Tradelands Economic Update – August 2022

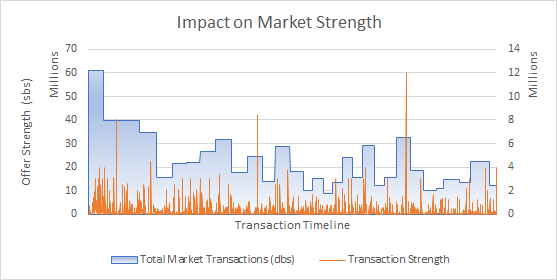

August represents the last month of the summer in Tradelands world. Now comes an expected decline in economic activity that will occur over the next few months. We already see a 40% reduction in market activity compared to last month which is where we usually sit until the next round of updates in October.

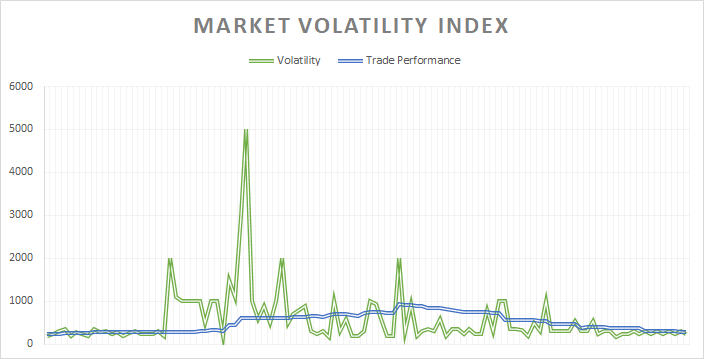

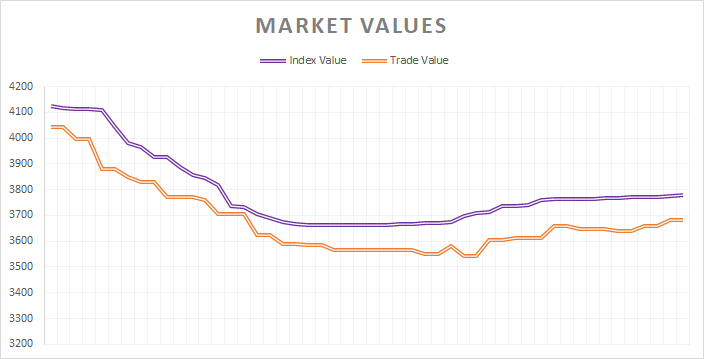

Recession Update

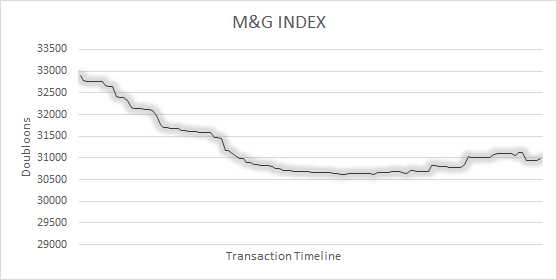

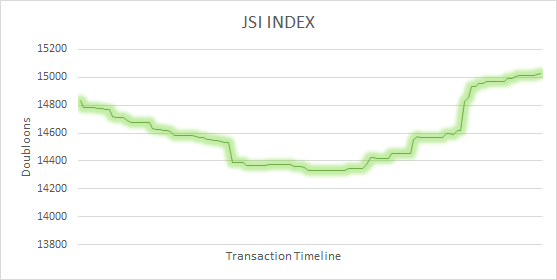

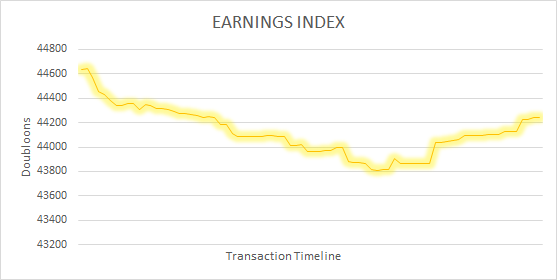

We are going into the 6th month following the start of a recession that occurred due to the The Purshovian Release. However, for the first time since April, we are seeing signs that a stabilization point is coming. All three of our primary indexes showed the same behavior in August, with one reporting a positive close, which is the first since April.

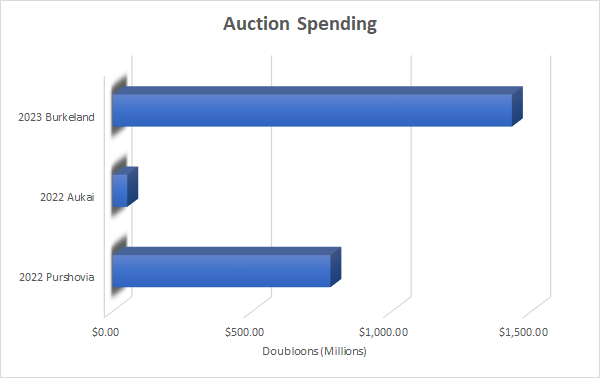

All three of our indexes show that, around mid-August, the constant downward price pressure was stopping. This can be largely attributed to a decrease in dedicated activity in the game. The most likely cause is a return to school. Another contributing factor is the end of the Aukai Release, and by extension the end of a near constant string of private auctions and minor releases that exhausted the market.

