Tradelands Economic Update – April 2022

The Tradelands economy did not fare well in April. The economy experienced early growth, but fell sharply following a lackluster release at the end of the month. The final calculation puts the total economic growth at 8.19%, a full point below the expected 9.50% growth rate for April. This under-performance means shareholders lost $1.04M doubloons (equivalent to $3,006USD). With that in mind, let’s do our monthly breakdown and see if things are as grim as they appear on the surface.

The Ugly Truth

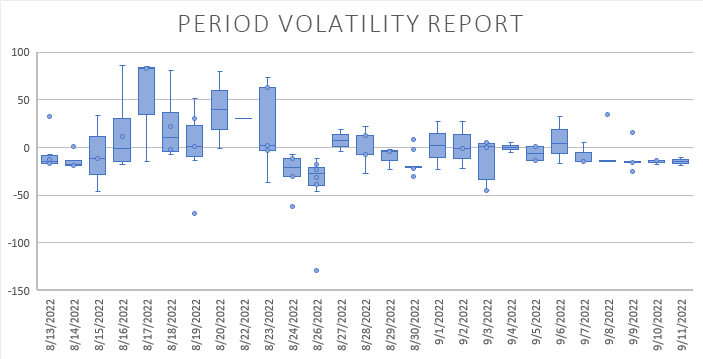

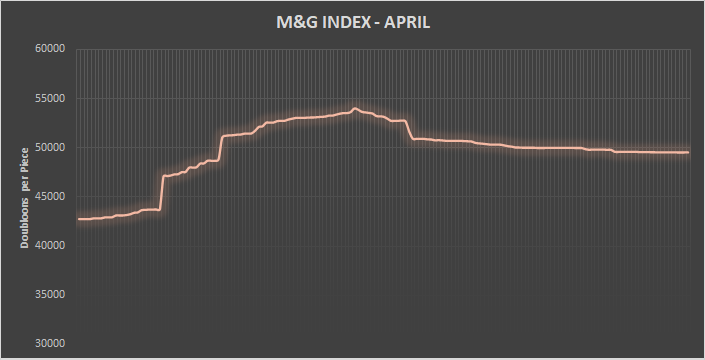

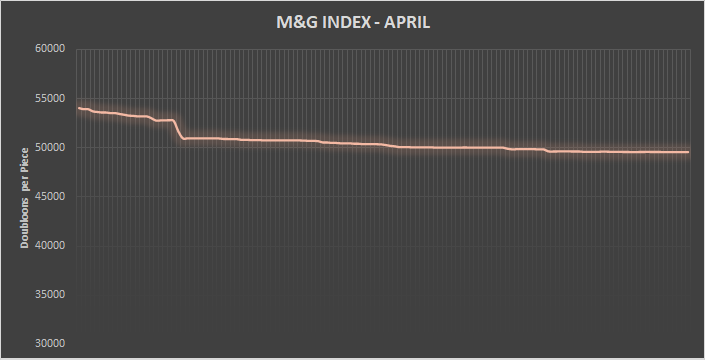

The release was really bad for miners. The idea of making rock mining more consistent with returns was a good idea on paper, but min/maxers who make up the majority of the mining base found a way to beat the system. As we reported last week, they were suddenly earning 10% – 15% less per pickaxe which had a significant impact on their profits. While the M&G index showed a respectable +13.73% increase this month, when you look at the performance of the index post release, it paints a much different picture.

M&G Index shows a -9.03% and -4,476db in value since the April 20 release. It’s safe to say the release was poorly received my miners. Hopefully a recovery will come soon, or we may see the first decline in performance in over a year and a half.

