Tradelands Economic Update – December 1st, 2023

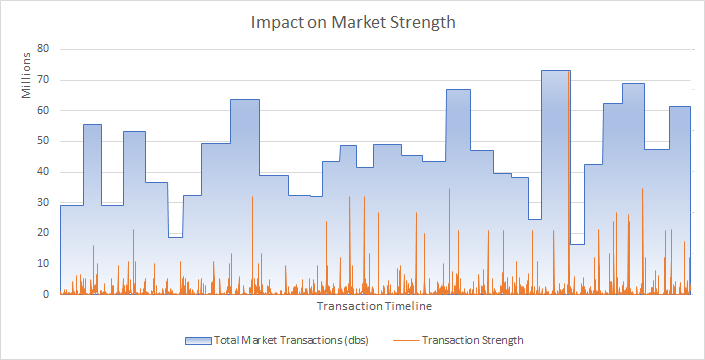

The market added $748 Million in new transactions in November. This is almost dead even with November 2022’s market performance and is in line with expectations. The market typically suffers from Market Fatigue following the Halloween release which is why buying and selling stay at low volumes of trading. The two key updates that impacted market performance this month were the re-release of the Demeter and the changes to resource counts. Other than that, the market is gearing up for the Winter Event which is typically one of the three biggest each year.

The Demeter Returns

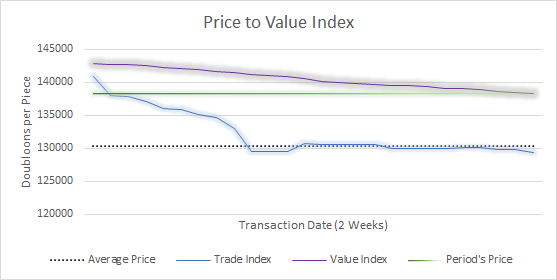

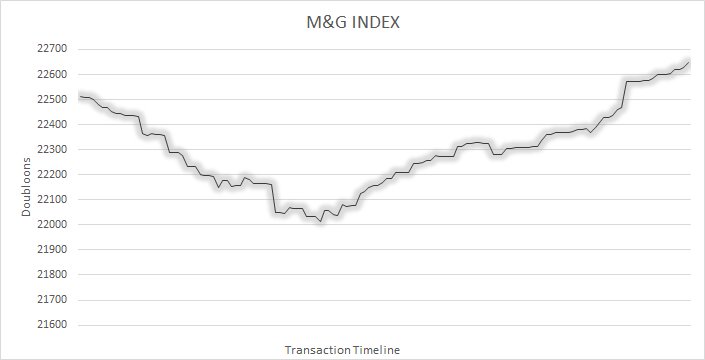

The Demeter is an end-game ship that is highly coveted by players. It is one of the only late game ships that can be crafted by players (as opposed to received through auctions or limited time vouchers). It was reintroduced to the game on November 16th which caused the market to immediately respond. Both the M&G Index and FEGRAM Index saw a shift towards positive momentum.

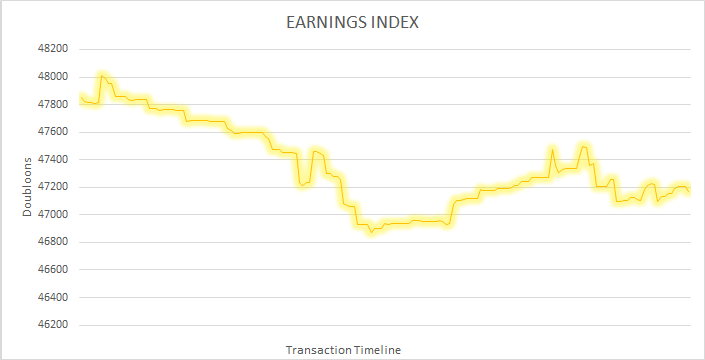

The shift is right in line with expectations for a release of this kind. Miners will already start to see some of the benefits from this, especially if they are selling in bulk amounts large enough to cover the number of materials needed to construct the metal components of the ship. The Earnings Index has a more muted effect, mainly because it is a far more diverse list of items and as a result the increase in demand only changed the momentum, rather than immediately starting a correction.

