Tradelands Economic Update – February 1st, 2023

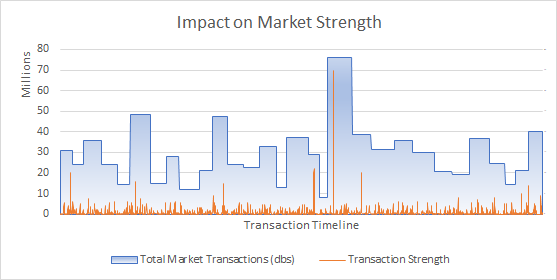

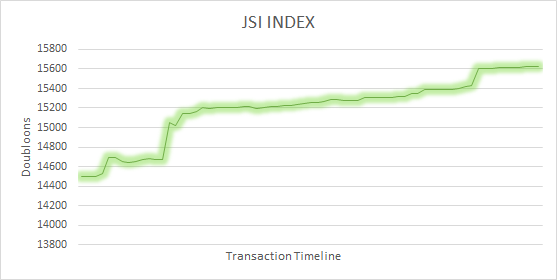

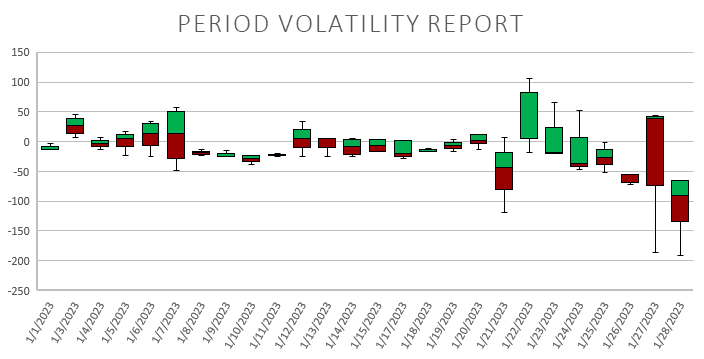

January saw the end of the 2022 Holiday Event and benefited from the late release of the Premium Material Cladifiers which did not have a noticeable impact December. Overall, market activity for the month was slightly above average, seeing $868,86M in economic activity when new additions to the game are considered. The last day of significant activity occurred when the portal to Mallorca was closed, officially ending the holiday season. However, the winter season didn’t end until the last day of January allowing for activities associated with winter, such as ice trading, to continue.

