Tradelands Economic Update – June 2022

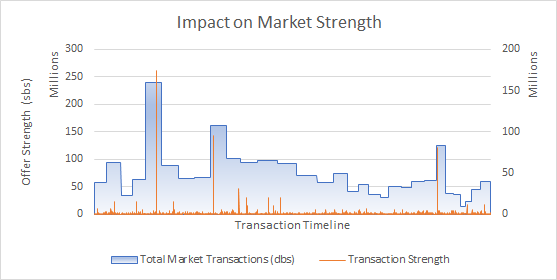

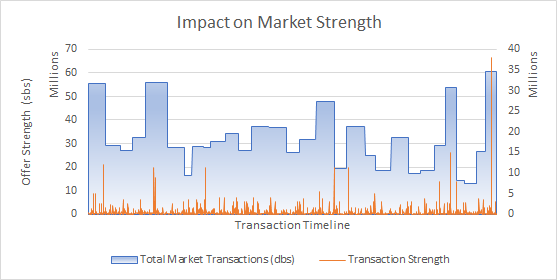

Compared to April and May, June was like a long respite after a marathon. The Purshovian Recession of 2022, if it can be called that, continues as all of our primary indexes continues to decline in June, as well as the overall trade volume. However, it seems like the unending fall has light at the end of the tunnel as we are starting to see some recovery across some items. This includes a short turn-around for the Earnings Index at the end of the month.

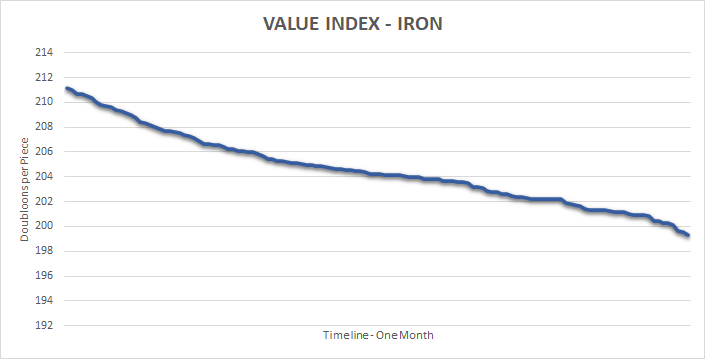

Iron Threshold Gets Hit

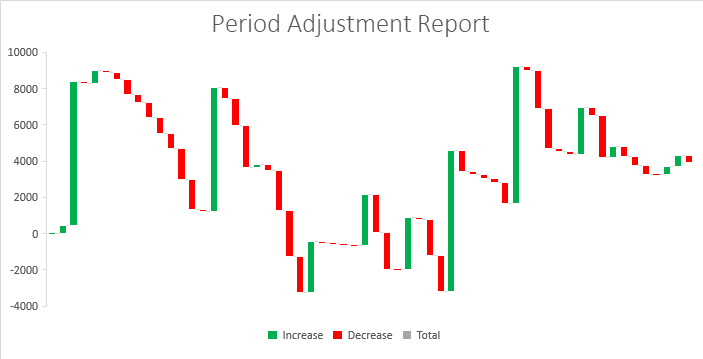

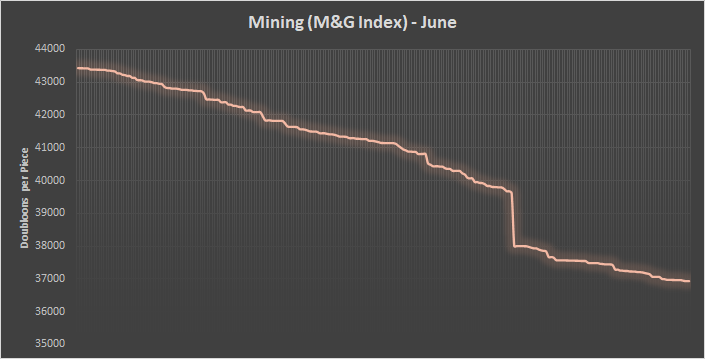

In last month’s special report on the M&G Index, we mentioned that fighting the Iron price correction was a bad idea. You can actually see the moment when it was clear that Iron would fall below $200 per piece with the -600 drop in value on the M&G Index.

On the bright side, the projections for July show some potential stabilization for Iron. This is a significant difference from last month when there was a real possibility that Iron would fall below the price of Oak. We will cover wood in another update, but it’s safe to say that isn’t going to happen in June. The thing to watch is the amount of buyer activity this month, as the more buyers there are the more stable the price will become.

