Tradelands Economic Update – March 1, 2024

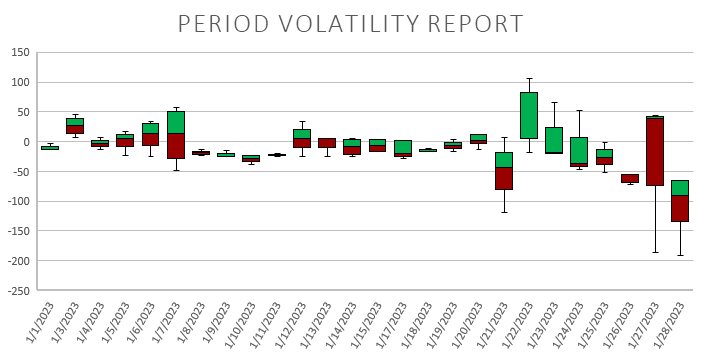

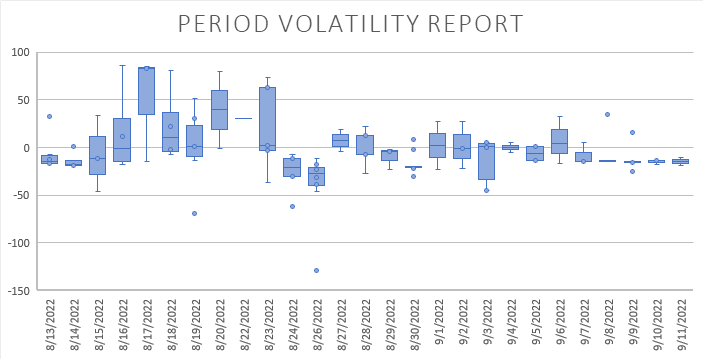

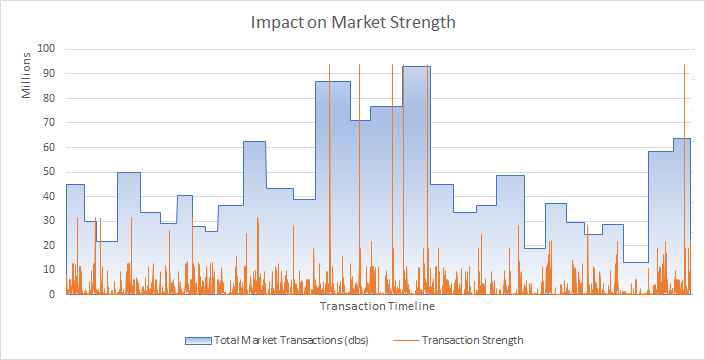

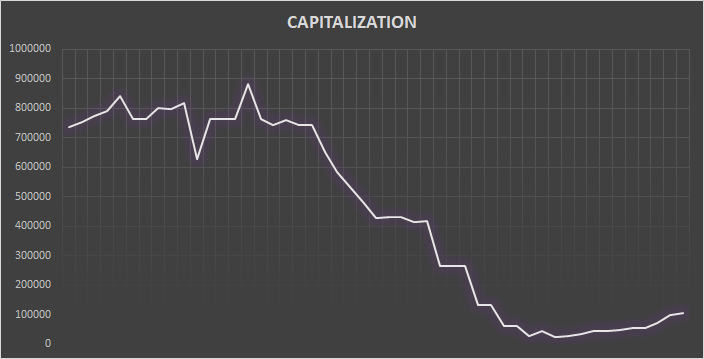

The economy saw $1.2 Billion in market activity in February which is under market expectations. In fact, this closes the month at $125 Million less than 2023. Despite this under performance, the spike in the middle of February coincides with the Valentines Day Event and shows the market remains healthy. Moreover, this event was more focused toward introducing new market mechanics such as tradeable mystery crates, instead of event specific items such as Cupid Cannons like we’ve seen in the past. As a result, we remain cautiously optimistic about the future of the economy and suggest traders watch how the market performs in March before jumping to conclusions.