Engine Hype

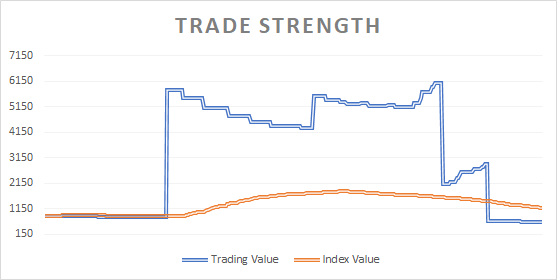

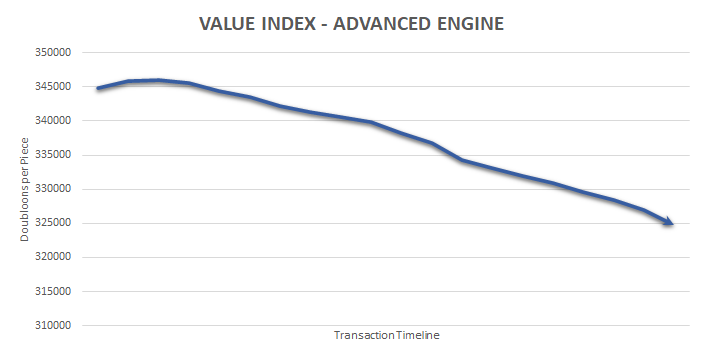

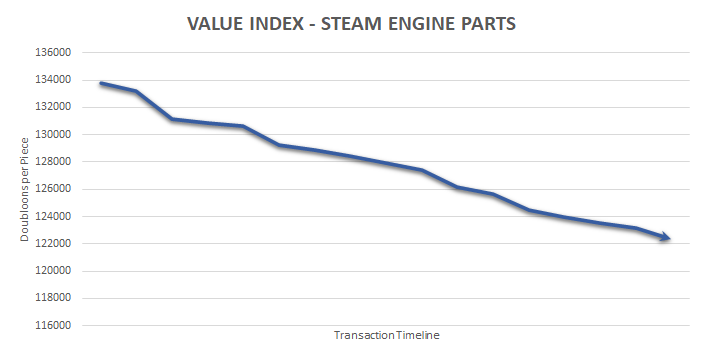

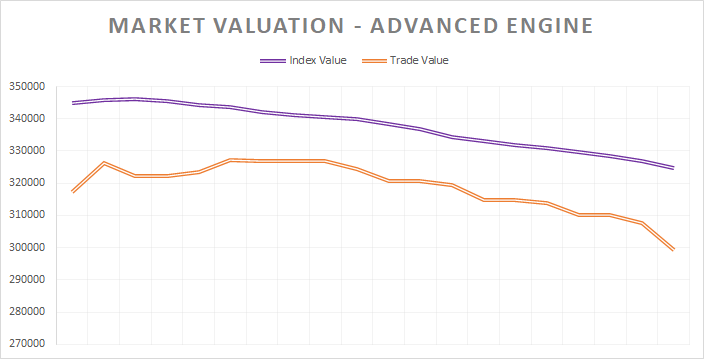

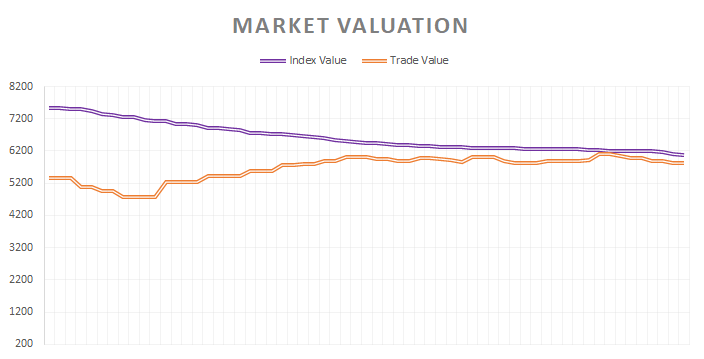

There were two new ships released at the end of December that required Steam Engines and Advanced Engines to build. The prices for these items were previously considered stale. Whenever a release focuses on a stale item, it typically improves consumer sentiment which is a measure of optimism around changes to the game. When this happens, we expect to see a boost in value in the affected item followed by a steady return to a long-term price point.

The trends between the two engine types available on the market indicate that the Mercury was a more successful addition than the Ceres. This assumption can be made based on the trends of the Steam Engine Parts, which is used only in the Ceres, and the Advanced Engine, which is used in both ships.

Despite the superior performance of the Advanced Engine in the month of January, we expect to see both of these continue to fall to lower price points as interest wanes. Both of the items continue to see ongoing downward price pressure from buyers. Steam Engine Parts are more likely to stabilize in February according to the Market Valuation projection.

The futures for the Advanced Engine project a -10% fall in February to be likely. However, the buying market remains somewhat lukewarm, so the speed at which the existing inventory will re-evaluate the price point is not certain. It may take several more months before a noticeable price correction will impact this market.

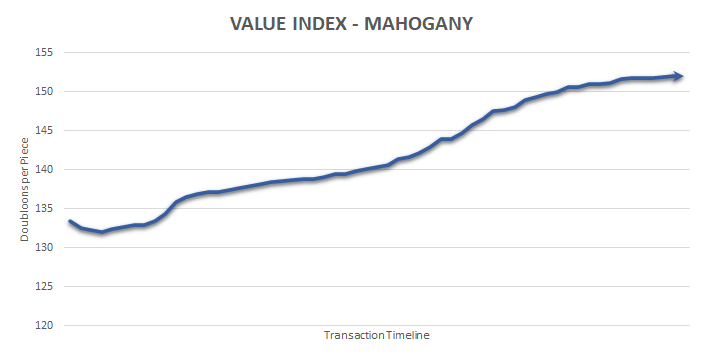

Timberfelling Strengthens

There is an ongoing trend towards building ships with materials that are obtained through trees instead of bought from the Premium Merchant. This is causing the wood markets to strengthen, especially for non-premium woods.