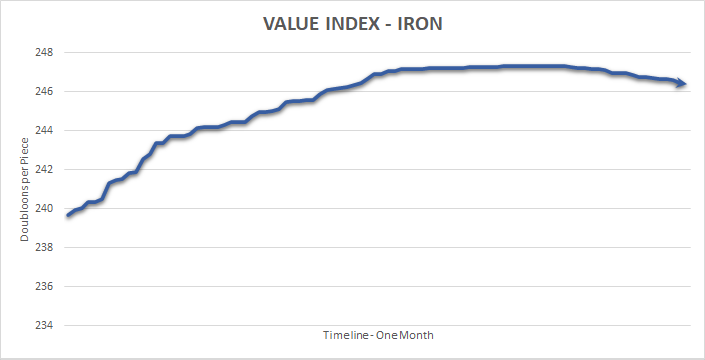

The market indicates the value of metals and gemstones will likely go down, by as much as 10% reduction in value. However, this might have been part of the plan. After all, the Iron Price Dilemma has been an ongoing discussion since it started rising in 2021. The fact that we are able to safely predict the stabilization of mining prices in general may be welcome news to the developers. Then again, it means that mining will not be a profession of choice for players going forward.

If the developers were seriously concerned about this trend (in the way a trader should be), there are ways to correct this. First, is to allow metals to be used in customizing ships instead of just wood. Second, release a new ironclad ship or new blacksmith options so crafters/builders have a reason to purchase materials. Third, look into optimizing the drop rates to match the rarity of the materials in-game. Any of these should help boost performance of M&G, but for now the economic statistics show mining as a profession to avoid until further notice.

Economic Abuse

Along with the poor performance of releases (April 1 and April 20 specifically), this month also saw some very obvious abuse from players. The scripts that determine and project the economic performance were able to detect several cases where players were scamming other players, as well as one case of clear laundering (selling in-game items for out of game Robux/USD or other real-life items). The developers openly stated that they will ban players who attempt this, and maybe it was in reference to the same players we caught doing it, but there is at least one case where the player was not caught but still managed to get karma thrown his way.

Ironically, the player was attempting to purchase out-of-game items with premium woods. However, shortly after the scam started, the release added new woods to the game and the scam was immediately wiped out because wood of similar color was suddenly a better and cheaper choice. We did some calculations behind the scene and believe the person perpetrating the scam lost a total of $1.34M doubloons.

More importantly to us isn’t how the developers handle them, it’s that abusive players like this are frustrating to manage in our economic models. We had to de-list several wood options this month from the stock exchange until we were sure the player was no longer influencing the system. We definitely appreciate any effort the developers take in helping remove scammers as it makes for a healthier trading environment. We also appreciate that the developers remain largely hands-off on the economy which allows the free market mechanics to shine. This is one of the truly unique things about Tradelands and hope it remains.

Finally, I want mention that there is a significant difference between “price corrections” and “pricing scams.” A price correction is an effort to move the overall price of an index or material to a new pricing level. It requires a lot of effort and coordination to successfully complete, and it benefits the entire community when it works, even if the price correction was down instead of up. A scam, on the other hand, is an attempt by (usually) one player to benefit from ignorance of other players, outright hacking, or by offering illicit benefits to others. In the real world, manipulating markets this way can carry stiff legal penalties if you attempt them. That’s why we track them and remove them from GISE if we are able to catch it in time. After all, we would prefer the economy of Tradelands succeed or fail based on its own performance, not from scammers who do not have the best interest of the game in mind.

Volatile Woods

Angelwood bottomed out at 570pp and appears to be recovering. It’s still very unstable but not likely to lose much more as demand increased as soon as the price fell to 575pp. As a result, we can expect that Angelwood will hover between 570pp to 600pp for the time being. It is once again safe to purchase Angelwood for profit, but if woods continue to be available from the premium market only, you will have to time your purchases accordingly. The demand for Angelwood is a consistent trend that rises when there are new items to make.

Blood Oak is the other unstable wood and we continue to see rapid increases and decreases month to month. The thing that surprised us the most was how the availability of an alternative, Red Oak, appears to have actually helped Blood Oak in price. The final week of the month saw a dramatic change in price, but it remains questionable how long it will last. This continues to be a risky buy as an investor and we instead advise purchasing this wood when you need it, not holding it in the chance that it will net you a profit later. Notice how the majority of the month Blood Oak was trending downward instead of upward.

