Copper Stabilizing (Sept 2022)

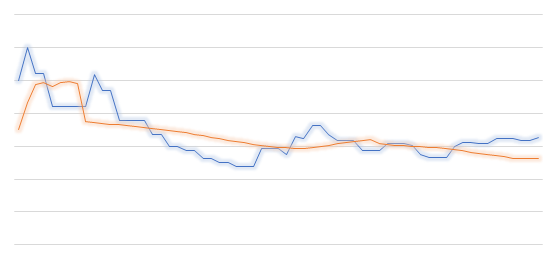

The Company is upgrading the rating for Copper from “Unpredictable” to “Very Stable.” This comes after the volatility we saw in August has stabilized and we are once again seeing a clear -3.5% trend in the material’s price.

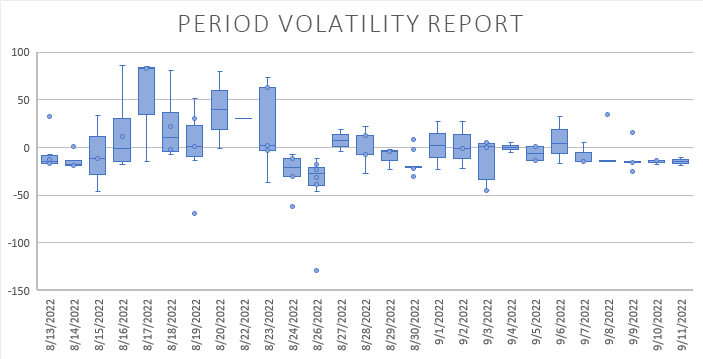

This chart is called a Period Volatility Report. It is a new addition to our suite of dashboards being used to monitor the economy of Tradelands. In general, the larger the bar is, the more volatile the trading price for that day of trading. The “dots” represent trades that are considered outliers (alt trades, scams, etc.) and are typically removed from the economic model until they are verified.

In terms of Copper, this tells us a couple of things:

- From 8/27 onward, we saw a stabilization of prices.

- Because the adjustments are stabilizing in negative numbers, it means the price of copper is falling at a predictable rate.

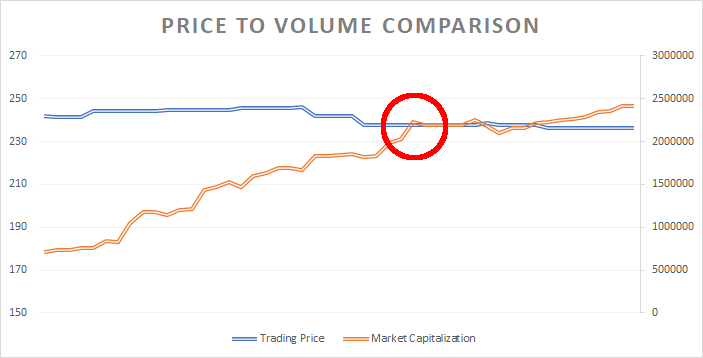

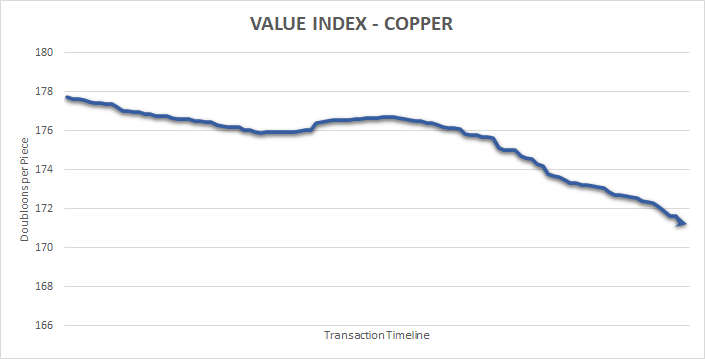

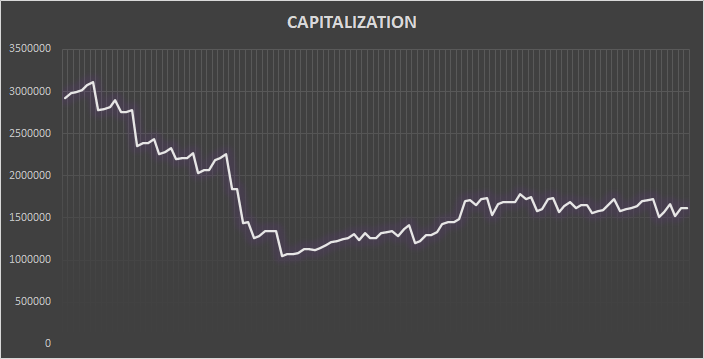

Whenever we see stabilization like this, we typically expect to see a steady line on the price of the material, as well as a consistent performance of the market capacity. We see both of these happening in the case of Copper.

In summary, if you are a bulk trader, you are going to lose out if you start selling now. That’s because, when the market trends downward, buyers expect discounts for bulk rather than premiums for high volume. You might want to wait until small traders start pushing prices upward before you sell.