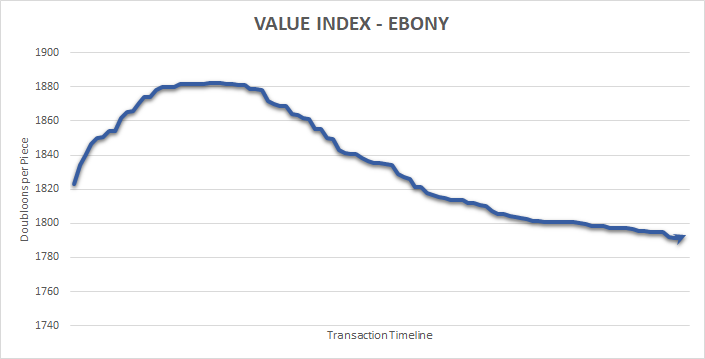

The Ebony Price War

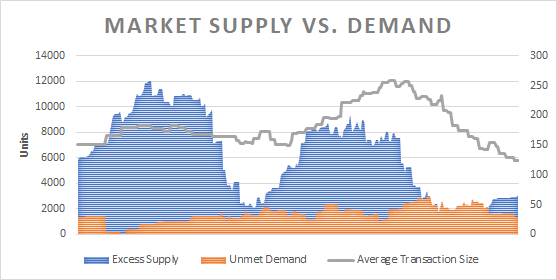

Ebony continues to be a main topic of the economic price wars for a second month in a row. This time it’s the buyers who started pushing the price back to it’s starting point at $1.2k per piece. However, it’s worth noting that because this was the previous sell point, the price correction has effectively been a success, since it’s unlikely that Ebony will go below the starting point in the next month or two.

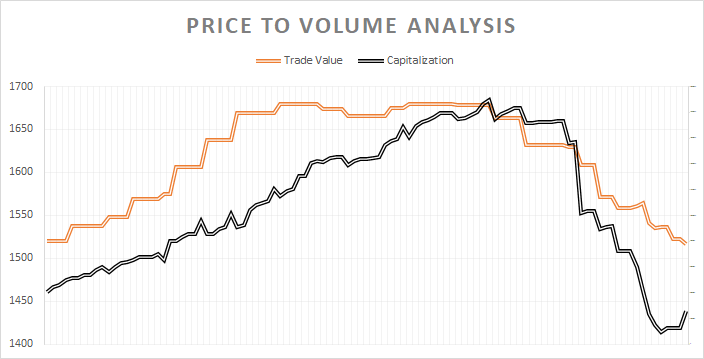

A review of the capitalization of Ebony tells an interesting story. The market is currently controlled by Buyers but this is because the sellers who were raising prices have withdrawn their stock from the market. This can be seen in a Price to Volume Analysis where the price began to fall once the total amount of Ebony went away as well. This effectively prevented the price from culminating which means the sellers may be setting up the market to push a further price correction in the near future. It also means that it is unlikely that Ebony prices will go down much further unless there is a change, such as adding Ebony back to the Premium Merchant.

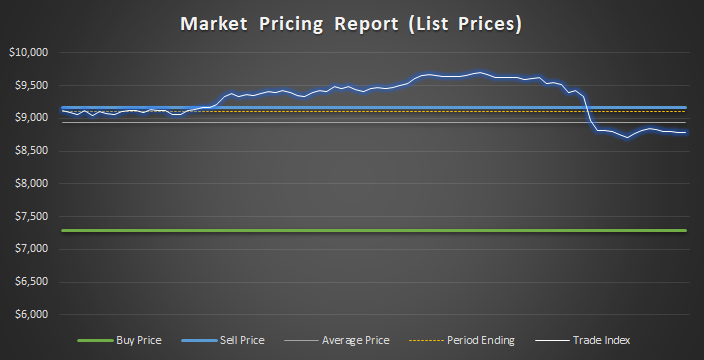

The Electrosteel Peak

The attempt to raise Electrosteel prices back to $10k per piece has stalled out at $9.2k per piece. This is going to be a disappointing finish for miners who were hoping for the correction to fix the ailing mining industry. Unfortunately, this was never likely to succeed as the data shows a strong buyer market remaining consistent at $7k per piece. This acts as an anchor to any price movement.

There is still a chance that a rebound can occur in the price for Electrosteel, but with the winter coming in a few months, and the distraction of the upcoming Halloween Event that typically dominates October and November, there isn’t a lot of time left. It may be worth holding on to whatever inventory players manage to collect, wait for Ice to come back on the mining scene, and use the change to reset the prices. Right now, capitalization is just too high (approx. $6.5Million) for a casual seller to make a significant impact.

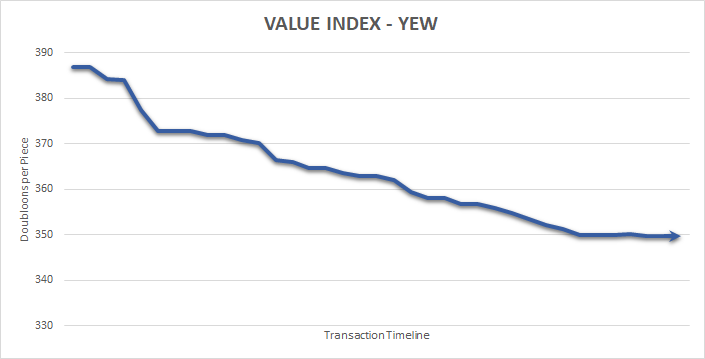

Yew Disappoints

For our final analysis of the month we look at Yew. This was meant to be the top performing wood of the Timberfelling profession, the counter balance to the mining Electrosteel. However, the wood has performed worse than Grimewood in terms of price, due mainly to its purely cosmetic nature and lack of notable combat performance characteristics.

The consistency of the price range where Yew is selling means that it will not reach the top tier pricing of the wood market. Even if we forget about the exclusive woods like Pwnwood and Heartwood, there are still other wood types that sell at better price points. These are Maple, Spruce, and Ebony respectively which are selling at or above $1.5k per piece. Moreover, this makes the value of Timberfelling during a rainstorm questionable, since it’s still more profitable to mine during this weather event despite the nominal improvement to drop rates.