New Woods, Mixed Results

We attempted to fast track the new woods into the GISE system, knowing that they were likely to be relevant going forward. So far, two of these wood types have met the criteria to be added to the stock exchange and both are listed as Premium Woods. That means they will appear under Woods on the Price Guide, and under the Merchant’s Guild on the actual exchange. Let’s see how they performed.

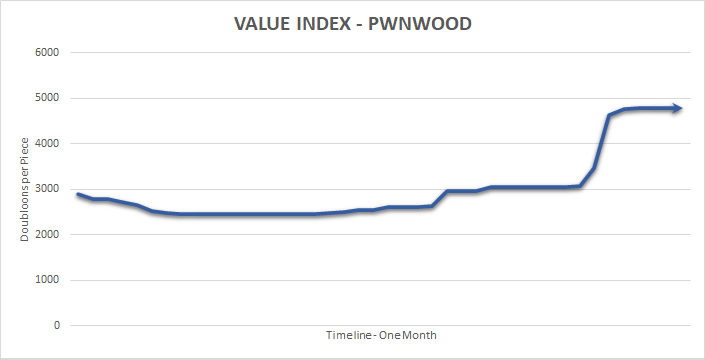

The IPO (initial public offering) for Blue Pine based on similar wood types was 800pp. Already we have seen that climb and it is currently outperforming expectation by nearly a factor of two. The Company believes this price point might be maintained due to the rarity of its cousin, Pwnwood, which trades at 4.7kpp at present. Because of the close cosmetic similarities in Blue Pine and Pwnwood, we project the rarity and price to be dependent on how often each are available from the premium merchant.

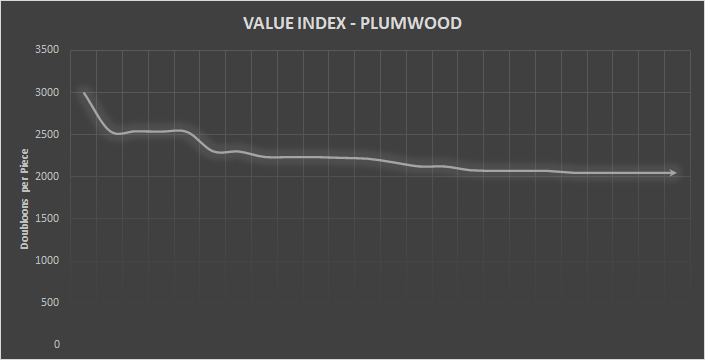

On the other hand, Plumwood had an IPO of 3kpp, expecting a similar value and performance to Pwnwood when it was the only blue wood available. This IPO seemed to match Plumwood due to it’s vibrant purple color which doesn’t have a non-premium alternative. However, the performance so far on the exchange has been very underwhelming, seeing an almost immediate fall close to 2kpp. It looks like it will be stable at this price until it goes off-sale. Then we will see how often it returns to the premium merchant to project the long-term performance of the material.

The final thing to note is how only two of the five new woods made it to the market by end of month, despite being fast tracked. That, coupled with the net zero gains between Blue Pine and Plumwood, show that the new wood materials greatly under performed expectations. The developers are probably happy that the release has netted them some new cash, but the statistics show that it could have gone much better for them. Overall, it looks like this update isn’t going to be the hype generator the 2021 release was in terms of changing the market’s performance.

