Economic Update – 1st Quarter 2022

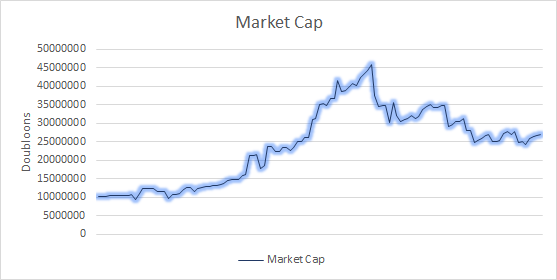

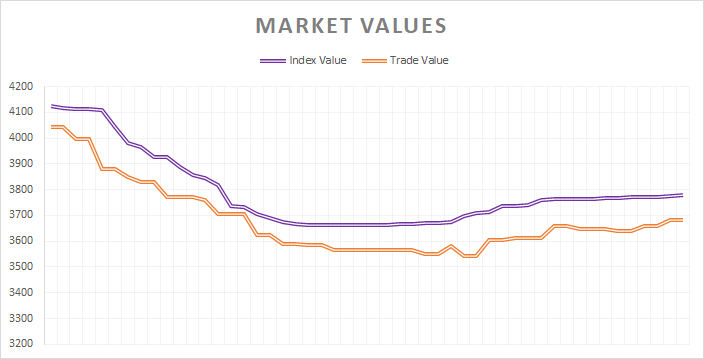

The economic activity in March declined slightly, but had an incredible rebound in the final week of the month. Let’s take a deeper look into the activities and see how things performed in our first month of the year without any special events.

In our last update, we noted that the performance of economic activity in March would offer insight into how the economy will fair in the summer. To summarize, the activity decreased overall, but there was higher volatility. This isn’t quite the clear indicator we were hoping for when trying to predict how the summer will go, but the numbers indicate that we are likely in for a rocky season.

A Bad Month for Wood

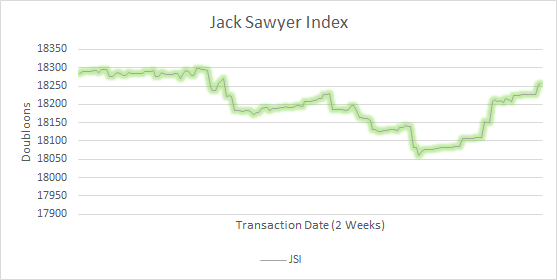

The JSI Index took a hit in the month of March. Luckily, it was able to ride the wave of increased market activity in the final month of March and make a rebound. We do not see anything concerning with this trend since it was caused from the sale of premium woods saturating the market at the end of February. However, it might be best to stockpile anything you have for the time being. There is a rumor that new ships will be released in April which are likely to dramatically increase the demand for wood, and with it the prices as well.

Let’s do a deeper dive on two of the wood prices in March and see if we can make any predictions for April.

