2022 Closing Index Summary Report

Below is the GISE Index Summary Report (ISR) for the items that are tracked on the stock exchange. This list is alphabetically sorted and only includes the top 90 items in terms of documented market activity. Descriptions and analysis are provided (where available) above each report. Only items that are actively traded on the stock exchange in 2022 are included in the report.

2022 Primary Indexes (Jan 1, 2022 – Dec. 31, 2022)

Consolidated Price Indexes

This report is a consolidation of all the prices shown on the Real Time Indexes page throughout the year. This is a snapshot in time. For the most up-to-date prices, please view the Real Time indexes directly or review the prices on the Price Guide.

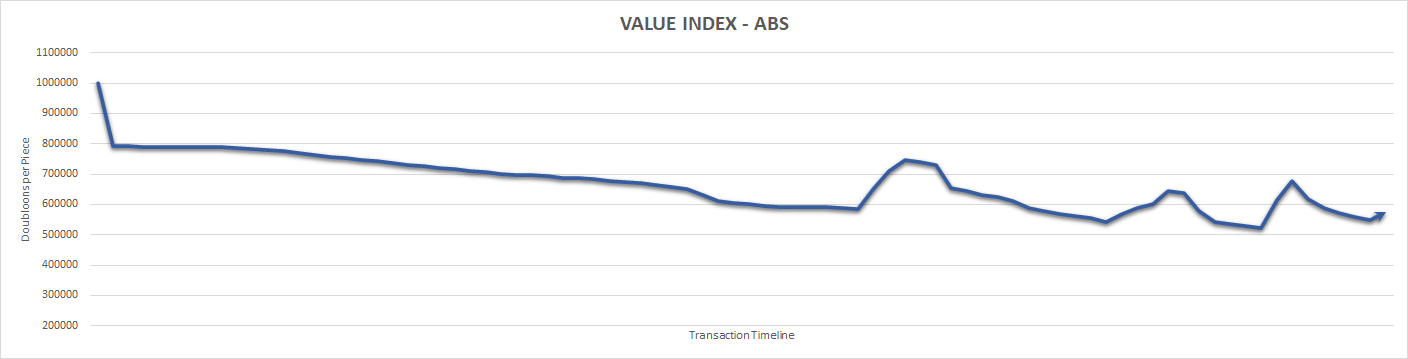

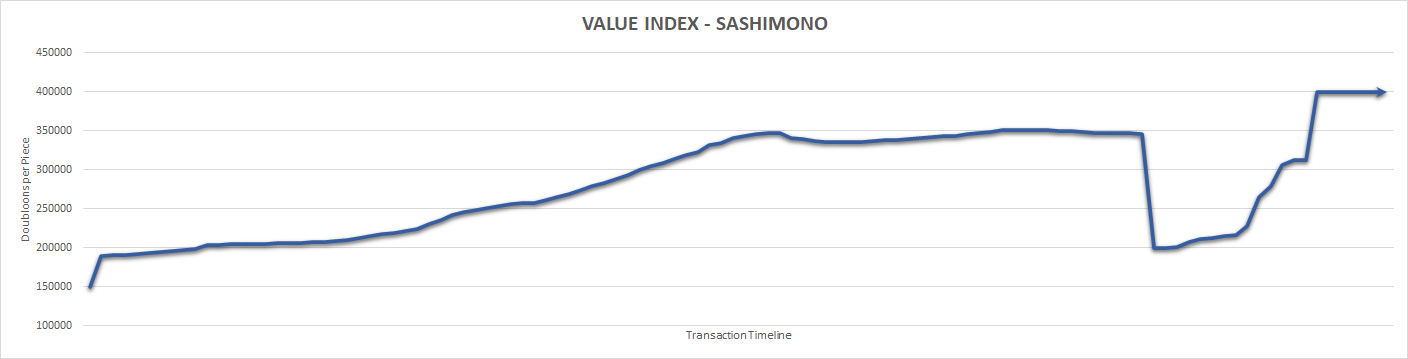

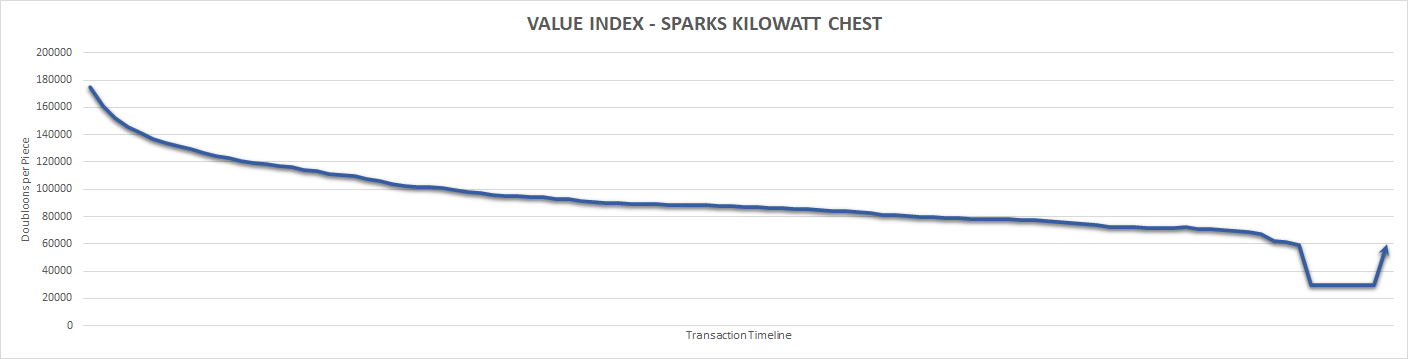

This is an accessory that can also be placed in a house as a furniture item. Prices steadily decline throughout that year, but players trigger price reset mechanisms whenever re-sellers re-introduce the items to the market.

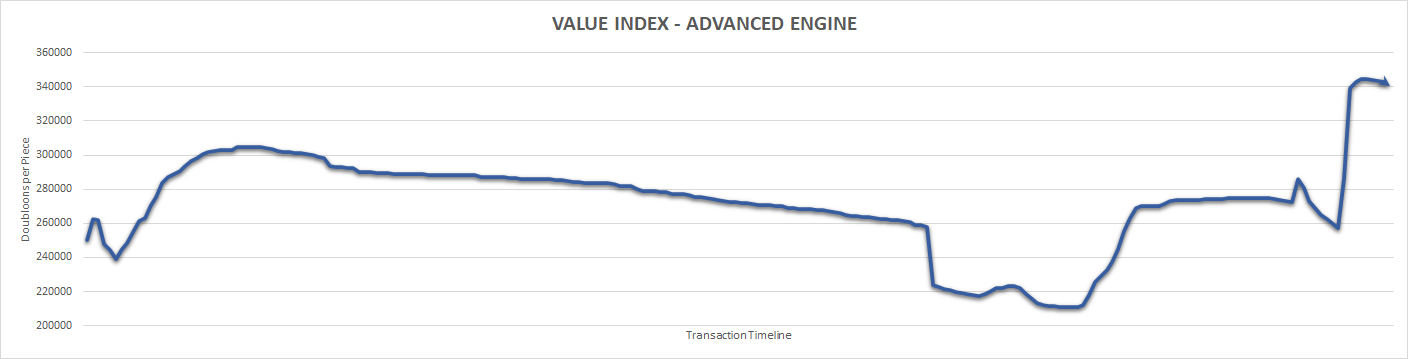

The Advanced Engine is a critical component to build certain ships. Demand for the item depends on the level of interest in building ships that require it. The large jump in demand at the end of the year are due to the release of new ships during the holiday event. Do not expect prices to remain at this inflated level unless additional ships are released that also require the Advanced Engine and are affordable.

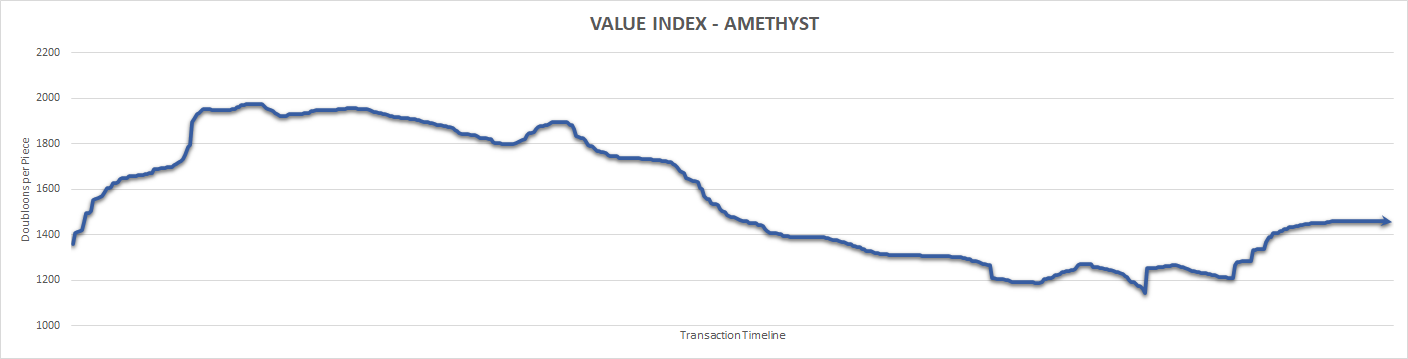

This item is one of three types of mid-tier gemstones that can only be acquired through mining. Amethyst tends to sell at a slight premium among its peers because it is perceived as a premium gemstone. Amethyst’s value grew by +6.53% in 2022 which makes it moderately acceptable as an investment.

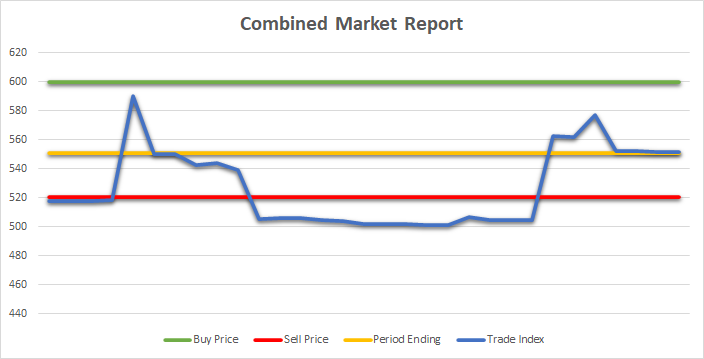

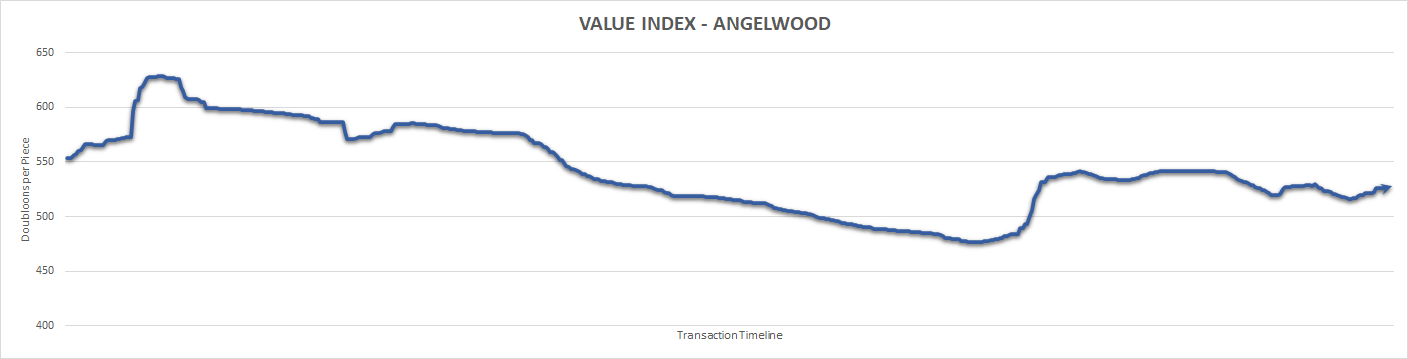

Angelwood is a critical component to the mining industry. As a result, it maintains consistent demand, and its availability from the Premium Merchant helps reign in price fluctuations. Despite these measures, it has struggled to break the 550 per piece barrier it enjoyed prior to the 2022 Recession.

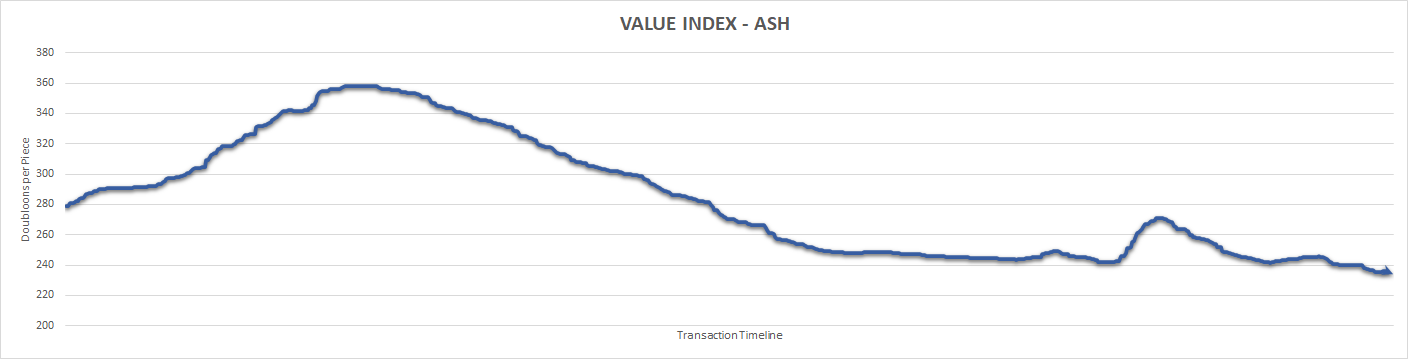

Ash is one of the low-tier rare wood drops and closely follows the trends of the overall wood market. Ash has not proved to be a recession resilient material, making it a poor investment based on the market conditions in 2022. Over the course of the year, the value of Ash dropped by -19.21%.

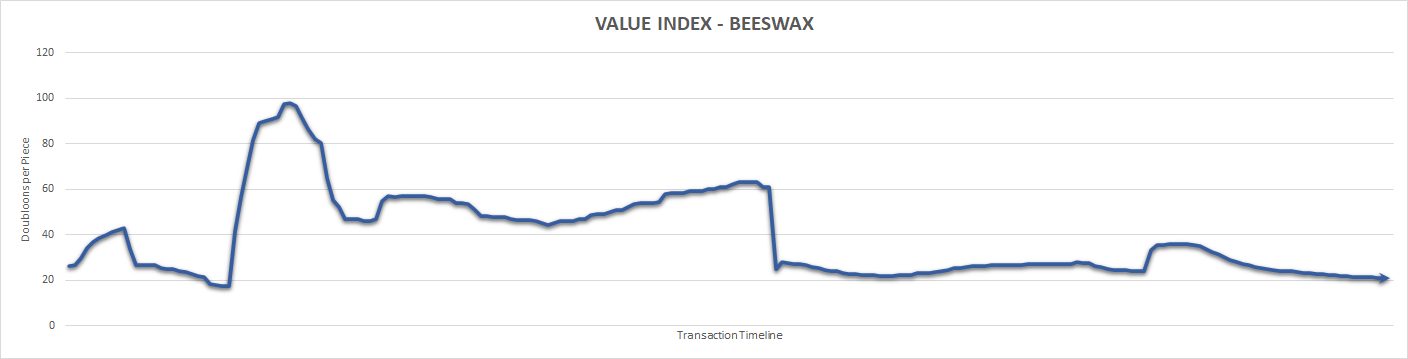

The dramatic fluctuations at the beginning of the year reflect the relatively unimportant/unobserved prices for this commodity item until they became a necessary component in item manufacturing. This has stabilized the material considerably, and the price point remains low since it can be farmed with relatively low amount of effort. Like most commodities, this was not a good investment in 2022.

This is an item that can only be purchased at the Premium Merchant and is consumed on use. Pricing for this item remains largely flat due to this dynamic. This item is recession/inflation resilient because its price is not set on doubloons, making it more valuable the more the value of doubloons is diluted.

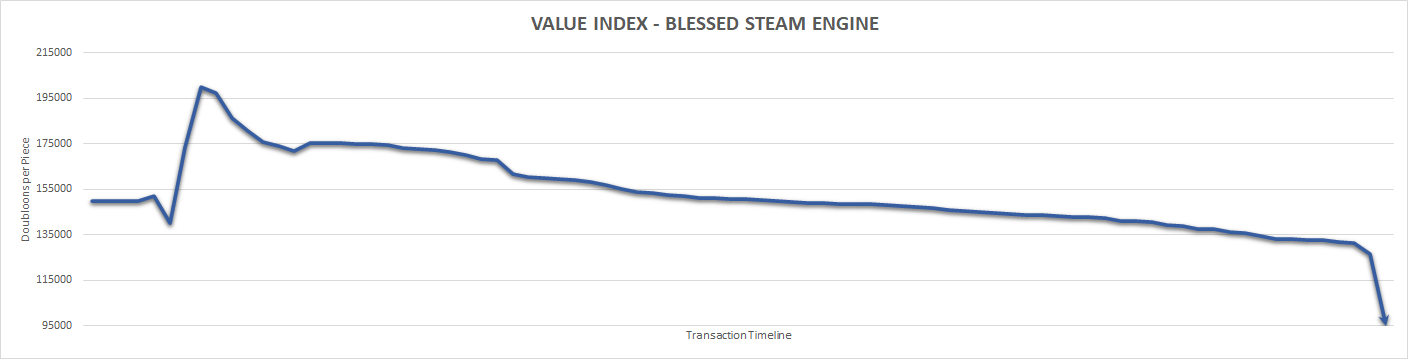

Blessed Steam Engines were removed from the stock exchange on June 16 following the item’s removal from the game. It remains possible to purchase one of these, but it is essentially a legacy item. The last close price prior to its default was 95,000, a -57.89% drop from in value.

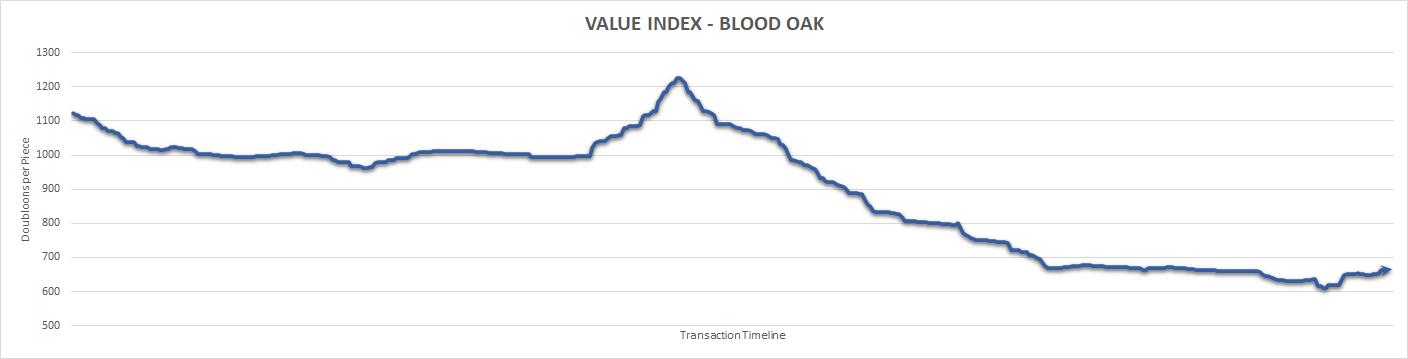

Blood Oak hit its peak over the summer when the new ships were being released and steadily fell after that point. Blood Oak has lost over half of its peak value from 2021 and the switch to Premium vs. non-Premium wood has not helped to recover the beleaguered wood. As of the end of 2022, Blood Oak closes down -68.82%.