Several wood materials are seeing potential price corrections. These are being conducted by some serious traders that have the inventory to actually make the price corrections have a long-term impact. If you are a spot seller, meaning you sell at the market price instead of trying to do bulk sales, you can sell your materials to one of these traders making price corrections at a profit. Right now, this is netting spot sellers between 7 – 10% above the asking price if sold this way.

This momentum is likely to continue into the middle of February. The determining factor will be if any new ships are added to the Shipwright for the next event, as well as the impact Heartwood will have on stabilization of wood prices. This occurs because the addition of Heartwood to the market will increase the overall capitalization. If demand doesn’t change, it will create a slight over saturation which will stop any upward trends. If a new ship is made available at the same time, the trends may continue to have momentum.

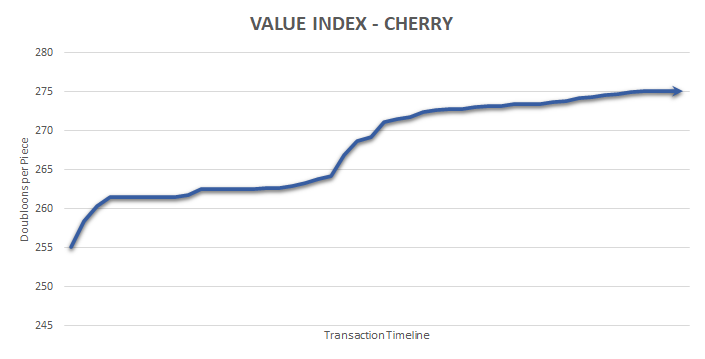

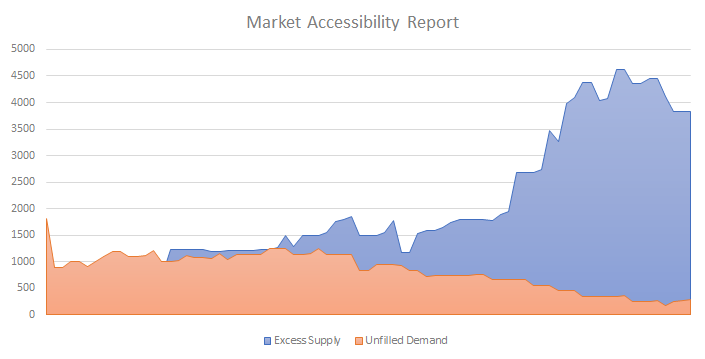

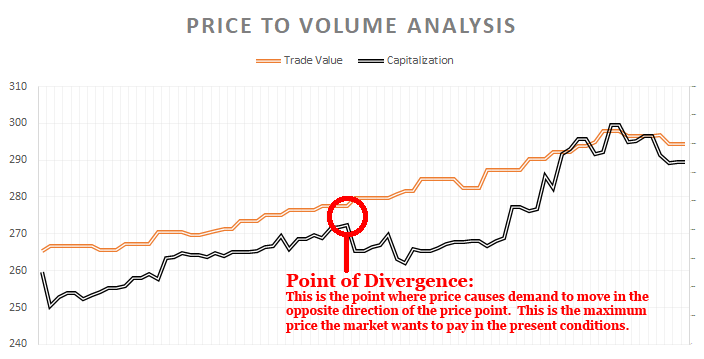

The Coal Coaster

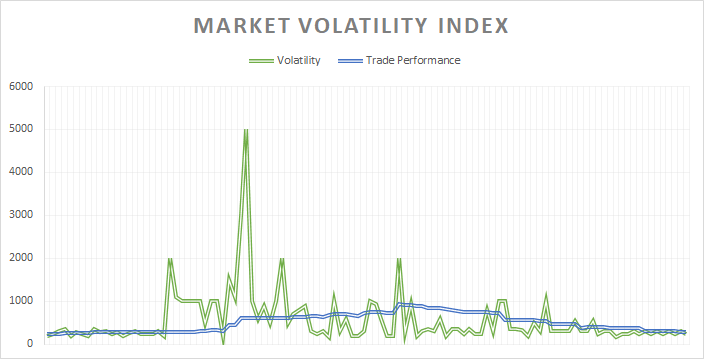

Coal is once again on the rise. The easiest reason to point to for the change is the addition of new coal powered ships which are increasing the overall demand in the market. However, this only tells part of the story. The other reasons are all economic trends that have been present for Coal since it’s temporary removal from the Premium Merchant in 2022 caused the market to reset its market valuation.