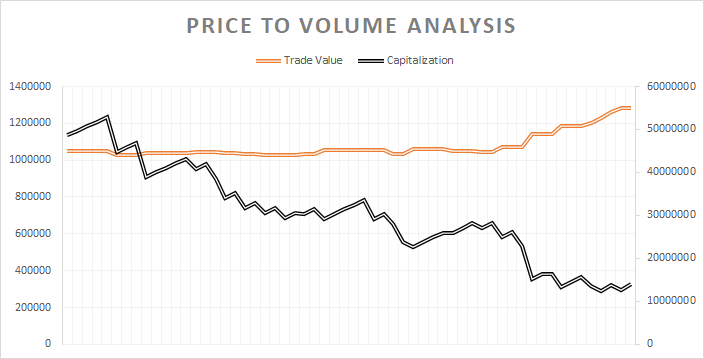

Angelwood Price Crash

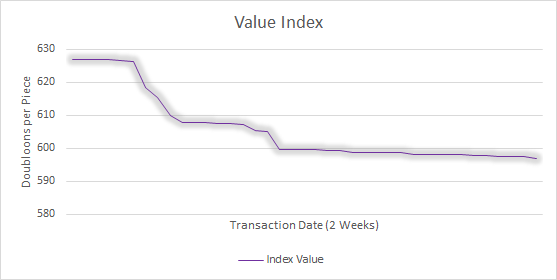

Angelwood appears to have been hit hard after the release of Heartwood, losing $30.16 and based on the new price point it’s likely a permanent fall. On the flipside, this is probably a good time to buy Angelwood while it’s cheap. However, you won’t be able to negotiate much as there is still a steady demand for it, meaning if you try to lowball your supplier, they are likely to just give it to someone else.

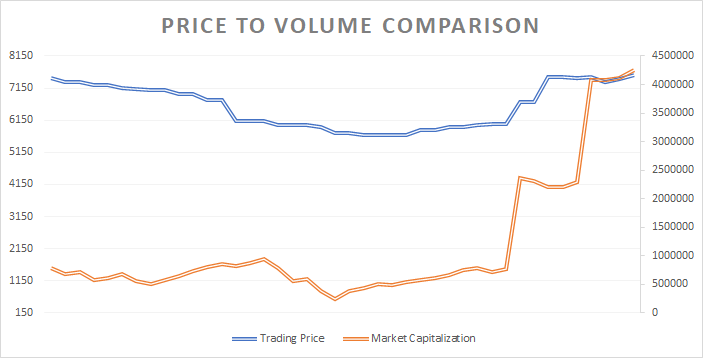

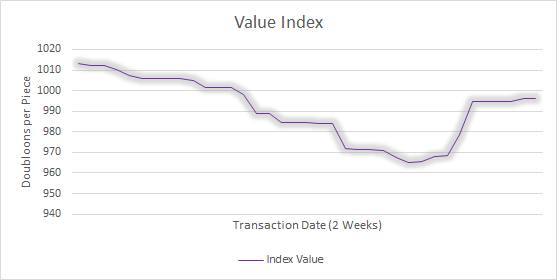

Blood Oak Still Unstable

We reported last month that Blood Oak was destabilizing and a price crash was expected. Well, this is the result. The last week of March saw a huge influx of buyers that helped bring prices back up, but this is still far from stable. However, there is some serious efforts by small time sellers to try and force a market correction, but the current projections show that it’s not likely to hit it’s previous high of $1050, and it may not even be able to break the $1k threshold.

Unlike Angelwood, this is still not a safe market for buyers. The prices are too volatile. Unless your desperate for the wood, I would hold off until it’s clear where Blood Oak will end up. Otherwise you are more likely to get yourself ripped off due to bad timing or a sudden market flux.

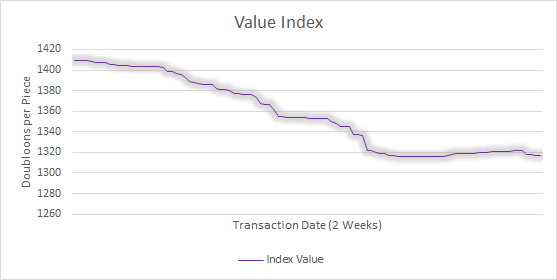

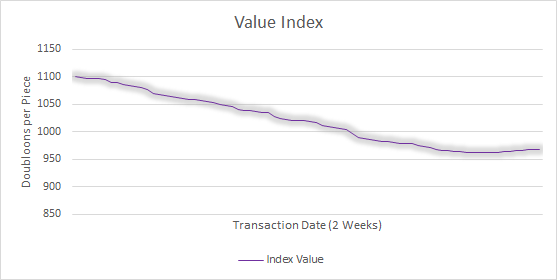

Heartwood and Ebony Crashed

Ebony

Heartwood

Ebony and Heartwood were the two premium woods that went on sales in February. We projected that both would see a massive price decrease as a result and we are happy to confirm this happened. Heartwood was the big loser, dropping below the $1kpp threshold. It has twelve months to recover, so we aren’t worried. Still, now is a good time to buy it if you are an investor.