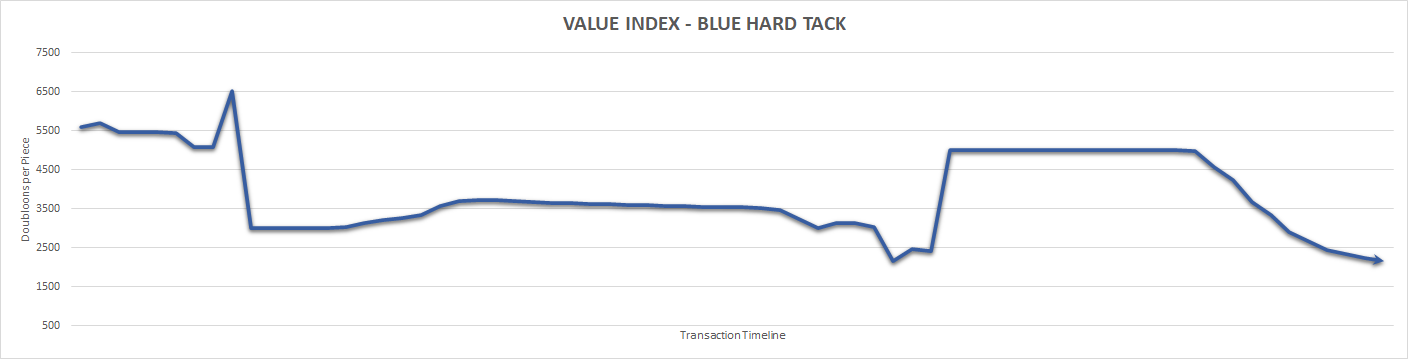

Blue Hard Tack is a low volume item and tends to maintain a low capitalization. This means it is easy to manipulate but doesn’t always represent the true market value, especially when it reaches near zero.

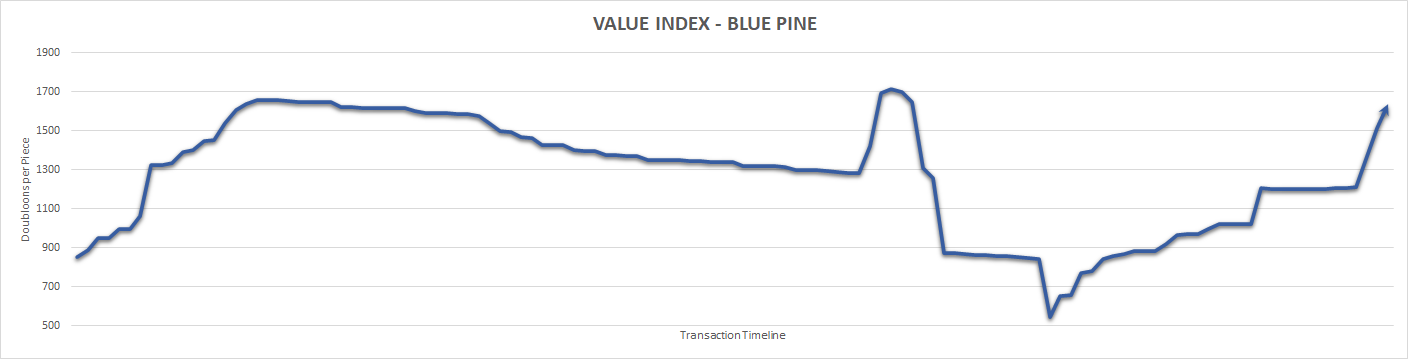

Blue Pine is a new entrance to the market with the first Initial Public Offering (IPO) occurring on April 23rd. It has a relatively low market capitalization has caused some severe price fluctuations in the fourth quarter of the year. That said, the material shows some promise as an investment by ending up +48.02% from the IPO.

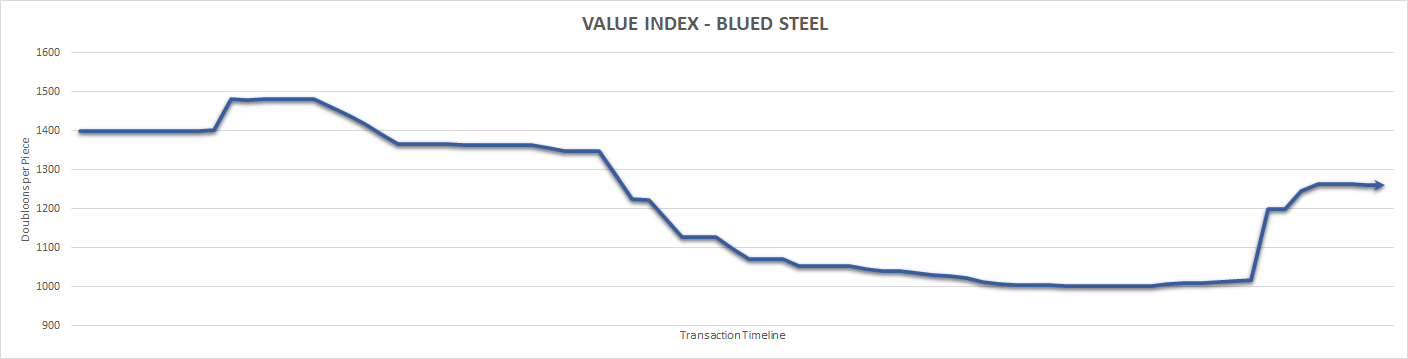

This is a new entrance to the market with the first Initial Public Offering (IPO) occurring on May 5th. The item had a slow start and remains a slow trading option with long lead times. This is due to its ability to be manufactured with non-premium materials. It is one of the most under performing materials that were released this year, closing at -11.14% below IPO.

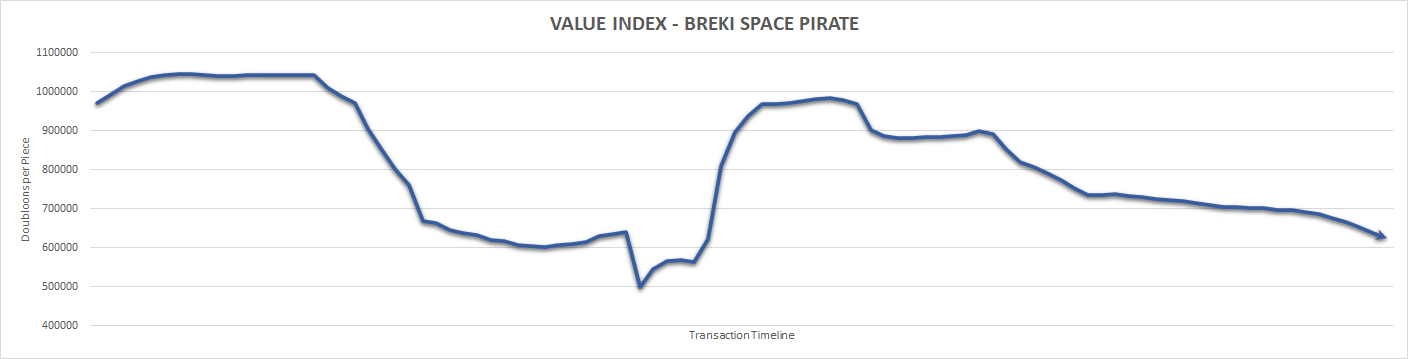

This is a furniture item that is considered a premium item due to its exclusive availability. The item maintains consistent capitalization but was impacted by the general degradation of the furniture market that occurred after the Purshovian Recession. It has seen a value drop of -55.21% over the course of the year.

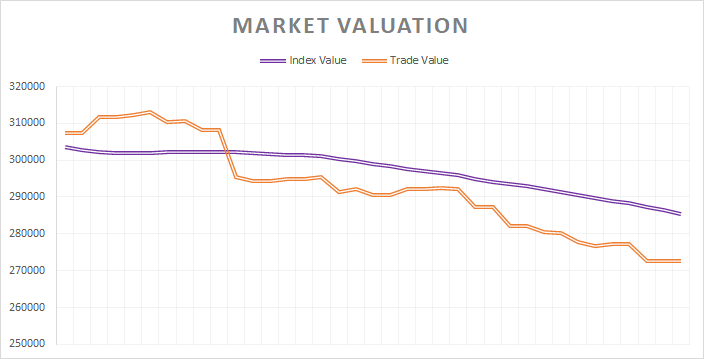

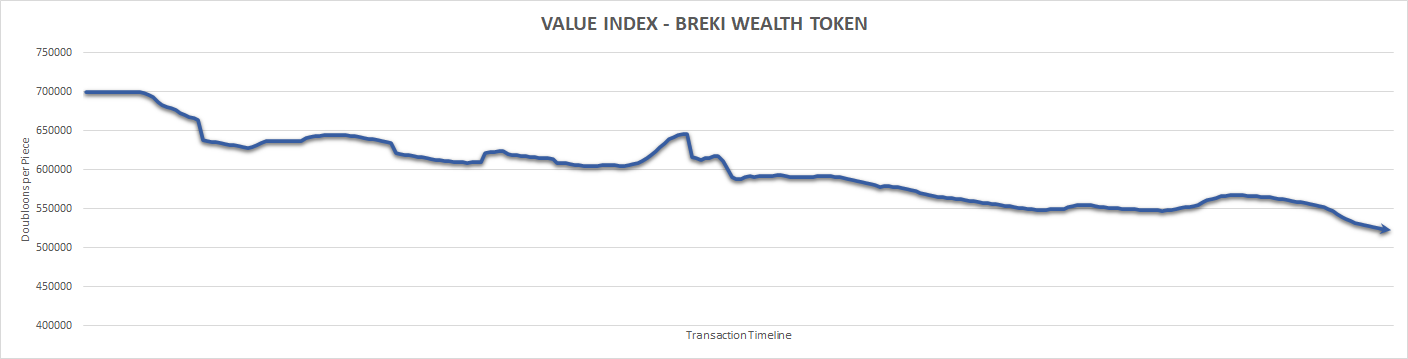

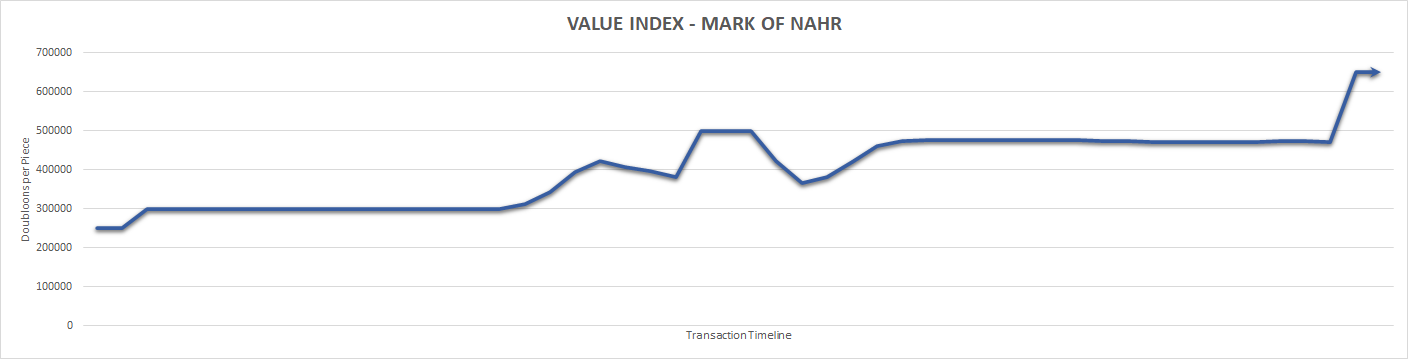

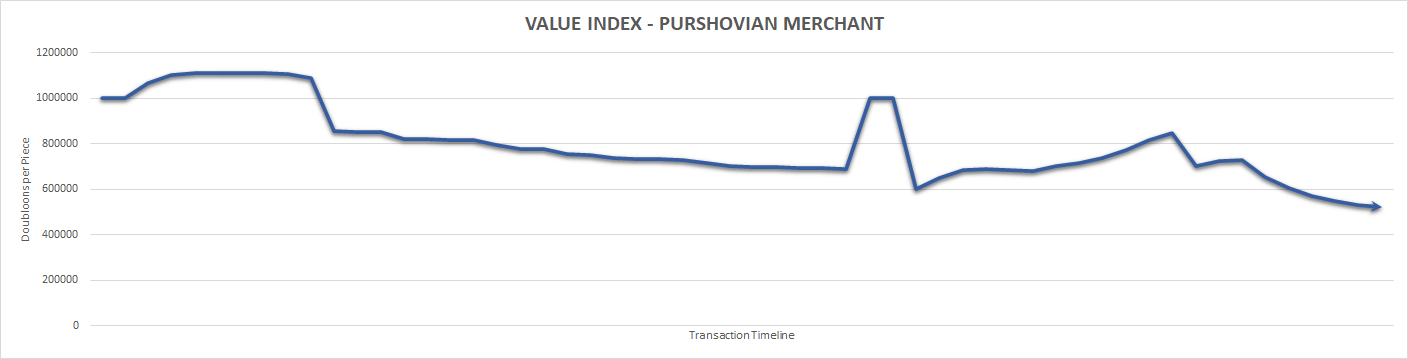

Breki Wealth Tokens have experienced a steady decline following the disintegration of the coalition that attempted to moderate access to the specialty vendor. Despite losing a third of its total value in 2022, it did not fall below its premium purchase price and should not fall much lower than it’s ending price point of $523,141.96 unless exclusive access to the vendor is open to the community.

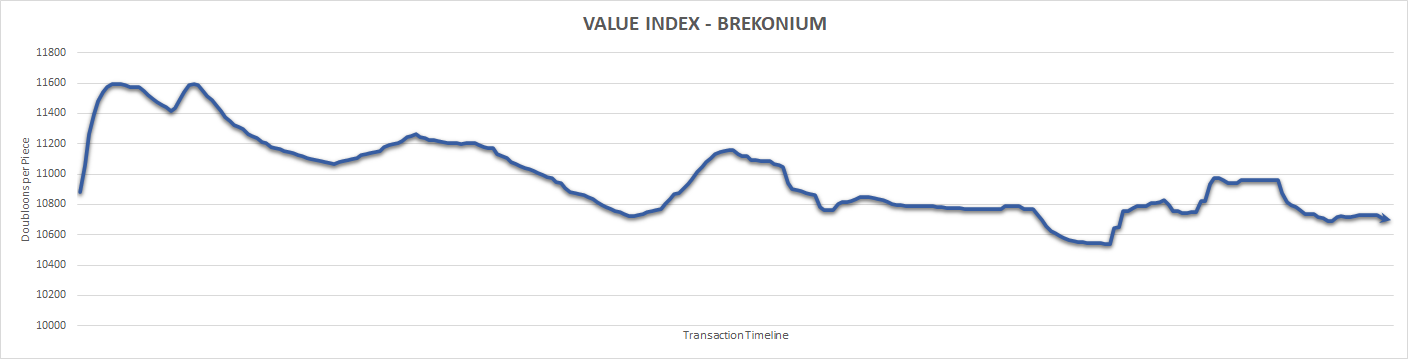

This is a recession/inflation resilient material, meaning it gains value when the value of doubloons decreases. The item has remained flat throughout 2022 due in large part due to its availability in-game for doubloons. Prices typically fluctuate between 10,500 – 11,000 per piece depending on the seller.

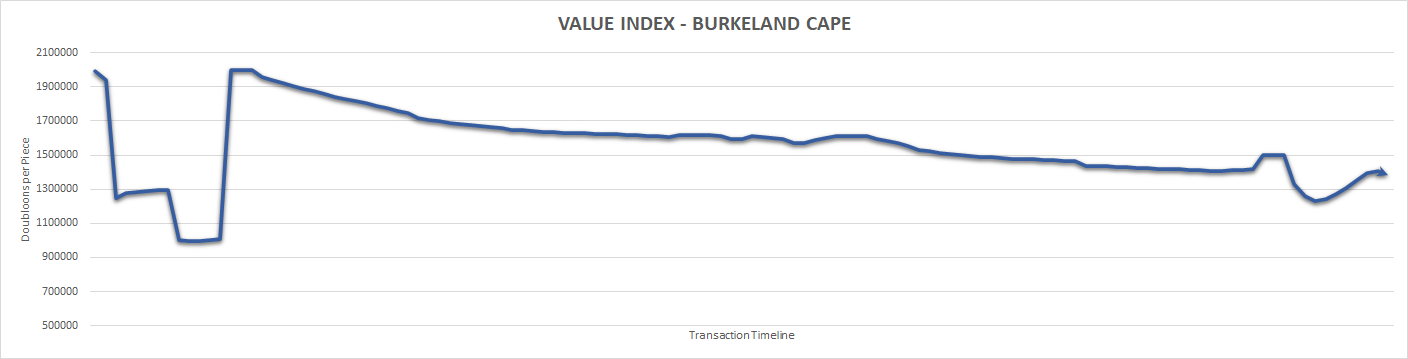

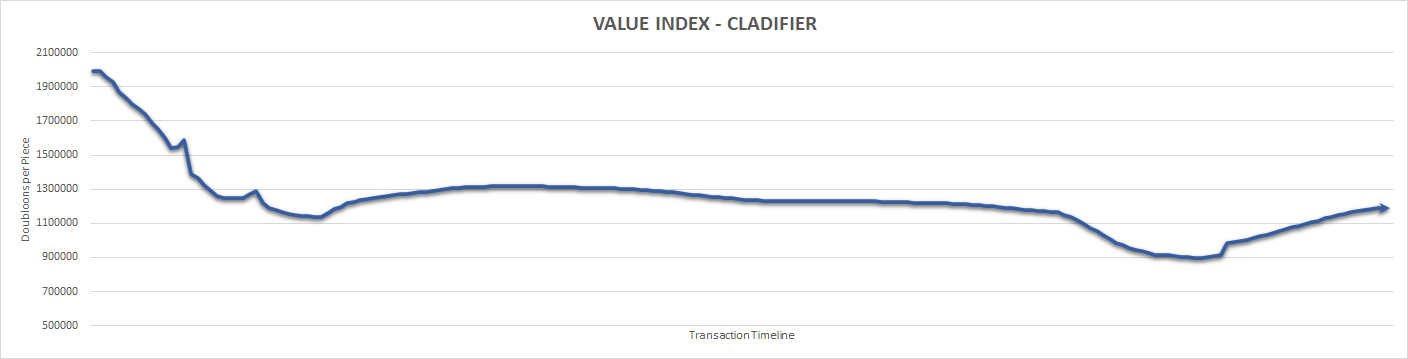

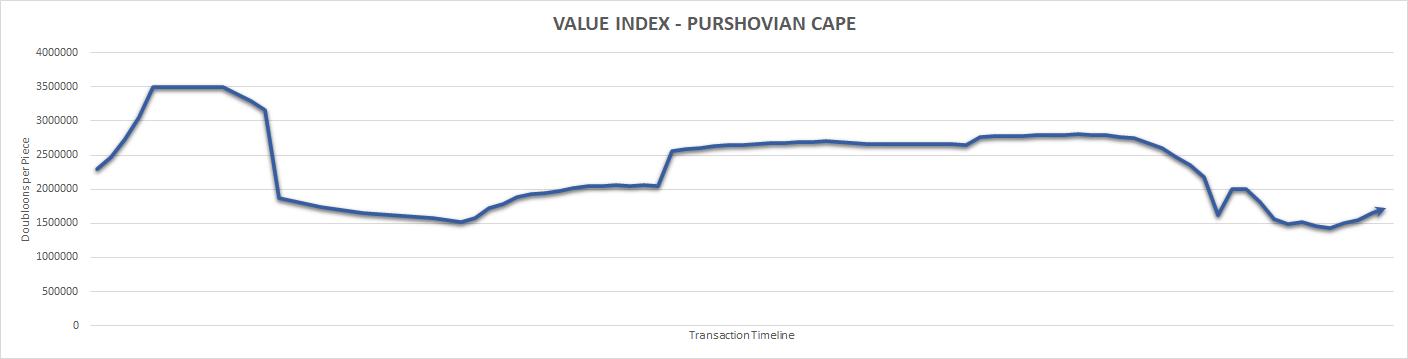

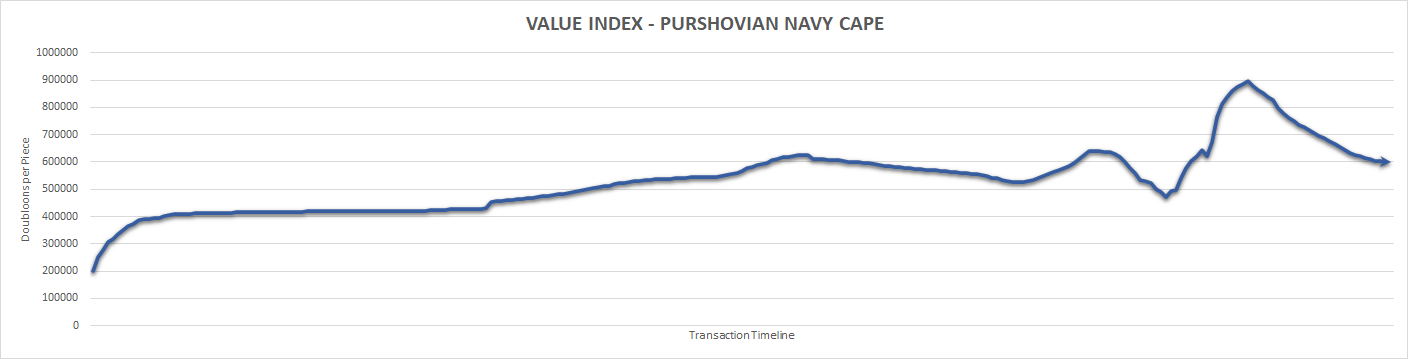

This is an accessory that also has value as a furniture item. After an early attempt to purchase the items at bulk prices early in the year, the cape has consistently maintained a price point between 1.7M and 1.3M for most of the year. It has lost -43.84% of its value over the course of 2022, but is misleading due to relatively few suppliers controlling market prices due to low overall capitalization.