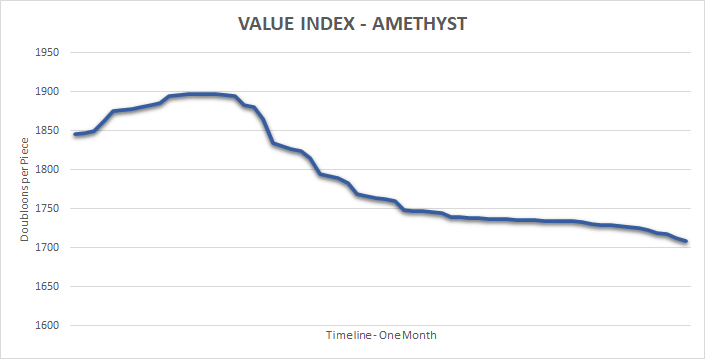

Amethyst Prices Normalized

To close out our comments from last month, it looks like the temporary inflation of Amethyst sales by new players quickly corrected itself and is back at a respectable price point again. If it was a price correction, it didn’t work. However, it looks to us like the typical mispriced items that happen when new players get hold of this material for the first time.

The lesson here is to do your homework before buying and selling materials you haven’t dealt with before. This same rule applies to Onyx which is another commonly mixed up material. Before you buy or sell Onyx, you need to have a full appreciation for why it is priced the way it is. That means understanding what it is used for and why.

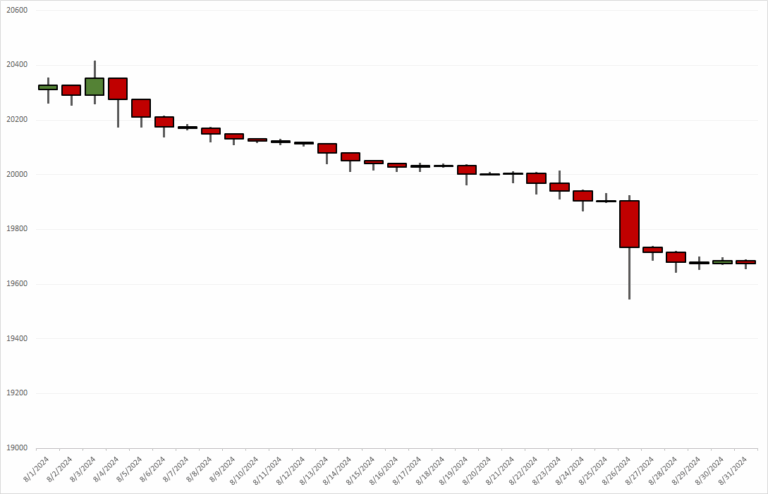

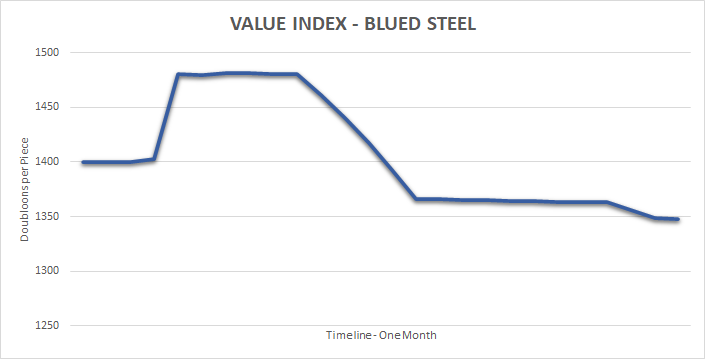

Disappointing Blued Steel IPO

Well, Blued Steel finally made it to the exchange after a difficult month of trading. Needless to say, it doesn’t have the typical IPO feel to it and is already selling at some chaotic numbers. This is not at all a good sign for a new material that just came onto the market.

There are a couple of things to unpack here. First, there were a few sellers that didn’t price the material correctly, which is why you see a sharp price increase early on. However, it seems these sellers quickly corrected their own prices, probably once they started checking with the community, and the price fell to it’s current stable price point. The interesting thing here is the price of Blued Steel is currently below the price of the materials used to make it, if those materials were sold separately.

This is what we call an “upside down” market. It means if you are trying to use Blued Steel for yourself, you are better off buying it from others. If you are trying to sell, you are better off selling the materials to make it than Blued Steel itself. That leaves the market for Blued Steel in a place where there shouldn’t be any available at all, since it’s not profitable for either buyers or sellers.

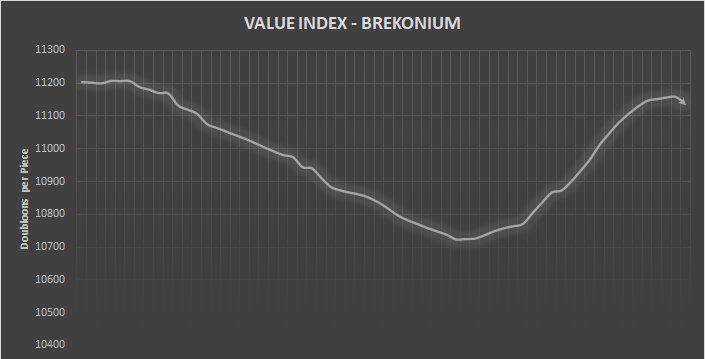

If this still confuses you, let’s take another example. Let’s pretend that Brekonium, which costs $10,000 per piece from the Brek merchant, was being sold on the market for $9,000 per piece. That means a seller would have to buy the material from the merchant for more than he could sell it. Why would a seller do that?