As for Ebony, it looks like it will stabilize after losing almost a hundred points. The more frequent sales events for Ebony ensure that it is more resilient than Heartwood. Plus, it has a higher volume of buyers that are around year round. We believe the current price decrease will be temporary and should recover as soon as a new furniture or ship release.

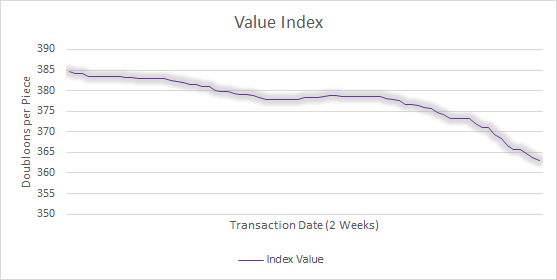

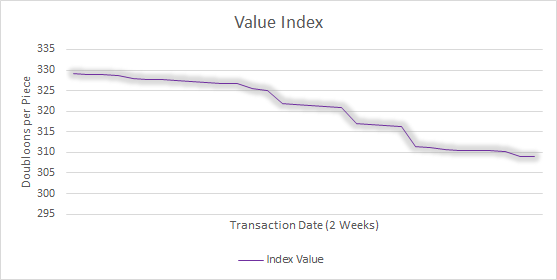

Premium Tokens Boom to Bust

Premium Tokens saw a tick up in February due to the fact that all premium purchases were in tokens instead of Robux. This seems to be a general trend to help games avoid scrutiny from their corporate overlords by making transactions happen with in-game currencies. This result of this is that Premium Tokens, the in-game currency of choice for Tradelands, sees a significant increase in demand during these events. Unfortunately, it also means there is a significant decline when the even ends. Since no events occurred in March, the prices are trending back toward their January price point of $359.33 on January 31.

Saltpeter Nets No Gains In 1Q

Last month, we showed what a price correction looks like when trying to increase prices of an index. This time, Saltpeter shows what a price correction looks like when done in reverse. Saltpeter is usually boring to talk about because it doesn’t to anything interesting. That’s because, as far as crafting materials go, it has an almost negligible impact on the price indexes because it’s not required in enough recipes. That means buyers have a lot of influence in price manipulation because sellers are often overstocked and eager to make a quick profit for selling any amount. That’s why you see the jumps, as large scale sellers are willing to out-compete each other on any put option placed on Saltpeter.

The other factor is the ease of collection. Saltpeter is coal’s ugly brother when it comes to secondary resources gathered in mining. Unfortunately, the popularity of gemstone mining means there is often an overabundance collected that cannot be used. This was made worse with the introduction of Smokey who gives free Saltpeter over time to anyone willing to wait for it.

Final Reflection on Economy

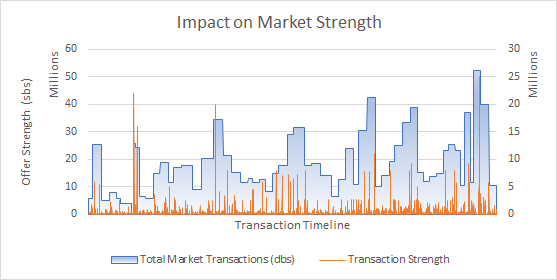

While March was overall uneventful, we did learn a few things about the future of the Tradelands economy going into April. The first is that the drop in the JSI index, which was largely based on supply/demand forecasting, shows that the market will have a strong rebound if they are able to release some new ships. The second is that the current growth rate overall is sitting at around 7% month to month. The sharp increase in economic activity at the end of the month is a concern in this regard. Finally, fact that trade volume remained mostly flat after the end of the Valentine’s event is a good sign that Tradelands will be able to sustain strong trading activity in the summer months.

If time permits, the F&BP Trading Company will expand on these in the next few days.