This is a commodity item that is consumed during use and is manufactured in bulk. Like most commodities, they were not good investments in 2022. The value of the item is dependent on its use in game during events and has fallen -41.76% in 2022 due to relatively few public events in-game.

This is an item that can only be purchased at the Premium Merchant and is consumed on use. Pricing for this item remains largely flat due to this dynamic. This item is recession/inflation resilient because its price is not set on doubloons, making it more valuable the more the value of doubloons is diluted.

This is a manufactured item and is classified as a component material and part of the in-game supply chain lifecycle. As a result, it is impacted by the price fluctuations of its raw material source, and will impact the value of the manufactured items. The value of the item has increased by +37.70% in 2022 due to changes in the way premium materials work.

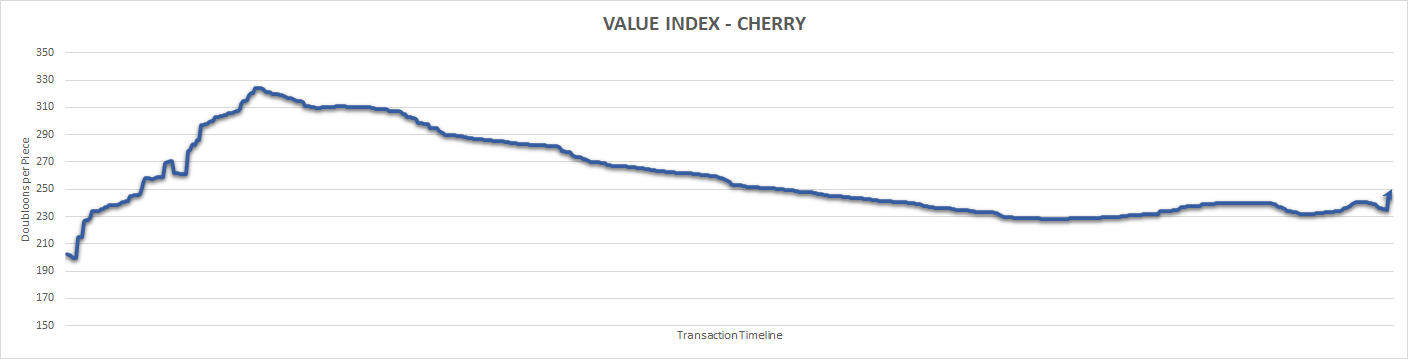

Cherry is one of the low-tier rare wood drops and closely follows the trends of the overall wood market. It has not proved to be a recession resilient material, making it a poor investment based on the market conditions in 2022. Over the course of the year, the wood material gained +19.00% but remains unimpressive given its high fluctuations of capitalization.

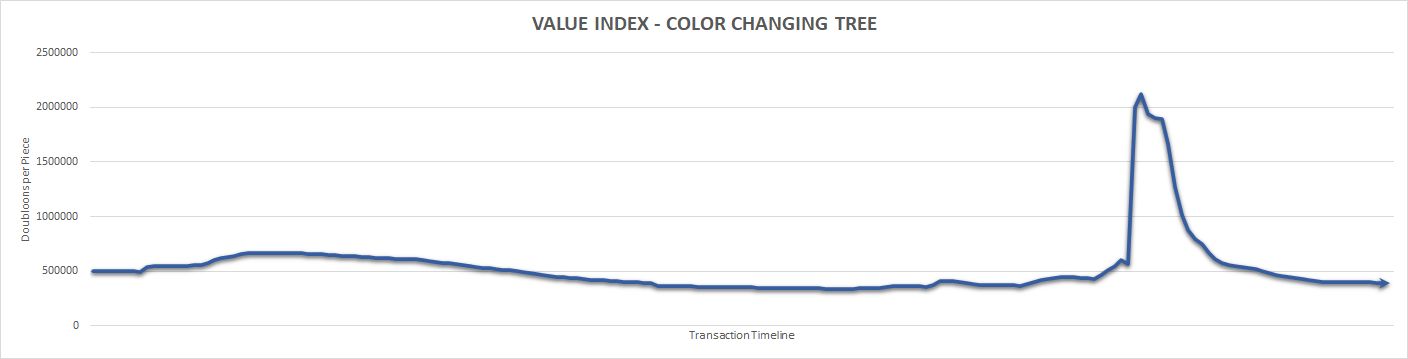

This is a high cost cosmetic item that is available only from the Premium Merchant. It is recession proof due to its value be separated from the value of doubloons. The item lost -67.11% of its value in 2022 due to the lack of new ships that can use it drying up demand until the last month of the year.

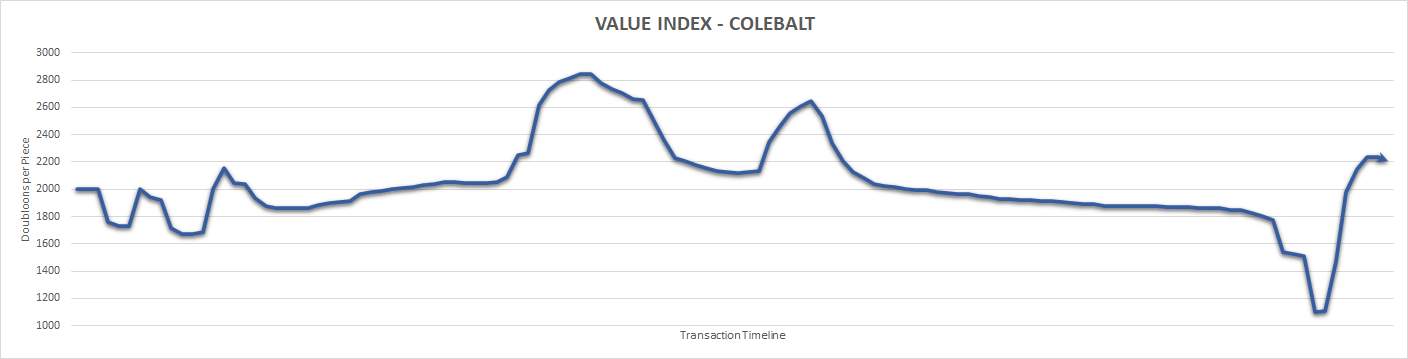

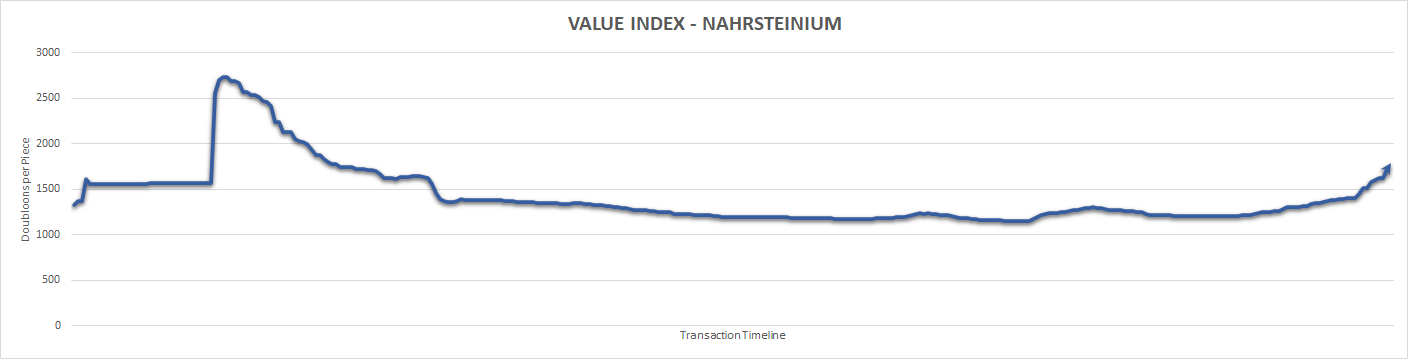

This is a high demand item that can be mined as well as purchased from the Premium Vendor. The item experienced an explosion in value when it was taken off the Premium Vendor temporarily, showing that it is a good investment due to it being an essential component for some ships and crafted items. However, it is a regulated market meaning prices tent to stay relatively flat except when regulators run out of materials to sell.

This material has minimal demand and is not currently available. However, re-sellers continue to offer the material to anyone who is interested which causes some spurts in demand before ultimately returning to its previous price points. The material slightly gained value at +9.40%.

This is a furniture item which failed to gain significant ground in price in 2022. The item briefly went up in value prior to the winter holiday due to its exclusion from mystery crates. However, the bump was short lived and the item ends the year having lost -29.13% since its introduction a year ago.

This is an exclusive material that has value in combat weapons. The fluctuations are due to low market capitalization, allowing those with large stockpiles of the material to influence market strength and rates. The material gained an impressive +51.90% in value in 2022.

This is a low-end rare material that is collected during mining. Despite its rare status, the material is considered less valuable than its common counterpart, Iron. Despite some market correction attempts during the recession, this material has maintained a consistent slide and closes out the year -56.14%.

This is a unique weapon that is currently exclusive. The item remains largely flat and did not see any major price fluctuations due to the limited nature of its availability. There was virtually no demand for the item in 2022 other than as an insurance item due to its perceived recession proof pricing.

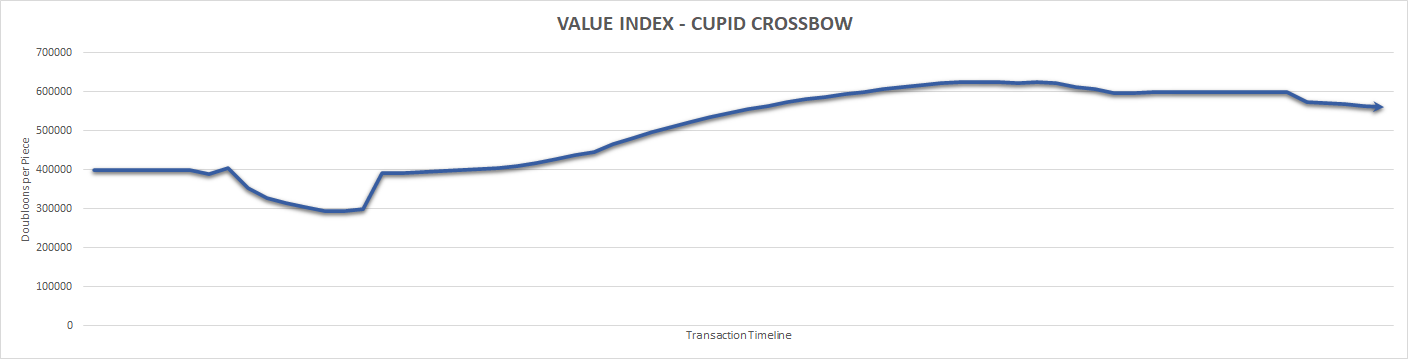

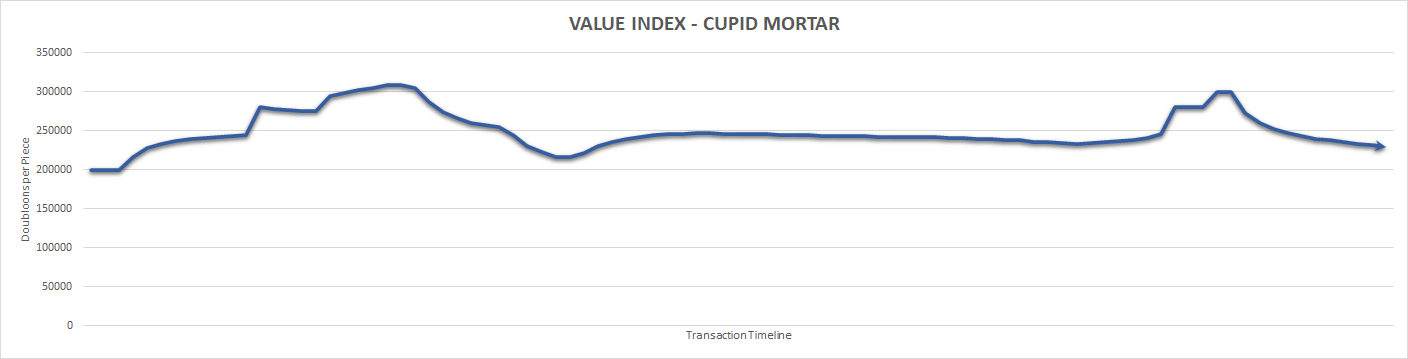

This is a unique weapon that is currently exclusive. The item was the focus of a price manipulation attempt in September which failed due to lack of demand. The value of the cannon remains largely flat and did not change due to no new Valentine’s Day ship items that would alter its price point.

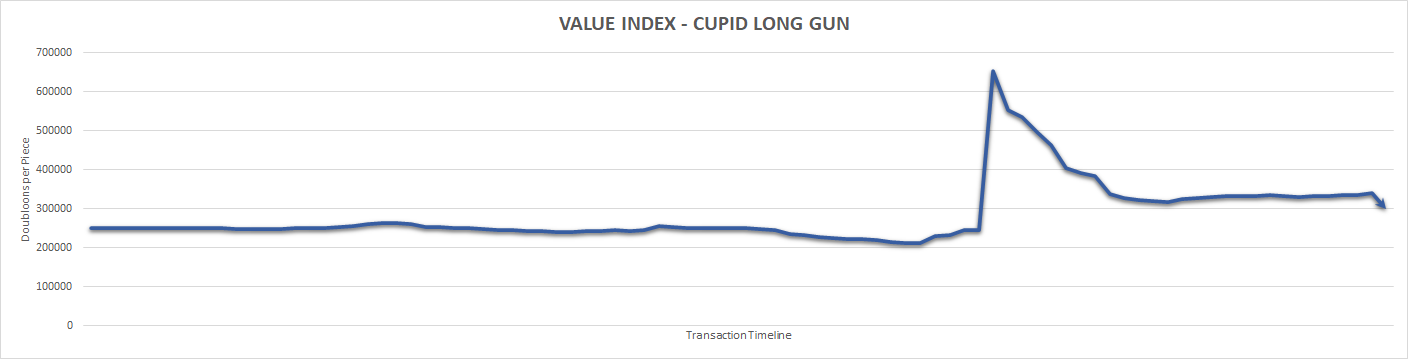

This is a unique weapon that is currently exclusive. The item was the focus of a price manipulation attempt in September which failed due to lack of demand. The value of the cannon remains largely flat and did not change due to no new Valentine’s Day ship items that would alter its price point.

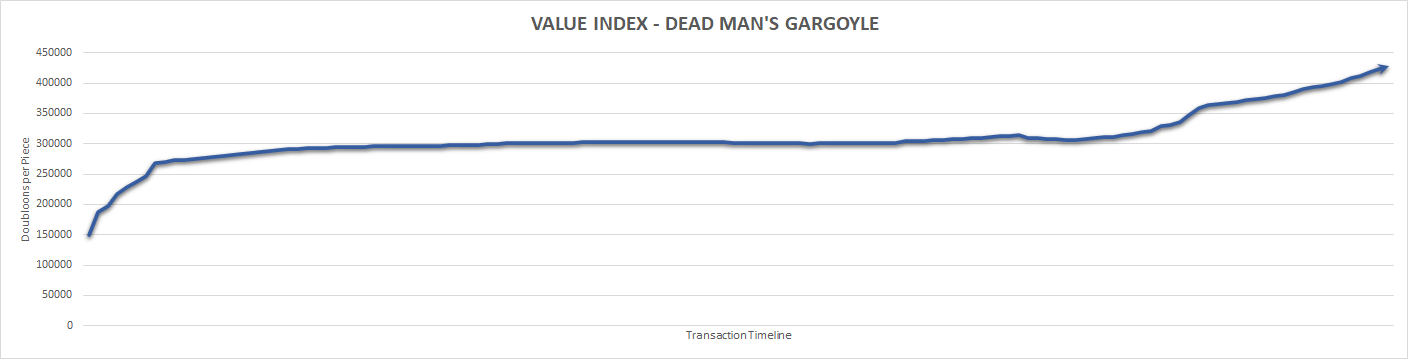

This is a new ship item that was added to the stock market on October 25th. It exceeded its Initial Public Offering (IPO) by 64.93% by the end of 2022. This is largely due to several price guides incorrectly valuing the item, causing sellers to lose money. The item has been rapidly gaining value as a response to natural price correction rather than active manipulation by players.

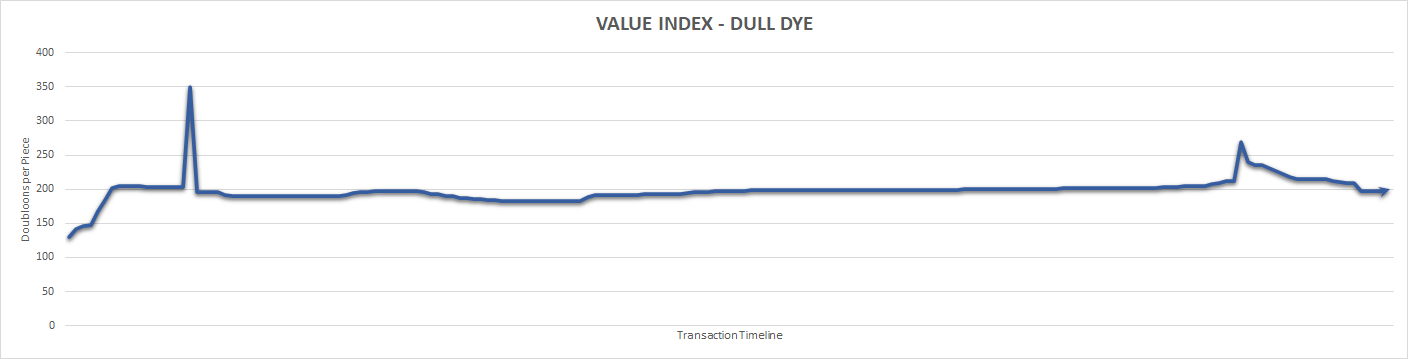

This is a commodity item that is consumed on use. It sees price spikes whenever there is a sudden increase in demand but it otherwise consistently flat. It was not considered a good investment item in 2022.