It would be more economical for the sellers to force buyers to go to the Brek merchant themselves. That’s why Brekonium always bounces up after it gets close to the $10k price threshold. It’s also why the price remains pretty stable, because the purchase price determines the true value of the material, not the market rates.

Pinewood Ships

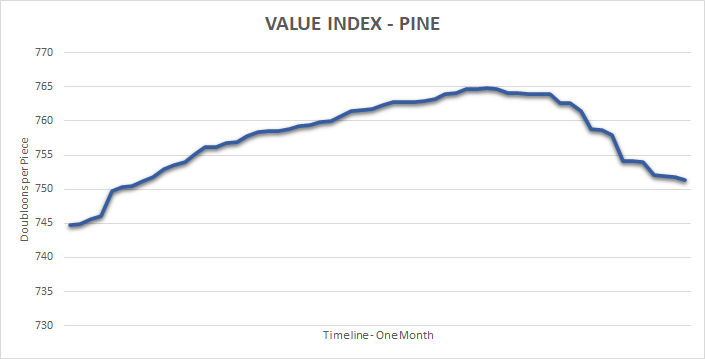

One of the positive notes of the month is the bleeding of Pine wood finally stopped. This, along with Spruce, was hardest hit during the Purshovian Update because the value of its exclusivity was negated. It ended up +0.89% which, given it had a projected fall of -15%, is a relief to those who didn’t sell it back in April.

Still, while we don’t want to disparage it’s achievement of positive momentum during a recession, there is still a lot we don’t like about Pine’s future. The upward trend is attributed to the announcement by the developers that a new ship would be released this month. Once it became clear that they were not going to release one, the value of Pine continued on its downward trajectory. That is an indication that positive movement for Pine may only be temporary at best, which doesn’t make it an attractive option for sellers.

Is The Recession Ending

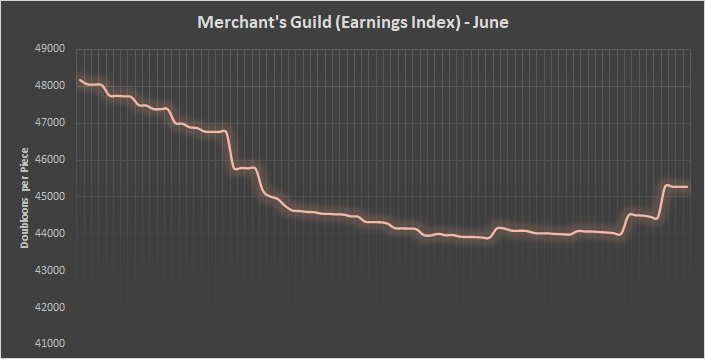

Finally, let’s talk about the biggest piece of positive news of the month and that is the performance of the Earnings Index at the end of the month. Just in case anyone is confused, the Earnings Index is the new internal name of the primary index previously referred to as the Merchant’s Guild Earnings Index, or EMG.

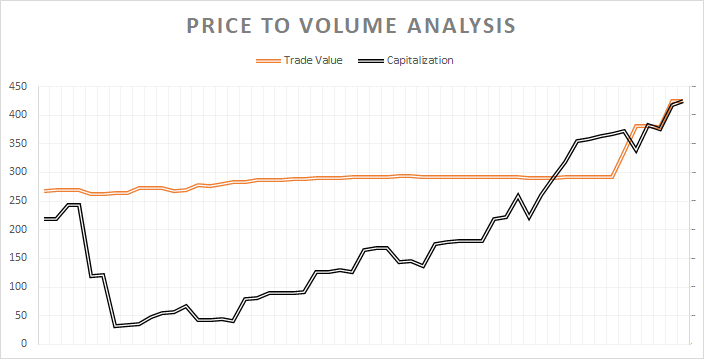

For the month, the Earning’s Index closed at $45,286.92 which is the lowest it has been since March 2022. It also fell another -6.38% which shows the recession is still in full force. However, the stabilization in the second half of the month, followed by two solid price correction attempts in the last week, are a sign that there is some life returning to the market. That will depend on whether there is an increase in market activity or if we can expect to see another month with little to know released content.

It’s not fair to put pressure on the market to try and keep the momentum we saw in April and May. Those two months were anomalies as far as the economy is concerned. However, when you have a reduction in prices at the same time there is a reduction in trade volume, things can go downhill quickly. It’s a warning sign of a sustained economic depression which, in terms of online games, could result in a player exodus if you aren’t careful. We aren’t ready to predict that outcome, however, as we are still seeing this as an outcome from the Pushovian Release and not a sign of deeper underlying problems with the economy.