Tradelands Economic Update – April 1st, 2023

March was a slow month in terms of releases and new additions to the game. This is a pretty typical occurrence every year – the quiet before the string of releases that typically come out in April and May, constituting some of the biggest changes to the game. This month saw a steady release of new dev-blog posts showing what is to come and it sets the stage for how traders will react. Large sell-offs typically mean higher anticipation and hype, whereas higher prices mean people are banking on the update having marginal impact overall.

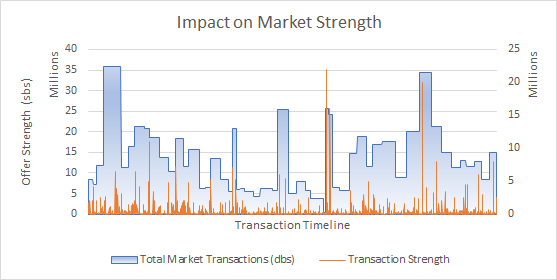

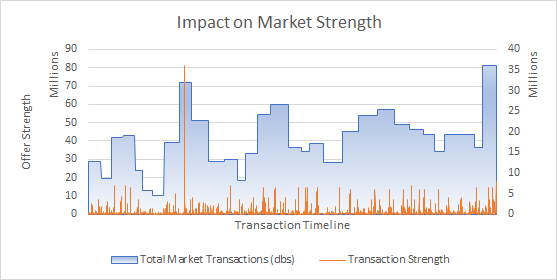

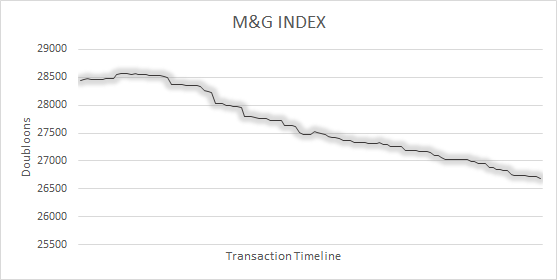

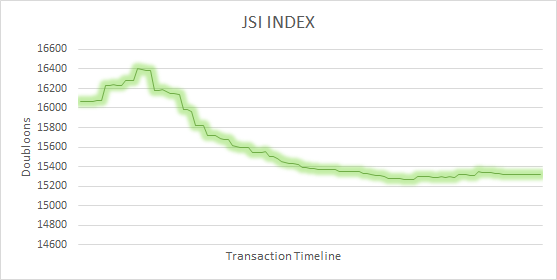

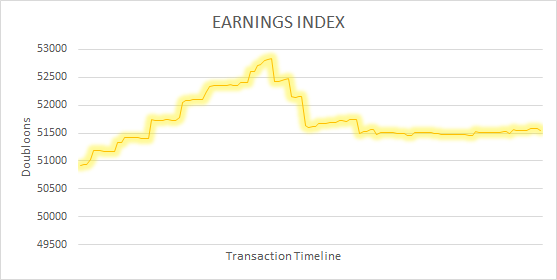

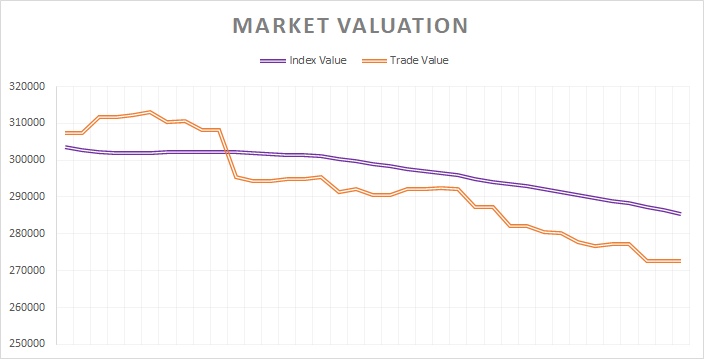

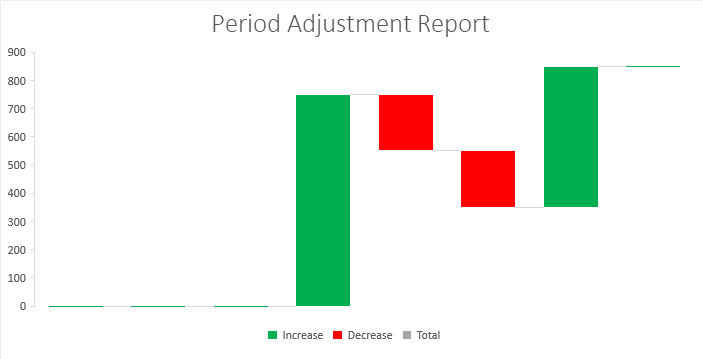

With that in mind, March saw a consistent level of market activity throughout the month, ending with around $1.23 Billion. This is lower than previous months and also saw a decline in two of the three key indices, and the third showing alarming signs of stagnation. All of these trends began at the point where the housing dev-blog updates occurred, meaning many of the trends are likely due to people saving up for this release instead of buying goods from other players. That means, if you are a discount buyer, this is a good time for you as many desperate players are willing to sell. It also means if you are running a discount store, you should be logging in every day to try and capitalize on the trend.