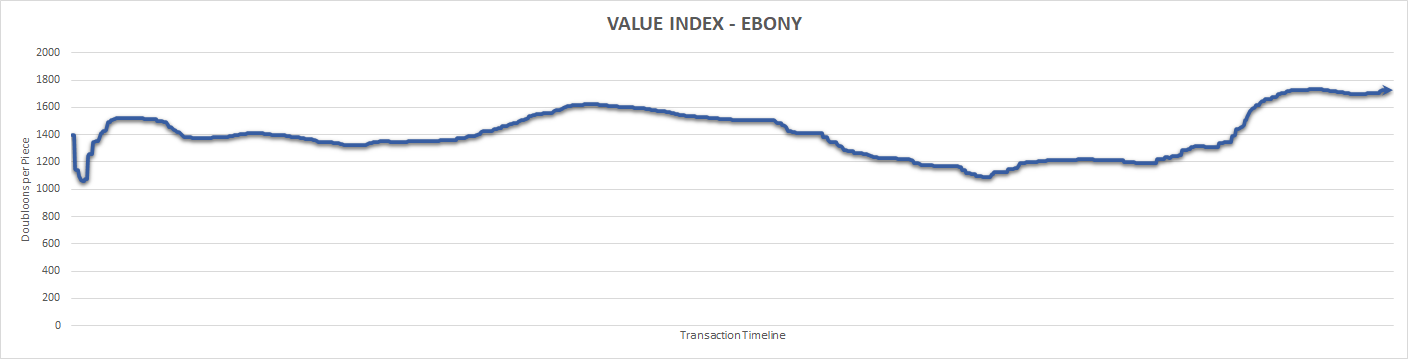

Ebony is one of the rarest woods in the game and one of the few that can be collected consistently by players at Level 1. It was a good investment material in 2022 due to steady demand and availability which keeps the market active. It is one of the few high volume woods that closed at a higher than expected price point, ending the year at +18.96%.

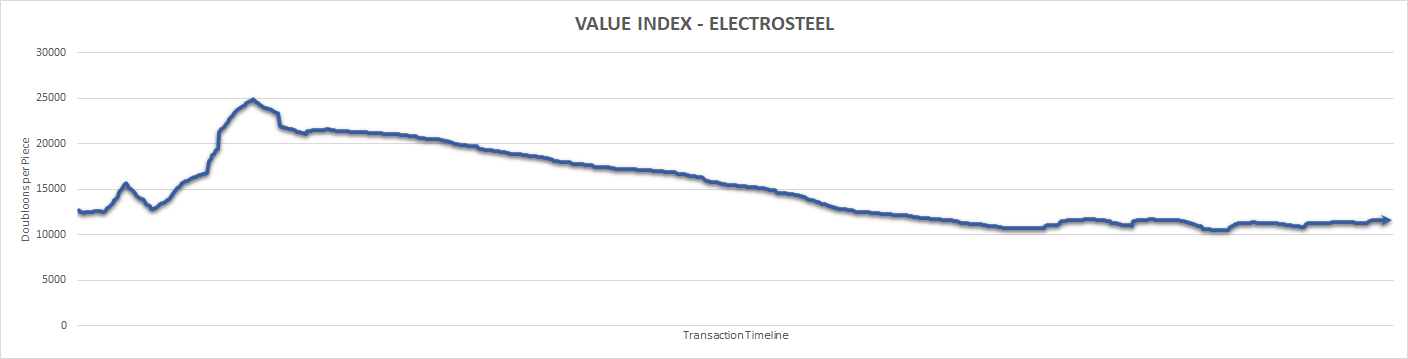

Electrosteel was not recession proof in 2022 and followed the same trend as most of the major indexes. The overall state of the material ended up flat for the year, with a moderate -8.85% loss of value overall. The switch into ice production at the end of the year which traditionally improved the value of Electrosteel occurred too late in the year to have a measurable impact.

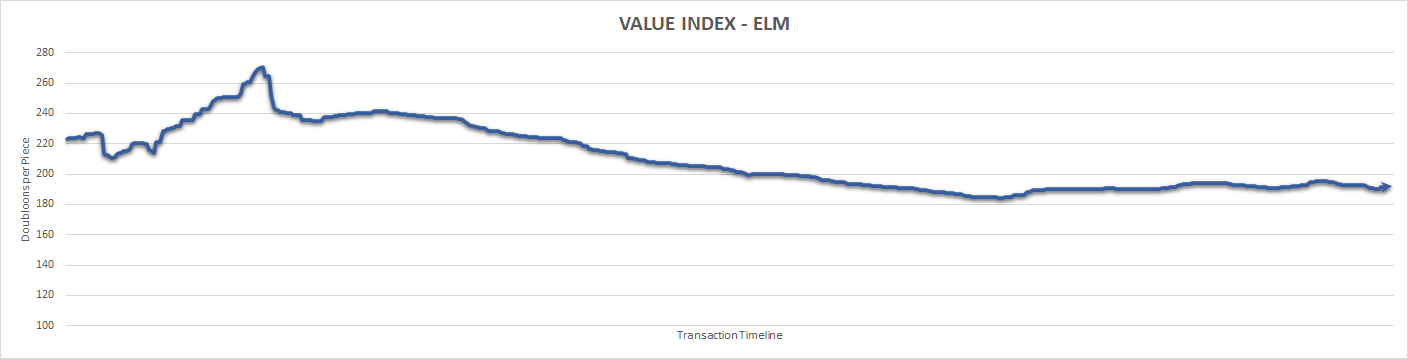

Elm is one of the mid-tier rare wood drops and closely follows the trends of the overall wood market. It has not proven to be a recession resilient material, making it a poor investment based on the market conditions in 2022.

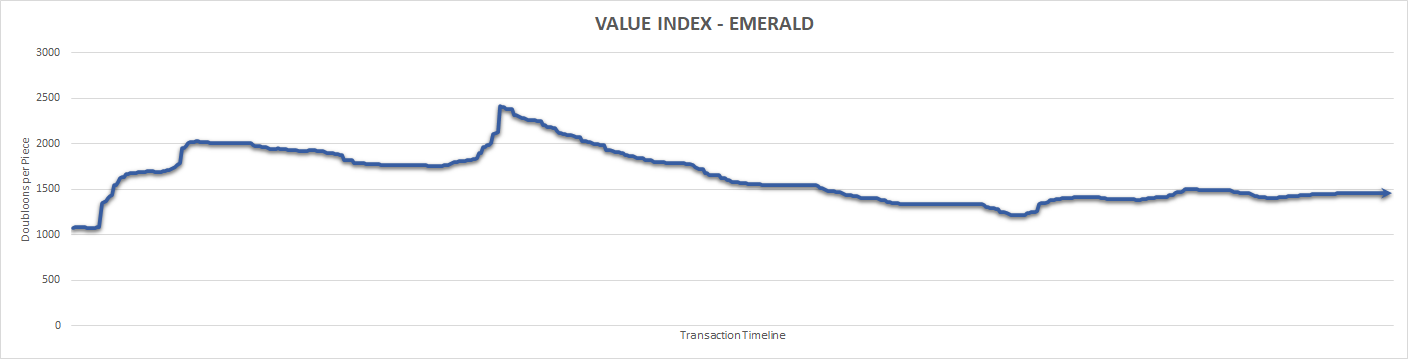

Emerald is a mid-tier gemstone and is largely viewed as the benchmark for gemstone prices in the market. While the industry saw a +26.45% increase in 2022, it missed several milestones and was impacted by the recession.

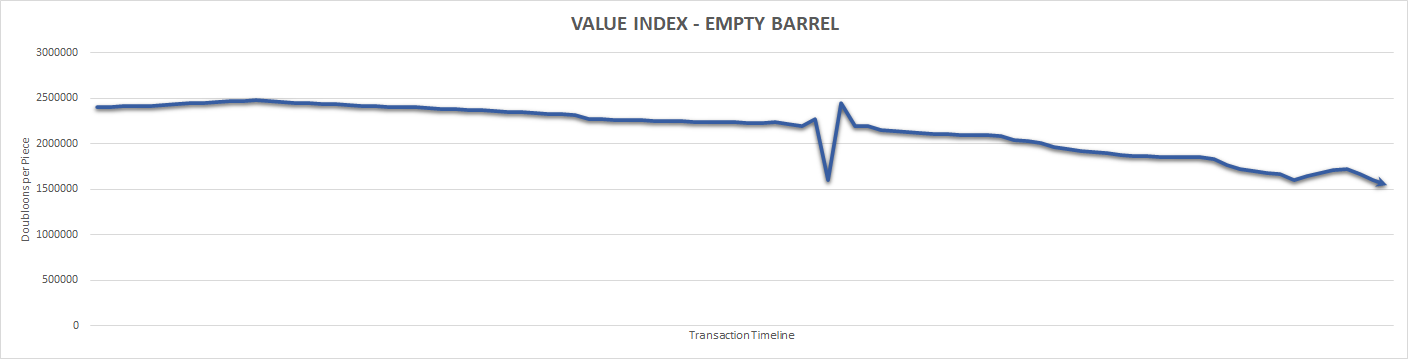

This is an exclusive item that is available to players. It is relatively consistent but saw a steady fall in value over the course of 2022. It was the subject of an overpay by a player which caused a fluctuation in the trend as supply and demand reset, but otherwise remained consistent all year.

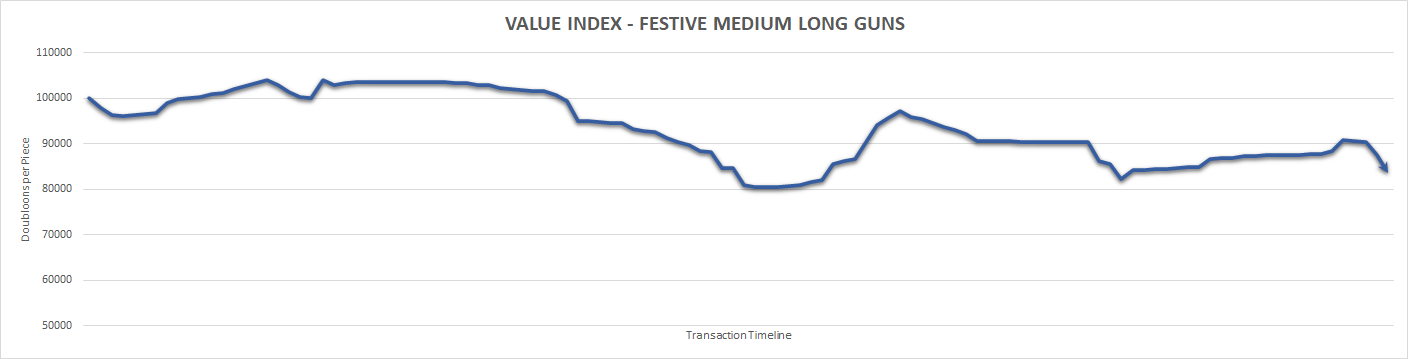

This is a holiday item from last year that was expected to make a return in 2022 but did not. The item remains relatively flat, with a quick drop at the end of they year as Cannon Cladifiers were released without the festive option, limiting its impact in the last day of the year.

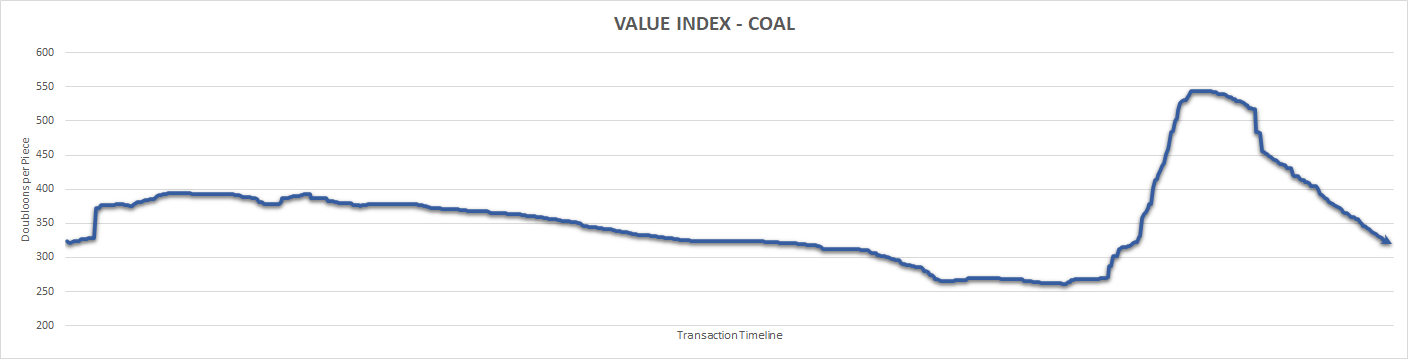

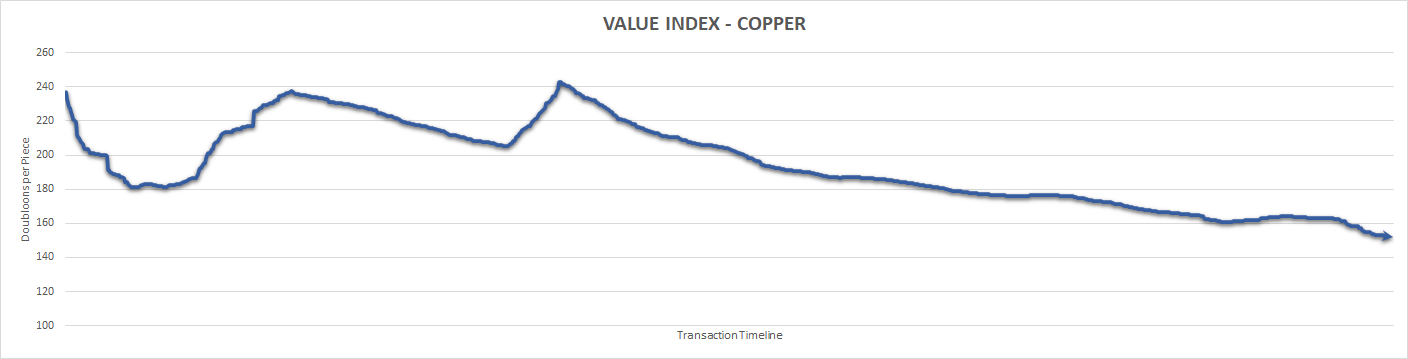

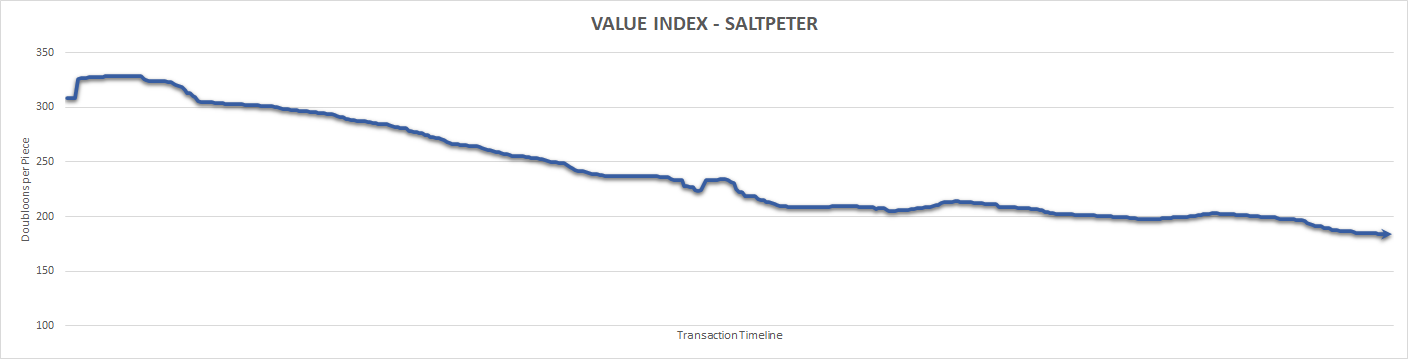

This is an item that saw stabilization in the second half of the year due to releases reinstating its value as a crafting material. However, the recession created an impenetrable price barrier at 400 per piece which it was not able to overcome, causing it to ultimately close at 258.76 per piece at the end of 2022.

This is a commodity that is consumed on use. While the item was resilient during the recession, it ultimately collapsed after a large buyout of the material occurred shortly before the Aukai release from which is was unable to recover.

This is a former holiday item that is now an exclusive. It did not make a return to the Halloween Event this year which caused prices to remain consistent. It had trouble generating enough demand making its price point consistently at risk to fall.

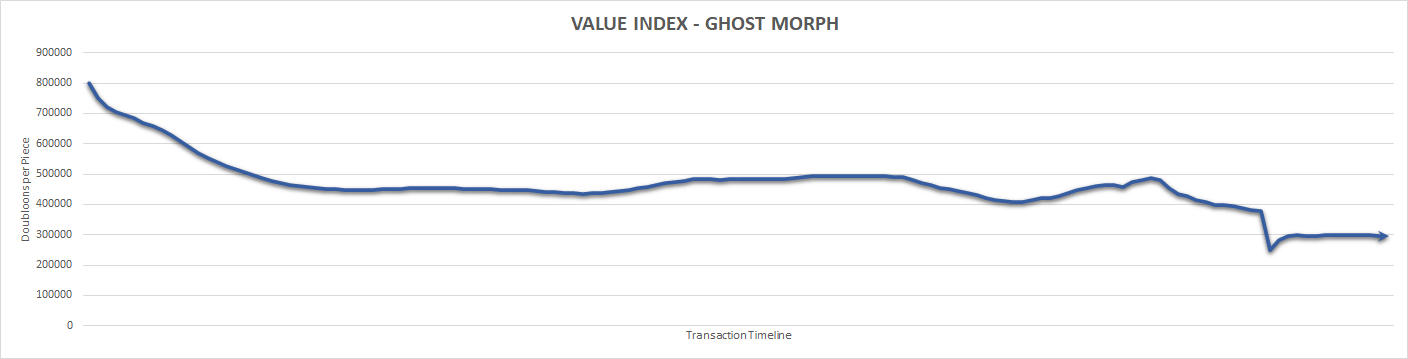

This is a former holiday exclusive that was made available to players again in 2022. The “dip” in prices was a sell-off in the months prior to the item re-entering the market. It was maintained a steady price point due to a new exclusive ship as well as updated content, but has yet to recoup the value it had in 2021.

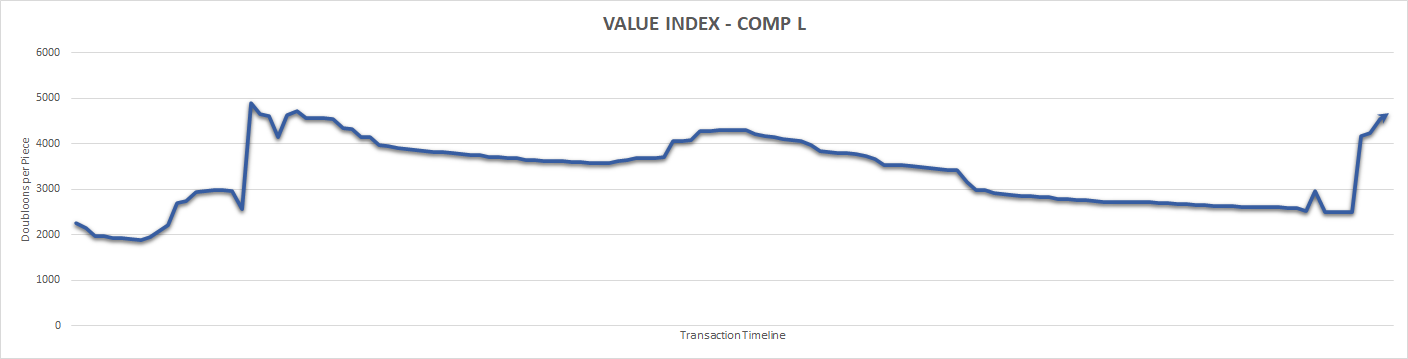

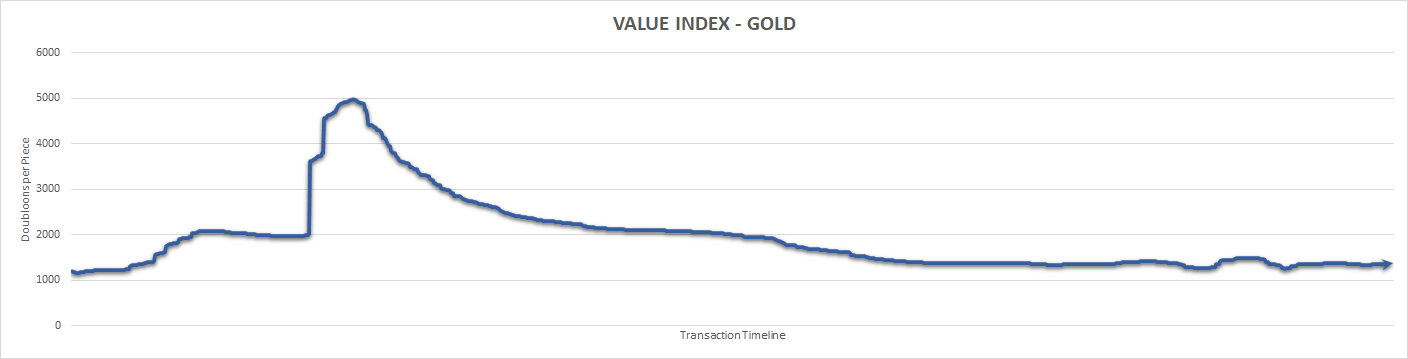

Gold is considered one of the most valuable items in the game due to its use in mining, timberfelling, and as a crafting material. It experienced a large spike in capitalization in the first few weeks of the recession as investors attempted to protect their wealth with the material, but it collapsed after hitting a 5k per piece high and has not recovered since. It closed out the year at +12.13% overall.