Impact of Roleplay and Releases

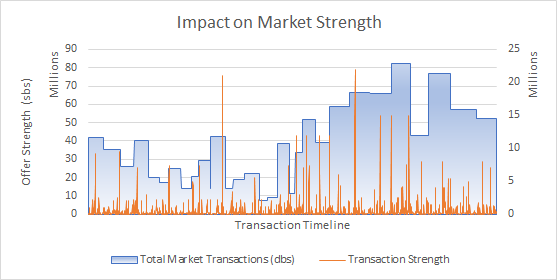

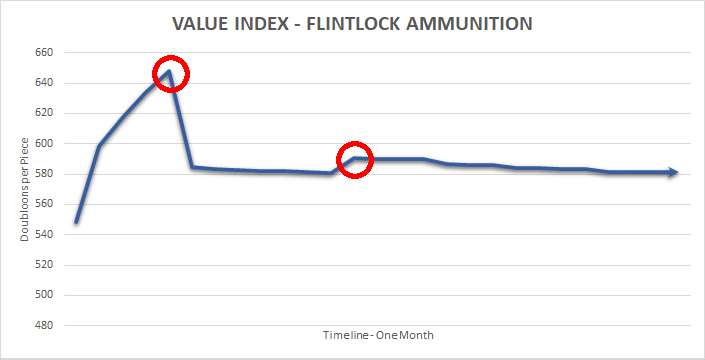

Another thing we noted this release was the relatively light to non-existant roleplay done to help promote the release. Last year, there were many economically oriented roleplay events that helped drive some significant activity and interest before the release hit. One of the most significant was the Nova Fort Rebuildathon, followed by the Sparks Kilowatt Metaverse event. One key demonstration of how underwhelmed players are with the release is the fall of ammunition prices, a sign that not enough role play events occurred in the same time frame.

We’ve noticed that whenever there are role play events where the public (aka non-navy) is offered to attend there is an accompanied increase in ammunition and weapon prices. We can usually predict the right timing for role play events when we measure the performance of these items, or how exhausted the community is with role play events when they have too many back to back.

In April, we saw a lot of players who were gearing up for a week or two of roleplay. The hype was strong following the successful April Fools release, but the announcement that another update wasn’t planned until later in the month killed that momentum. Finally, as the date came closer, there was a lot of hype for an Inyolan invasion event but this either never happened, or wasn’t available publicly. As a result, the attempted market correction failed and led to some pretty disappointing results. Moreover, it shows that the community doesn’t believe any significant role play will occur and are “exhausted” of updates with no role play component to them.

It’s worth noting that private events do occur. However, these are not publicly available and typically don’t have an impact on the market. The one recent exception to this was the near daily invasion by Nova Balreska in 2021 that caused some significant roleplay fatigue when it finally ended. Still, because these are not public, they have an almost negligible impact on new and returning players. In terms of economic activity, these new additions to the economy are often energetic and create a lot of economic activity.

Hyped Items

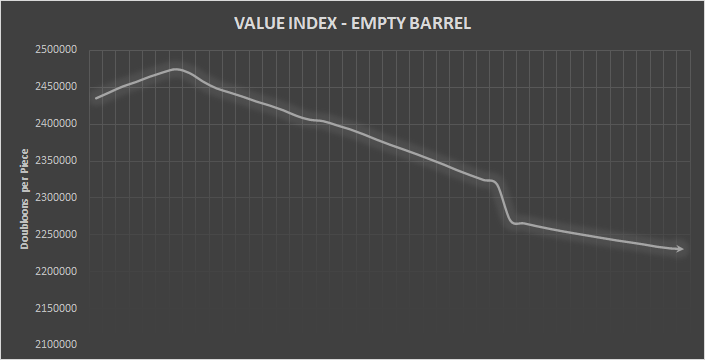

This is the first time in a while that Empty Barrels made an appearance on the market. It will probably be the last time for a while as well so we might as well take the time to talk about it. The reason for their emergence is purely due to volume. The barrels are usually a niche item, but due to the April Fools release, the Titan suddenly became relevant again. Barrels saw a brief spike in value before collapsing back to their usual price point. We don’t expect anything more to happen here unless the developers do some kind of crazy release, like make Bilbo’s barrel boat or something.

