Tradelands Economic Update – June 1st, 2023

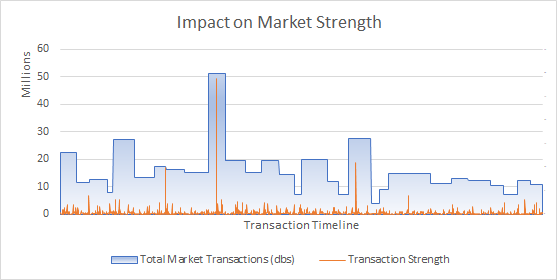

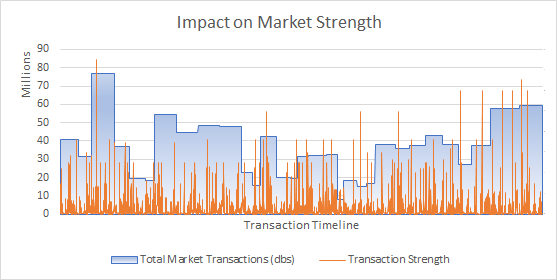

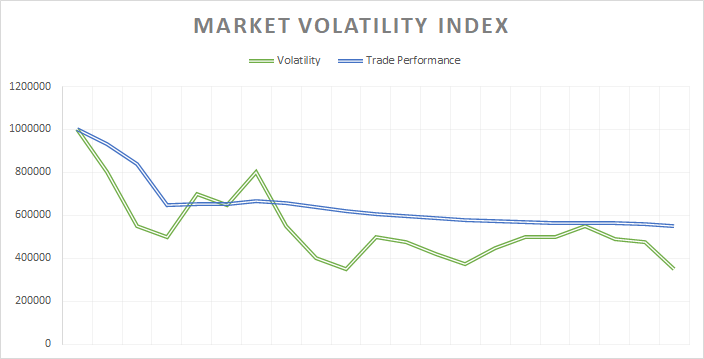

May is when Tradelands typically gets its major update for the year. However, the release has seen multiple delays and the impact has been noticeable on the market trends for the month. The total market activity just barely exceeded $1 Billion doubloons for the month, far below expectations and only half of what we saw last year.

Moreover, if you remove all the items that were added in the last 12 months and do a like for like comparison, the market activity is actually down -67.1% what it was last year. We can now safely say this was the total overall impact of the recession which hit Tradelands during the Purshovian Release of April and May 2022. In the real world, this would result in a major financial crisis. In a closed system like a computer game, this can sometimes be intentional as a method of re-balancing the game or attempting to take the player base in a different direction.

The other likely reason for the lower overall performance is the delayed release of item crates, as well as the lack of any major game changes in May. As a result, it’s better to wait another month before drawing any conclusions about the state of the Tradelands economy. Last year, we didn’t report the financial outcome until the end of June, and because of how the releases fell this year, we may not perform that analysis until July 2023.

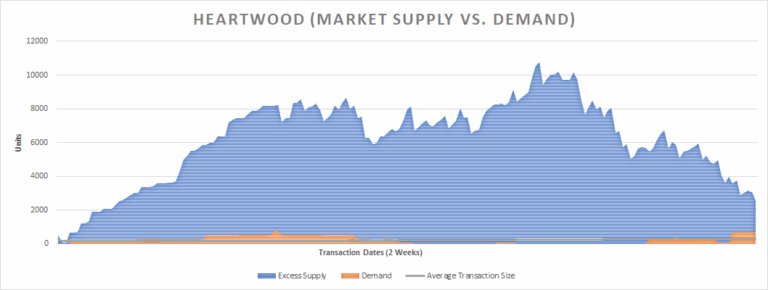

New Wood Types Released

There are several new wood types that were released this month, as well as the re-release of last year’s exclusive woods. These new wood types round out the missing colors such as orange, and have finally given two types (a dull and vibrant version) of every primary color in the spectrum. However, this comes with the announcement that Blood Oak will become an exclusive wood, meaning all of the vibrant colors will be exclusive going forward which will limit the customization for newer players to the game.

As of today, only Blood Oak was obtainable through in-game means by timber-felling. However, the drop rate for this was extremely low and therefore had minimal impact on the economy. The price of the wood was influenced by the availability in the Premium Merchant. As a result of its removal, we expect to see price fluctuations that mirror other exclusive woods like Inyolan Oak and Pwnwood, where the prices are determined based on how frequently it re-appears.