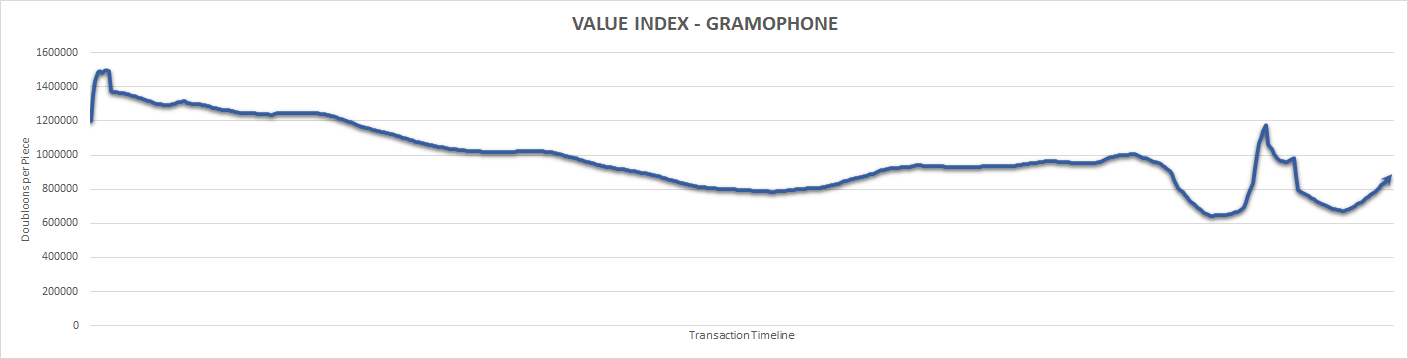

This is an item which has been bought and sold by players for years but entered the stock exchange for the first time in 2022. It has been in a steady decline since the audio changes in Roblox limited to value to many players. It has since seen a resurgence as a vanity item but at far lower demand which caused price fluctuations. It ends the year as a risky investment.

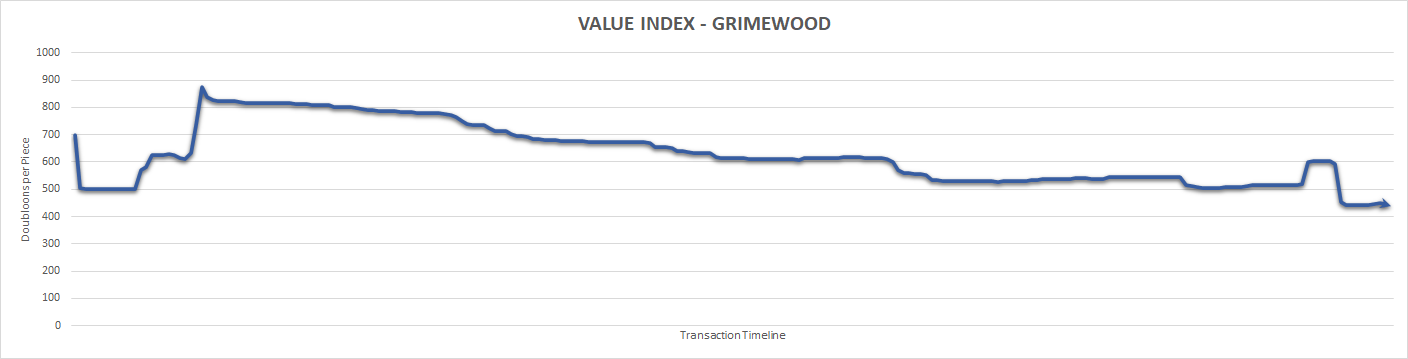

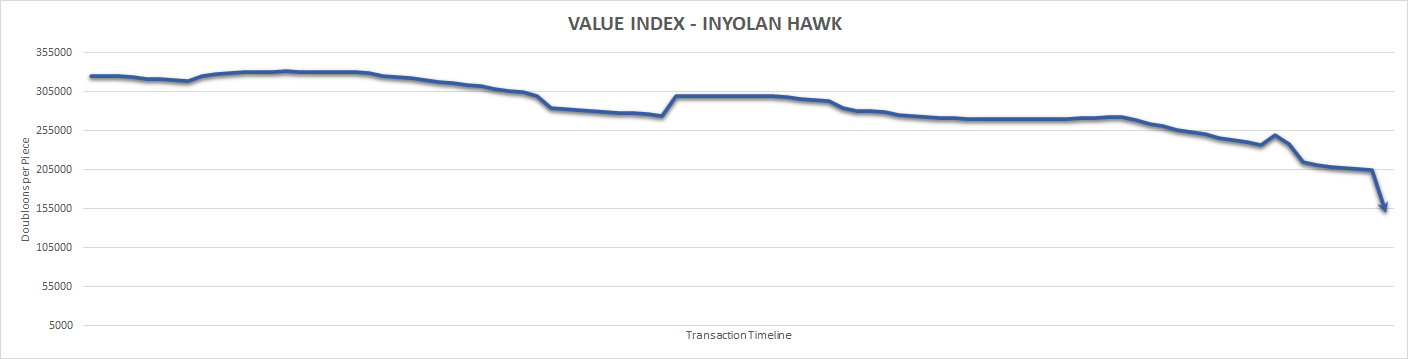

This is a premium wood material and is a rare timberfelling item. It was the subject of controversy in April when a money laundering attempt was made with the wood, requiring it to be audited for the remainder of the recession. The material is not recession proof and lost -59.77% of its value in 2022 as a result of overall lower demand.

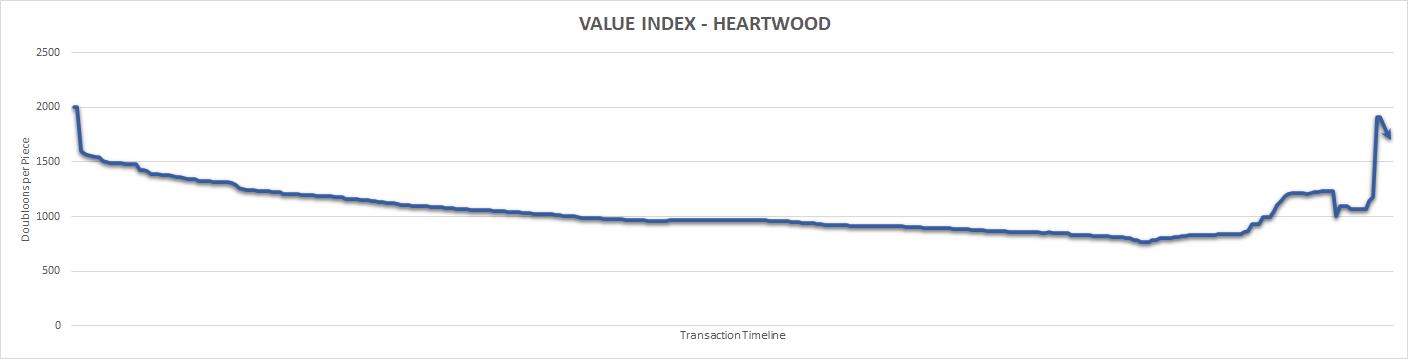

The exclusive wood is one of the items consistently on sale during Valentine’s Day. The end of year volatility is due to a last minute price manipulation attempt that is in progress at the turn of the year. Most of the year saw the material trading under 1.5k per piece, although the material ends flat based on the increased volatility in December.

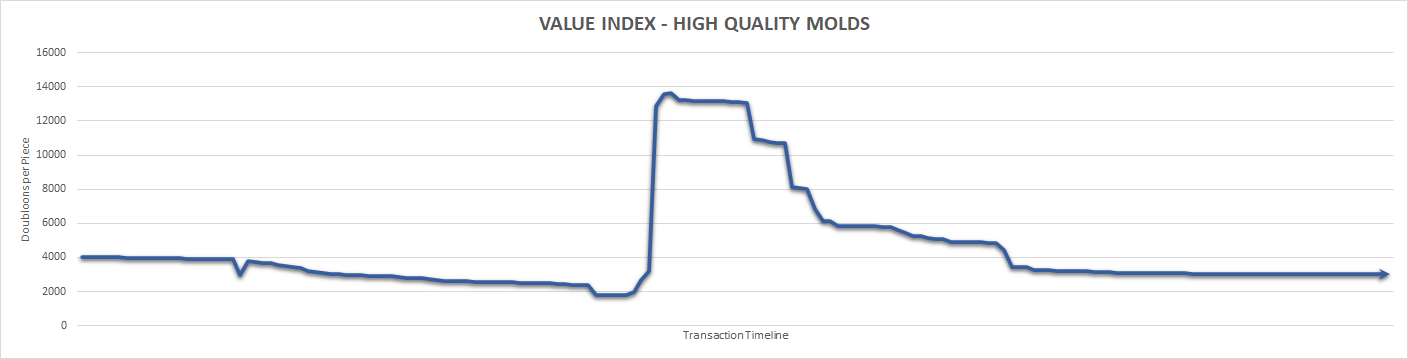

High Quality Molds are an important part of the supply chain for crafting. The spike in value is due to a change in September that modified the method of creating the item as well as the raw materials needed to built it. This eventually corrected itself to the current price point. The changes to the item have actually decreased it’s overall value by 1k per piece overall, which is reflected in the reduced price of the item’s index.

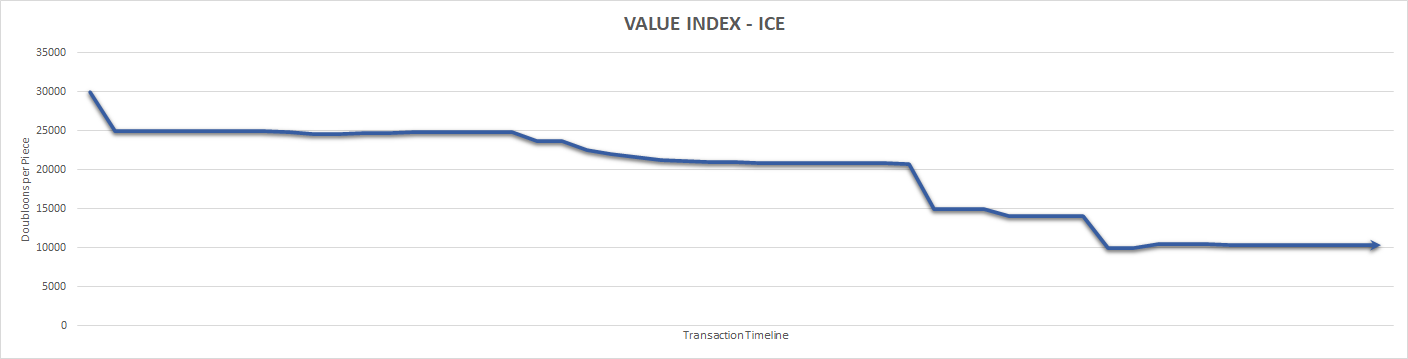

This is one of the only combat effect materials that be mined by players. Due to the late release of winter in 2022, the price was not able to correct itself in time to have an impact in the overall price. It is normal to see a drop in price during summer and a rebound after winter ends. At present, Ice has lost two thirds of its total value, which may prevent it from fully recovering in 2023 as a result.

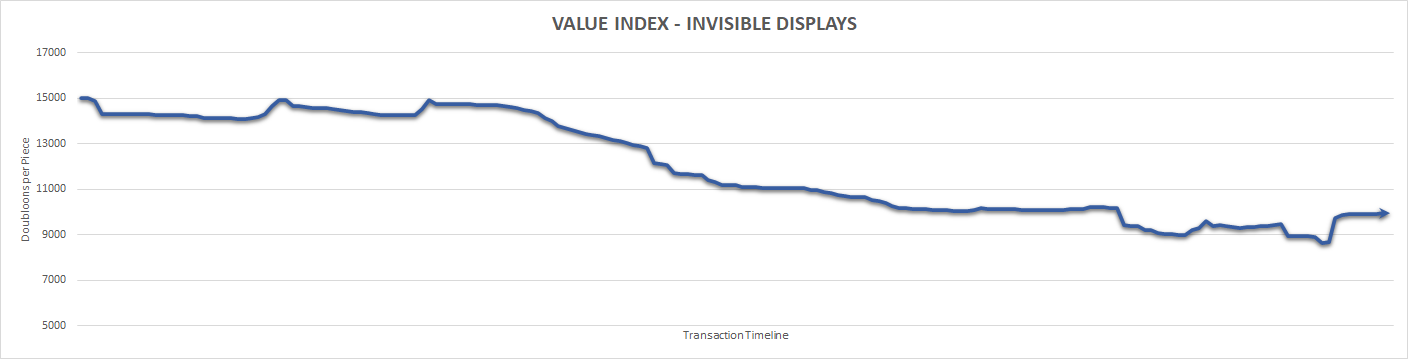

This is used in many houses as a furniture item. Value was stable until the recession set it on a steady decline. It has not yet reached a point of recovery, having lost -50.86% of its total value in 2022.

This item suffers from low demand and therefore low interest in manipulating prices. The November and December decreases are not a sign of default, rather sellers attempting to use the item to purchase additional doubloons.

This is a premium wood that is only available during specific events. It greatly benefited from the limited ships available over the summer. However, sellers are anticipating the release of additional wood and appear to have withdrawn their stocks from the open market. This is causing downward pricing pressure for November and December. The wood ended up +31.05% for 2022.

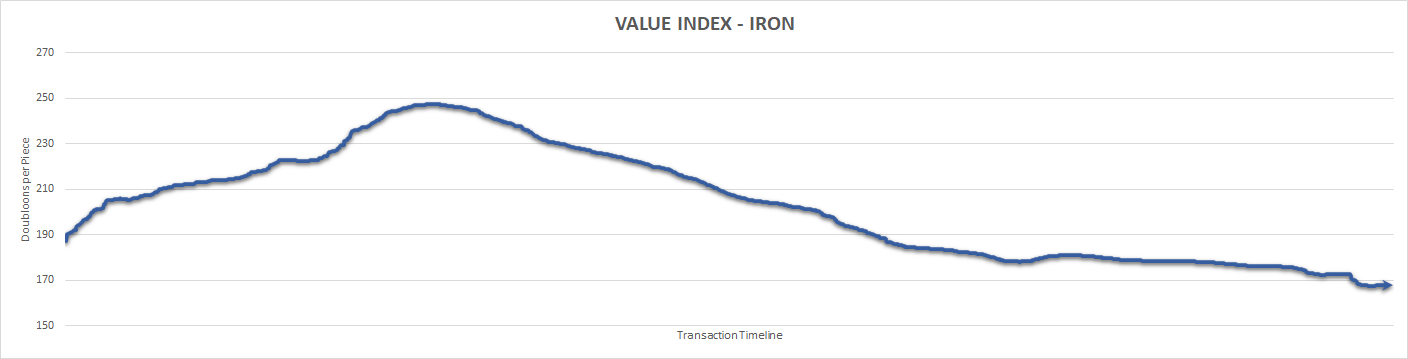

Iron is one of the cornerstone materials available in game. It has high capitalization making it difficult to manipulate and it tends to follow the overall market trends, especially for the metal and gemstone market. This market was a specific target of the Purshovian Release which caused the index to lose -11.52% of its value in 2022.

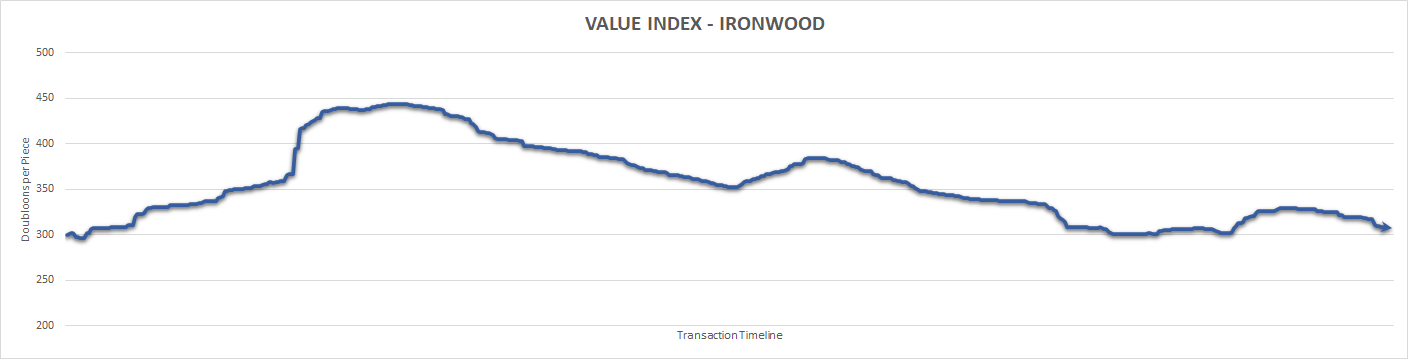

This is a premium wood that is also obtainable through timberfelling. The material was able to over perform for most of 2022, netting +2.33% in profitability by the end of the year. Despite its performance, the material’s price ends the year flat. Bumps in price are correlated to releases of new ships into the game.

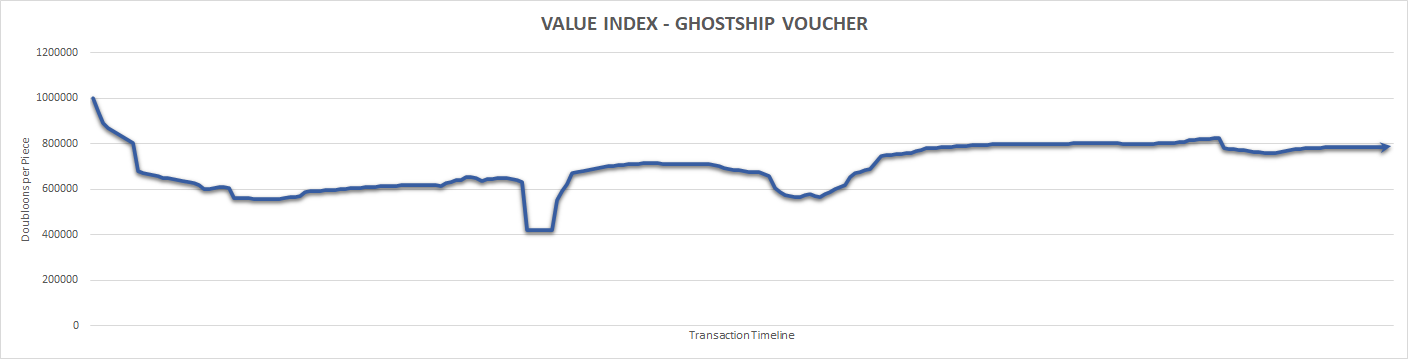

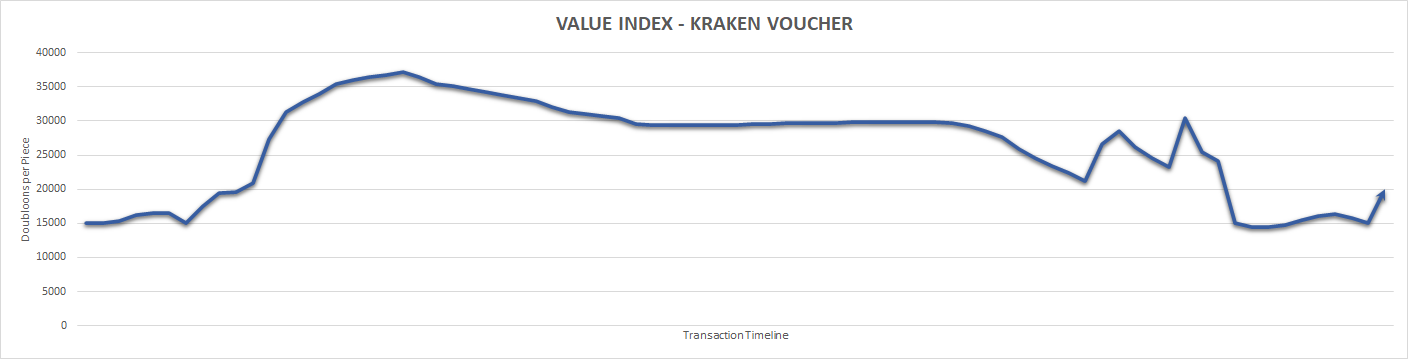

This item is used to purchase a specific ship in game and is available by scrapping items. The item follows predictable patterns for vouchers, but a seller attempted a price correction during the de-valuation phase of the cycle, likely to try and protect an investment, but after brief destabilization, fell to its projected price point where it remains at the end of they year.