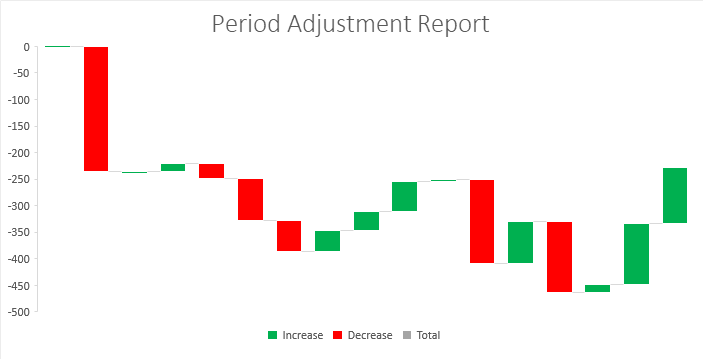

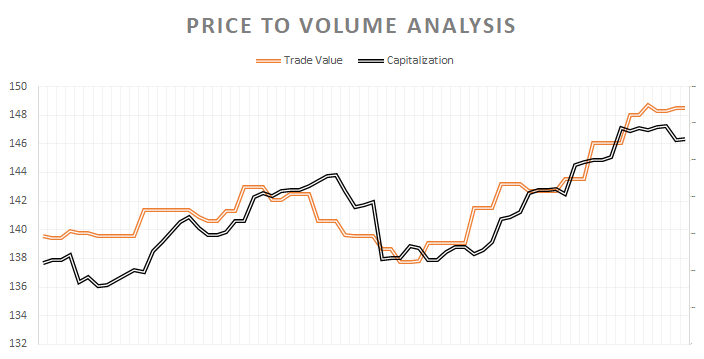

First, when a material’s capitalization trend follows the same trend as the Trade Value, it’s a sign that the market for that item is predictable. In Coal’s case, it has been in alignment since 2022 until it started deviating around 275 per piece. In terms of market indicators, this is known as a point of divergence. It’s a sign that the price has reached a point where buyers and sellers are no longer aligned. In Coal’s case, it means that buyers are likely to stop buying at trend prices and instead work to reduce the overall price point.

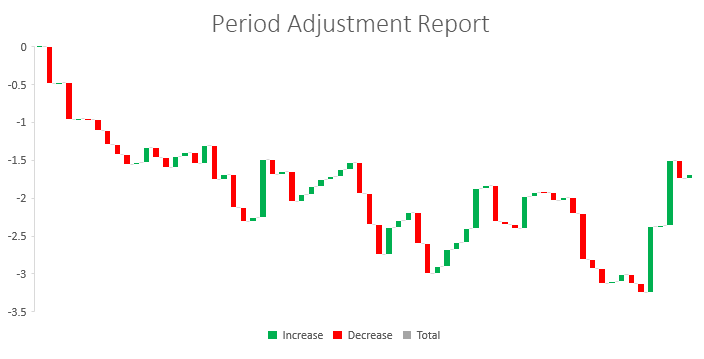

The second indicator is Market Accessibility. This is how well connected buyers and sellers are in the market. A healthy market always includes a segment of unfulfilled supply and demand. These include cases where players high-ball or low-ball prices looking to make a good deal, not just complete a transaction. However, the spike in excess demand after the point of divergence is an indicator that people have stopped showing interest in purchasing Coal. The demand has also started to slowly decline as a result. If demand for Coal falls too low, it will have a long-term impact on the economy, so it’s not in the sellers best interest to push this trend too far.