Advanced Engine Ages Badly

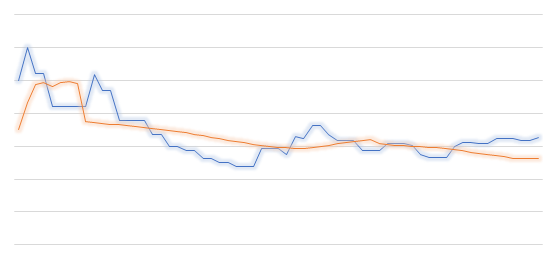

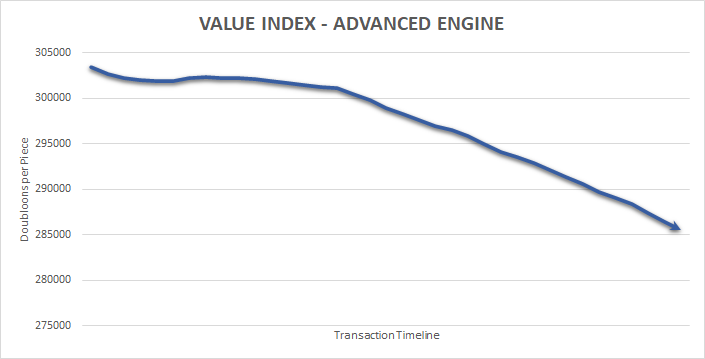

It’s hard to believe, based on the trend we are seeing with Advanced Engines, that the Mercury is only three months old. However, the item which usually sells for over 300k each has been struggling to keep it’s price point. It’s not just buyers who are driving the price point lower, but sellers as well who have started listing it regularly at 250k per engine and in some cases even lower than that.

One reason for this trend is the value of other items in the Premium Vendor. In summary, this items is considered over-priced because it is worth more than other items which cost the same amount from the Premium Merchant such as Premium Tokens. As a result, when new players who enter this market for the first time decide to buy one, which occurred on March 13, the first thing they do is question why it is over-valued and then attempt to move the price closer to a point where it is more equitable. You can see this moment occurring in the month’s index trend where the price point moved from slightly above 300k per engine to a downward trend that ends around $285k per engine.

Stiletto Upgrade Futures

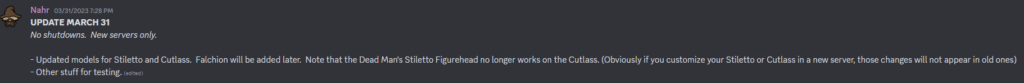

In the final days of March, an important update impacted the Stiletto Figurehead. This is an item that, when placed on the Stiletto, causes the ship’s features to change. It’s a completely cosmetic change, but the dev-blog had been hinting at a re-design of the ship all month which was causing increased hype for this item.