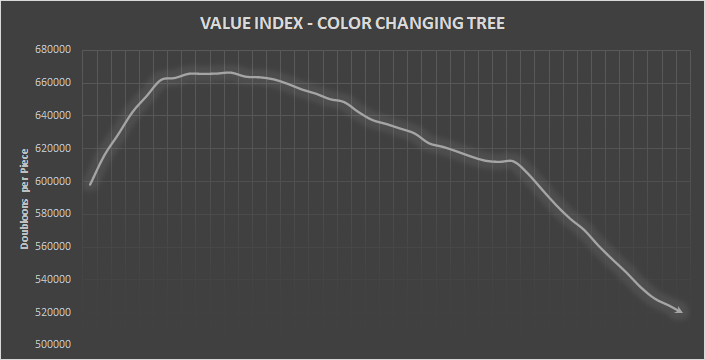

Color changing trees also made an appearance this month, although we expect them to come back again. This item has been on a fairly steep decline, and once again we saw a fall of -21% in value. The trees were impacted by the same update the hurt Gramophones. We reported on this in a previous article, so I won’t repeat it here. The value of trees should easily be over $1M so this is one of the few items that constantly under performs the market value. We have also noted that the tree is not holding value over time, meaning it’s popularity seems to be seasonal versus event-based.

End of Pine and Spruce Domination

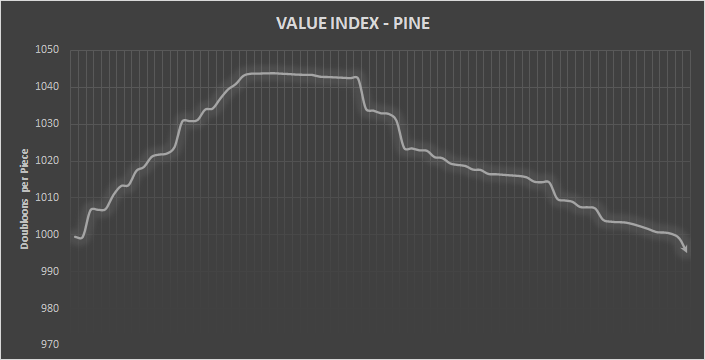

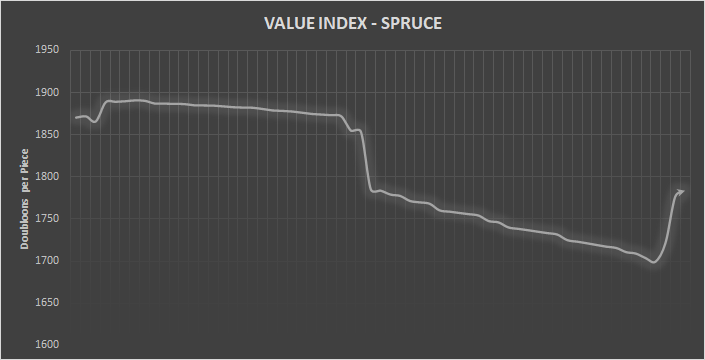

One announcement that was somewhat surprising was that Pine and Spruce Decking would no longer be required for high end ships. Instead, the costs would simply be built into the construction of the ship itself. This means decking, an item never tracked on GISE because it was considered “redundant,” is effectively obsolete.

In just a week and a half, the value of Pine and Spruce have declined. The release has wiped out all of Pine’s gains, and is currently below the 900pp mark and is expected to fall further. Spruce isn’t fairing any better, having started the slide a few days later, but the trend is the same. Some desperate sellers have temporarily devalued the market, but the correction already took hold before month end and the final of -4.85% appears to be the true hit these once powerful market items have taken as a result of the changes