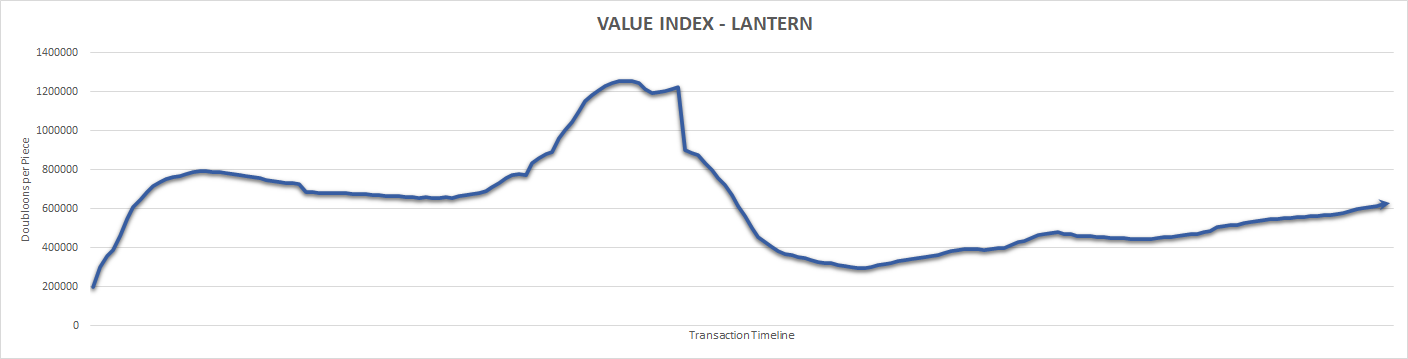

This category contains the various types of Lanterns available through crates. It is highly influenced by cosmetic factors, causing large swings in price based on the mix of items that are being placed on the market.

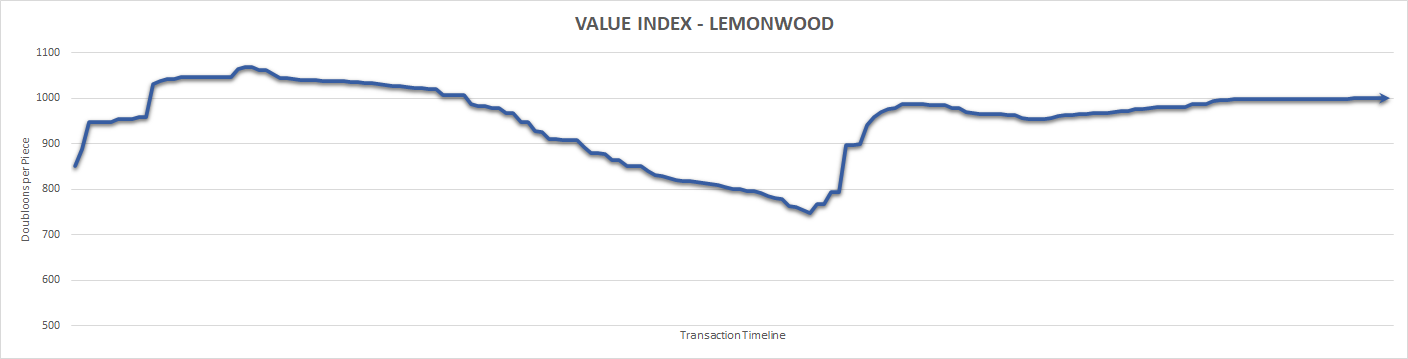

Lemonwood had an Initial Public Offering (IPO) on April 23rd when it was first added to the stock exchange. It has shown consistency in pricing, with corrections occurring any time it appears to fall below its IPO price of 850 per piece. The material ends the year with a 14.97% improvement on the IPO price and was consistently trading around 1k per piece for most of they year.

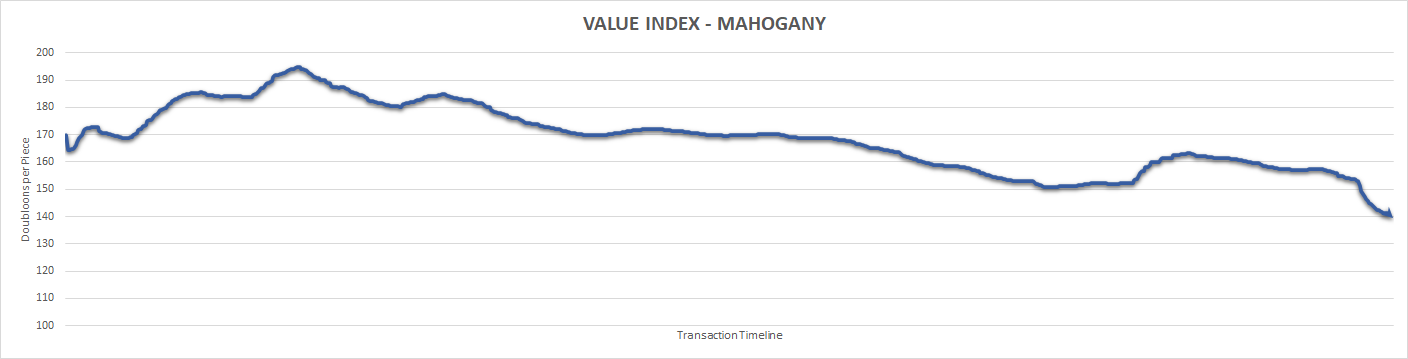

Mahogany is a high volume item that trades around the same price point as Oak. The item is not as popular as other wood options, making it susceptible to buy/sell waves. The wood is not resistant to recessions and resulted in a -21.88% value loss in 2022.

This item is susceptible to price fixing due to low volume. It is a required item for constructing some ships. Price fluctuations frequently occur as the volume on the market increases, with stabilization occurring whenever the trade volume slows or stops.

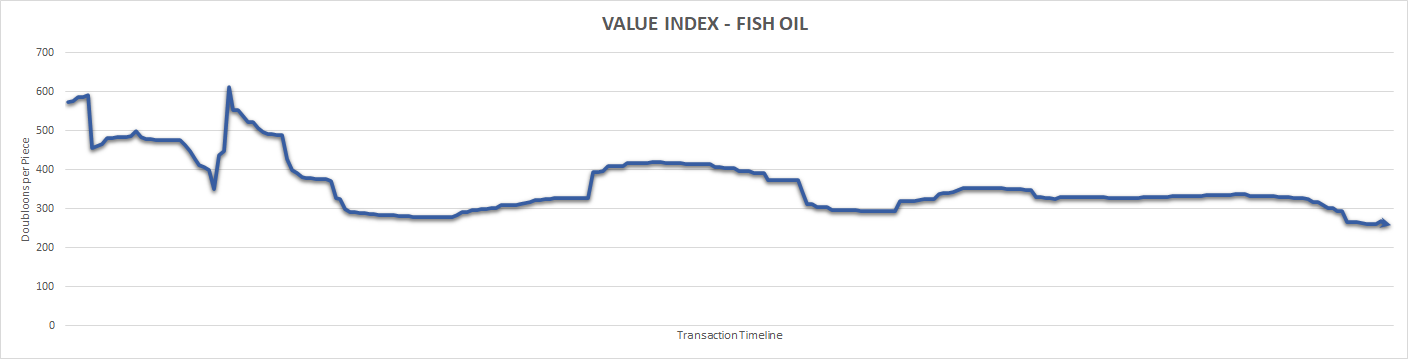

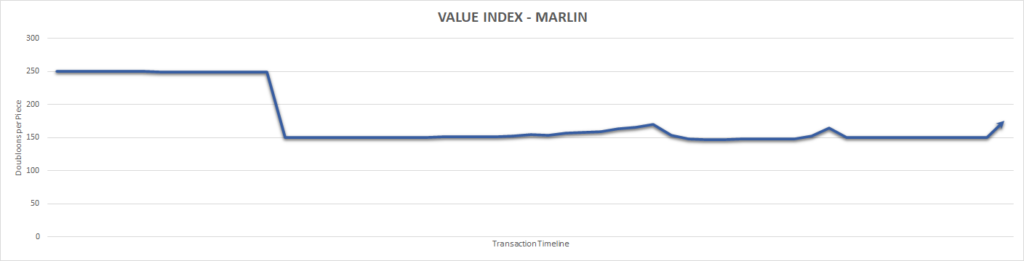

This market shifted from a sellers market to a buyer’s market on May 15th. This had a direct impact on the overall prices on the market which have not seen a correction in 2022. Owners of this item saw a loss of -42.86% in selling, making it a better option to use on trade routes or convert to Fish Oil instead of selling directly to the market.

This is an exclusive premium material. It experienced a large price fluctuation during a sell-off attempt just prior to the Purshovian Release which waned due to overall market forces. The material had consistent trade volume throughout most of 2022 and is following a predictable trading pattern.

This is a commodity that is consumed on use. It was a consistent performer and is relatively flat. The two price jumps occurred during the two largest trade volume reports of 2022, making it a good indicator of how active the market is trading.

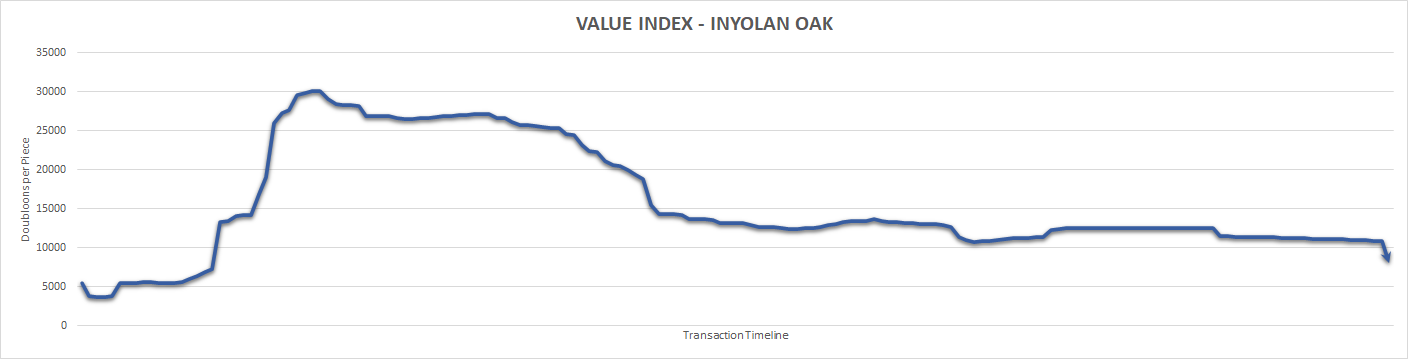

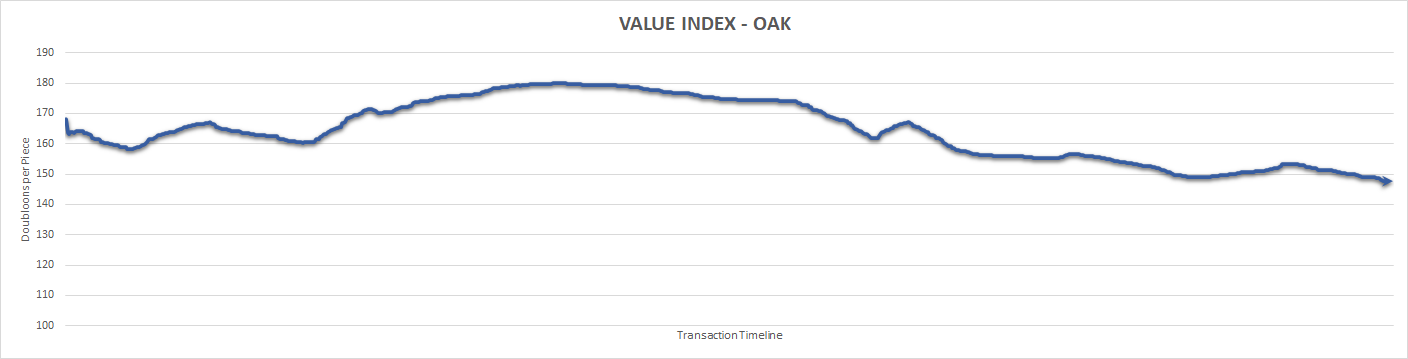

Oak is one of the cornerstone materials in the game. It is a high volume material meaning it is difficult to manipulate and tends to follow the overall market trends. It lost -13.97% of its value in 2022 but had a brief moment where its price was higher than the other cornerstone material, Iron, before falling into its second place position to end the year.

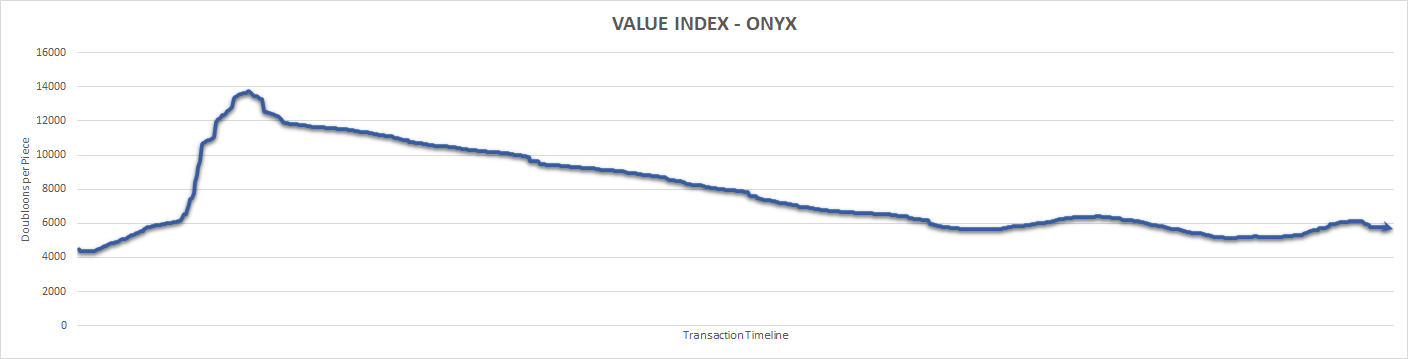

This is a top-tier gemstone material. It peaked in value just prior to the recession and has declined ever since. However, it was able to stave off its losses due to its perceived value, ending the year at +20.62% for 2022.

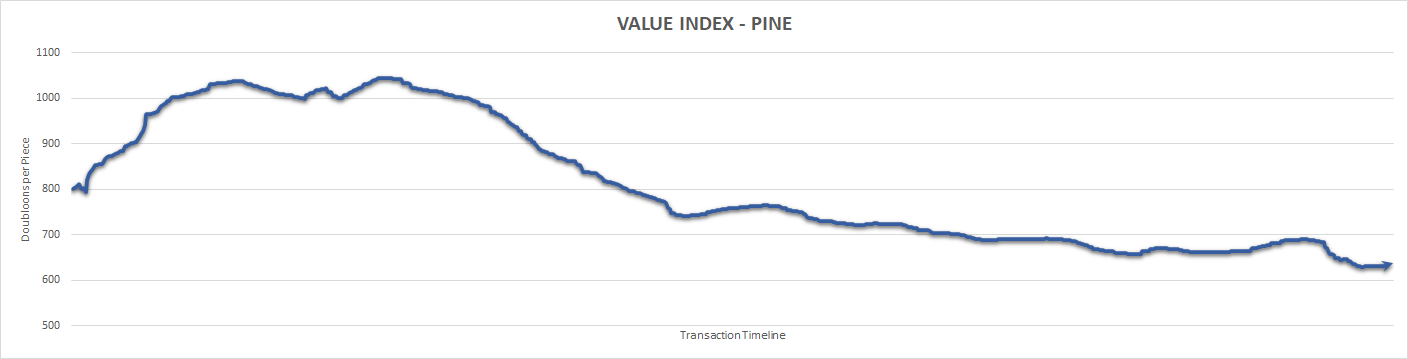

Pine is a wood material that can only be collected through timberfelling. It was previously an important component in ship building but has since lost its status as a required material when decking was removed from the game. It has lost significant value since that point and closed the year at -25.63% for the year.

This is a furniture item that is affected by depreciation over time. This is a reflection of limited interest in the item, with most people who want one already in possession of one.

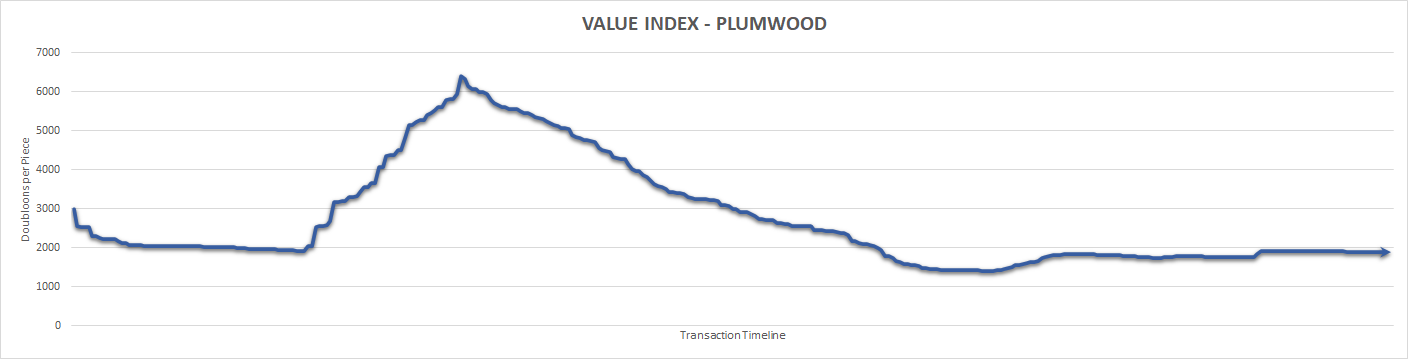

This is a new premium wood that had an Initial Public Offering (IPO) on April 23rd. The item obtained upward momentum due to its cosmetic value in shipbuilding, but declined after the initial rush to an ending price point of 1,887.12 per piece at the end of 2022.