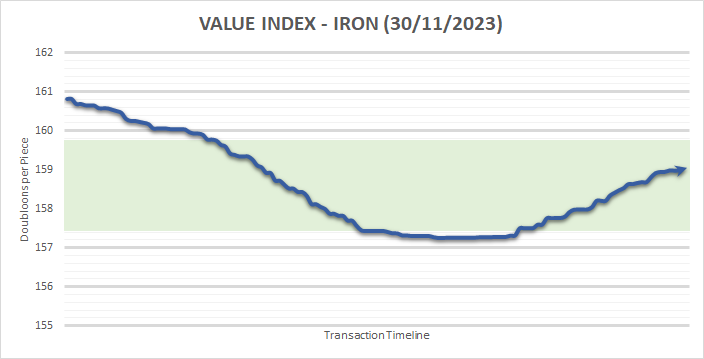

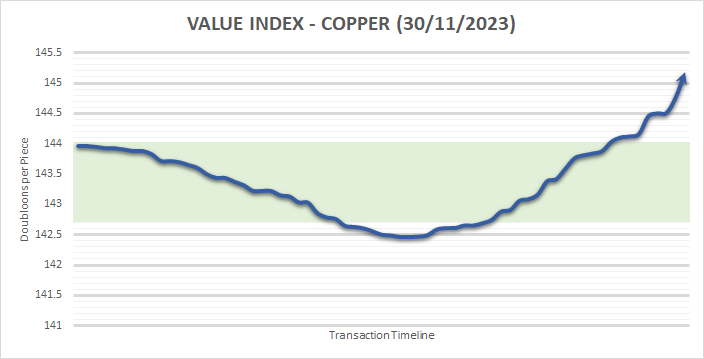

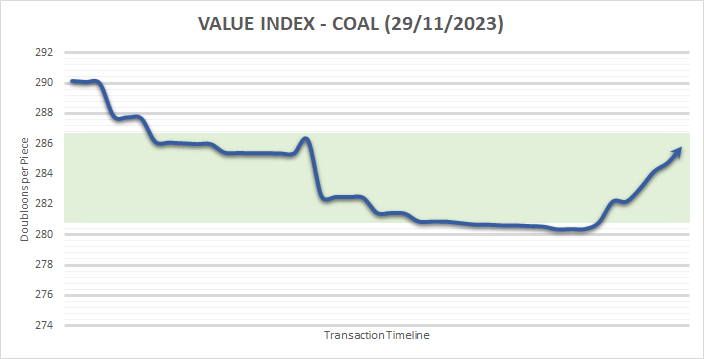

It’s also worth noting that Iron, Coal, and Copper make up the highest demand items in that index.

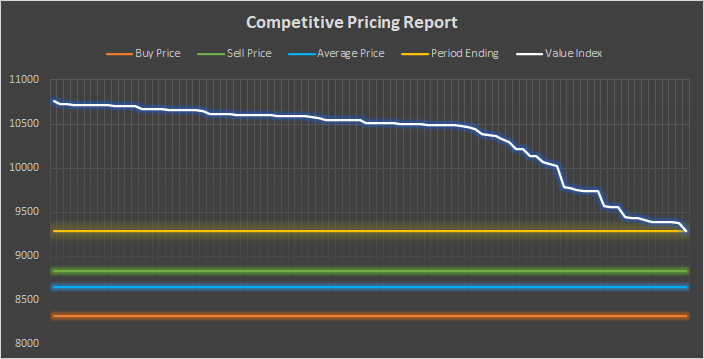

While two of the three indexes are trending down over the course of the month, they all saw a mid-month correction start. The timing for these can all be traced to November 16th, the same day the Demeter was put back in the Shipwright. While it’s uncertain that this momentum will last into December, it’s important to note that Coal and Copper have continued to see a positive trajectory, whereas iron has started to stabilize. This probably has more to do with Iron being viewed as hitting it’s stable price point, where Copper will be expected to hit $150 and Coal at $290 before the same happens to those indexes.

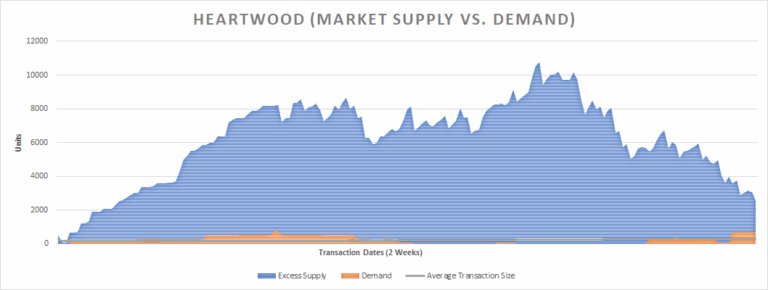

Wood Woes

While the Demeter’s introduction impacted the metal market, it did not have a similar impact on the wood market. The main reason for this is the abundance of Premium Woods which are often preferred over timberfelled wood in ship construction. Oak, as an example, is often viewed as the “poor man’s option” when a player cannot collect enough of another wood type to make the ship.

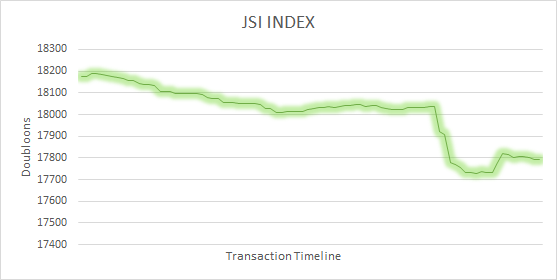

The reason the the late season collapse in prices is due to another factor that happened in November. On November 25th, the following change log appeared:

In short, this means if you are mining or timberfelling on a server with more than 25 people, you are not limited in the amount of resources you can collect. Previously, this began to deteriorate once you reached 2,000 resources collected. The change in the JSI index coincides with this update, meaning players are already anticipating a collapse in wood prices to occur because of this update. However, there are not enough days in November to properly determine if this is the case. However, this is likely to be a factor for prices in December.