The problem is the announcement that immediate followed the official release of the updated Cutlass, Stiletto, and Falchion in-game:

While it’s uncertain if it matters to players, it immediately stops any projection of upward movement of this item because its in-game cosmetic value is now in question. In real-life circumstances that mirror this kind of change, it’s common to see markets fall as this is perceived as negative news. However, there is usually a correction period where the price points stabilize and will settle at it’s new long-term valuation. That means, if you want to capitalize on the negative hype, you can offer to buy the item at a lower price point than it’s current index price to see if any players bite.

However, if you have one already you are better off holding it to see where the price point ends up. Unless a good portion of players were actually using this on the Cutlass, a ship with relatively poor ratings, this is probably a meaningless update and will not have a long-term impact in the price. It will, however, likely stop any future upward momentum this item was gaining.

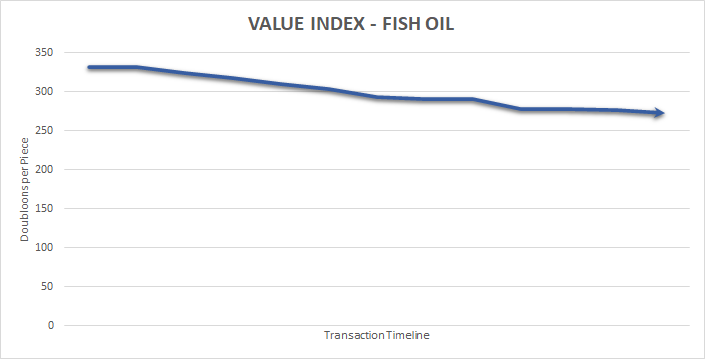

Fish Market Crash

The fish market is hitting hard times. This has caused a number of players to demand there be an update to the fishing mechanics in-game, all of which appear to be falling on deaf ears. This is because, while the current outlook is bleak, the changes are more due to misinterpreted market indicators from a handful of pricing guides than an actual problem with the market itself.

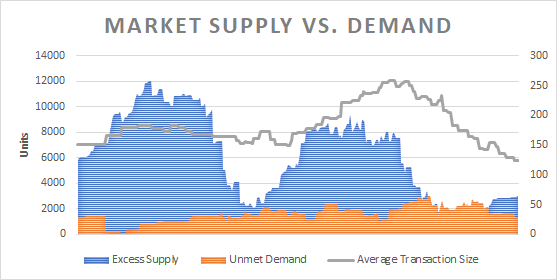

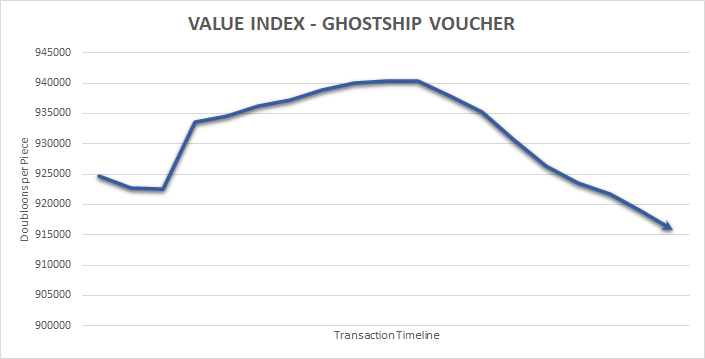

Ghostship Voucher Cap

The Yellow Ghostship vouchers were originally estimated to have a material cost of around $1M which set the benchmark for how much they should cost players to acquire for doubloons. Since that original valuation, the vouchers have maintained a price point of around $800k per voucher despite several attempts to raise the price. We saw more of the same in March.

This constant struggle to even hit the item’s break even value means those who bought them in the hopes of re-selling them for a profit should be disappointed. At the time, it looked like a safe investment. After all, Ghostships have the added benefit of allowing their hull color to be changed without having to reconstruct the ship. This means using a voucher for any ship Level 10 or higher can provide a good value to the player. Unfortunately, this fact has not been marketed heavily by the development team, and isn’t used by players to market the value of the voucher. As a result, we will continue to watch this item to see if it can ever recuperation its cost or if this an item you should just cut loose if you have it already.

