2022 Purshovian Update

On May 5th, the Purshovian Update of 2022 was published. This followed The Great Oakening update that occurred at the end of April. Together, these two releases provided a well-rounded update to Tradelands which had a measurable impact on the economy. Even though the release doesn’t technically close until the end of the week, we are already seeing some interesting trends.

Iron Price Dilemma Resolved?

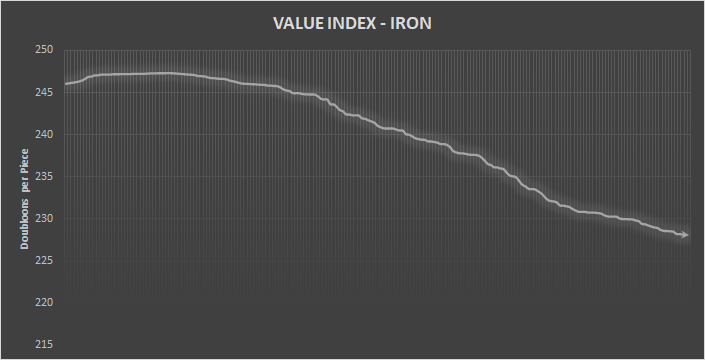

Back in February, we made a report on the Iron Price Dilemma. Essentially, we explained why the price of iron was seeing consistent inflation every month. In that report, we concluded that if the developers wished to truly resolve the issue, they could take two steps to fix it. Here’s the actual quote from that post:

“The two factors that have the highest impact are the weather events and the weekly resource cap. If the community wishes to drive down the cost of iron, convincing the developers to update these two factors will provide the quickest impact to the price index.”

It’s not often that we get to test the accuracy of our statements, but the development team has effectively done both of these changes. First, they appear to have removed the ability to exploit Kraken Nights because the audio notification seems to have stopped working and they are not trying to fix it. The second change was to raise the resource caps to 2,000. Effectively, they implemented both of the suggestions we presented. The real question is if our predicted outcome was right.

Indeed, it appears to be so! We already saw an economic slowdown around the time the Kraken Night notification stopped. (NOTE: It’s possible that this notification is still occurring, but our fleet hasn’t registered an occurrence since the April 25 release) Then, when the resource cap was raised, the price of Iron has been falling ever since. There was a third change as well, which was to update the performance of rocks that drop iron which had a nominal impact as well. As a result, it’s pretty clear the developers intended this to happen, and it’s great to see that our economic indicators were spot on in predicting this.

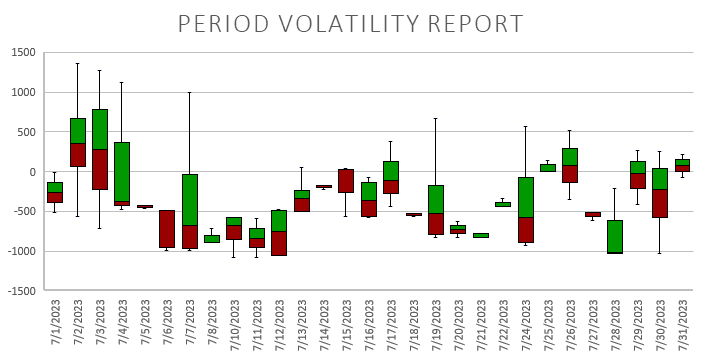

The only thing that remains is to watch the price for the next few weeks to determine the impact the two releases had on prices. However, we didn’t see a large spike in demand for iron during the release like we did with wood, so the impact might be negligible. What we can see, however, is the amount of supply miners are adding to the market. This might be due to players trying to make a quick profit before the Demeter goes off sales, and if it is then prices will go up as this supply gets withdrawn from the market next week.

Impact of Demeter

The new ironclad, the Demeter, caused a quick stir in the market due to the short duration in which to build it. After taking a look at the market data, there is some very clear trends that happened as a direct result of this new ironclad.