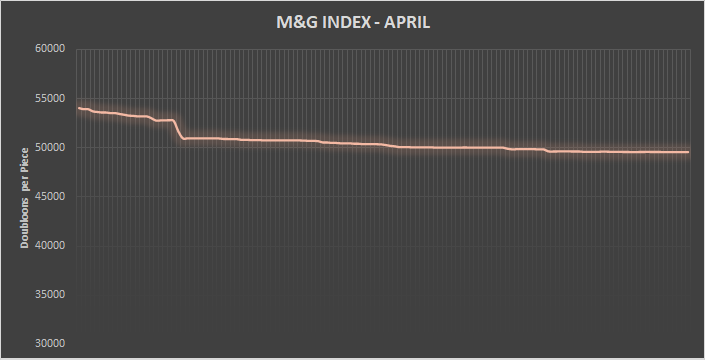

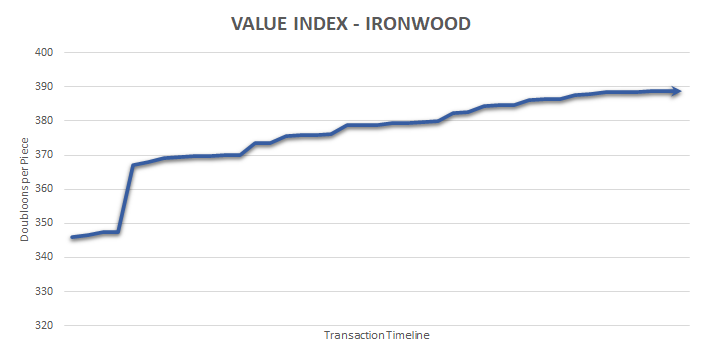

Copper Consistency

To demonstrate the point made above, Copper has been a consistent material since the beginning of the year. Compared to Coal, you can see how the Price to Volume has remained consistent, as well as how the adjustments have kept prices in line with the trend over a long period of time.

The main issue with Copper is the external demand for the material. Most miners and traders will use this in construction of their own equipment and items instead of selling it. As a result, there is a low amount of demand except for bulk purchases. This tends to keep prices flat which helps with consistency but makes it a less profitable material when selling.

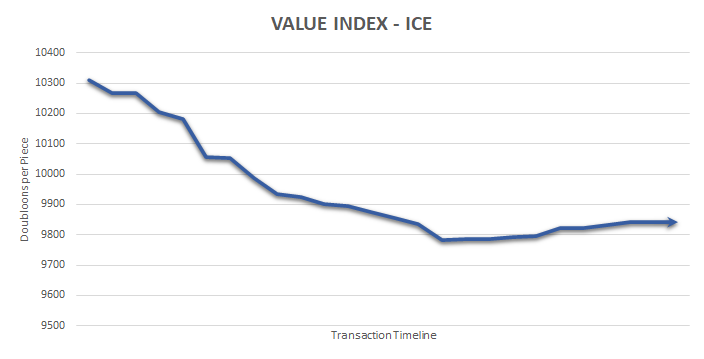

Stockpiles of Ice

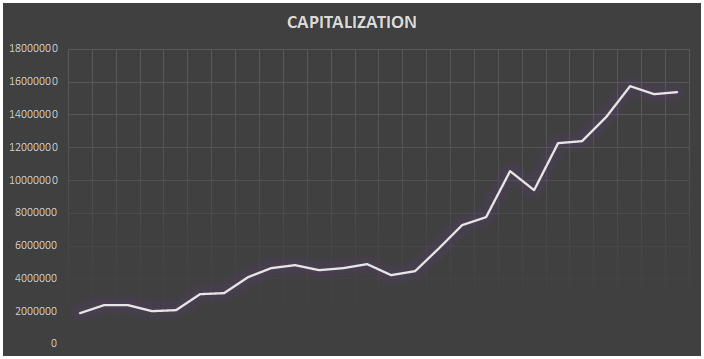

Ice stockpiles have gone from $5M prior to the start of winter to around $15M at the end of winter. This figure only includes items that are being actively marketed so the figure may be even higher. However, the dynamics of the ice market are likely to change in 2023. The release of new Ice Pickaxes means there is a way to replenish Ice stocks mid-year, whereas last year the only way to obtain it was to wait until the next winter event.

Right now, most sellers are targeting between $8k to 10k per piece as the starting price point for Ice. For reference, in January 2022 the target price for Ice was 25k per piece. The price did not go down to $15k per piece until May 2nd, and did not reach $10k per piece until June 28th. In other words, the market is starting the price point for Ice $15k below last year, which means a significant loss for this item which was once viewed as a top tier material in years past. It also means the future projections of this material do not see the price exceeding last year’s high in 2023. That makes this a long term, and very risky, material for investment.