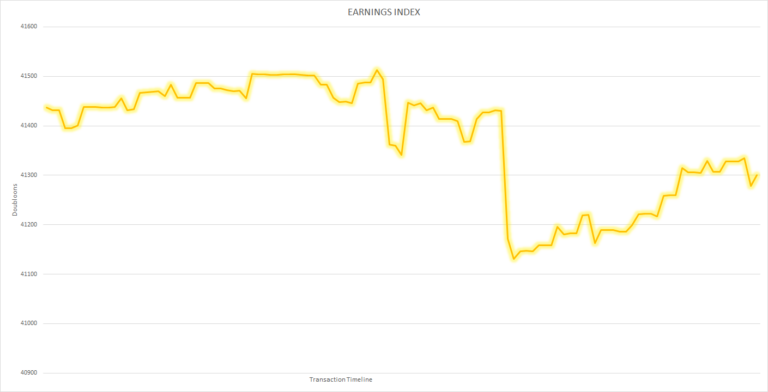

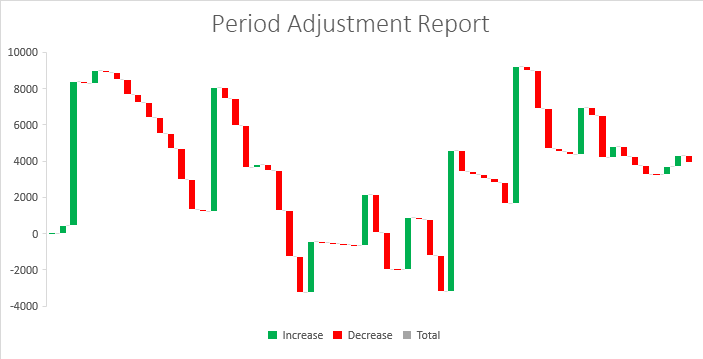

Other than the Market Strength report, all three of the Stock Exchanges reported positive movement. The two big winners this month were the JSI index which inches ever closer to the $20k line (an increase of 6.25%) and the FEGRAM Earnings Index which saw the attrition-like trend finally stop with the introduction of tradeable Inyolan Mystery Crates. Taken together, this means the we will need to wait another month to see if this increase in value is a true change in trajectory, or if it is early signs of a bubble that will burst.

The Inyolan Impact

Credit: TLO Discord #change-log

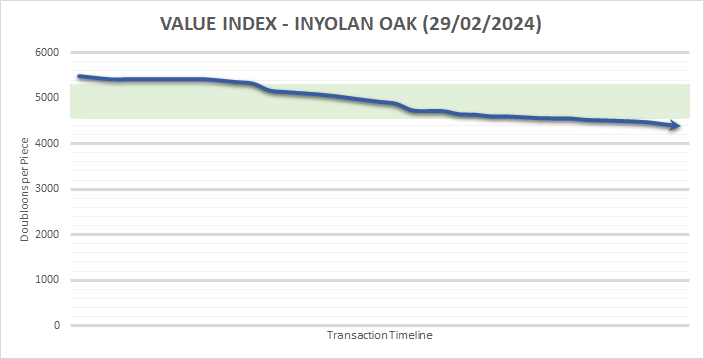

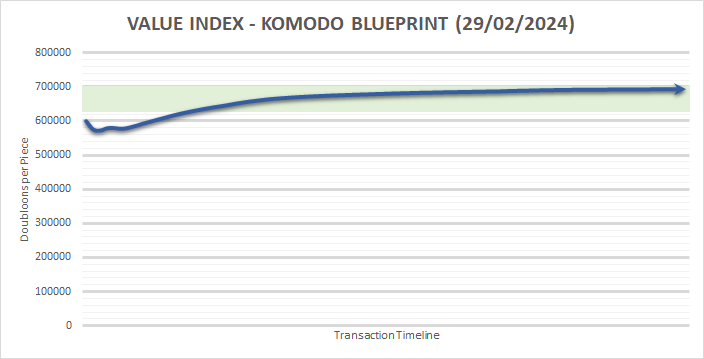

February was decidedly the month of Inyola. The Inyolan Mystery Crate was released along with the return of Inyolan Oak to the Premium Merchant. Moreover, the game saw a re-vamp of the Kraken, a new Komodo Blueprint, and a new voucher ship called the Fang. These are all ships of Inyolan/Asian flavor and the community largely sees Inyolan Oak as the meta wood for building ships of this type. The result of this mix has been a strong uptick to the economic fortunes for those who support the faction.

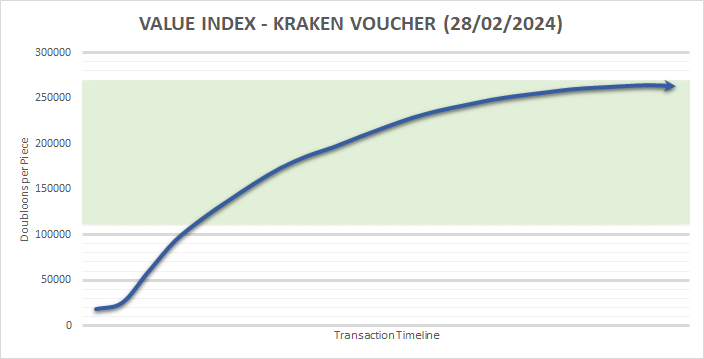

The changes also come with a striking increase in the cost of vouchers, making these ships difficult to obtain for players. Moreover, because the Kraken already existed as a voucher, the increase means that players who kept one in their inventory just saw a major jump in its value, to the tune of almost 10x increase in value.