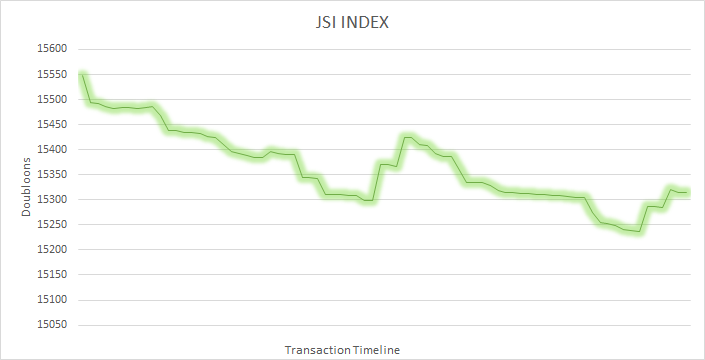

The one thing we are safe predicting is the new woods that were added will likely cause an increase in the JSI Index which is heavily influenced by Timberfelling. As of today, this profession earns about half the revenue of Mining due to higher demand and larger number of items which can only be obtained through that profession. If the new woods end up in the timberfelling drop table, then expect the value of this profession to increase as well.

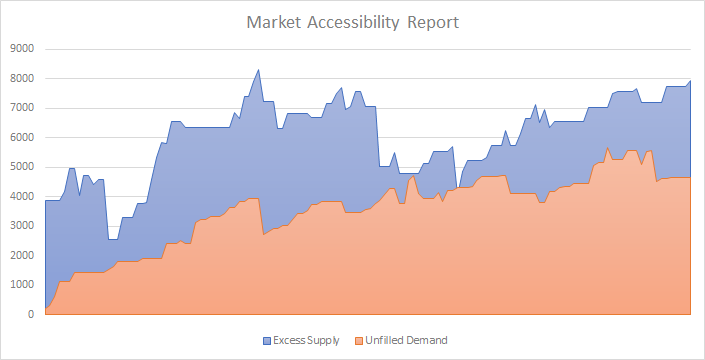

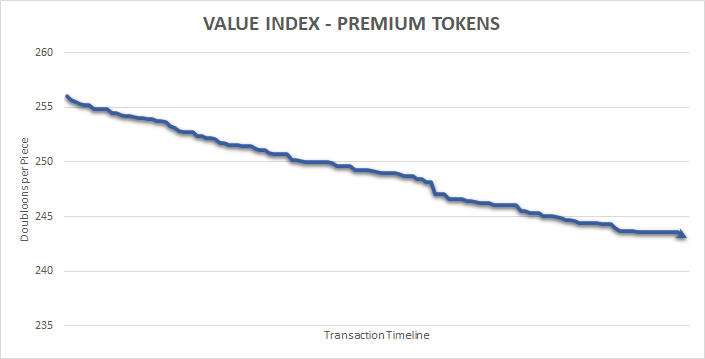

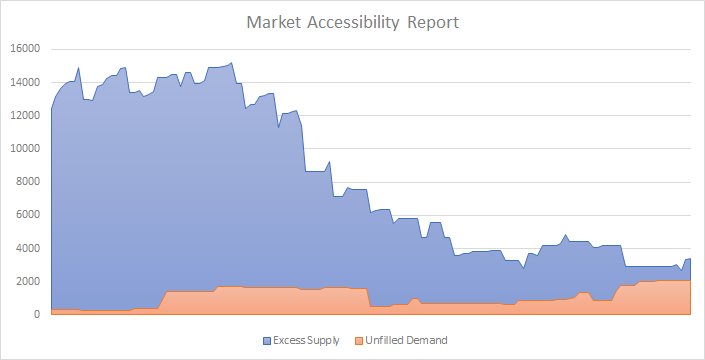

Consistent Token Value

Premium Tokens continue to demonstrate consistent value as releases tend to rely more on this in-game currency than Robux. The new woods that were released are purchasable with tokens, which has created an increase in demand. This has remained steady, even as the amount of excess supply in the market begins to dwindle. The price drop being experienced this month is due to inventory being exhausted, and a higher number of sales being done below the listed price. However, this will likely correct itself once the new items to off-sale and suppliers begin re-building their stocks.

If you are a Premium Token supplier, this is probably the best time of the year to use up your inventory. This is usually one of the most anticipated releases of the year, and if you do not sell your tokens the next opportunity is likely to occur in October. Last year the Aukai Release happened in July, but it was far less impactful than the May/June release.

