Tradelands Economic Update – April 3, 2024

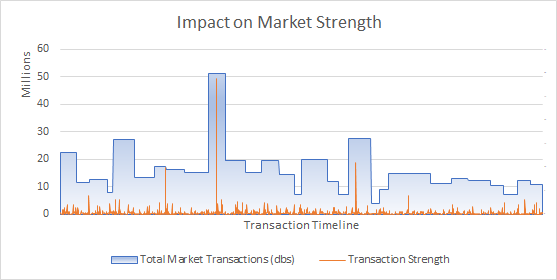

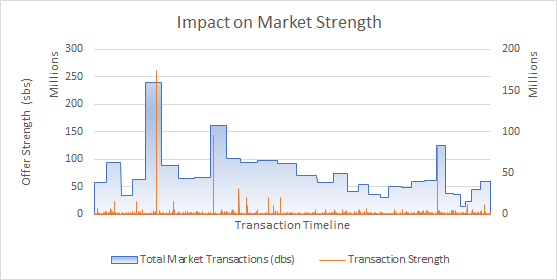

Tradelands saw $1.2 Billion in market activity in March. This is the second month in a row that the monthly performance we lower than it was in 2023, which had $1.3 Billion in trade activity, down -5.73%. This is an interesting trend that might be worth looking into, given that it could show a consistent economic slowdown across the game. However, since we don’t have enough evidence of this being the case, the best we can say is that March shows that the market is showing a calm before the storm.

The storm is the expected annual releases that usually start at the end of April. Based on past trends, we predict that the market will see some upward momentum as sellers start offering discounts in order to build up enough doubloons to participate in the usual round of auctions. Since the market is already at its softest point in over a year, it is easier for prospective buyers to enter the market and purchase items at prices perceived to be bargains.

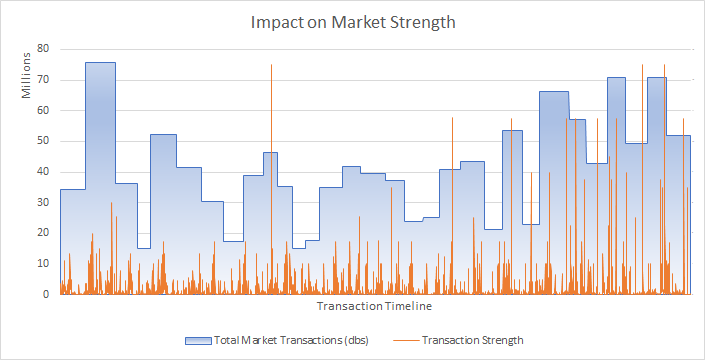

Blood Oak Revival

Blood Oak is an exclusive wood that used to be purchasable from the Premium Merchant. It is also available in Timberfelling. The decision to pull it from the market caused the price to go up, but also for a dramatic fall in the buyer interest in the wood. The main reason for it’s original demand was that it was one of the only dark colored woods at the premium merchant. When it essentially took the same role of Ebony, making limited occasional returns, it essentially lost the value it had to players, except as a counter color to Red Oak.

Despite this positive sign for market demand, the truth is the wood hasn’t returned at the frequency expected on the market. As a result, the Market Capitalization remains noticeably low for an exclusive wood, at roughly $450k. That means this is a market which is easy to manipulate if you have the means to do so, and unless others are interested in buying you out, there is very few methods for competitors to product additional stocks.