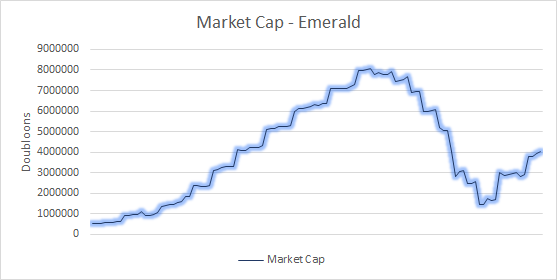

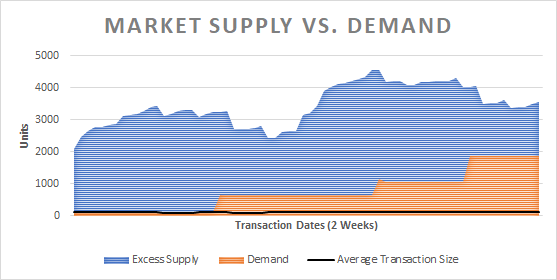

Ironwood Ironclads

The first trend is Ironwood. If you see a Demeter in game, chances are it was made with Ironwood. Even looking at screenshots from players, the majority of them are made of Ironwood, with Angelwood playing a distant second place. We can see this trend in the Market Supply Report as well. This report measures how many units of Ironwood are on the market and how much is being actively purchased or used by players. It’s important to note that this report doesn’t measure how much could be added to the market, only the present state of the market.

At present, 57% of the total available supply of Ironwood was used in the past two weeks, with the majority of that being used since May 5th. As the report shows, players have been slowly buying more Ironwood over time, usually in chunks that grow on weekends. This usage is currently exceeding the ability of players to replenish the supply of Ironwood, as demonstrated by the sudden downward trends in the blue area when bulk purchases are made. It also means if you are holding any Ironwood on you today, you could probably sell it very quickly this weekend if you were short on cash.

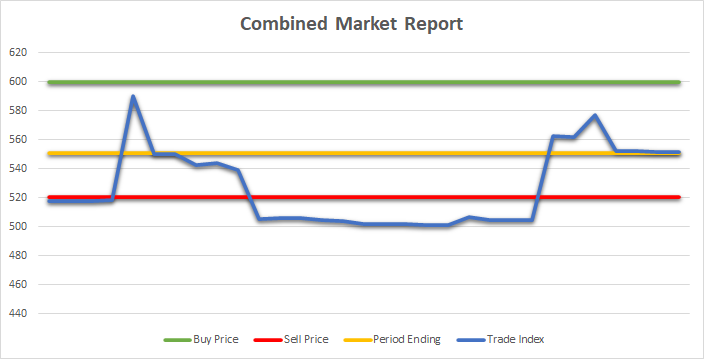

Steam Engines Return

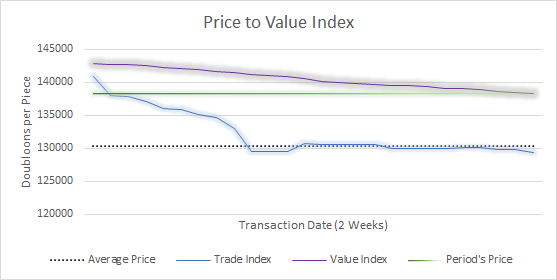

The Demeter and the Prometheus have led to a return of the Steam Engines to the Merchant’s Guild. However, we don’t expect them to remain, primarily because the developers already announced they will be going away at the end of the month. As a result, this is probably the last report we will ever do on them while they are on sale.

The unfortunate truth of a limited release item is there cannot be a long-term impact on prices. The Prometheus is a nostalgia ship that requires five steam engines, but those that really want one probably already have it. Unless there are new unannounced releases coming in the future, this is probably the last hurrah for the once cornerstone premium item of the Merchant’s Guild. The fact that the Trade Index (Blue line) has already fallen below average (dotted line) is an indicator that a collapse is imminent.