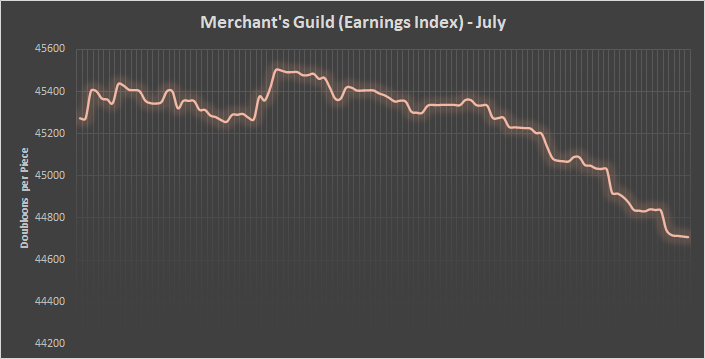

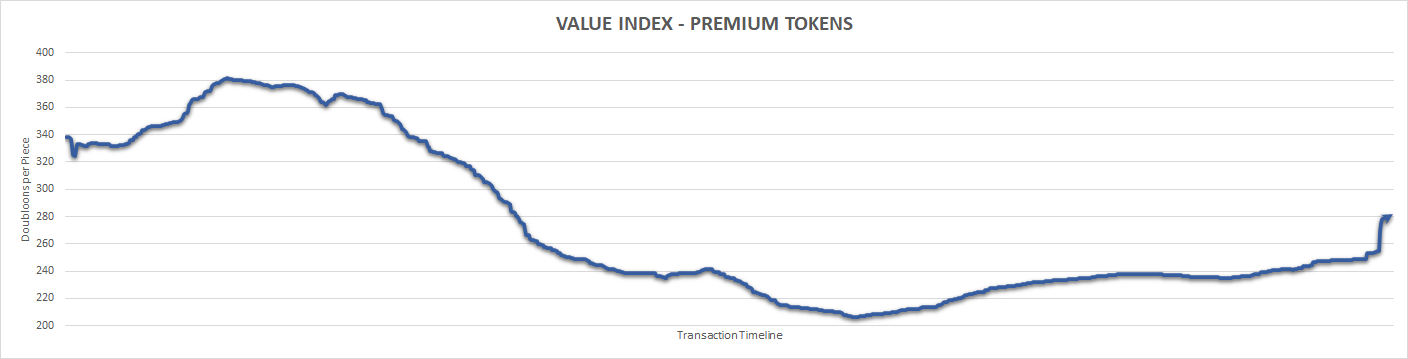

Premium Tokens saw a major decline in value due in large part to the recession that dominated six months of trading in 2022. It ends the year at -19.95% due to a series of delayed releases which caused the market to over-price tokens due to misalignment of expectations with players. At one point, the item was trading at around 200 per piece, considered to be its baseline value, and a sign of how precarious the market was during the recession.

This is an accessory item that also has value as a furniture item. It suffers from low sustainable demand which causes significant price fluctuations. Unlike its counterparts, pricing trends remain consistent with expectations and value fell -33.14% over the course of 2022.

This is a furniture item that is impacted by depreciation. With few new items entering the market, it is subject to waning interest over time. Owners of this item saw a -91.42% loss in value in 2022.

This is an accessory item that also has value as a furniture item. It has an Initial Public Offering (IPO) on May 5th. It’s novelty value has given it an increase in overall value, collecting a +66.70% value above IPO for 2022.

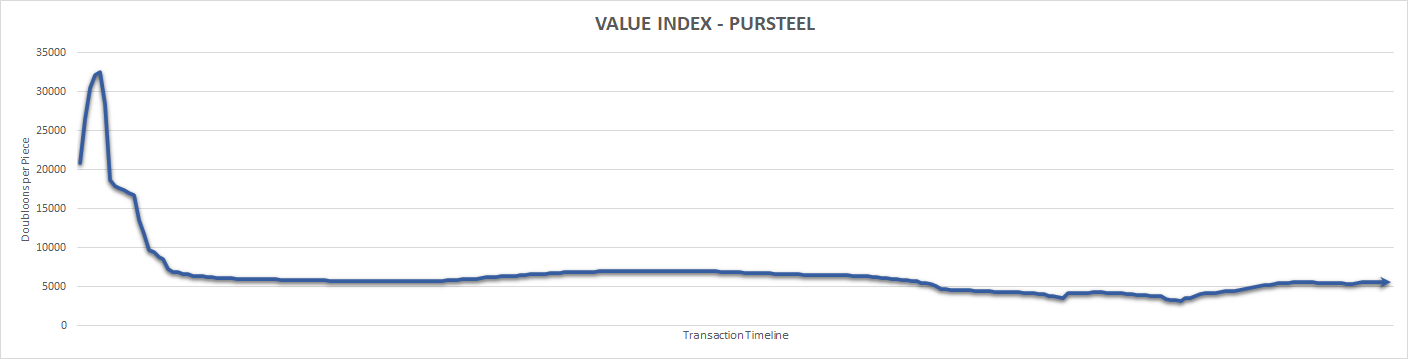

This is an exclusive item that saw a dramatic decline in value once it was added to the Premium Merchant in May. It has consistently sold at its lower price point and closes out the year at 5,644.69 per piece, significantly below its starting price point which mirrored Inyolan Oak in 2021.

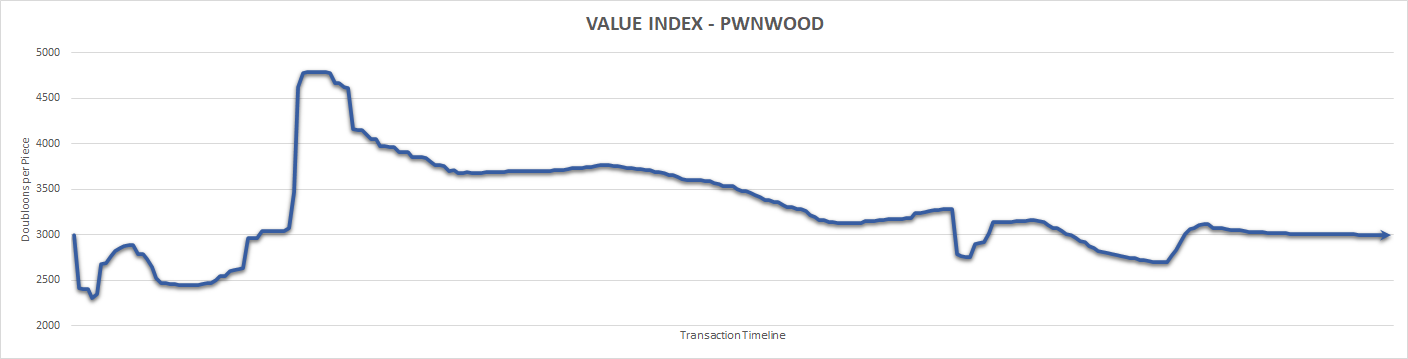

Like most items sold during the first weeks of the recession, a sell-off of items occurred followed by a steady decline in prices until it ultimately stabilizes. The premium wood is valuable due to its cosmetic and combat characteristics and ends the year flat at around 3k per piece.

This is a premium wood with an Initial Public Offering (IPO) on April 23rd. The wood initially performed as expected but it is plagued with low demand, allowing buyers to have control of the prices. The end of year jump is a price manipulation attempt to inflate the value of the wood which allowed it to end the year at +43.67% but has otherwise been consistently trading between 700 and 1,100 per piece.

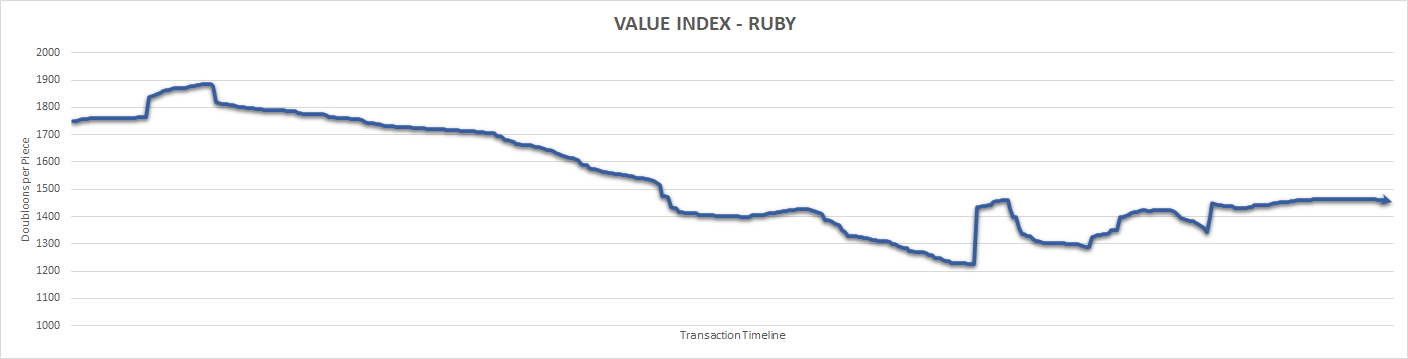

Ruby is a mid-tier gemstone. It stayed in line with the overall market trend and ends the year at -20.48% overall.

This is a minable material and is generally considered an unwanted byproduct and not a desired drop. As a result, it was consistently hit with attrition effects as well as the general market downturn which caused the market to lose -67.84% of its overall value. There was no sign of recovery during the course of the year.

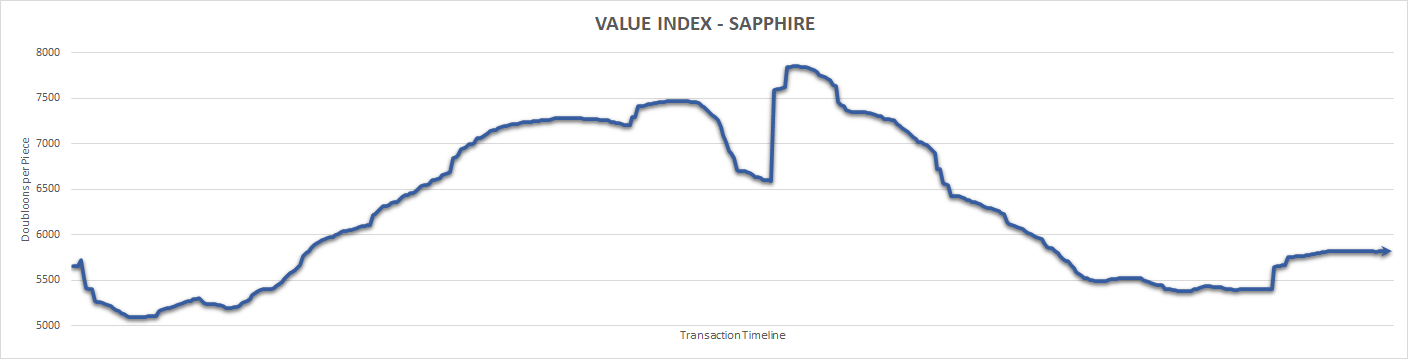

This is a top-tier gemstone and under performed expectations in 2022 due to price fixing. Despite its high demand status, the price point ended flat for 2022, gaining only +2.89% in overall value.

Low demand for this wearable item causes prices to experience rapid falls when demand increases. The limited availability of this item technically makes this a sellers market though, which has led to an overall increase in value in 2022.

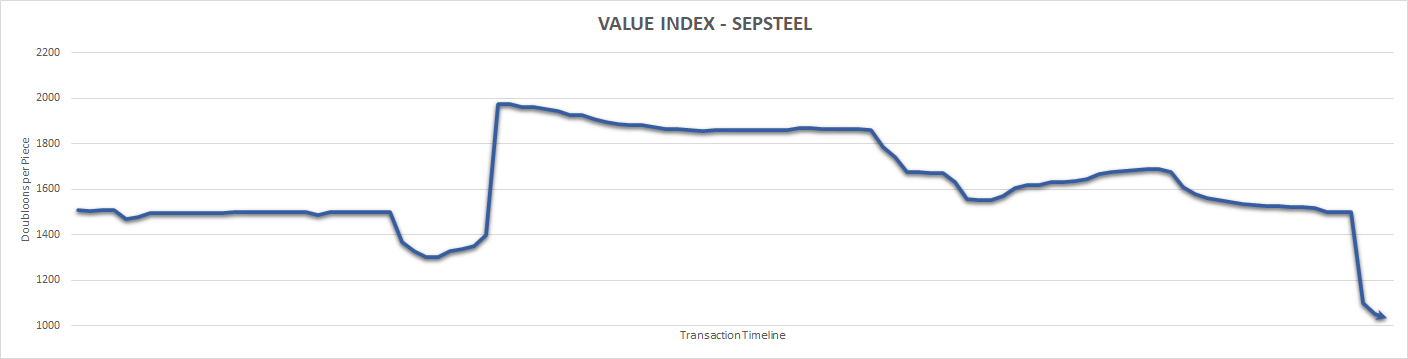

Sepsteel saw an improvement in demand over the summer months only to decline again following the release of Skelestone. The item lost investors -46.11% of their overall value in 2022 and was not a good investment option.

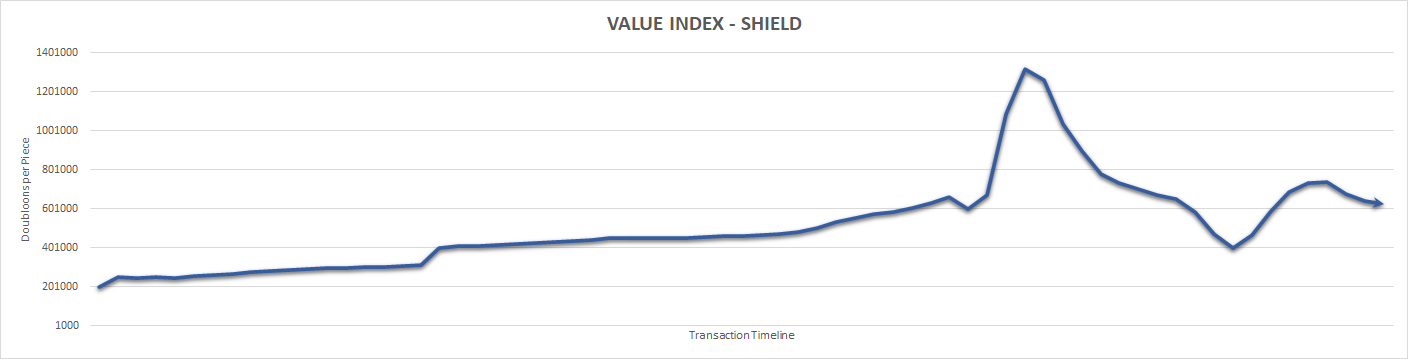

Shields had an Initial Public Offering (IPO) on July 31st. The price fluctuations are based on the mix of cosmetic options available on the market in this category. However, they have consistently traded within the parameters outlined in our review of the shield when they were launched. Moreover, the continued addition of new shield options have allowed the market to gain momentum whereas other markets have struggled to keep demand.

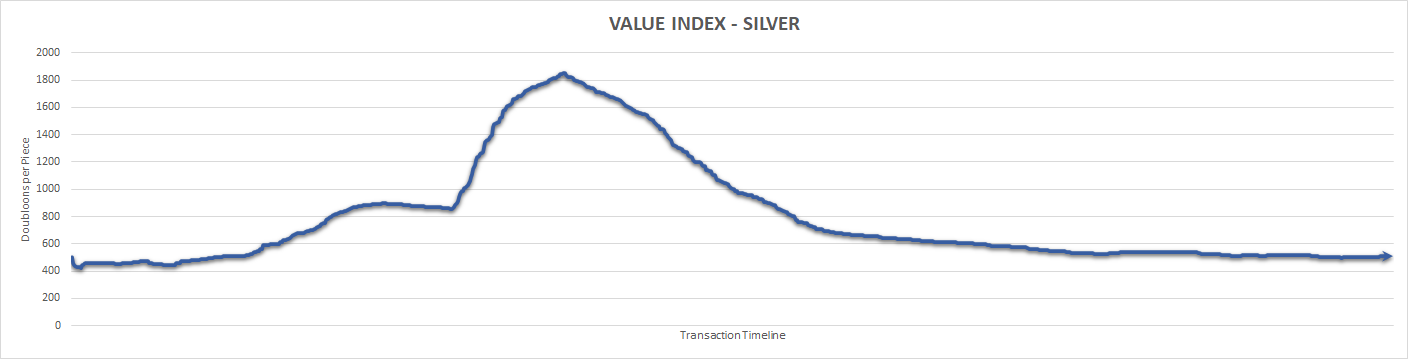

This material can only be obtained through mining. It was the subject of one of the largest price manipulation attempts recorded all year, but ultimately could not overcome the significant capitalization volume of the market. There was limited overall impact on the final price by the end of the year, causing it to remain flat. The one positive note is Silver investors did not take a loss during the recession as a result of this attempt.

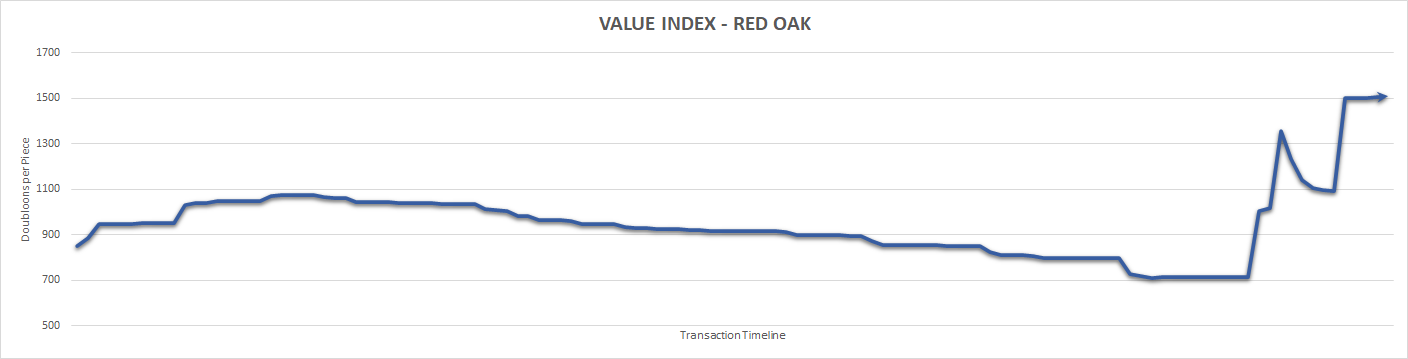

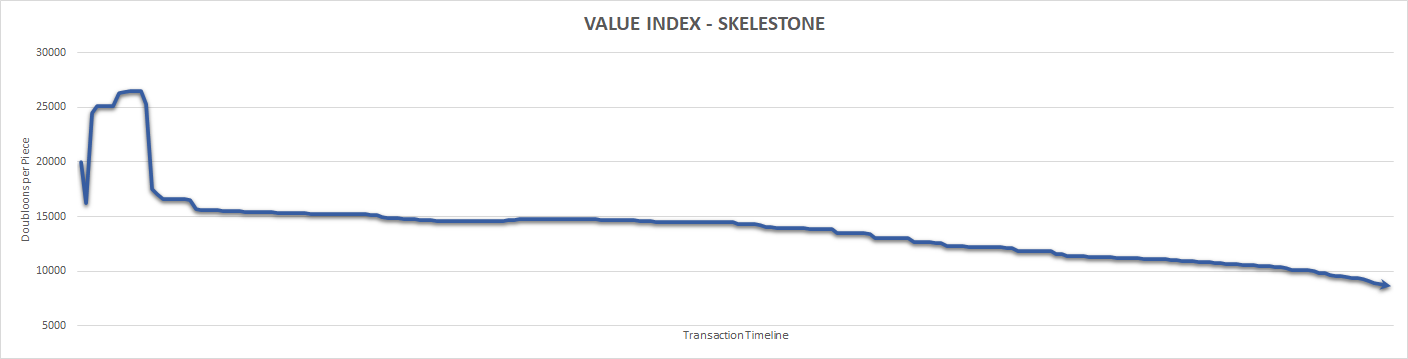

This material had an Initial Public Offering (IPO) on October 25th and was significantly overvalued by the community, likely due to price guides valuing it incorrectly. It has low demand and has been steadily decreasing ever since the initial release. It has fallen -12k per piece since the introduction two months ago, and is expected to continue falling. The true value of the material was measured at only 1.5k per piece at the end of 2022, based on trends and demand.

This is a furniture item that offers value to anyone who cannot afford to build their own chest. The item suffers from ongoing attrition since it could only be obtained from an event that closed in 2021. The dip in value in December was through an attempted fire sale to obtain doubloons, but it was short lived and is already on recovery.