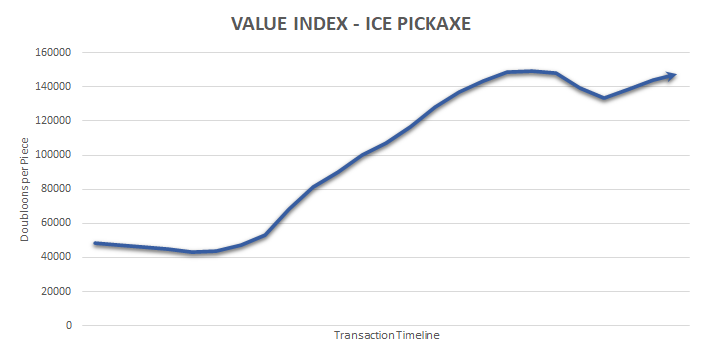

There is an inverse correlation of axes capable of mining Ice and the value of ice itself. This means you are better off keeping any Ice Pickaxes you have and waiting until after winter ends before selling. That said, this is also a misleading trend as the cosmetic value of the pickaxe is also factoring into the value of the axe. We are still seeing put requests made for pickaxes at around $40k each, but most sellers have opted to sell them above the $100k price point which means we may not see a return to the $40k price unless they turn out to have minimal impact on the ice market this summer.

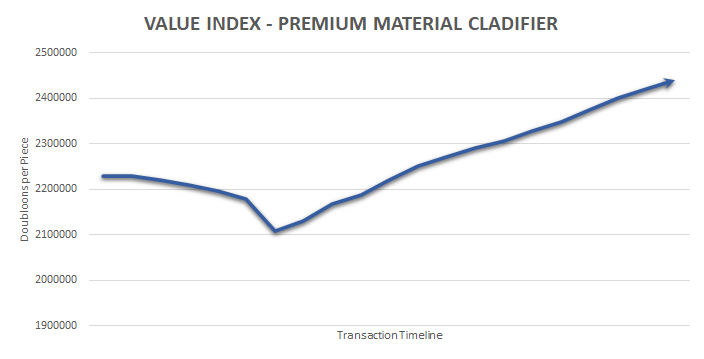

Premium Cladifiers

One of the hottest new additions this winter was the Pre-cladded Cladifiers that were available at Freeport. On the stock exchange these are listed as “Premium Material Cladifier.” Unlike the default cladifier available at the Premium Merchant, this one comes with a material already provided. This means you can cladify a ship without needing to purchase 1,000 of the intended material as well, but at the same time the price of these premium cladifiers will be more expensive as a result.

The biggest concern for the future of cladifiers will be what the developer does with this new item in the future. The item just barely met the requirements for Initial Public Offering (IPO) in January, which means its future is still very uncertain. If the premium material cladifier becomes a regular item released during each future event, this will become a strong addition to the market and is likely to gain momentum. However, if this goes the way of the Festive Long Guns and Terry Guns, then the special cladifiers will lose their importance and eventually fall into obscurity.

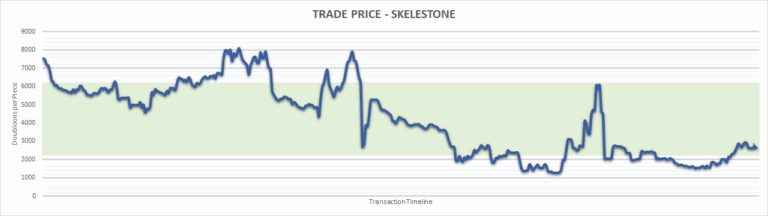

Skelestone Culminating

Skelestone is one of the hyped items from the 2022 Halloween Event which has been disappointing on the market. It has not been successful at generating any sustainable demand. However, in January, sellers began pulling their inventory from the market which caused Capitalization to fall below $5M for the first time since October.

While the true value of Skelestone remains around $1.5k to $2k per piece, the remaining sellers on the market seem unwilling to sell their stocks underneath the $5k per piece mark. Because many of these sellers are not banking on quick sales, and instead are looking at long-term investments, it will be difficult for buyers to have them go any lower on price. Moreover, these sellers own an overwhelming majority of the market share. Unfortunately, this is likely to be the state of the economy until next October where more materials may appear on the market.

The Hype Survey

Finally, if you made it this far into the post, here is a survey which which will be featured in our upcoming video. We are eager to get your opinion!