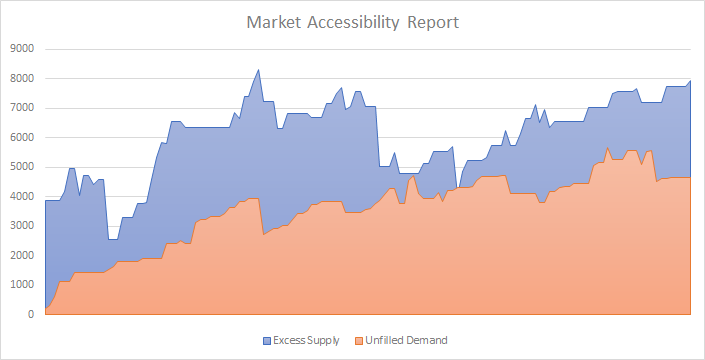

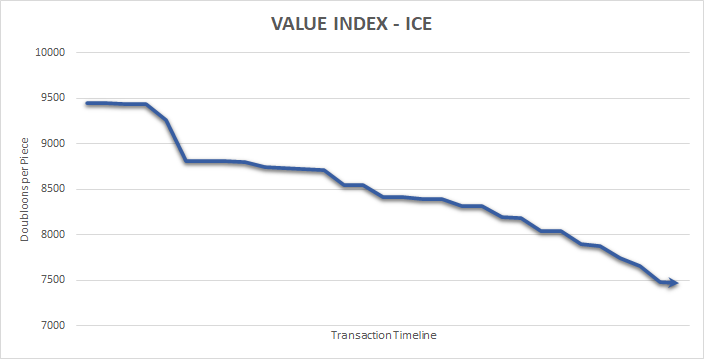

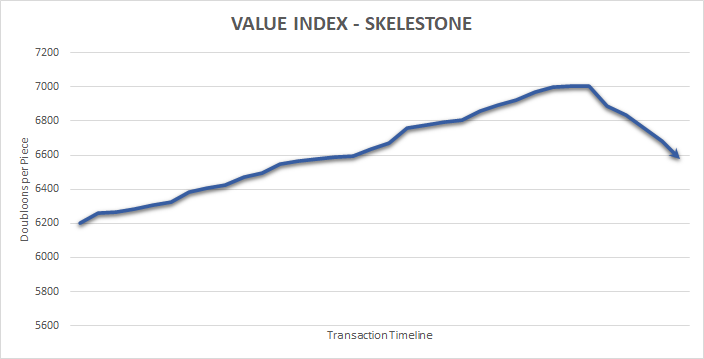

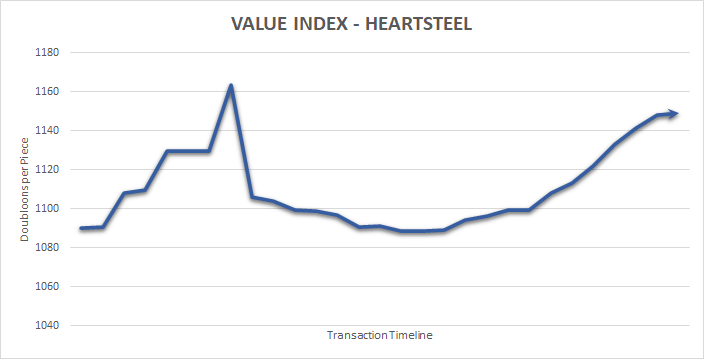

Ice, Skelestone, and Heartsteel

The three holiday related materials are Ice, Skelestone, and Heartsteel. Heartsteel is still new enough to the market that it will have some room to go up if demand can be generated for it. However, Skelestone has likely peaked already and isn’t likely to go higher than $7k per piece unless some desperate buyer comes in and makes a purchase. But perhaps the most alarming of these is Ice, which has been on the market the longest of the three seasonal items, and is in a near free fall and hit $7k per piece in March.