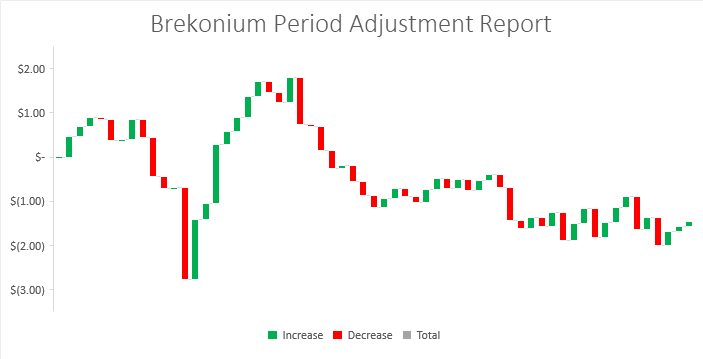

For players who base their merchant activities around margins, this means buying Inyolan Oak during the event currently sells at an 81.6% margin. For reference, the current margin for the Timberfelling industry as a whole is 83.81%, meaning this price point is actually close to where it should be, if not actually slightly higher. However, the buyer price point for Inyolan Oak is sitting at $2,500 per piece, which is wishful thinking for this material, as the trending price point is currently above the $3.4k seller threshold, which is stable at the moment due to the higher than normal demand for this off-sale wood.

That said, the real story for all of you hoarders (like me) is the surging price of Kraken Vouchers. Along with a complete revamp of the ship model, the voucher price, which has to be obtained from the scrap merchant, has also gone up in price. There are still some laggards in the market who are capitalizing on the fact they probably obtained the voucher for $25k, and therefore have nothing to lose by undercutting newer sellers. But this is expected to a minimum price point of around $250k and stabilize there, meaning if you have one you should consider its value as if you paid the new price to obtain it, rather than the former 500 scrap. That mentality put your mind in the right place as you negotiate.

Lastly, the Inyolan Crates themselves are now tradeable, giving players a way to purchase one without the use of Robux. This is a significant enhancement to the game as it means the crates can be used as a way to measure the overall sentiment of the items within, instead of having to track each item individually and performing comparisons to their counterparts. While it’s too early to draw conclusions about the future value of these, we do know they are expected to increase in value over time because the items inherit future changes to material tables instead of remaining static to one point in time.

Firebreather Disappointment

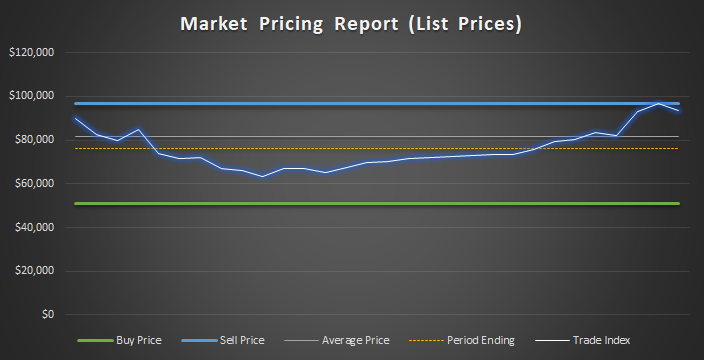

After the success of the Trapshooter Blunderblaster, the market has high expectations for the unique ranged weapon that is released with each new crate. This month saw the introduction of the Firebreather, but it had an underwhelming performance in its opening week and doesn’t appear to be heading for a value above $100k like the Blunderblaster did in 2023.

There are several indicators that appear to show the Firebreather will not beat the Blunderblaster in overall performance. For what it’s worth, the Trapshooter averaged a selling price between $110k and $125k for most of February whereas the Firebreather’s top price point was at $90k. At its best moment, the Firebreather was 27% cheaper than the Trapshooter, and today it ends almost a third below the price point of the Trapshooter. This means, for sellers, it is a bad investment option and, for buyers, it’s a way to get a decent weapon at a fairly good value.

Temporary Wood Corrections

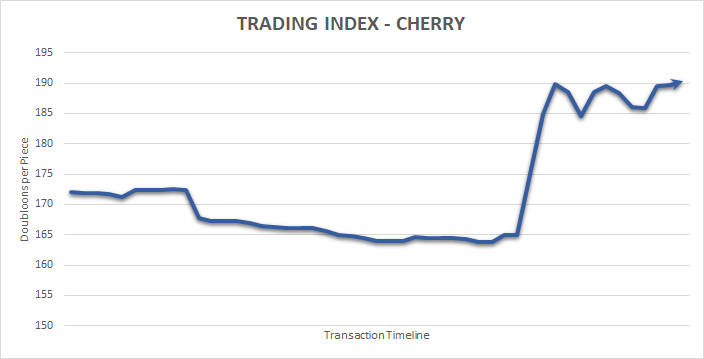

We are noticing an uptick in wood pricing since the completion of the Valentine’s Day event. While corrections during this month are expected due to the availability of Heartwood at the Premium Merchant, this one seems to have a deeper impact. Moreover, it appears to be a concerted effort by a handful of wood sellers working together to raise prices.

As with all price correction attempts, the success or failure of the initiative depends on the ability to buy out competitors long enough to push buyers toward the new price. We already see that the initiative for Cherry has shifted from buyers (meaning buyer demand drove prices) to sellers. The most likely reason for this is the availability of new options in the Shipwright. These new ships are very expensive, which means they are likely to impact premium woods but less likely to impact highly available woods like Mahogany and Oak.