Prize Token Valuation

Every release has at lease one item that is viewed as the premier item of the release. During the Halloween Event in 2022 it was the Dead Man’s Gargoyle Figurehead. In the Winter Event it was the Exclusive Cladifiers. For this release, it appears to be the Burkeland Prize Token. This item, which was originally projected to sell around $1M has since fallen to an average of $600k and is likely to fall even further.

Last year we demonstrated how to calculate the value of a crate item by using Shields as an example. Using that same math, we are able to project that the material cost (the amount a player has to spend to get one from a crate) is $296,700 doubloons. That means the item may continue to fall until it hits this amount, or it will stay slightly above it, with the difference between the index price and the material price being the profit earned in re-sale.

The most interesting outcome from this is that the release of this prize token effectively allows players to choose the reward instead of having a random one assigned to it. It also means that it is one of the few cases where a crate reward will always result in an item that suits the player’s interest, as well as allowing the new woods to be used in the crafting process as well.

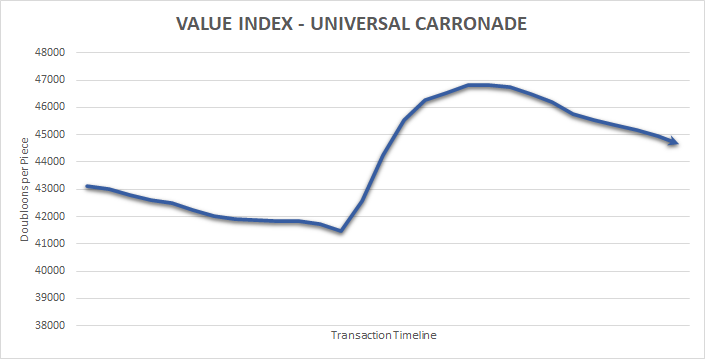

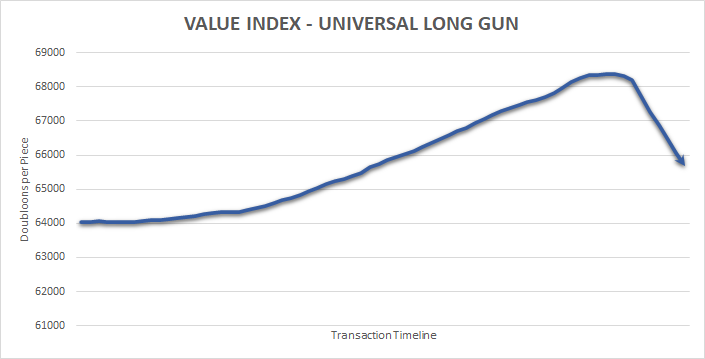

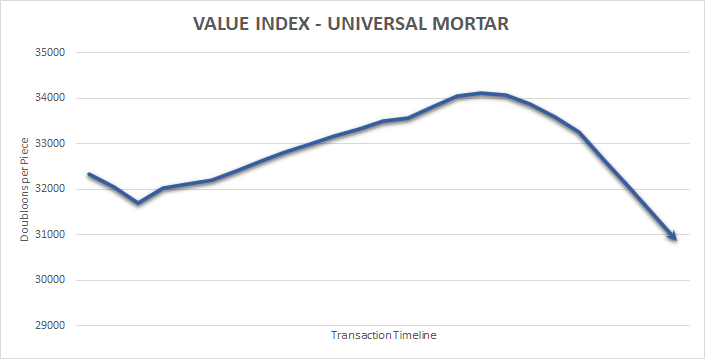

The Universal Downturn

The three universal cannon types have all seen a downturn at the end of the month. This is likely attributed to the lack of any new exclusive ships being released like last year’s Demeter. As a result, there is less demand for cannons. That said, the Beaver was an overwhelming success due to it’s impressive cosmetic characteristics and this caused a surge in interest for universal cannons, specifically for Long Guns and Carronades.

These items appear to have consistent interest in them, meaning players find them to be valuable. However, the reason for the low overall demand is because of an overabundance of options on the market. This is why the purchasing pressure (the curves at the end of all three price points) is consistently controlled by buyers. The Beaver, which had need for both Carronades and Long Guns but not for Mortars, is a classic case of this in action. The Long Gun was the most resilient of the three because it has higher demand than the other two cannon types.