The commonality in all three of these indexes is the complete lack of demand. Only Heartsteel showed some marginal demand earlier in the month before it too hit a point where no one was buying. For normal, high volume items, the way to generate demand is to lower the overall price until buyers find it interesting to purchase. However, this doesn’t appear to be happening in this case, meaning players who wanted the material seem to have just purchased it themselves rather than buy it from resellers.

It looks like these items are beign repurposed as a method to boost a person’s own wealth statistics rather than a true attempt to sell. Skelestone is the most obvious of the three, where players attempted to manipulate prices higher without the intention of finding a buyer, only to lose the trend later in the month to people who are actually selling the item outpaced the price correction attempt. In the case of ice, it’s likely that this will limit the number of players who will partake in the Ice trade when winter comes back in December 2023.

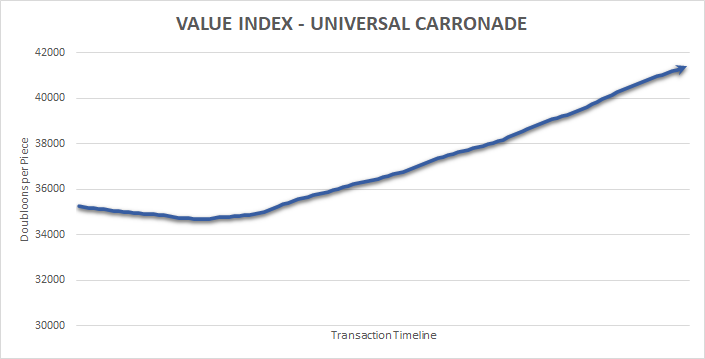

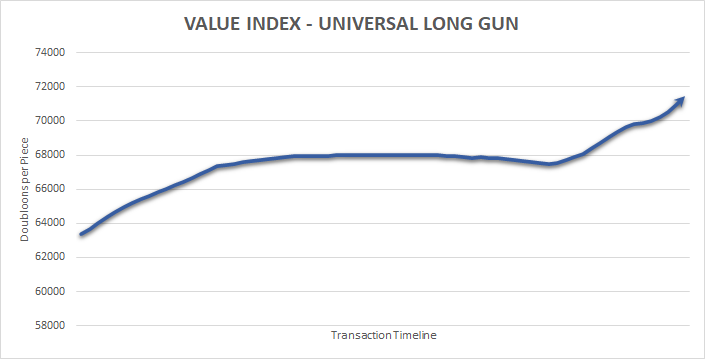

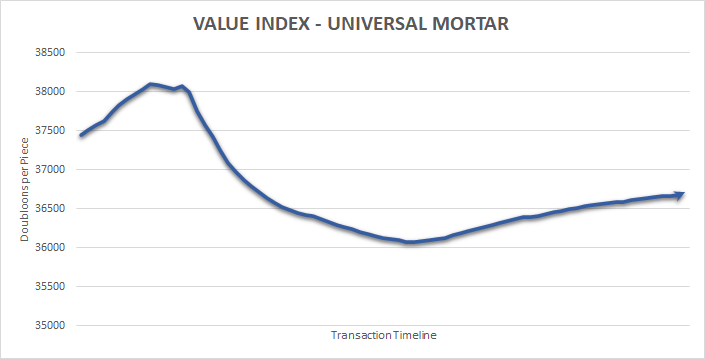

Universal Cannons

Our final note for this monthly report is about Universal Cannons. This has been one of the hottest additions to the economy in recent months. One of the only limitations to the ability to trade these items is the lack of methods in which to display them to players, in the way you can with Weapons Displays. As a result, these are almost exclusively being traded word of mouth.

If a method of displaying these in shops is ever introduced to the game, expect the volume of items being bought and sold to increase dramatically. Until then, we can see that Long Guns are the most profitable and sought after. Second to this is Carronades which are used as a secondary choice when the exact cannon you are looking for is not available as a long gun. Finally, Mortars are the third most sought after and their overall value is limited to the number of ships that can carry them since their slots are not interchangeable in the same way as carronades and long guns.