Unfortunately, there just isn’t enough demand for this item. There are currently only two ships that require steam engines, which means most players will need, at most, 7 of them throughout their entire time playing Tradelands. With the announcement that Blessings aren’t required and Premium Tokens can be used instead, it’s possible that the developers intend to kill this mechanic entirely, perhaps in an attempt to move towards more Advanced Engines in the future.

Premium Purchases

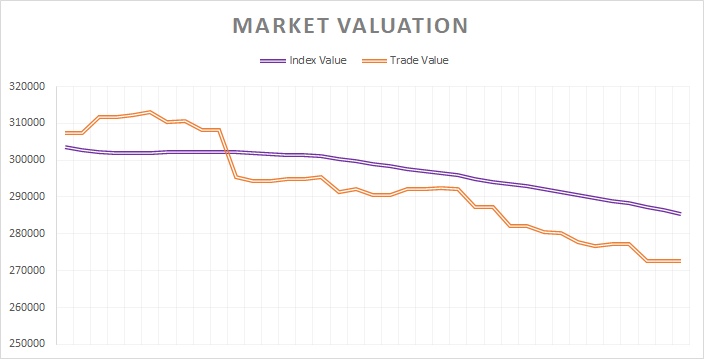

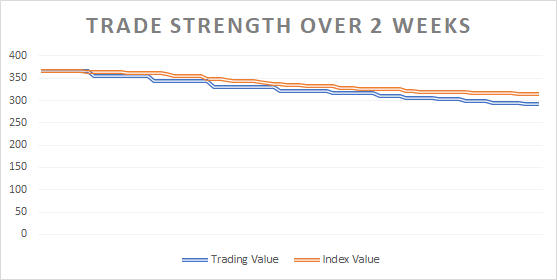

We previously reported that the April 25th release performed below expectations from a spending perspective. We decided to watch those same metrics over the past two weeks to see if things got better, or at least met performance expectations. Here is what we saw.

In short, this release was much better. This graph shows that Premium Token purchases stayed in-line with the item’s purchasing power, meaning players were buying them and using them for in-game purchases. Moreover, it shows that purchases are only 5% over market value, meaning that people are interested in spending them when they get them. This is a good sign for the developers, especially after the under performance of the April 25 release, meaning people were struggling to justify making purchases in April.

Undoubtedly the release of weapon crates helped open up some purchases. Others probably had a reason to start buying woods they previously passed on with the release of the Demeter. Overall, the data shows that this release was much healthier than the last one. It’s unfortunate that no public events were also put in place as this might have caused the value of items to tick upward, instead of continue their slow and steady downward trend.

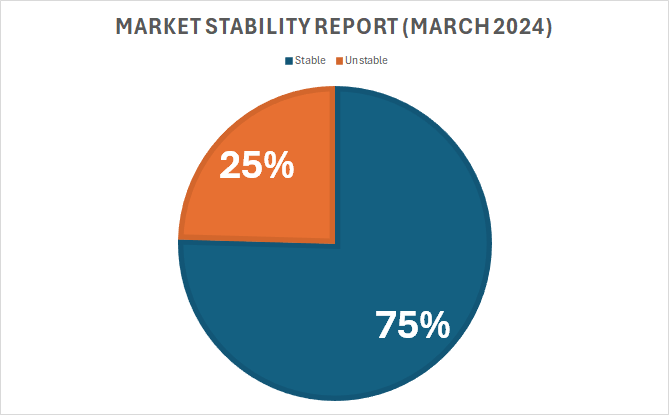

All that said, one thing is clear. Expect a month of high volume trading and a decrease in stock market value across the board when we report numbers at the end of May. This is one of the highest months of trade F&BP has ever recorded. We even had to open additional memory to process the market valuation this month. This is a very healthy sign for the economy overall, and we encourage you to view any declines in the stock market as a reaction to the fact that runaway inflation has finally been addressed, not that there is a long-term problem brewing.