It’s worth nothing that this is not the first time the resource counts have changed. This game feature has long been used as a way for the development team to control the amount of transactions which occur in game and to prevent abuse of the system. This change was likely meant to help aid players who were trying to build a Demeter but were lagging behind on the resource collection component. Whether it remains a feature or not will be determine on if it is successful at driving players to populate larger servers instead of the current policy of traders trading only on low population servers.

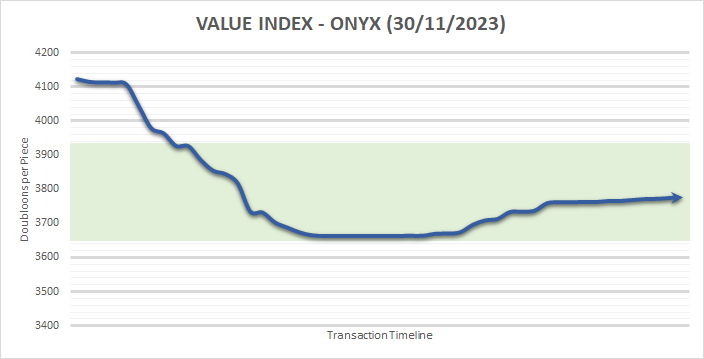

Changes to Onyx Drop Rates

The final economic update of the month is due to a change in Onyx drop rates. This is a material that can only be collected on Cannoneer’s Key and Freeport. Previously, this had a drop rate that was similar to Emerald but, based on change logs from previous years, was supposed to decrease over time. This has been changed to have the drop rate dependent on the server size, yet another method of driving players to grind on high population servers, rather than creating smaller personal servers.

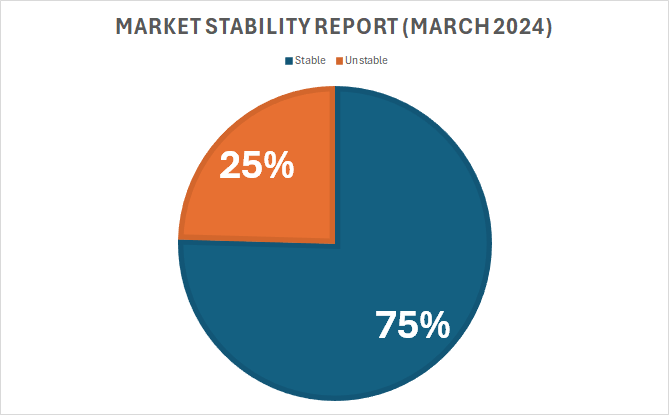

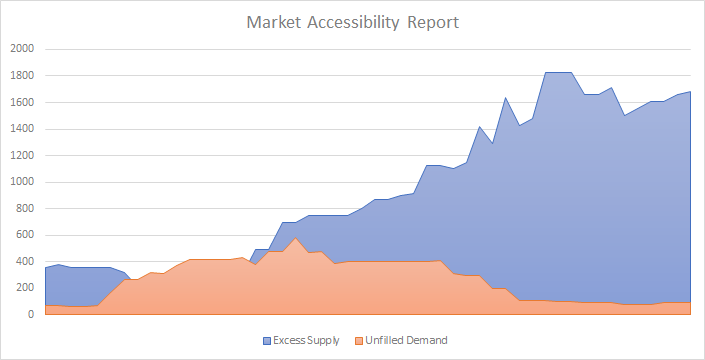

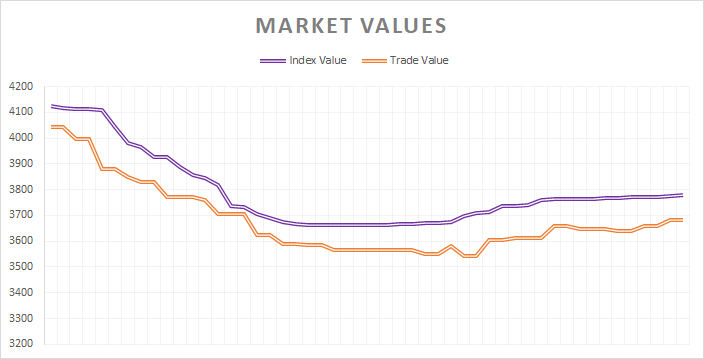

The main reason why this hasn’t mattered yet, and in fact largely went unnoticed by the mining community, is because this item has notoriously low demand. At present, demand for the Onyx is at 5.07%, whereas the market as a whole shows a current buyer demand of 33.86%. That is a significantly lower amount of interest in Onyx compared to where the rest of the market is currently. Furthermore, this is reflected in the continuous trend of the Trade Value being lower than the Index Value.

However, what is likely to happen long-term is the amount of extra Onyx on the market will begin to dwindle as it is used. The most common use will be in the construction of axes meant to obtain Maple. If this happens fast enough, the restriction on Onyx mining is likely to be lifted. However, if players do not start buying bulk quantities, this is a feature that is likely to stick around for the long-term.