Skelestone Price Gouging

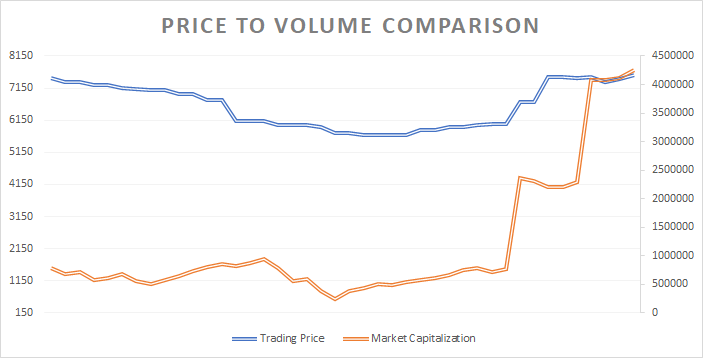

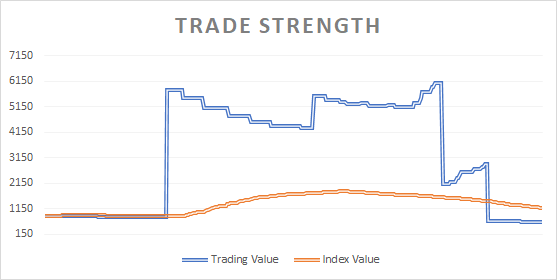

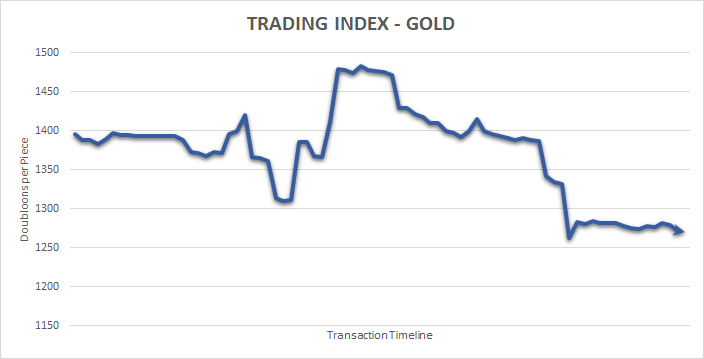

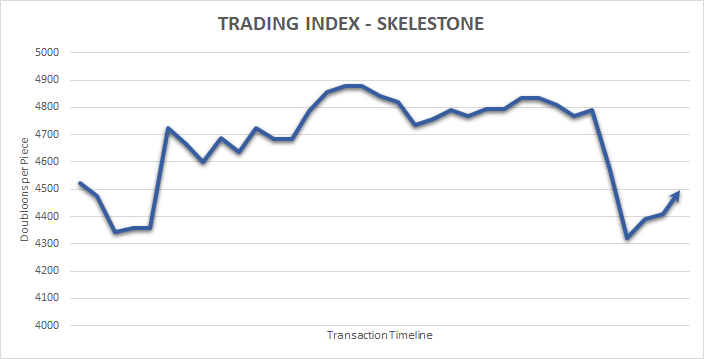

When Skelestone was first introduced to the market, we reported on the likelihood that it will follow the pricing model for Gold. This is largely proven to be true. However, we also noticed a trend where the price of Skelestone seems to increase above the true market value.

Skelestone currently has a market capitalization of $8.9 Million which is a reflection of how much material sellers are trying to place on the market. One way to interpret that is there is a significant surplus. This is driven by low demand. Most players are successfully making transactions for Skelestone in the range of $800 per piece to $1.2k per piece. If you are a buyer, the recommendation is to start in this range and see if you can locate a seller who is willing to match the price point.

Market Stability

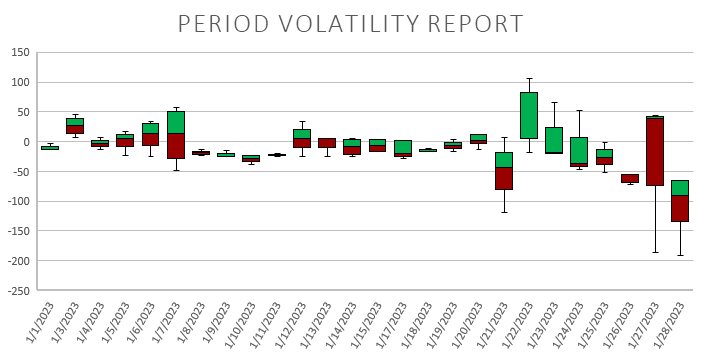

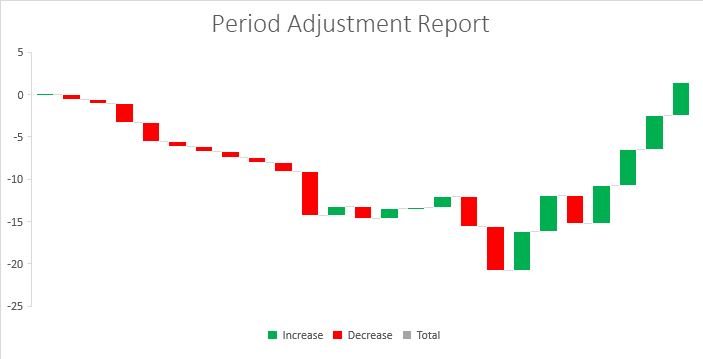

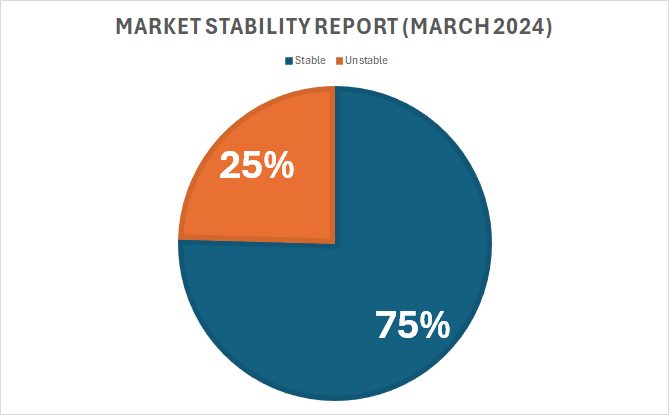

One of the side effects to the consistent downward trend of the stock market is an improvement in overall stability. The Bond Market shows this by doing a quick count of items trending towards lower stability vs. items trending towards higher stability.

In a typical healthy market, the ratio of items becoming less stable compared to items becoming more stable is between 1-1.5 to 1. Right now this ration sits at 3 to 1. In the real world, we would use this as an indicator that a market shakeup is about to occur. We use the phrase “calm before the storm” and once again this data seems to show the same theme. Moreover, it is an indication that the attritional trends that are occurring on prices are becoming an accepted reality within the game.

Anecdotally, we are also noticing a lot more consistency in pricing for new items this year. As an example, the Komodo Blueprint and Nautilus Blueprint both entered the market at a price point relative to Ghostship Vouchers, where as in past years this typically saw a lot of fluctuation before it stabilized at the long-term price. The driving reason behind this might be as simple as better visibility on that item’s long-term viability and consistency in expectations when new releases come out.

For what it’s worth, stable markets are good for average players, but worse for long-term investors. It’s going to be interesting to see if this move towards stability continues as the new release season comes closer, or if we see a return to volatility that tends to redefine the market each year.