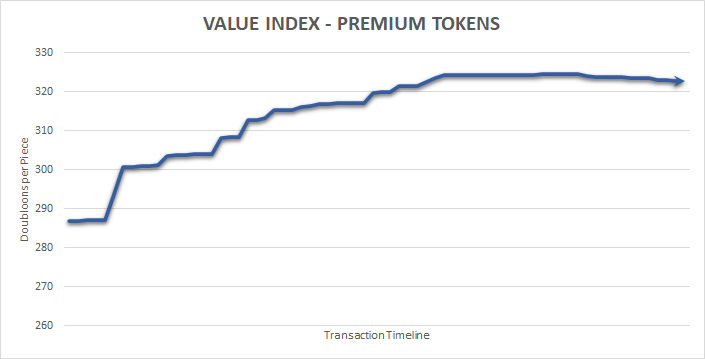

Ebony Price Correction

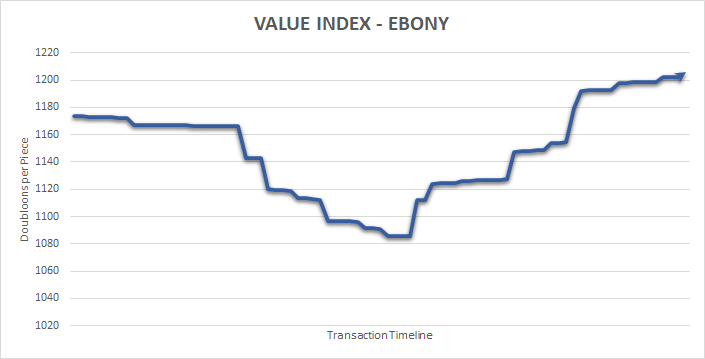

Ebony was the subject of a price correction called a Bull Raid in August. In this case, a buyout of excess inventory occurred mid-month, with renewed inventory being placed back on the market at a higher price point a few days later. While some smaller sellers are continuing to offer the material at its lower value, bulk sellers are causing the market to adjust to these new investors who are buying out the lower priced sellers.

Long-term, this manipulation isn’t likely to have a lasting impact. The goal of this was to net a short-term profit for the trading company performing the action. In our estimations, this operation netted a maximum of around $4M doubloons in revenue for the trading companies performing the price correction. However, the end result shows a trend similar to the JSI Index as a whole, which means we can expect it to follow the industry trend in September.

As the graph shows, the manipulation caused a short-term dip in price, the result of helping the trading companies buy the wood at a lower price point. The after-market price increased to $1,313 doubloons per piece, which caused the index to end the month at +2.66% overall. This should help some smaller sellers gain a small bit of extra profit next month.

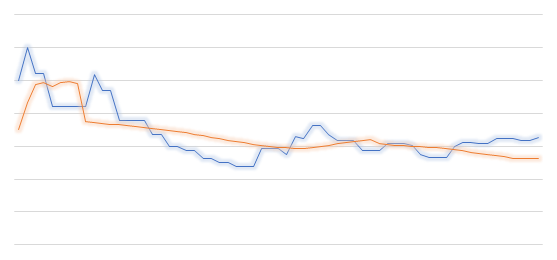

Is Iron Falling Further?

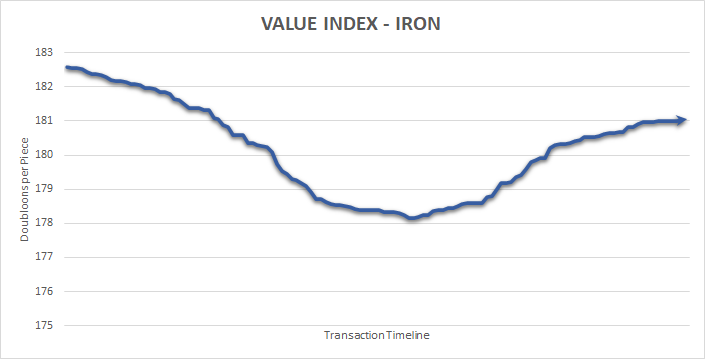

Some positive news for miners out there is that Iron appears to have hit a bottom and started to rebound. This is great news for miners who have been fighting against the constantly falling prices for 6 months.

Despite this very positive trend, it has to be noted that there is still significant pressure to lower the price further. This is mostly coming from buyers that are used to the constantly falling prices and are causing the current sale price to hover near the absolute top of the buy/sell threshold. The preferred buy price is currently at $148 per piece. As a result, the downward trend may not be over, but even a temporary lull is a breath of fresh air on this hard hit material.

Pine Resilience Crumbles

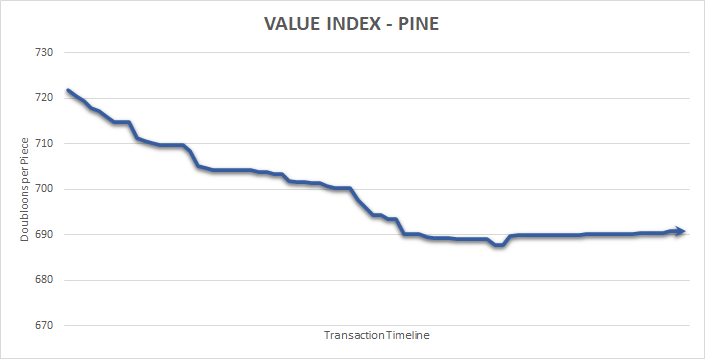

Pine finally fell below the $700 per piece threshold. The material was teetering on the edge of a collapse for several months now, but since it’s value to the economy was removed it was more a question of when, not if, it would fall below this benchmark number.

The interesting thing to note is how, as soon as the price fell below $700 per piece, there was an immediate 10 point fall to 690 per piece. This is an indicator that the price in unpredictable and easily manipulated. As a result, we will have a hard time predicting the future movement of this index with certainty, because it could change based on market demands very easily.