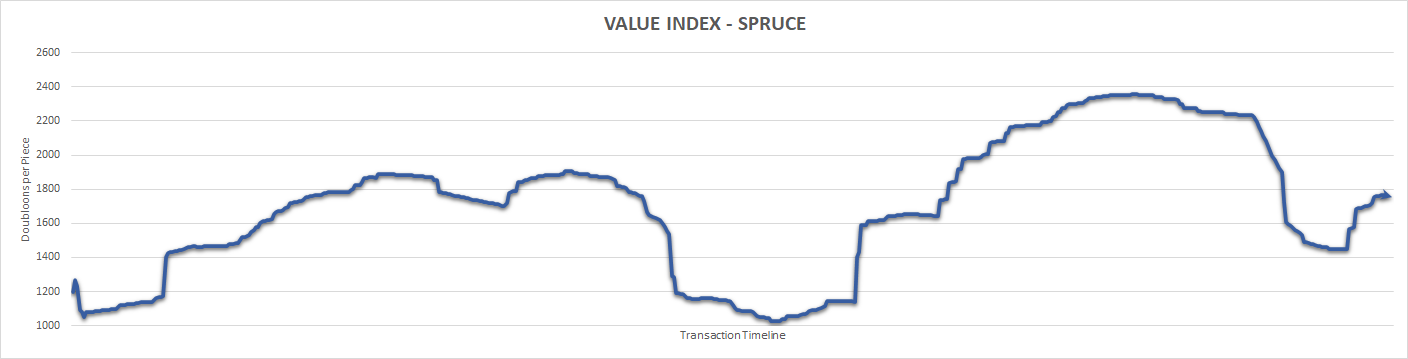

This is a wood material that can only be collected through timberfelling. It has defied odds and become an excellent investment material. It appears to be recession proof, but this is due to very careful and well coordinated price/demand manipulation which has allowed it to retain its value. The longevity of the price correction is a textbook example of how to corner a market effectively. It actually gained +31.70% in value over the course of 2022 despite the wood market experiencing losses across the board, making it one of the best performing materials of the year.

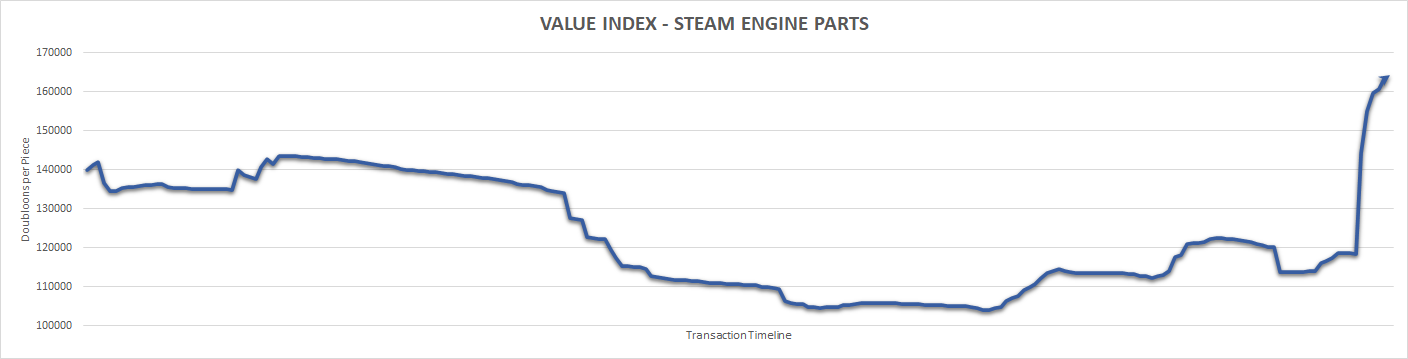

This is an item used in ship construction and its price is determined by demand to build ships that require a steam engine. The spike in December is due to a late release of the Ceres, a ship that requires four of them to construct. As a result, demand of the item increased, producing a modest +14.77% increase in value at the end of 2022.

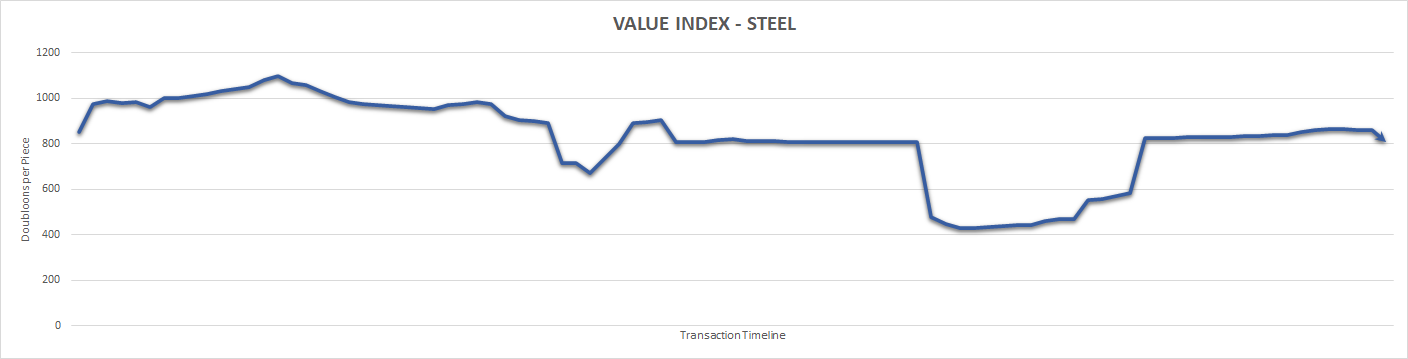

This is a manufactured item that is used in the construction of multiple items in game. As a result, it is part of the supply chain lifecycle. Prices are a determination of the cost of raw materials to make Steel, as well as the demand for the items that require Steel to manufacture. As a result of its supply chain position, the item remains largely flat in 2022.

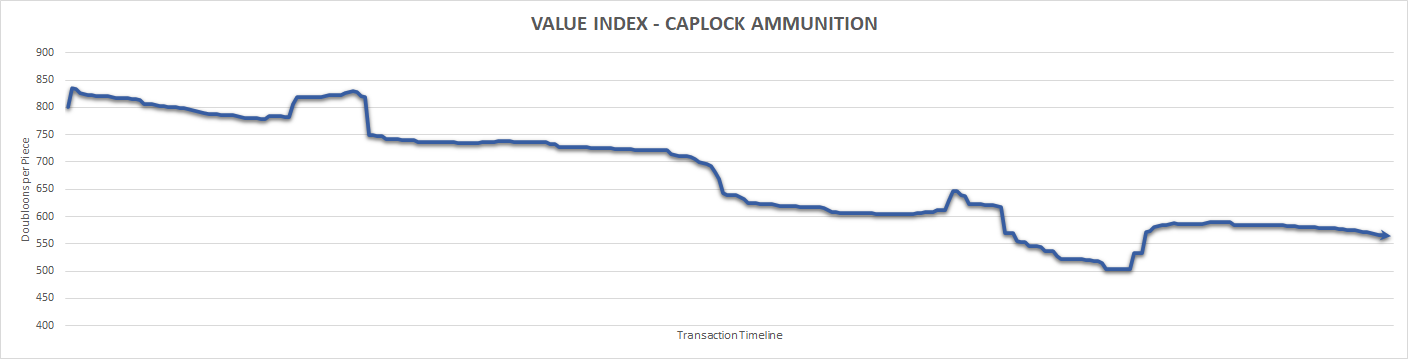

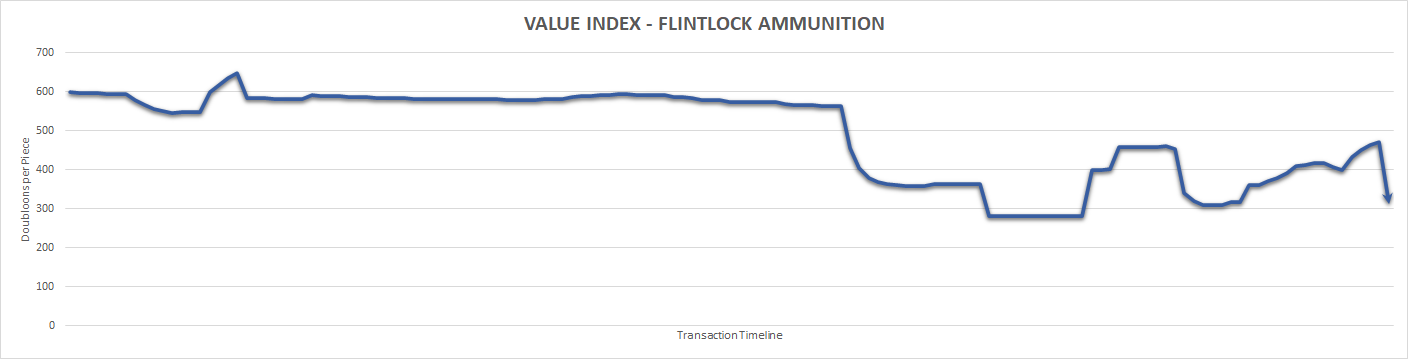

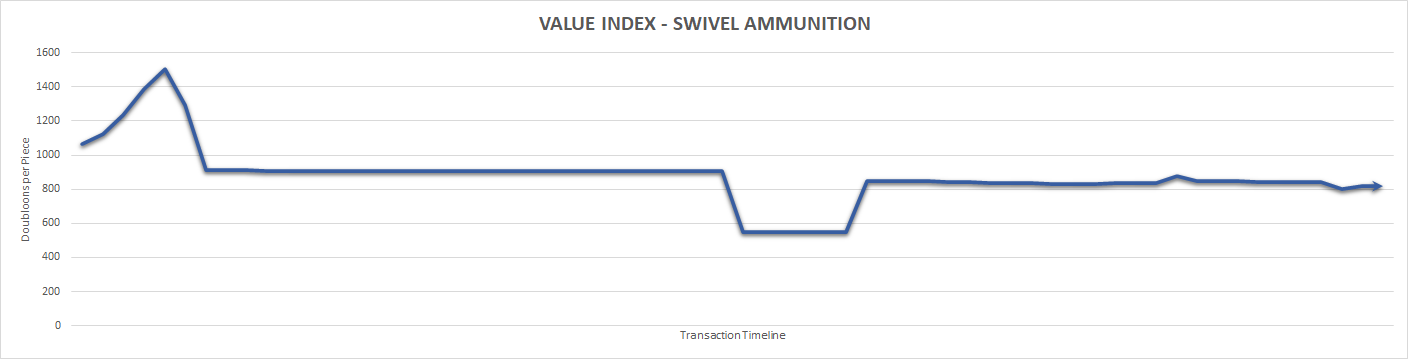

This is a commodity that is consumed on use. It is generally considered more expensive to produce, compared to other types of ammunition. It remains largely flat and is not a good investment choice as the raw materials had more value than the ammunition itself in 2022.

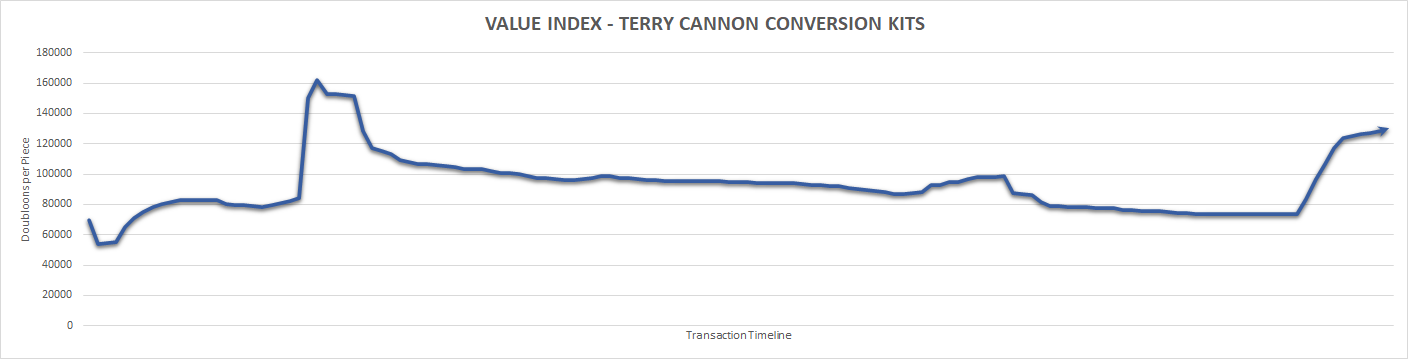

This is a cosmetic item that is consumed on use. The kits remained mostly flat throughout the year but saw a bump in value in December when it was apparent that they would not be on sale for the Holiday Event. The item gained 46.38% in value in 2022.

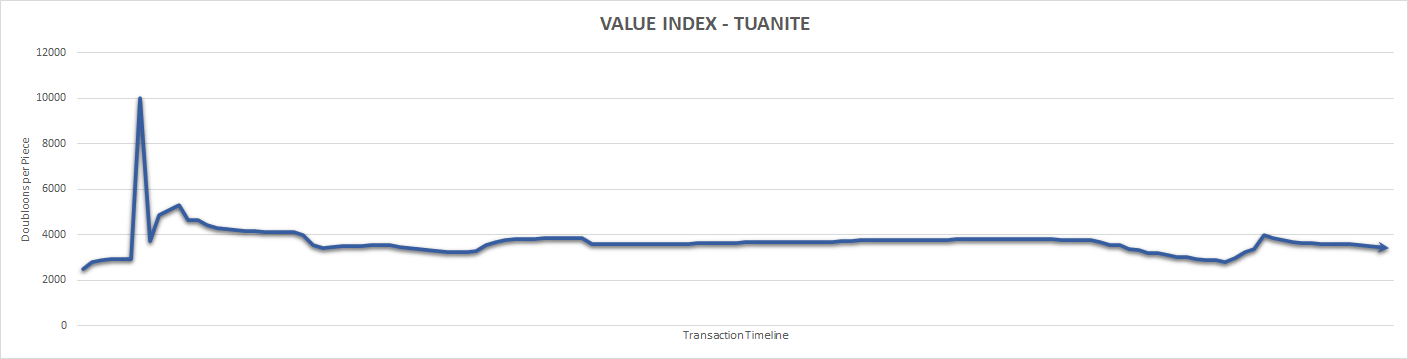

Tuanite is a former exclusive material that is still be traded by players. It appears to be recession and inflation proof due to a small section of the market controlling demand and pricing. There is little buyer interest causing the value to remain flat for 2022.

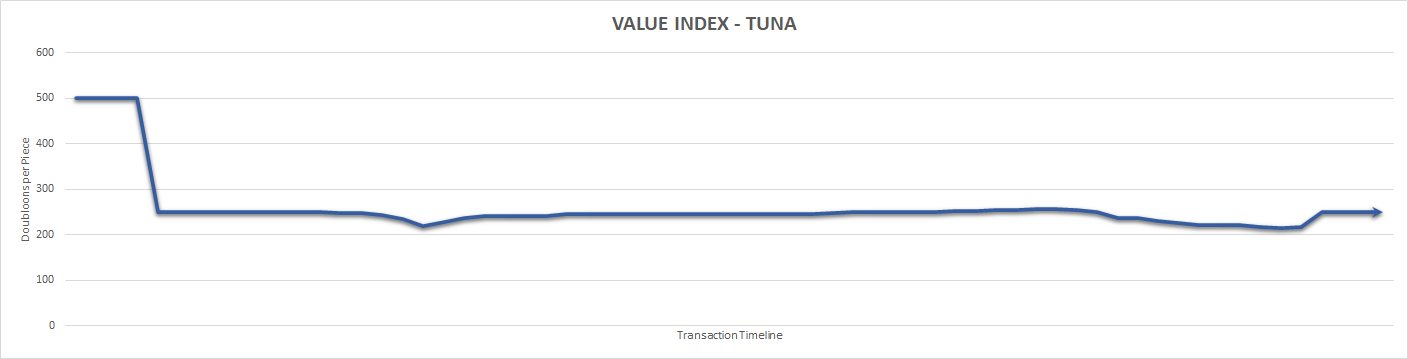

This market shifted from a sellers market to a buyer’s market on February 27th. This had a direct impact on the overall prices on the market which have not seen a correction in 2022. Owners of this item saw a loss of 250 per piece, making it a better option to use on trade routes or convert to Fish Oil instead of selling directly to the market.

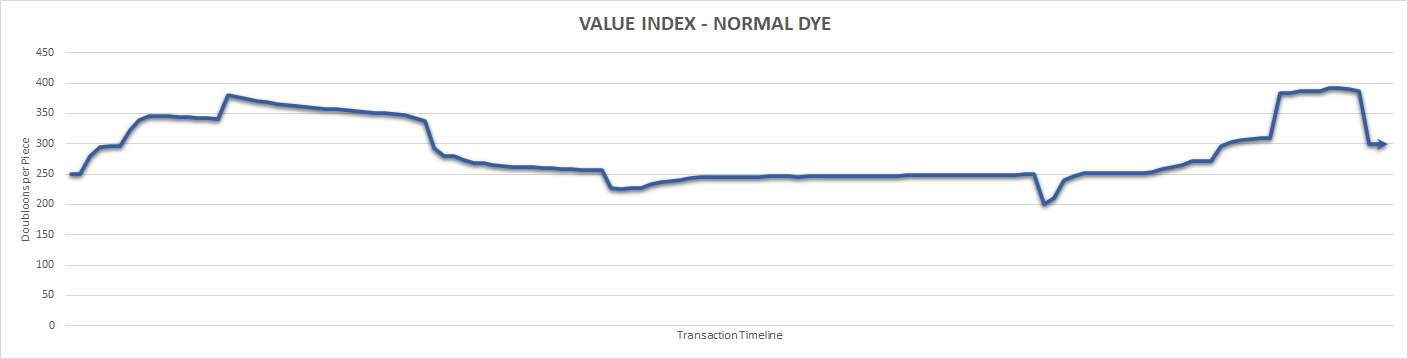

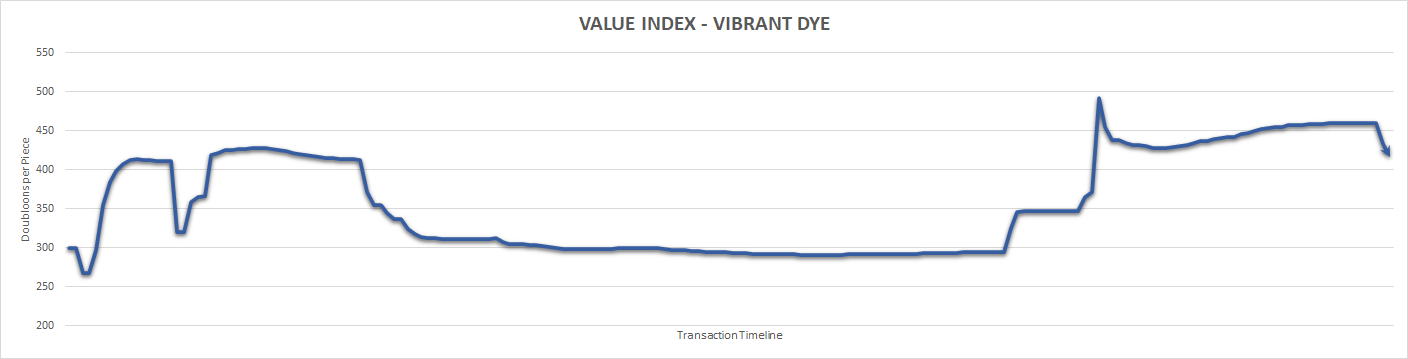

Vibrant Dye is a premium item that is consumed on use. It saw an increase in value of +27.89% in 2022 but shows signs of long-term investment in order to obtain a value, due to shifting demand throughout the year.

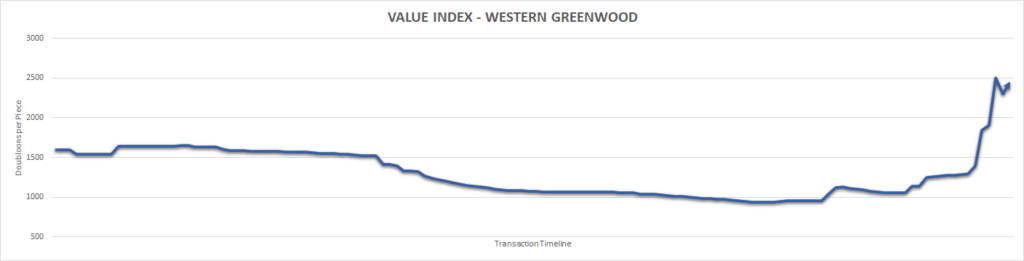

Western Greenwood is a premium wood with an Initial Public Offering (IPO) on April 23rd. The material was under performing until a price correction attempt was started at the end of December, raising it’s value by 34.96%.