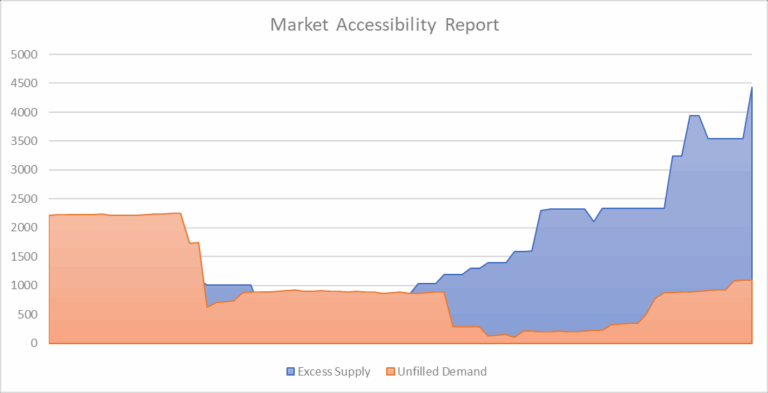

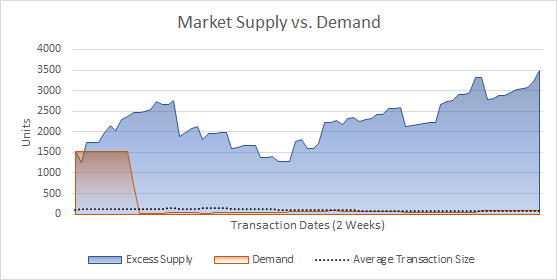

In case there is any doubt that they will re-bound, The Company is fairly certain this slide is real and permanent. The Demand for Pine and Spruce hit near zero over night once Decking was no longer a requirement. This is supported by the market analysis provided by the ML script, and the drop was quite noticeable. The demand has even fallen below the transaction size (the amount of items you need in inventory to have an effect on in-game trading) meaning it will fall until demand returns.

As a result, it’s likely that Pine sellers will have to wait a while before they can recoup their losses. The only thing these woods still have going for them, which will make them more valuable than premium woods, is that they cannot be obtained from the premium merchant. That means you can safely assume the wood will never fall below the price for Grimewood and Angelwood. However, it is also unlikely to ever reach the same level of Ebony.

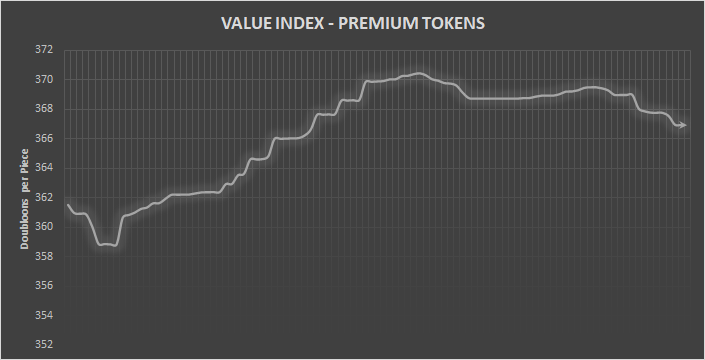

Premium Tokens Post Update

After the April Fools release, we did a valuation of Premium Tokens, assuming that all future releases would require them because they translated directly to Robux (i.e. money for the developer). We expected, based on past trends, that Premium Tokens would see a spike in value around each release that decays over time. We used this assumption to test the future market strength following the Valentine’s Day update.

While we were pleased to see that spikes on both April 1st and April 20th did in fact occur, what surprised us was how minimal they were. Premium Tokens were projected to go up by at least 5% and we saw only a 1.48% rise in the last release. In a way, this is the smoking gun that alerted us to the fact that the player base didn’t spend as much as they could in the new release. As a result, the developers may not have seen the return on investment they could have received. There are a lot of reasons for this, many of which were discussed above, but the poor performance of Premium Tokens in a month that had two releases is somewhat alarming.

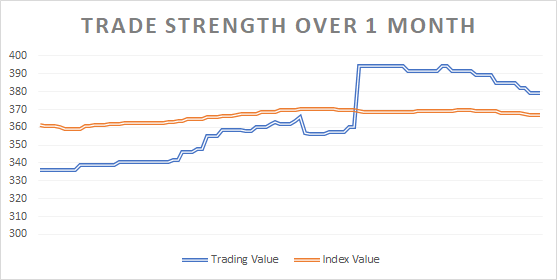

This isn’t just an opinion, the data shows it. The “Market Average” shows the value of the item against the players perceived “Trade Value” (i.e. how much they could spend on it). When the trading value exceeds your index value, it means your item is “under market value” and is therefore not achieving its full potential worth.

In the case Premium Tokens, which are bought with real dollars in the form of Robux, this means the developers did not make as much money from this release as they could have. In fact, we measured this amount and, while we don’t want to reveal the true numbers for privacy reasons, we anticipate it could be in the thousands of lost revenue.